- Home /

- Forex Brokers /

- BigBoss

BigBoss Review

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a BigBoss Financial Account

- Trading Platforms and Tools

- Deposit Bonus

- Customer Support

- Customer Reviews and Trust Scores

- Discussions and Forums about BigBoss Financial

- Employee Overview of Working for BigBoss Financial

- Pros and Cons

- In Conclusion

BigBoss is a Forex and CFD broker in Seychelles. BigBoss is renowned for its Deposit Bonus Carnival with up to $42,000 bonus funds. They offer four flexible account types that suit all types of traders.

Overview

BigBoss Financial, operating under Big Boss Ltd., is a global forex and CFD broker offering a range of trading instruments and platforms. The company is registered in 🇰🇲 Comoros with an International Brokerage and Clearing House License (No. BFX2024045).

Additionally, it partners with Brickhill Capital (Mauritius) Limited, which holds a Global Business License and Investment Dealer License (No. GB20025563) in 🇲🇺 Mauritius. Despite its international presence, the broker’s regulatory status has been a point of contention among traders.

Frequently Asked Questions

What is BigBoss Financial’s regulatory status?

BigBoss Financial is registered in 🇰🇲 Comoros with an International Brokerage and Clearing House License. However, the regulatory framework in Comoros is minimal, which raises concerns regarding the oversight and protection of client funds. The broker does not participate in any investor compensation schemes.

What trading platforms does BigBoss Financial offer?

BigBoss Financial provides access to multiple trading platforms, including MT4, MT5, and their proprietary BigBoss QuickOrder. These platforms are compatible with various devices, catering to both beginner and experienced traders.

Our Insights

BigBoss Financial offers a range of trading instruments and platforms, appealing to a broad spectrum of traders. However, its regulatory status and the absence of investor protection schemes may pose risks. Potential clients should conduct thorough research and consider these factors before engaging with the broker.

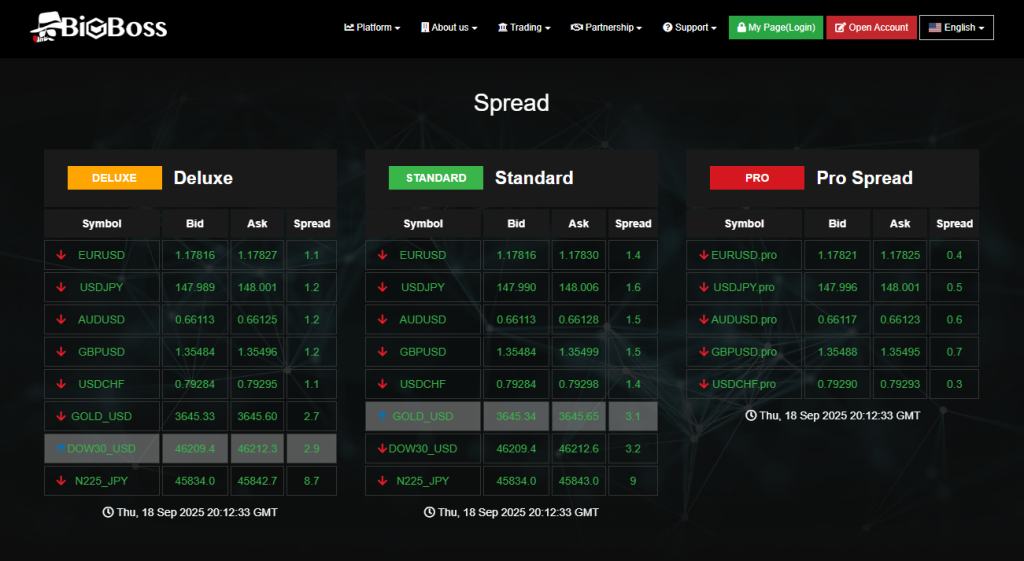

Fees, Spreads, and Commissions

BigBoss Financial offers a range of account types with varying fees and spreads. The Deluxe Account provides customizable features with a commission of $2.50 per lot, while the Pro Spread Account charges a $4.50 commission per lot. The Standard Account has no commission fees, catering to traders seeking straightforward pricing.

| Account Type | Commission per Lot | Spread Range | Leverage |

| Deluxe | $2.50 | Variable | Up to 2222:1 |

| Pro Spread | $4.50 | Variable | Up to 1111:1 |

| Standard | None | Variable | Up to 1111:1 |

Frequently Asked Questions

What are the commission fees for BigBoss Financial accounts?

The Deluxe Account charges a $2.50 commission per lot, the Pro Spread Account charges $4.50 per lot, and the Standard Account has no commission fees. These fees apply to Forex and CFD trades, with specific conditions for cryptocurrency CFDs.

How do spreads vary across BigBoss Financial accounts?

Spreads at BigBoss Financial are variable. For example, the EUR/USD spread starts from 1.1 pips, while the N225/JPY spread can be as wide as 6.7 pips. Spreads may differ based on account type and market conditions.

Our Insights

BigBoss Financial provides competitive and transparent pricing across its account types. Traders can choose an account that aligns with their trading style and budget, benefiting from clear commission structures and variable spreads. However, it’s essential to consider the impact of spreads and commissions on overall trading costs.

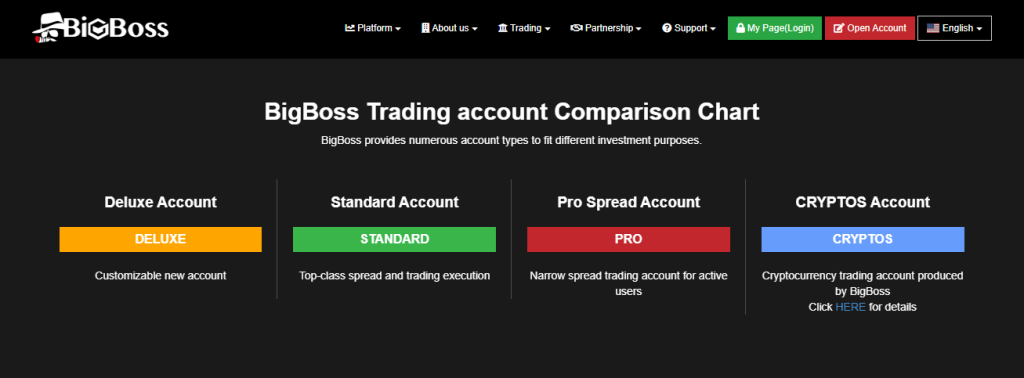

Minimum Deposit and Account Types

BigBoss Financial offers a variety of account types to suit different trading preferences. The Standard Account requires a minimum deposit of $100, while the Pro Spread Account has a minimum deposit of $50. The Deluxe Account allows for customization but may require a higher initial investment.

| Account Type | Open an Account | Minimum Deposit | Customization | Leverage |

| Deluxe | Higher | Yes | Up to 2222:1 | |

| Pro Spread | 50 USD | None | Up to 1111:1 | |

| Standard | 100 USD | None | Up to 1111:1 |

Frequently Asked Questions

What is the minimum deposit required for BigBoss Financial accounts?

The minimum deposit varies by account type. The Standard Account requires $100, the Pro Spread Account requires $50, and the Deluxe Account’s minimum deposit is not specified but is higher due to customization features.

Can I customize my BigBoss Financial account?

Yes, the Deluxe Account offers customization options, allowing traders to tailor their account settings to match their trading style. This includes adjusting leverage, margin levels, and other parameters.

Our Insights

BigBoss Financial provides flexible account options with varying minimum deposit requirements. Traders can select an account type that aligns with their financial capacity and trading goals. The Deluxe Account offers customization for experienced traders seeking tailored features.

How to Open a BigBoss Financial Account

Opening a BigBoss Financial account is mostly online and can be done quickly. You select an account type, provide identity documents, and once approved, fund your account to begin trading using their platform.

1. Step 1: Visit BigBoss Quick Open/Open Account page

Go to BigBoss Financial’s website and click “Quick Open Account” or “Open Account”.

2. Step 2: Fill in personal information

Enter required details such as your full name, date of birth, nationality/country of residence, email, phone number, and choose account currency (USD or JPY) and trading platform (MT4 or MT5).

3. Step 3: Agree to the terms and verify your email

Accept their user agreement, privacy policy, then confirm your email through a link sent to your inbox.

4. Step 4: Complete identity verification (KYC)

Upload a valid photo ID and proof of address documents. For Quick Open accounts, verification usually happens before withdrawals; full account types require verification before trading.

5. Step 5: Fund your account and start trading

Once your account is approved, deposit funds using supported methods, then you can access the platform and begin trading.

This entire process can take just a few minutes for registration, though full document verification may take up to one business day.

Trading Platforms and Tools

BigBoss Financial provides a diverse suite of trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its proprietary mobile application, BigBoss Trends. These platforms cater to a wide range of traders, offering advanced tools and features for efficient trading.

| Platform | Device Compatibility | Key Features | Ideal For |

| MT4 | Windows Mac Mobile | Automated trading Customizable | Beginners |

| MT5 | Windows Mac Mobile | Advanced charting Multi-asset | Experienced traders |

| BigBoss Trends | Android iOS | Real-time trading Market analysis | On-the-go traders |

Frequently Asked Questions

What are the key features of BigBoss Financial’s trading platforms?

BigBoss Financial offers MT4 and MT5 platforms, known for their advanced charting tools, automated trading capabilities, and high-speed execution. The BigBoss Trends (BBQ) mobile app provides real-time trading with one-touch order execution and built-in market analysis tools, enhancing the trading experience for users on the go.

How can I access BigBoss Financial’s trading platforms?

Traders can download MT4 and MT5 for Windows, Mac, and mobile devices directly from the BigBoss Financial website. The BigBoss Trends (BBQ) mobile app is available for download on both Android and iOS devices, providing seamless access to trading functionalities anytime, anywhere.

Our Insights

BigBoss Financial’s diverse platform offerings cater to both novice and experienced traders. While MT4 and MT5 provide robust desktop and web-based trading solutions, the BigBoss Trends (BBQ) mobile app ensures that traders can manage their accounts and execute trades on the go, offering flexibility and convenience.

Deposit Bonus

BigBoss Financial offers an enticing deposit bonus program that rewards traders with up to $13,700 in bonus credits. By depositing into eligible accounts, traders gain additional margin for trading, enhancing their exposure and potential profits while maintaining flexibility and fast account activation.

| Cumulative Deposit Amount | Bonus Rate | Bonus Credit Amount | Eligible Accounts |

| 0 USD - 700 USD | 100% | 700 USD | Deluxe |

| 701 USD - 5,700 USD | 30% | 1,500 USD | Deluxe Standard Pro Spread MASS Standard |

| 5,701 USD - 63,200 USD | 20% | 11,500 USD | Deluxe Standard Pro Spread MASS Standard |

Frequently Asked Questions

Who is eligible for BigBoss Financial’s deposit bonus program?

Traders with Deluxe accounts opened before January 31, 2024, or Deluxe, Standard, Pro Spread, and MASS Standard accounts opened after February 1, 2024, can claim the bonus. Accounts using cashback services, CRYPTOS accounts, or certain referrals are excluded from participation.

How is the bonus distributed and applied to my account?

The bonus is credited within one business day after deposit. It reflects cumulative deposits across all eligible accounts held by a user. Withdrawals or fund transfers proportionally reduce the bonus, and inactive accounts or accounts involved in illegal transactions will have the bonus canceled.

Our Insights

BigBoss Financial’s deposit bonus program provides a strategic boost for both new and existing traders. By offering a three-tier structure, the program increases trading capital significantly while encouraging active account management. It is ideal for those looking to expand margins and explore leveraged trading opportunities.

Customer Support

BigBoss Financial provides responsive customer support for all account holders, ensuring queries and issues are addressed promptly. Clients are advised to check common issues such as spam folders or input errors, while general and account-specific inquiries are handled efficiently during working days.

Frequently Asked Questions

How quickly does BigBoss Financial respond to inquiries?

BigBoss Financial aims to respond within the next working day. For issues related to account opening, deposits, or withdrawals, clients should ensure their email is correctly entered and check spam folders, as misdirected emails can delay responses.

What information is required to contact BigBoss Financial support?

Clients need to provide their name, email, country, and account number if applicable. Only registered email addresses can be used for inquiries regarding account details, deposits, or withdrawals, protecting personal data and ensuring compliance with privacy standards.

Our Insights

BigBoss Financial offers structured customer support with clear guidance on common issues. While response times are generally reliable, users must ensure their email information is accurate. Overall, the support framework balances accessibility with data privacy, but attention to detail is necessary.

Customer Reviews and Trust Scores

Customer reviews of BigBoss Financial reveal concerns around regulation, withdrawals, and overall transparency. Some review sites give moderate ratings for cost and platform quality, but many warn about risky or vague broker practices.

BigBoss is registered in Saint Vincent and the Grenadines (SVG), but that jurisdiction is often viewed as having weak oversight.

| Source | Rating/Score (10) | Key Criticisms |

| BrokersView | 6.0 | Lack of strong regulation, withdrawal issues |

| TradersUnion | 1.96 | Many clients dissatisfied |

| Scamadviser | Low to moderate | Alerts about high-risk claims |

Customers often caution that while some trade experiences are smooth, others report delays or difficulty in withdrawing funds.

Discussions and Forums about BigBoss Financial

Online discussions show mixed but leaning negative sentiment. Some traders share positive stories about execution speed, deposit methods, and customer service response. Others raise red flags about hidden terms, leverage, and the trustworthiness of claims. Many caution that promises seem too good to be true.

| Topic | Positive Feedback | Negative Feedback |

| Deposit Withdrawal | Multiple deposit options, fast deposits | Difficulty withdrawing, delays, hidden fees |

| Leverage | High leverage praised by risk-takers | Risk of large losses, misleading leverage promos |

| Regulation Claims | Transparent on website | Claims vague, SVG registration seen as weak |

| Customer Service | Multilingual support mentioned | Some users say support unresponsive or opaque |

These forums suggest that potential users should read fine print, test small deposits, and check withdrawal terms before committing large sums.

Employee Overview of Working for BigBoss Financial

There is very little reliable public information from employees about working at BigBoss Financial. No major job boards show consistent user ratings for internal culture, pay, or job satisfaction. Some mention multilingual teams and global customer support, but those are external claims rather than verified employee testimonial.

| Factor | Known/Claimed Strengths | Unknown or Weak Areas |

| Multilingual Staff | Support in languages like English, Chinese, Japanese | No clear internal feedback on work-life balance |

| Global Support | Worldwide customer service | No verified reviews on pay, growth or management |

| Platform Tools | Many financial products, high leverage | Possibly misleading execution or risk |

| Transparency | Some info published about company identity | Regulatory clarity and employee satisfaction unclear |

Due to a lack of verified internal feedback, it is hard to draw firm conclusions about employee experience.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Wide range of trading instruments | Limited regulatory oversight |

| Multilingual customer support | No clear local office presence |

| High leverage options | Limited educational resources |

| Crypto deposits accepted | Website transparency could improve |

| Variety of account types | Restricted payment methods in some regions |

References:

In Conclusion

BigBoss Financial positions itself as a global forex and CFD broker, serving traders across multiple regions with multilingual support including English, Japanese, and Chinese. While it promotes worldwide accessibility, it does not publicly highlight specific local office locations, instead focusing on online support channels to reach its international client base.

Faq

BigBoss offers traders the option of receiving tailored trade setups based on their specific charts. This feature improves the trading experience by addressing unique needs.

BigBoss uses strong encryption and multi-factor authentication to protect trading activities. These safeguards prioritize the security of the user accounts and transactions.

Trading on an unregulated platform, such as BigBoss, may raise risk because these platforms do not provide the same level of investor protection as regulated firms.

Some negatives include unexplained fees, account blocking, and larger spreads than other brokers. These concerns can influence cost-effectiveness and overall satisfaction.

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a BigBoss Financial Account

- Trading Platforms and Tools

- Deposit Bonus

- Customer Support

- Customer Reviews and Trust Scores

- Discussions and Forums about BigBoss Financial

- Employee Overview of Working for BigBoss Financial

- Pros and Cons

- In Conclusion