- Home /

- Forex Brokers /

- FinPros

FinPros Review

- Overview

- Why does FinPros stand out?

- Safety and Security

- Spreads, Commissions, and Other Fees

- Understanding the Leverage

- Account Options Explained

- Social and Islamic Accounts

- How to Open a FinPros Account

- Demo Account

- Advanced Execution and Trading Tools

- Market Research and Analysis Tools

- What Can You Trade with FinPros?

- Withdrawals and Deposits

- FinPros Partner Program - Daily Payouts, No Caps, and Real Support

- FinPros Education Hub

- Customer Support

- FinPros vs AvaTrade vs XM - A Comparison

- Insights from Real Traders

- Common Complaints About FinPros

- What Traders Want and Need to Know about FinPros - Quick Q&A

- FinPros vs Eightcap vs Axi - A Comparison

- Pros and Cons

- In Conclusion

FinPros is a regulated broker in Seychelles and Cyprus, providing fast and transparent trade execution through MetaTrader 5, supported by Equinix LD4 hosting. The platform offers four account types, social trading capabilities, AI-powered onboarding, and built-in protection against negative balances.

★★★★★ | Minimum Deposit: $100 Regulated by: FSA Crypto: Yes |

Overview

FinPros, which is regulated in both Seychelles and Cyprus, was launched in 2021. It offers MetaTrader 5 with fast execution, no advice, and four account types. Suitable for self-directed traders, it emphasizes simplicity, flexibility, and solid trading infrastructure over hype.

Frequently Asked Questions

Is FinPros regulated and safe to use?

Yes, FinPros is regulated by the FSA in Seychelles and CySEC in Cyprus. This dual setup offers both global access and a European regulatory option, depending on your trading needs and location.

What types of accounts does FinPros offer?

FinPros offers four distinct account types designed for various trading styles—from low-cost trading to social strategies. You can start small, test approaches, or scale up—all on the same MetaTrader 5 platform.

Our Insights

FinPros is a simple broker designed for self-directed traders. It offers transparent pricing, fast execution, and flexible accounts. However, it suits those who don’t require much guidance and know exactly what they want. Therefore, it appeals to confident, independent traders.

Why does FinPros stand out?

FinPros offers Shariah-compliant trading, fast execution via Equinix LD4, and a range of account types tailored to diverse trading styles. It features AI-powered onboarding, social trading, MetaTrader 5, negative balance protection, flexible pricing, and daily affiliate payouts. Thus, it effectively caters to diverse trader needs.

★★★★★ | Minimum Deposit: $100 Regulated by: FSA Crypto: Yes |

Safety and Security

FinPros holds licenses in Seychelles and Cyprus and enforces strict ID verification, 2FA login security, and negative balance protection. While there’s no compensation scheme, client funds are held in segregated accounts, and withdrawals follow strict AML protocols.

| Protection Feature | Details |

| Licensing | Seychelles FSA (SD087), Cyprus CySEC (418/22) |

| Client Fund Safety | Held in segregated bank accounts |

| Negative Balance | Protection applies to all accounts |

| Login & Identity Security | 2FA, PIN access, document re-verification for any changes |

| Compensation Scheme | Not available |

Frequently Asked Questions

Is FinPros a safe broker in terms of fund protection?

Yes, FinPros enforces strong client protections – 2FA login, identity checks, and negative balance protection. Client funds are held in segregated accounts, though there’s no compensation fund if the broker fails. Overall, it’s a structured but self-directed safety setup.

How does FinPros manage risk during volatile trading conditions?

FinPros tracks margin in real time and closes positions automatically if required levels drop. While there’s no guaranteed stop-loss or slippage protection, the platform prevents your balance from going negative, even in fast-moving or gapped markets.

Our Insights

FinPros provides strong security through fund segregation, regulatory oversight, and balance protection, offering traders a reliable safety net. However, lacking a compensation scheme, it suits informed and self-reliant traders best. Therefore, it balances safety with trader responsibility effectively.

★★★★★ | Minimum Deposit: $100 Regulated by: FSA Crypto: Yes |

Spreads, Commissions, and Other Fees

Every account type at FinPros has a unique pricing structure. You’re either paying through the spread, through commission, or both. The cost differences matter more over time, especially when you trade often or hold positions overnight.

Spreads

| Account Type | Spreads (Typical EUR/USD) | Commission | Pricing Model |

| Cent | From 1.6 pips | None | Spread-only |

| Social | From 1.6 pips | None | Spread-only |

| ClassiQ | From 1.6 pips | $5 per lot | Spread + commission |

| Pro | From 1.0 pip | None | Lower spread-only |

| Raw+ | From 0.0 pips (session-based) | Fixed commission per trade | Raw spread + fixed commission |

Commissions and Other Fees

Only the Raw+ account charges a commission – $2.50 per side, per lot. That’s $5 total per lot traded. Cent, Pro, and Social accounts are commission-free, relying solely on spreads for pricing with no added transaction fees.

FinPros charges no fees to open an account, use the platform, or make internal transfers. Deposits and withdrawals are free on their end, though your bank or payment provider may still apply separate transaction fees.

Swap Fees

Swap fees apply if trades stay open past 10 PM GMT, with rates based on instrument, size, and direction. Some swaps are credits, others are charges. Triple swaps apply on Wednesdays. Swap-free trading is available by request on ClassiQ accounts.

Frequently Asked Questions

Which FinPros account has the lowest trading cost?

The Raw+ account offers the tightest spreads, starting from 0.0 pips, and uses a fixed commission model. It’s ideal for high-volume or cost-sensitive traders who prioritize precision pricing, especially during peak market sessions with tighter liquidity.

Are there any hidden fees with FinPros?

FinPros does not charge account opening fees, internal transfer fees, or platform usage fees. Deposit and withdrawal processing is free on their side, but banks or payment providers may apply charges. Swap fees apply unless you request a swap-free ClassiQ account.

Our Insights

FinPros maintains transparent and competitive costs tailored to different trading styles. It offers commission-free and raw pricing accounts to suit scalpers, overnight holders, or budget-conscious strategy testers. Therefore, traders can choose the account that fits their approach best.

★★★★★ | Minimum Deposit: $100 Regulated by: FSA Crypto: Yes |

Understanding the Leverage

Leverage lets you control larger trade sizes with a smaller amount of capital. It’s a tool (not a feature), and its application at FinPros depends on what you trade, your account, and the size of your positions.

FinPros does not change the leverage suddenly. If big events or abusive behaviour, or extreme high-risk trading, they will communicate with the client first, and only as a last option, it can reduce the leverage, but again, only after informing the client.

| Factor | Details |

| Maximum Leverage | Up to 1:500 (varies by asset/account) |

| Custom Limits | Based on experience and trading history |

| Reductions Possible | Yes, but only with prior notice |

| Triggers for Change | High volatility large positions low liquidity |

When is Leverage Capped?

Maximum leverage can be reduced, but only with prior notice.

- During high-volatility events.

- Around major economic announcements.

- When market liquidity drops.

- If you trade unusually large positions.

FinPros also considers your trading history and experience when setting leverage limits. In other words, just because 1:500 is offered doesn’t mean you’ll have it by default.

★★★★★ | Minimum Deposit: $100 Regulated by: FSA Crypto: Yes |

Account-Level Leverage Overview

| Account Type | Max Leverage |

| Cent | Up to 1:500 |

| ClassiQ | Up to 1:500 |

| Pro | Up to 1:500 |

| Raw+ | Up to 1:500 |

| Social | Up to 1:500 |

★★★★★ | Minimum Deposit: $100 Regulated by: FSA Crypto: Yes |

How Does Margin Work with FinPros?

Margin refers to the amount of money you have in your account while a trade is open. It’s not a charge or a fee, but the capital required to keep that trade running. The size of that margin depends on the amount you trade, the current market price, and the level of leverage you select.

The higher the leverage, the lower the margin you need. If your leverage is lower, the platform will hold a larger portion of your balance to cover the trade. This applies to all accounts, regardless of the asset.

For example:

- If you trade a commodity and the platform sets a 10% margin requirement, you need 10% of the full trade value in your account to open the position.

- The rest is covered by leverage, but only as long as your margin level remains healthy.

- The margin is locked during the trade and released when the position closes.

If the market moves against you and your available funds drop too far, the platform will automatically close trades to protect the account from going into a negative balance.

Frequently Asked Questions

What is the maximum leverage available at FinPros?

FinPros offers leverage up to 1:500, but the amount depends on your trading experience, account setup, and asset class. You won’t automatically get the maximum—it’s tailored to your risk profile and prior trading behavior.

Can FinPros lower my leverage without warning?

No. FinPros doesn’t reduce leverage without prior notice. If your positions are unusually large or market volatility spikes, they may contact you first to adjust settings. It’s a protective measure, not a sudden restriction.

Our Insights

FinPros offers high leverage limits while promoting responsible use. It considers trader experience and notifies users of changes, avoiding overly aggressive or restrictive leverage policies. Thus, it maintains a balanced approach that protects traders and supports their strategies.

★★★★★ | Minimum Deposit: $100 Regulated by: FSA Crypto: Yes |

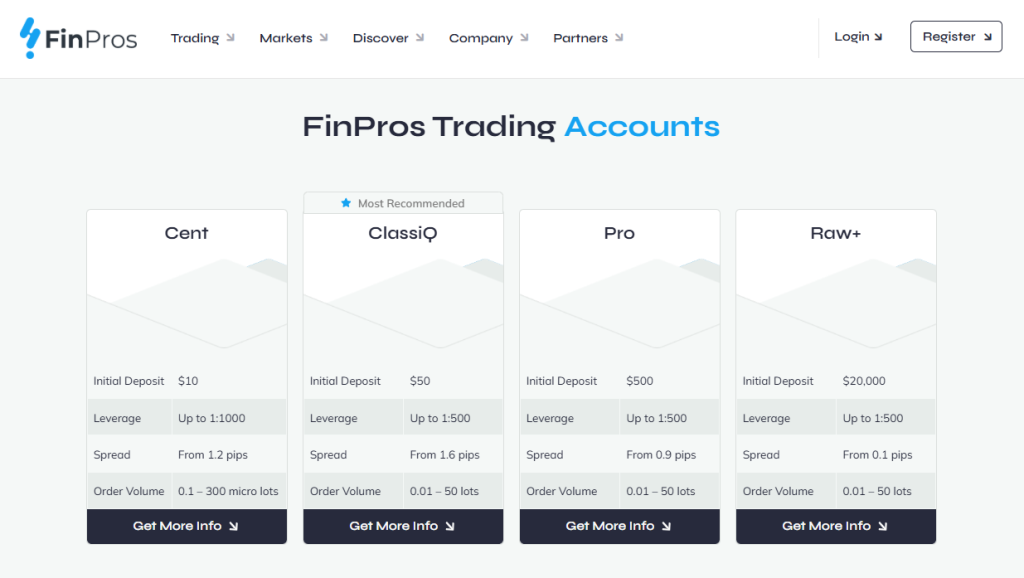

Account Options Explained

FinPros offers four account types with different pricing models, trading access, and optional features. All accounts include full access to MetaTrader 5, standard leverage options, and negative balance protection.

The differences are in how trades are priced, whether commissions apply, and whether you want to use features like copy trading or swap-free conditions. There’s no “best” option, only what suits how you manage trades and costs.

FinPros Account Comparison

| Account Type | Open an Account | Min. Deposit | Spreads |

| Cent | 10 USD | Variable | |

| ClassiQ | 100 USD | From 1.6 pips | |

| Pro | 500 USD | From 1.0 pip | |

| Raw+ | By approval | From 0.0 pips | |

| Social | 100 USD | From 1.6 pips |

Cent Account

The Cent account is an ideal starting point for all traders who aren’t ready to risk large amounts of capital. All trades are denominated in cents, and a spread-only pricing model applies.

The minimum deposit is low (10$), and all trades are commission-free. Despite being a lower-tier account, you’re not restricted to the instruments you can trade.

★★★★★ | Minimum Deposit: $100 Regulated by: FSA Crypto: Yes |

ClassiQ Account

ClassiQ employs a spread and commission ($5) model. It is the only account that supports swap-free trading upon request. The minimum deposit is standard. This account provides access to the full trading platform, with no restrictions on order types or execution tools. – no commission

★★★★★ | Minimum Deposit: $100 Regulated by: FSA Crypto: Yes |

Pro Account

Pro lowers the spread slightly compared to ClassiQ while still avoiding commissions. It requires approval from FinPros based on your profile, and a minimum deposit of $500 is required. The structure suits traders who want better pricing but prefer not to pay separate commission costs.

★★★★★ | Minimum Deposit: $100 Regulated by: FSA Crypto: Yes |

Raw+ Account

Raw+ applies raw pricing with zero spread markup. Instead of paying through the spread, you pay a fixed commission of $2.50 per side, per lot on each trade. This account is available upon request and is suitable for traders who require complete transparency on execution costs.

★★★★★ | Minimum Deposit: $100 Regulated by: FSA Crypto: Yes |

Social and Islamic Accounts

FinPros offers real-time copy trading through the Social account and supports swap-free trading on ClassiQ for clients who request Islamic account settings. Both options are tailored, not automatic, and must be activated manually.

| Feature | Social Account | Islamic (Swap-Free) Option |

| Pricing Model | Same as ClassiQ | Same as ClassiQ |

| Copy Trading Access | Via social trading app | No |

| Swap-Free | None | On request, ClassiQ only |

| Available Automatically | Manual activation | Requires approval |

Frequently Asked Questions

What’s the best FinPros account for beginners?

The Cent account is ideal for new traders. It uses cents instead of dollars, has no commissions, and only a $10 minimum deposit, letting you trade real instruments with lower financial risk and full MT5 access.

Is swap-free trading available on all accounts?

No. Swap-free trading is only available on the ClassiQ account, and it’s not automatic. You must request this feature during or after registration. Once activated, overnight interest is removed from open trades that would usually incur swaps.

Our Insights

FinPros accounts cater to various trading styles, offering options for low-risk entries, no commissions, raw spreads, or copy trading. The essential factor is aligning costs and features with your trade management approach. Therefore, traders can find an account that fits their strategy perfectly.

★★★★★ | Minimum Deposit: $100 Regulated by: FSA Crypto: Yes |

How to Open a FinPros Account

Opening an account at FinPros is quick and mostly automated. With documents ready, AI-driven verification usually approves your profile in under a minute. Here’s what to expect:

1. Step 1: Register Your Profile

Fill out a short form with your name, country, email, and phone number. Set your password and verify your email. This creates your user profile but doesn’t activate trading yet.

2. Step 2: Choose Your Account Type

After logging in, select an account. ClassiQ and Social are instantly available. Pro and Raw+ require approval based on your trading background. You can also request a swap-free setup, but only on ClassiQ.

3. Step 3: Upload Verification Documents

Submit a government-issued ID and proof of address (utility bill or bank statement). FinPros supports over 8,000 document types, and most users are verified within minutes via AI. If flagged, manual review may be needed.

4. Step 4: Set Account Preferences

Choose your base currency, leverage level, and whether to enable copy trading. Be sure, some settings like swap-free status can’t be changed without support later.

5. Step 5: Fund Your Account

Deposit minimums range from $10 (Cent) to $500 (Pro). Use a card, bank transfer, e-wallet, or crypto options vary by region.

Once funded, you’ll receive your MetaTrader 5 login. If you selected the Social account, you’ll also gain access to the copy trading app to mirror other traders in real time.

★★★★★ | Minimum Deposit: $100 Regulated by: FSA Crypto: Yes |

Demo Account

FinPros provides a free MT5 demo that mirrors live trading conditions, yet shields your capital while you learn. You open it inside the client portal, and there is no time limit, allowing unlimited practice across markets and account types before going live.

| Aspect | What You Get | Notes | Platform |

| Access | Open in portal: Trading Accounts → New Demo Account | Inside client area after signup | MT5 desktop web mobile |

| Time limit | None | Practice indefinitely | MT5 environment |

| Account simulation | Mirror live account types | Compare spreads and costs | MT5 |

| Markets | CFDs on forex, indices, metals, shares, crypto | Real-time pricing, virtual funds | MT5 |

Frequently Asked Questions

Does the FinPros demo account expire?

No. The MT5 demo at FinPros has no time limit, so you can keep practicing as long as you need. This is useful for testing strategies under live-like conditions without risking funds, and it aligns with best practice for beginner skill-building.

How do I open the FinPros demo, and can I mirror live accounts?

Log in to your FinPros portal, select Trading Accounts, then New Demo Account. After registration, you can choose a simulated version of each live account on MT5, helping you compare pricing models before funding a real profile.

Our Insights

FinPros’ non-expiring MT5 demo stands out for hands-on learning with zero risk. Because you open it inside the portal and can mirror live account setups, it is a practical testbed before funding. Regulation is via 🇸🇨 FSA SD087, with an 🇨🇾 CySEC entity for EU coverage.

★★★★★ | Minimum Deposit: $100 Regulated by: FSA Crypto: Yes |

Advanced Execution and Trading Tools

FinPros delivers fast execution via MT5 and Equinix LD4, ideal for scalpers and serious traders. While lacking some tools like VPS or calculators, it makes up with clean infrastructure, no dealing desk, and real-time copy trading via its Social app.

| Tool or Feature | Available | Platform(s) | Notes |

| MetaTrader 5 | Yes | Desktop Web Mobile | Full MT5 access with syncing across devices |

| Copy Trading | Yes | FinPros Social App | Works independently from MT5, real-time mirroring |

| Trading Calculators | None | N/A | Not natively provided |

| VPS Hosting | None | N/A | Not supported |

Frequently Asked Questions

Is FinPros good for fast execution and low-latency trading?

Yes. With infrastructure hosted in Equinix LD4, FinPros routes trades at sub-microsecond speeds. This setup minimizes latency and slippage, making it ideal for scalpers and short-term trading strategies.

Does FinPros offer VPS, calculators, or custom tools?

No. FinPros doesn’t provide VPS hosting, trading calculators, or exclusive custom-built indicators. The platform relies on the core MT5 suite, which is powerful but not extended with proprietary tools.

Our Insights

FinPros targets performance-driven traders prioritizing execution speed over extra features. If you’re familiar with MT5 and seek reliable market routing combined with robust copy trading, it meets those needs effectively. Thus, it suits traders focused on efficiency and practicality.

★★★★★ | Minimum Deposit: $100 Regulated by: FSA Crypto: Yes |

Market Research and Analysis Tools

FinPros doesn’t try to reinvent the research wheel, but what they do offer hits the basics with enough substance to matter. Tools aren’t behind a paywall, and they don’t upsell “insights.” FinPros offers usable analysis perfect for retail trading.

| Tool | What It Does | Where It’s Found |

| Technical Views | Identifies trade setups and timing based on technical analysis | On MT5 |

| Economic Insight | Real-time event tracking + impact previews | Integrated with MT5 |

| Economic Calendar | Global economic events with filtering options | MT5 Web Dashboard |

| Blog/Seminars | Covers strategy, fundamentals, platform usage | Website and education section |

| Trading Glossary | Breaks down common terms and jargon | Website |

| FAQs | Covers platform, account, and tool related questions | Client portal and main website |

Frequently Asked Questions

Does FinPros provide premium research tools for traders?

FinPros doesn’t segment tools behind paywalls. All core research features – like technical views, economic calendars, and live event insights – are included free with your account. The content supports real-time trading without needing third-party analysis subscriptions.

Can beginners benefit from FinPros’ research tools?

Yes. FinPros’ tools are beginner-friendly. The glossary helps with trading terms, the blog covers strategy and fundamentals, and the platform’s built-in insights are visually accessible. You don’t need expert-level knowledge to start using their research features.

Our Insights

FinPros provides essential market research tools without unnecessary clutter or extra cost. Though it lacks advanced institutional features, its clear integration of technical and fundamental analysis meets the needs of most retail traders focused on daily decisions. Therefore, it supports practical trading well.

★★★★★ | Minimum Deposit: $100 Regulated by: FSA Crypto: Yes |

What Can You Trade with FinPros?

FinPros gives access to several asset classes, all offered as CFDs. You don’t own the underlying asset; you trade on price movements. The selection isn’t massive, but it covers the basics well enough for most retail traders.

| Asset Class | Examples | Notes |

| Forex | EUR/USD GBP/JPY USD/ZAR | Leverage up to 1:500 on majors. Lower on minors. |

| Indices | US30 DE40 FTSE100 | Includes major US, European, and Asian benchmarks. |

| Commodities | Oil Natural Gas Metals | Both metals and energies. Gold traded in USD. |

| Shares (US) | Apple Tesla Amazon | Only US-listed stocks. No European or UK equities. |

| Cryptocurrencies | BTC LTC ETH, etc. | Commonly traded against major currencies like USD |

The platform focuses on liquid, high-volume markets. You won’t find smaller instruments or niche stock exchanges.

★★★★★ | Minimum Deposit: $100 Regulated by: FSA Crypto: Yes |

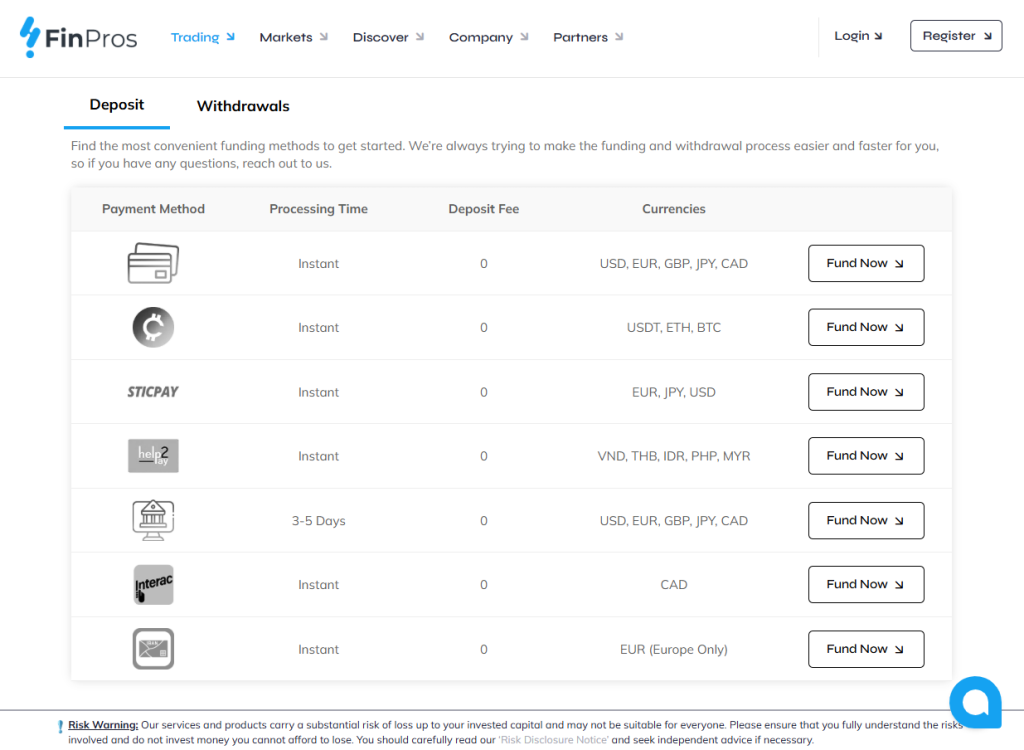

Withdrawals and Deposits

FinPros supports cards, bank transfers, and e-wallets for funding. Deposits are mostly instant, with a $100 minimum initially and $50 afterward, except bank transfers require $200+. Withdrawals must match the deposit method; no third-party payments allowed.

| Method | Minimum Deposit | Processing Time | Notes |

| Card | 50 USD | Instant to 2 hours | Must match your name |

| Bank Transfer | 200 USD | 1–3 business days | Not processed if below $200 |

| E-wallet | 50 USD | Instant to a few hours | May vary by provider |

| Crypto | 50 USD | Same/Next Day | Blockchain fees might apply |

Step-by-Step: Making a Deposit

Log in to the client portal.

- Click “Deposit Funds” and choose the account to fund.

- Choose a payment method.

- Enter the amount and submit.

Wait for confirmation. Cards, crypto, and wallets reflect within minutes. Bank wires take longer.

Step-by-Step: Withdrawing Funds

Go to the same wallet in your portal.

- Click “Funds” and then “Withdraw.”

- Select the method associated with your deposit.

- Enter the amount.

- Submit the request.

- Track the status inside your dashboard.

Withdrawals are processed daily. However, note that there may be delays on weekends and holidays.

★★★★★ | Minimum Deposit: $100 Regulated by: FSA Crypto: Yes |

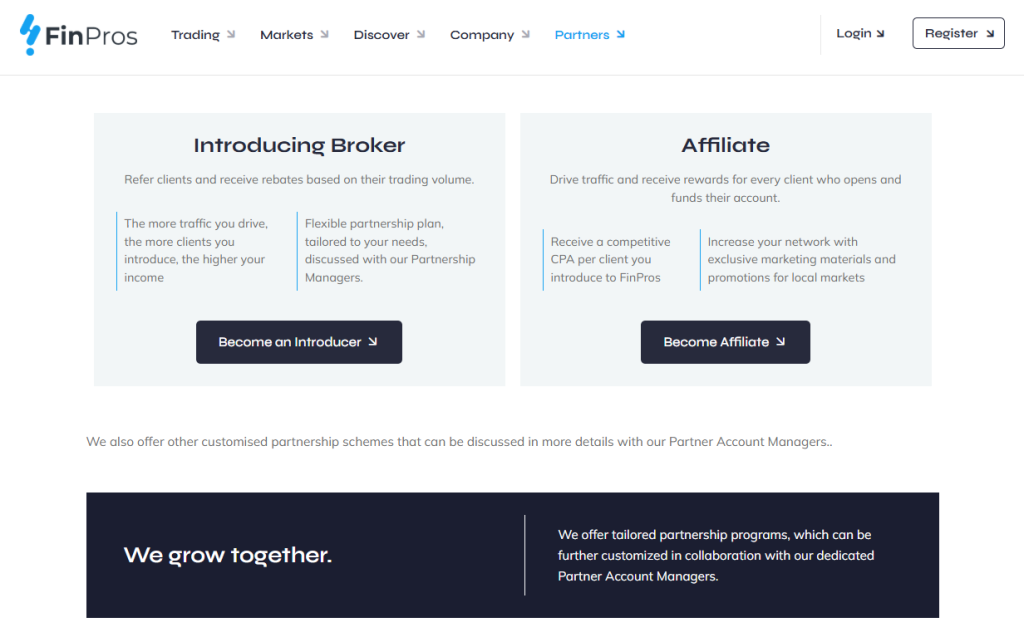

FinPros Partner Program – Daily Payouts, No Caps, and Real Support

FinPros offers a performance-driven partner program built for serious affiliates. With daily payouts, high commissions, and real marketing support, it caters to professionals who care about ROI, conversion rates, and retention, not just banners and links.

| Feature | Details | Notes | Restrictions |

| Payout Frequency | Daily | No monthly or weekly delays | Must meet minimum payout threshold |

| Max Commission Per Lot | Up to $10 | Based on trading volume | No volume cap |

| CPA Deals | Up to $1,000 per trader | Depends on region and quality | Subject to review |

| Automation Policy | Structured EAs allowed | Must not exploit latency or feeds | Abusive systems are restricted |

Frequently Asked Questions

How often are partner commissions paid out?

Unlike most brokers that delay affiliate payments, FinPros pays commissions daily. This allows partners to manage ad budgets and campaigns more effectively, especially those running high-traffic funnels or team-based acquisition strategies.

Can I use automated trading systems as a partner referral?

Yes, automated strategies like EAs and structured systems are allowed. FinPros only restricts abusive practices such as latency arbitrage or server flooding. Communication always occurs before any action is taken on flagged activity.

Our Insights

The FinPros partner program offers aggressive commissions, fast payouts, and strong marketing support rarely found in retail trading. Consequently, it suits affiliates who approach trading traffic as a serious business rather than a casual side activity.

★★★★★ | Minimum Deposit: $100 Regulated by: FSA Crypto: Yes |

FinPros Education Hub

FinPros delivers practical, no-nonsense trading education tailored to beginners and self-guided traders. With blogs, seminars, glossaries, and FAQs, it focuses on real-world skills, not hype, giving users the basics they need without promising overnight success.

| Resource | Format | Focus Area | Best For |

| Blog | Articles | Strategy psychology platform tips | Beginners/self-learners |

| Seminars | Live/Recorded | Platform use trading techniques | Visual and interactive learners |

| Glossary | Web tool | Trading terms and definitions | Quick reference during sessions |

| FAQ Section | Web-based | Platform and account help | Resolving common user questions |

Frequently Asked Questions

Is the FinPros education center suitable for beginners?

Yes. While it doesn’t offer a full academy, FinPros provides well-structured material covering core trading concepts, platform usage, and strategy basics, ideal for newcomers who want to learn fundamentals without being overwhelmed or misled.

Does FinPros offer live educational sessions?

FinPros runs occasional live and recorded seminars led by experienced traders. These focus on practical strategy, platform navigation, and market insights, helping users build confidence and avoid common mistakes early in their trading journey.

Our Insights

The FinPros learning center suits traders who want to control their own education. It provides clear, practical content without hype and focuses on genuine skill development, rather than claiming to be a full trading academy. Therefore, it supports focused, self-driven learning effectively.

★★★★★ | Minimum Deposit: $100 Regulated by: FSA Crypto: Yes |

Customer Support

Support at FinPros is direct and functional. You don’t get 24/7 coverage, but when they’re available, they respond quickly, primarily through live chat. Most issues are resolved without requiring excessive effort.

| Method | Details |

| SupportPros@ FinPros.com |

|

| Live Chat | Available on the website and inside the platform |

| Phone | No public call center handled by account managers if applicable |

| Office (HQ) | CT House, Office 4A, Providence, Mahé, Seychelles |

| EU Office | Shop 4, Anna City Court, 6 Laiou St., Limassol, Cyprus |

Support is available in English, with localized assistance available depending on the region and account type. There is no phone support for standard accounts, but once you’re approved for Pro or Raw+, or if you work as a partner or an IB, you’ll typically receive a dedicated account manager.

★★★★★ | Minimum Deposit: $100 Regulated by: FSA Crypto: Yes |

FinPros vs AvaTrade vs XM – A Comparison

★★★★★ | Minimum Deposit: $100 Regulated by: FSA Crypto: Yes |

Insights from Real Traders

⭐⭐⭐⭐

Been with FinPros for just over a year, and the experience’s been solid. I joined as an IB and brought in a lot of referrals, and Mr. Diaa’s support with my clients made a real difference. Out of all the firms I’ve worked with, this team’s been the most responsive.

Emma

⭐⭐⭐⭐⭐

They handled all my requests with no drama. Not sure what someone else was talking about in a bad review. I’ve met the team in person at a Dubai event. No fake names, no dodgy behavior. They’re legit.

Michael

⭐⭐⭐⭐

Setting up an account was faster than I expected. Uploaded my ID, added my card, and I was ready to trade in minutes. Deposits went through instantly, and live chat answered me right away, with an actual person.

Sophie

Customer Reviews and Trust Scores

| Platform | Rating/Score | Trust Score (5) | Summary of Feedback |

| Forex Peace Army | No ratings yet | N/A | FinPros is listed but currently has no user reviews or ratings. |

| Google Play (FinPros App) | 500+ downloads, no rating | N/A | The app has 500+ installs, but no public rating or reviews are visible. |

| App Store (iOS) | Not listed or unrated | N/A | No official rating or reviews currently appear in the App Store. |

| BestBrokers.com (via Trustpilot) | 4.5 | 4.5 | FinPros is rated 4.5 out of 5 on Trustpilot, highlighting positive user satisfaction. |

Note: This information is based on trader comments and views; it is subject to change.

★★★★★ | Minimum Deposit: $100 Regulated by: FSA Crypto: Yes |

Common Complaints About FinPros

| Issue | Description |

| Slippage Reports | Some users experience higher-than-expected slippage, especially around bonuses or high volatility. |

| Withdrawal Challenges | A few traders report delays or blocks in withdrawals, particularly after large deposits or profitable trades. |

| Aggressive Marketing | There are claims that some sales reps use pressure tactics, such as promising high returns or suggesting bank loans. |

| Customer Support Gaps | Complaints mention poor follow-up or lack of resolution when issues are flagged, especially with profit reversals. |

| Weak Regulation | FinPros is regulated in Seychelles, which some users consider less protective than major financial regulators. |

★★★★★ | Minimum Deposit: $100 Regulated by: FSA Crypto: Yes |

Note: This information is based on trader comments and views; it is subject to change.

What Traders Want and Need to Know about FinPros – Quick Q&A

Q: What’s the minimum deposit to open a FinPros account? – John

A: 10 USD for Cent, ClassiQ, or Social, and 500 USD for Pro. Bank transfers require a minimum of 200 USD.

Q: Does FinPros offer a swap-free account for Islamic traders? – Maria

A: Yes, but only through the ClassiQ account.

Q: Does FinPros charge fees for deposits or withdrawals? – Ahmed

Q: Is slippage common on FinPros trades? –Sophie

Q: Are FinPros withdrawals fast? – Liu Wei

★★★★★ | Minimum Deposit: $100 Regulated by: FSA Crypto: Yes |

FinPros vs Eightcap vs Axi – A Comparison

Pros and Cons

| ✓ Pros | ✕ Cons |

| Daily partner payouts with no earning caps | No compensation scheme in case of broker insolvency |

| Fast client onboarding with AI-based ID checks | No VPS hosting or platform-integrated trading tools |

| Raw+ account offers true zero-spread pricing | No guaranteed stop-loss or slippage protection |

| All accounts include negative balance protection | Only one swap-free account type (ClassiQ) |

| Strong MT5 infrastructure hosted in Equinix LD4 | Limited asset variety beyond core forex and indices |

References:

In Conclusion

FinPros delivers strong execution, flexible account options, and reliable infrastructure. With MT5, tight spreads via Raw+, and fast AI-based onboarding, it suits self-directed traders seeking performance, not handholding, across commission-free, Raw+, or copy-trading setups.

Faq

You download their app, link your account, select a trader, and their trades are synced with yours.

Yes, but it’s not shown on the site. You’ll find it inside the client portal after signing up.

Yes, FinPros offers CFDs across markets, including Crypto, Forex, Commodities, Indices, and Shares.

Usually yes. Their system uses AI verification, and approval is completed in under a minute.

- Overview

- Why does FinPros stand out?

- Safety and Security

- Spreads, Commissions, and Other Fees

- Understanding the Leverage

- Account Options Explained

- Social and Islamic Accounts

- How to Open a FinPros Account

- Demo Account

- Advanced Execution and Trading Tools

- Market Research and Analysis Tools

- What Can You Trade with FinPros?

- Withdrawals and Deposits

- FinPros Partner Program - Daily Payouts, No Caps, and Real Support

- FinPros Education Hub

- Customer Support

- FinPros vs AvaTrade vs XM - A Comparison

- Insights from Real Traders

- Common Complaints About FinPros

- What Traders Want and Need to Know about FinPros - Quick Q&A

- FinPros vs Eightcap vs Axi - A Comparison

- Pros and Cons

- In Conclusion