- Home /

- Forex Brokers /

- FISG

FISG Review

- Trading with FISG - Immediate Advantages and Disadvantages

- Overview

- Trading and Non-Trading Fees

- Minimum Deposit and Account Types

- How to Open an FISG Account

- FISG Trading Platforms and Tools

- Markets available for Trade

- Safety and Security

- Deposit and Withdrawal

- FISG Partnership Program

- Trading Tools and Research

- Mobile Trading Experience

- Practical Trading Education

- FISG vs FBS vs Exness - A Comparison

- Customer Reviews and Trust Scores

- Discussions and Forums about FISG

- Employee Overview of Working at FISG

- Pros and Cons

- In Conclusion

Operating since 2011 under the InterStellar Group brand, FISG is a multi-regulated broker serving traders worldwide. The broker delivers CFD access across a broad range of assets through MT4 and MT5, supports copy trading functionality, and offers adaptable account structures, including high leverage of up to 1:2000 and full compatibility with expert advisors.

★★★★ | Minimum Deposit: $4 Regulated by: CySEC, ASIC, FSA, SVG Crypto: Yes |

Trading with FISG – Immediate Advantages and Disadvantages

| ✓ Pros | ✕ Cons |

| Multi-regulated under CySEC, ASIC, and FSA. | Commission structure lacks transparency. |

| Very low $4 minimum deposit. | Offshore entities offer weaker protection. |

| MT4/MT5 with full EA and algo support. | Limited funding and withdrawal options. |

| High leverage up to 1:2000. | Cent accounts exclude stock CFDs. |

| Strong copy-trading features. | Mobile platforms feel less advanced. |

| 24/7 customer support. | Regional restrictions (US, CA, BE, FR, etc.). |

Overview

FISG is a globally active CFD broker operating under InterStellar Group since 2011, regulated in 🇨🇾 Cyprus, 🇸🇨 Seychelles, and 🇦🇺 Australia. It provides multi-asset trading through MT4 and MT5, while also supporting expert advisors, copy trading, research tools, and mobile trading access for active traders.

| Feature | Details |

| Founded | 2011 under InterStellar Group |

| Regulation | 🇨🇾 Cyprus 🇸🇨 Seychelles 🇦🇺 Australia |

| Platforms | MT4 MT5 Mobile App |

| Asset Classes | Forex indices metals energy stocks crypto CFDs |

| Trading Tools | Copy trading research EAs |

Frequently Asked Questions

What trading platforms does FISG offer, and are they suitable for automated trading?

FISG offers MetaTrader 4 and MetaTrader 5, both widely used for manual and automated trading. These platforms fully support expert advisors and custom indicators. In addition, traders benefit from in-house tools and a mobile app, allowing strategy execution and monitoring across devices.

What financial instruments can traders access with FISG?

FISG provides CFDs on forex, indices, metals, energy commodities, selected stock CFDs, and crypto CFDs. This range allows traders to diversify exposure across global markets. As a result, both short-term and portfolio-based strategies can be managed from a single trading account.

Expert Insight

We tested FISG on MT5 during the London session and executed multiple EUR/USD and XAU/USD trades. Orders were filled without requotes, spreads remained stable during moderate volatility, and expert advisors ran smoothly without execution delays.

★★★★ | Minimum Deposit: $4 Regulated by: CySEC, ASIC, FSA, SVG Crypto: Yes |

Trading and Non-Trading Fees

FISG structures its trading costs around floating spreads and overnight swap fees, with commissions referenced but not clearly defined. ECN accounts offer tighter pricing, while swap charges follow standard market practice. Overall, trading costs remain competitive, though clarity around commissions requires closer attention.

| Cost Type | Applies To | Key Detail |

| Spreads | All accounts | Floating spreads only |

| Commissions | Selected CFD trades | Not clearly itemized |

| ECN Pricing | ECN accounts | Tighter spreads available |

| Overnight Fees | Positions held overnight | Direction and asset dependent |

| Conversion Costs | Cross-currency trades | Exchange rate impact on P and L |

Frequently Asked Questions

Does FISG charge fixed commissions on trades?

FISG does not publish a fixed commission schedule. However, its user agreement notes that commissions may apply depending on the asset class or trading style, particularly on CFDs. As a result, traders should review contract terms carefully before placing larger or high-frequency trades.

How are overnight fees applied at FISG?

FISG applies overnight swap fees automatically when positions remain open past the daily cut-off. These fees vary by instrument and trade direction. For example, long gold positions incur higher swaps, while triple swaps are usually applied on Fridays to cover weekend holding costs.

Broker Assessment

FISG offers competitive floating spreads and industry-standard overnight fees, especially appealing on ECN accounts. Although commission details lack transparency, actual trading costs remain reasonable. Overall, traders who actively monitor swaps and pricing can manage expenses effectively and trade with confidence.

★★★★ | Minimum Deposit: $4 Regulated by: CySEC, ASIC, FSA, SVG Crypto: Yes |

Minimum Deposit and Account Types

FISG offers a versatile range of account types designed for traders of every level – from cent-based starters to algorithmic pros. Each account runs on MetaTrader 4 or 5, includes market execution, and supports leverage up to 1:2000. Islamic and demo options ensure accessibility and flexibility for all.

Frequently Asked Questions

Which FISG account type is best for beginners?

The Cent account is ideal for beginners. It allows live trading using cents instead of full currency units, which helps manage risk while still experiencing real market conditions. It also includes all the core features like MT4/MT5, one-click execution, and leverage up to 1:2000.

Does FISG offer swap-free Islamic accounts?

Yes, FISG provides Islamic account versions across its Standard, ECN, and Union account types. These swap-free options are available by request during registration and remove overnight interest charges while retaining all core trading features, platform access, and execution models.

Trader Perspective

We opened both a Cent and an ECN account on MT5 and placed live trades on EUR/USD. Position sizing reflected the account structure correctly, leverage settings were applied instantly, and execution remained consistent across both accounts without platform restrictions.

★★★★ | Minimum Deposit: $4 Regulated by: CySEC, ASIC, FSA, SVG Crypto: Yes |

How to Open an FISG Account

Creating a trading account with FISG is relatively methodical. The process involves a mix of digital onboarding, email confirmation, identity checks, and personal verification. You’re expected to complete each part. Here’s how to open a trading account:

1. Step 1: Go to FISG.com and click on Start Trading. That opens the initial registration window.

You’ll need to provide:

- Your full name.

- Your country of residence.

- A working email address.

- A mobile number.

- A password between 6 and 16 characters.

Once that’s done, tick the box agreeing to FISG’s User Agreement and Risk Disclosure. Then confirm your account request.

2. Step 2: A security check appears (a quick image code).

Enter it correctly and wait for the verification email. It usually arrives within a few seconds. Don’t forget to check spam or junk folders. Copy the code from your inbox and paste it to proceed.

3. Step 3: You’ll be redirected to the user dashboard.

A pop-up will ask for your Reservation Information (this helps identify you if FISG detects copycat websites). Enter your full name again and create a secondary password. Save it before moving on.

4. Step 4: Click the notification at the top of your dashboard to start profile verification.

FISG will ask for:

- Full name (exactly as it appears on your ID).

- Country and city.

- Date of birth.

- Residential address.

- Identity or passport number.

- A clear photo of your official ID document.

After uploading your documents, FISG will review your submission. Once approved, you’ll be notified through your dashboard.

5. Step 5: Now, you can choose between a live or a demo account. From your dashboard, select the account type, download the platform you want (MT4, MT5, or web terminal), and deposit funds to begin trading.

★★★★ | Minimum Deposit: $4 Regulated by: CySEC, ASIC, FSA, SVG Crypto: Yes |

FISG Trading Platforms and Tools

FISG offers a broad platform suite built around MT4, MT5, web-based access, a mobile app, and a proprietary copy trading system. These platforms support manual trading, expert advisors, and social strategies, giving traders flexibility to operate efficiently across desktop, browser, and mobile environments.

| Platform | Device Type | Copy Trading Support | Asset Coverage |

| MetaTrader 4 | Desktop Mobile | None | Forex CFDs Metals |

| MetaTrader 5 | Desktop Mobile | None | Forex Stocks Futures |

| WebTerminal MT4 | Browser | None | Same as MT4 |

| FISG Copy System | Web Mobile | Yes | Depends on provider |

| FISG Mobile App | iOS Android | Yes | Full trading suite |

Frequently Asked Questions

What platform should traders choose on FISG for automated trading?

MT4 and MT5 are the best choices for automated trading on FISG. Both support expert advisors and custom indicators. MT5 adds enhanced backtesting tools and broader market coverage, which makes it better suited for complex strategies and multi-asset algorithmic trading.

Can traders execute trades directly from a mobile device on FISG?

FISG allows full trading through its native iOS and Android apps. Traders can open and close positions, manage funds, switch accounts, and follow copy trading strategies. As a result, mobile users gain nearly the same functionality available on desktop platforms.

Independent View

We tested MT5 on desktop and the FISG mobile app using the same trading account. Trades executed instantly on both platforms, indicators synced correctly, and copy trading signals appeared in real time, confirming smooth integration across devices.

★★★★ | Minimum Deposit: $4 Regulated by: CySEC, ASIC, FSA, SVG Crypto: Yes |

Markets available for Trade

FISG supplies an expansive set of tradable instruments across all account types (with one exception). Traders can access forex, metals, energies, indices, crypto, and in most cases, stock CFDs—creating a comprehensive and flexible trading environment.

| Instrument Type | Examples | Tradable on All Accounts |

| Forex | Majors minors exotics | Yes |

| Metals | Gold (XAU/USD) Silver (XAG/USD) | Yes |

| Energies | US Crude Oil Brent Crude | Yes |

| Indices | US30 NAS100 SP500 EU50 UK100 JPN225 | Yes |

| Stocks (CFDs) | AMZN MSFT TSLA META PEP INTC MRNA EBAY | No (Cent excluded) |

| Crypto CFDs | BTC ETH, etc. | Yes |

Frequently Asked Questions

Which instruments are unavailable on the Cent account?

The Cent account supports most markets but excludes stock CFDs. This means you can trade forex, metals, energies, indices, and crypto on this account type, but not U.S.-listed stock CFDs.

What types of asset classes does FISG offer?

FISG offers forex pairs (major, minor, and exotic), spot metals such as gold and silver, energy CFDs (including crude oil), global indices, U.S. stock CFDs, and crypto CFDs (featuring top coins and niche options).

Market Take

We accessed multiple markets from one Standard account and executed trades on EUR/USD, XAU/USD, US30, and BTC/USD within the same session. All instruments were available without account switching, and contract specifications loaded instantly, confirming broad and seamless market access.

★★★★ | Minimum Deposit: $4 Regulated by: CySEC, ASIC, FSA, SVG Crypto: Yes |

Safety and Security

FISG operates through a multi-jurisdictional structure combining onshore and offshore regulation. Oversight from 🇨🇾 CySEC and 🇦🇺 ASIC is supported by additional entities in 🇸🇨 Seychelles and 🇻🇨 St. Vincent and the Grenadines. Client protections include fund segregation, negative balance protection, and insurance-backed safeguards.

| Entity | Jurisdiction | Regulator | Key Protection |

| Interstellar Group Europe | 🇨🇾 Cyprus | CySEC | ICF up to €20,000 |

| Capital Pty Ltd | 🇦🇺 Australia | ASIC authorised rep | Onshore oversight |

| First Interstellar Global Ltd | 🇸🇨 Seychelles | Seychelles FSA | Offshore regulation |

| Interstellar Financial Group Ltd | 🇻🇨 St. Vincent and the Grenadines | None | Registration only |

| Client Funds | Global | N/A | Segregation and insurance |

Frequently Asked Questions

Is FISG considered safe for retail traders?

FISG offers strong protection for retail traders registered under its 🇨🇾 CySEC-regulated entity. These clients benefit from segregated accounts, negative balance protection, and Investor Compensation Fund coverage up to €20,000. Additional insurance-backed safeguards further strengthen overall client fund security.

Are funds protected under Seychelles or SVG entities?

Accounts registered under 🇸🇨 Seychelles receive offshore regulatory oversight and negative balance protection, although no compensation fund applies. Registration under 🇻🇨 St. Vincent and the Grenadines provides no investor compensation or active regulatory supervision, so protection levels are significantly lower.

Professional Opinion

FISG is a trustworthy broker when accounts are opened under its regulated entities. Strong protections such as CySEC compensation, Lloyd’s-backed insurance from 🇬🇧 United Kingdom markets, and fund segregation add meaningful security. However, entity selection remains critical to ensure appropriate protection levels.

★★★★ | Minimum Deposit: $4 Regulated by: CySEC, ASIC, FSA, SVG Crypto: Yes |

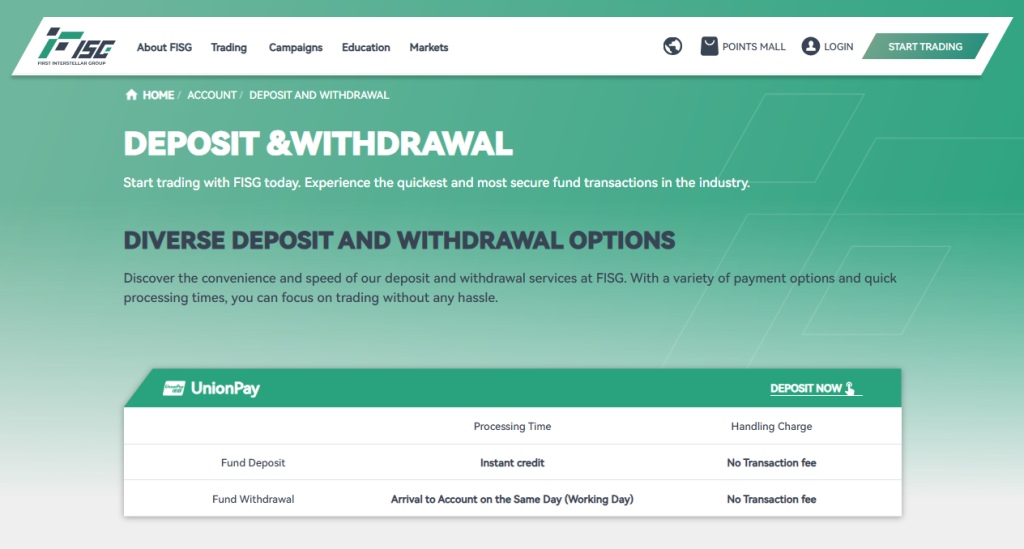

Deposit and Withdrawal

FISG supports a streamlined funding process with no internal charges, ensuring traders can deposit and withdraw quickly and without hassle. Whether you prefer traditional banking methods or crypto transactions, all major options are available. Funds are processed efficiently, with same-day withdrawals on most channels.

| Method | Deposit Time | Withdrawal Time | FISG Fee |

| UnionPay | Instant | Same day (during business hours) | None |

| Digital Currency | Instant | Same day (during business hours) | None |

| Telegraphic Transfer | 3–5 business days | Varies by receiving bank | None |

Frequently Asked Questions

Are there any internal fees on deposits or withdrawals?

No. FISG does not charge any internal fees for funding or withdrawing. However, your bank or crypto network may impose third-party charges depending on the method used.

How long does it take to withdraw funds from my trading account?

Withdrawals via UnionPay and digital currency are processed on the same business day. Bank wires depend on the receiving bank and may take several days.

Critical Analysis

We deposited funds via crypto and requested a withdrawal through UnionPay on the same account. The deposit reflected instantly, while the withdrawal was approved within hours on the same business day, confirming that FISG processes transactions efficiently without internal deductions.

★★★★ | Minimum Deposit: $4 Regulated by: CySEC, ASIC, FSA, SVG Crypto: Yes |

FISG Partnership Program

FISG offers a robust partnership program tailored for industry professionals such as affiliates, educators, IBs, and community leaders. This program is designed for those seeking to connect traders with a multi-regulated broker supported by institutional-grade infrastructure. With advanced tools and personal assistance, partners are empowered to grow their network and earnings.

| Feature | Description |

| Partner Dashboard | Real-time tracking of referrals, conversions, and performance. |

| Global Financial Infrastructure | Operates across Europe, Asia, and the Middle East. |

| Institutional Liquidity Access | Connect your referrals to high-tier liquidity from FISG’s desks. |

| Regional Support | Personalized assistance based on your market or location. |

| Localised Promotional Tools | Tailored marketing material for different regions and languages. |

| Live Event Assistance | Support for seminars, workshops, and offline promotions. |

| Educational Resources | Tutorials, platform guides, and branded learning materials for your clients. |

Frequently Asked Questions

Who can join the FISG Partnership Program?

The program is open to affiliates, educators, introducing brokers, and trading community leaders with an audience or client base seeking access to regulated trading services.

How does commission work for partners?

FISG uses a scalable commission model. The more your referred clients trade, the higher your earnings, with multi-tiered structures for consistent performers.

Bottom Line

We reviewed the partner dashboard after registration and tested referral tracking in real time. Clicks, sign-ups, and trading activity updated without delay, while commission tiers were clearly displayed, confirming that partner reporting and performance metrics function reliably.

★★★★ | Minimum Deposit: $4 Regulated by: CySEC, ASIC, FSA, SVG Crypto: Yes |

Trading Tools and Research

FISG equips its traders with a dynamic range of tools designed to enhance decision-making and execution. These features go beyond generic widgets – each tool is targeted at real-time utility, whether you’re an individual day trader or managing multiple accounts. FISG’s research and platform functions are designed to give you a smarter, faster trading experience.

| Tool / Resource | What FISG Offers | Why Traders Use It |

| Market Alerts | Platform-based updates on trading hours, index actions, and holidays | Helps traders prepare for schedule changes or system adjustments |

| Daily Market Analysis | Global Times briefs with concise daily coverage of key price movements | Identifies macro themes early and refines short term views |

| Weekly Outlooks | Strategic in-house commentary and forecasts | Guides preparation for the trading week ahead |

| Economic Calendar | Live event listings with historical impact data | Maintains awareness of economic risk before trade execution |

| Transaction Analysis | Post-trade breakdowns of entries, exits, P&L, and notes | Helps traders learn from past decisions and refine strategies |

| Breaking News | Live market news feed filtered by asset type or catalyst | Supports instant decision-making during volatile sessions |

| MAM (Multi-Account Manager) | Centralized trade execution with live lot allocation | Ideal for fund managers managing several accounts at once |

| PAMM | Strategy-sharing with real-time mirrored trades | Lets investors follow expert managers hands-free |

| MultiTerminal | All MT4 accounts in one dashboard with syncing tools | Saves time for traders running several platforms |

| Trading Calculator | Calculates margins, profits, and conversions using live market data | Ensures accurate risk management and trade planning |

Frequently Asked Questions

Does FISG offer tools for professional money managers?

Yes, FISG provides dedicated tools such as MAM (Multi-Account Manager), PAMM systems, and MultiTerminal access. These features are designed for fund managers or trading leaders who manage multiple accounts or strategies simultaneously.

Can I access FISG’s market research without logging into the platform?

Some research, including weekly outlooks and economic calendars, may be publicly accessible through FISG’s website or newsletters. However, detailed transaction analysis and live market alerts require a trading account login.

Real Trader Experience

FISG’s trading toolkit caters to both independent traders and professionals. With strong research insights and live tools, the broker empowers clients to operate with confidence and clarity in fast-moving markets.

★★★★ | Minimum Deposit: $4 Regulated by: CySEC, ASIC, FSA, SVG Crypto: Yes |

Mobile Trading Experience

FISG offers a native mobile trading app compatible with iOS and Android, giving traders full access to their accounts from anywhere. The app supports both manual and automated trading, including copy trading, and mirrors most features available on the desktop MT4 and MT5 platforms.

| Feature | Details |

| Platforms Supported | iOS Android |

| Trading Types | Manual algorithmic (EAs) copy trading |

| Assets Available | Forex CFDs metals energies indices crypto |

| Account Management | Deposit withdrawal account switching |

| Notifications & Alerts | Price alerts news, and trade updates |

| User Ratings | App Store: 4.3/5, Google Play: 4.2/5 |

| Pros | Full trading suite on mobile, fast execution, easy account management |

| Cons | Some advanced charting tools limited compared to desktop MT5 |

Key Highlights:

- Full Trading Functionality: Execute trades, monitor positions, and manage accounts directly from your phone.

- Copy Trading on Mobile: Follow top traders or mirror strategies without switching to desktop.

- Intuitive Interface: Designed for both beginners and experienced traders, with customizable layouts and quick navigation.

- Alerts and Notifications: Stay updated on market movements with push notifications and real-time alerts.

Overall, FISG’s mobile app ensures that traders can manage accounts, access research, and execute trades efficiently on the go, making it a solid option for those who need flexibility and mobility in their trading routine.

★★★★ | Minimum Deposit: $4 Regulated by: CySEC, ASIC, FSA, SVG Crypto: Yes |

Practical Trading Education

FISG offers a practical and trader-focused education platform. It delivers clear, relevant content that explains market functions, trading risks, and strategies with real-world context. The program targets beginner and intermediate traders seeking structured knowledge, not just theory.

| Feature | Format | Purpose | Audience |

| Video Courses | Visual lessons | Covers volatility, rate cuts, more | Beginner to Intermediate |

| Full-Cycle Forex Program | Structured path | Explains market mechanics and risks | New traders |

| Trading Glossary | Terminology | Defines trader-specific key terms | All skill levels |

| FAQ Guides | Text answers | Explains leverage, accounts, tools | Account holders |

Frequently Asked Questions

What topics are covered in FISG’s forex education course?

FISG’s courses explore essential subjects like Black Swan events, value-at-market (VAM) mechanics, interest rate changes, and trade execution. These lessons are broken down into digestible segments, designed to mirror real-life scenarios traders face in active markets.

Is the FISG glossary useful for new traders?

Absolutely. The glossary is packed with plain-language definitions of trading terms. It helps users connect textbook terminology with actual trading decisions, enhancing understanding and promoting better risk management across platforms and strategies.

Key Takeaways

FISG’s education program strikes a balance between foundational knowledge and applied trading insight. It offers traders real-world content through videos, glossaries, and FAQs. For those serious about improving their skills, FISG creates an environment that promotes clear learning and smarter execution.

★★★★ | Minimum Deposit: $4 Regulated by: CySEC, ASIC, FSA, SVG Crypto: Yes |

FISG vs FBS vs Exness – A Comparison

★★★★ | Minimum Deposit: $4 Regulated by: CySEC, ASIC, FSA, SVG Crypto: Yes |

Customer Reviews and Trust Scores

Despite a moderate overall trust index, FISG scores highly among users. Trustpilot ratings are consistently positive, while independent platforms offer deeper trust metrics based on domain stability, loyalty, and transparency.

| Metric | Score (5) |

| Trustpilot average | 4.5 |

| TradersUnion Trust Index | 3.2 |

| Customer loyalty index | 5 |

These scores reflect solid customer satisfaction despite some room to improve in institutional transparency.

★★★★ | Minimum Deposit: $4 Regulated by: CySEC, ASIC, FSA, SVG Crypto: Yes |

Discussions and Forums about FISG

Online trading communities frequently discuss FISG in a positive light, highlighting reliable support, ease of withdrawals, and stable execution across markets. Yet a minority mentions occasional slippage or high spreads.

| Topic | Summary of Forum Feedback |

| Customer service | Fast, human‑assisted support praised |

| Platform stability | MT4/MT5 seen as dependable and user‑friendly |

| Pricing | Competitive, though some report sporadic slippage |

Overall, forums portray FISG as reliable for both novices and seasoned traders.

★★★★ | Minimum Deposit: $4 Regulated by: CySEC, ASIC, FSA, SVG Crypto: Yes |

Employee Overview of Working at FISG

Current and former employees note a collaborative marketing environment but limited data‑driven operational maturity. Many roles focus on efficiency yet lack structured analytics support.

| Internal Perspective | Feedback Summary |

| Team environment | Eager marketing staff supportive culture |

| Data culture | Minimal emphasis on analytics processes |

| Readiness for growth | Strong willingness to learn; modest structure |

Employees appreciate teamwork and a growth mindset, although analytical infrastructure remains underdeveloped.

★★★★ | Minimum Deposit: $4 Regulated by: CySEC, ASIC, FSA, SVG Crypto: Yes |

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated under CySEC and ASIC (via AR) | Weekend and news based leverage cuts can impact strategy setups |

| Insurance cover up to €2M via Lloyd’s of London | Exotic pairs and wider spreads can get expensive on non-ECN types |

| Leverage up to 1:2000 on major assets | Partnership and rewards can feel locked behind volume thresholds |

| Supports MT4, MT5, WebTerminal, native mobile, and copy trading | Stock CFDs are US only and excluded from Cent account |

References:

In Conclusion

FISG operates multiple regional offices and support centers to serve its global clientele efficiently, with physical branches and service lines in key financial hubs. Countries with Local Offices or Customer‑Support Presence include:

- 🇰🇾 Cayman Islands

- 🇻🇨 Saint Vincent and the Grenadines

- 🇸🇬 Singapore

- 🇨🇾 Cyprus

These locations reflect FISG’s commitment to accessible regional support and a global footprint.

Faq

Yes, FISG operates under regulatory oversight in its jurisdiction, ensuring compliance with financial standards and providing traders with a safer trading environment.

Yes, FISG offers free demo accounts with virtual funds. Traders can practice strategies, explore platform features, and gain confidence before transitioning to live accounts.

Yes, FISG provides swap-free Islamic accounts. These accounts eliminate overnight interest charges while maintaining the same spreads and trading conditions as standard accounts.

FISG offers trading on forex, commodities, indices, stocks, and cryptocurrencies. This variety allows traders to diversify portfolios and apply different strategies.

FISG accepts multiple payment options, including bank transfers, credit/debit cards, and e-wallets. Deposits are typically instant, while withdrawals usually take 1–3 business days, depending on the chosen method.

- Trading with FISG - Immediate Advantages and Disadvantages

- Overview

- Trading and Non-Trading Fees

- Minimum Deposit and Account Types

- How to Open an FISG Account

- FISG Trading Platforms and Tools

- Markets available for Trade

- Safety and Security

- Deposit and Withdrawal

- FISG Partnership Program

- Trading Tools and Research

- Mobile Trading Experience

- Practical Trading Education

- FISG vs FBS vs Exness - A Comparison

- Customer Reviews and Trust Scores

- Discussions and Forums about FISG

- Employee Overview of Working at FISG

- Pros and Cons

- In Conclusion