- Home /

- Forex Brokers /

- FxGrow

FxGrow Review

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open an FXGrow Account

- Safety and Security

- Trading Platforms and Tools

- Trading Instruments

- Deposits and Withdrawals

- Introducing Brokers and Affiliates

- Customer Support

- Customer Reputation and Trust Scores

- Discussions and Forums on FXGrow

- Employee Overview of Working at FXGrow

- Pros and Cons

- In Conclusion

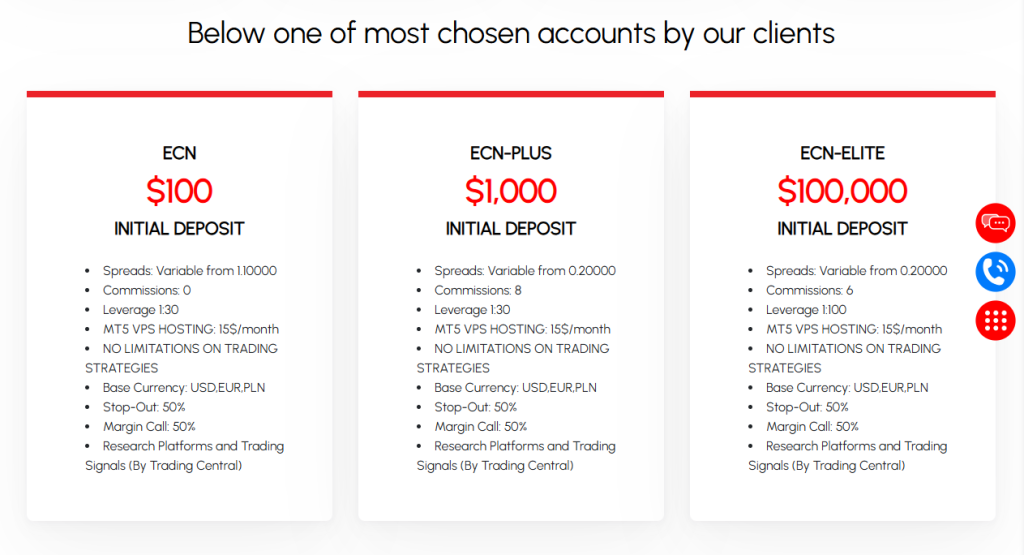

FXGrow is a trusted broker with a strong Trust Score of 85/100. Licensed by nine Tier-1 regulators, it ensures high reliability. Traders can choose from three retail accounts: ECN, ECN Plus, and ECN Elite, offering flexible options for different trading needs.

Overview

FXGrow is a multi-award-winning broker with transparent trading conditions, fast execution, and strong regulation. Over 16 years in the market underline its stability. The platform offers daily market analysis and negative balance protection, giving traders assurance in fast execution and clarity at every step.

Frequently Asked Questions

What makes FXGrow stand out compared to other brokers?

FXGrow combines secure regulation under EU laws with fast order execution (under 10 ms), negative balance protection, 24/5 support, and daily market analysis—creating a safe, proactive environment where traders can act decisively and confidently.

Which account type suits beginner traders best?

The standard ECN account requires $100 to open, charges no commission, and features spreads from 1.1 pips, leverage of 1:30, and MT5 VPS hosting. This solid combination lets beginners access professional trading conditions with minimal entry cost.

Our Insights

FXGrow delivers a powerful combination of regulation, execution, and tools that empower traders of all levels. Lower-tier ECN accounts let newcomers start with professional-grade conditions. For high-volume traders, Elite accounts offer tighter spreads and better leverage—though they require substantial capital.

Fees, Spreads, and Commissions

Independent reviewers note FXGrow offers traders a fair balance between spreads and commissions. The broker’s ECN accounts provide choices from spread-only models to low-spread accounts with commissions, enabling flexible strategies. Traders gain transparency while benefiting from institutional-grade liquidity and stable conditions for execution.

| Account Type | Spreads From | Commission | VPS Hosting |

| ECN | 1.1 pips | $0 | $15/month |

| ECN Plus | 0.2 pips | $8 | $15/month |

| ECN Elite | 0.2 pips | $6 | $15/month |

Frequently Asked Questions

What is the minimum deposit for FXGrow accounts?

The ECN account requires only $100 to start, making it highly accessible for beginners. ECN Plus raises the entry to $1,000 with lower spreads, while the ECN Elite account demands $100,000 but rewards professional traders with higher leverage and reduced commission rates.

Do all accounts share the same features?

Yes, all accounts allow unrestricted trading strategies, base currencies in USD, EUR, and PLN, and access to research signals via Trading Central. However, leverage and cost structures vary, giving traders clear choices aligned with their deposit size and experience level.

Our Insights

FXGrow’s account structure ensures accessibility for new traders and sophistication for professionals. With deposits ranging from $100 to $100,000, clients can scale up as their skills grow. Research tools, flexibility, and transparent rules make these accounts a practical fit for diverse trading goals.

Minimum Deposit and Account Types

Industry perspectives emphasize FXGrow’s adaptability through its three ECN account types. Each offers distinct benefits from low entry deposits to professional-grade conditions. Traders of all levels – from beginners to experienced professionals – find tailored opportunities, ensuring accessibility without sacrificing high-quality trading environments.

| Account Type | Open an Account | Min Deposit | Leverage | Key Benefit |

| ECN | 100 USD | 1:30 | Beginner-friendly entry | |

| ECN Plus | 1,000 USD | 1:30 | Tight spreads | |

| ECN Elite | 100,000 USD | 1:100 | Best for professionals |

Frequently Asked Questions

What is the minimum deposit for FXGrow accounts?

The ECN account requires only $100 to start, making it highly accessible for beginners. ECN Plus raises the entry to $1,000 with lower spreads, while the ECN Elite account demands $100,000 but rewards professional traders with higher leverage and reduced commission rates.

Do all accounts share the same features?

Yes, all accounts allow unrestricted trading strategies, base currencies in USD, EUR, and PLN, and access to research signals via Trading Central. However, leverage and cost structures vary, giving traders clear choices aligned with their deposit size and experience level.

Our Insights

FXGrow’s account structure ensures accessibility for new traders and sophistication for professionals. With deposits ranging from $100 to $100,000, clients can scale up as their skills grow. Research tools, flexibility, and transparent rules make these accounts a practical fit for diverse trading goals.

How to Open an FXGrow Account

Opening an FXGrow account is a quick process: register, verify, fund, and start trading on MT5. Follow these concise steps to get set up confidently.

1. Step 1: Visit the Website

Go to the official FXGrow site and select “Open Live Account.”

2. Step 2: Register and Confirm Email

Complete the sign-up form with your personal details, submit, then confirm the verification email to activate your secure client area.

3. Step 3: Log In to Client Area

Sign in with your registered email and password to access your dashboard and complete your profile.

4. Step 4: Verify Your Account (KYC)

Upload a government ID (passport, national ID, or driver’s license) and a recent proof of address, then submit any required questionnaires to satisfy CySEC KYC rules.

5. Step 5: Choose Your Platform

Select MetaTrader 5 in the portal; it is FXGrow’s primary trading platform.

6. Step 6: Choose Account Type

Pick ECN, ECN Plus, or ECN Elite based on your needs and minimum deposit requirements.

7. Step 7: Fund Your Account

From the client area, choose a supported method such as Visa or Mastercard, Skrill, Neteller, or bank wire. Follow on-screen prompts to complete funding.

8. Step 8: Start Trading

Open a live MT5 account from the portal, download the platform, log in with your trading credentials, and place your first trade. You can also open a demo account if you prefer to practice.

After these steps, your account will be verified and ready, allowing you to trade with confidence on demo or live funds once verification and funding are complete.

Safety and Security

FxGrow demonstrates a strong commitment to investor security and market transparency by adhering to multiple regulatory frameworks across Europe. The broker is licensed by 🇨🇾 CySEC and authorized under MiFID, while also holding recognition from regulators in 🇬🇷 Greece, 🇪🇸 Spain, 🇭🇺 Hungary, 🇳🇴 Norway, 🇫🇷 France, 🇵🇱 Poland, 🇩🇪 Germany, and 🇸🇪 Sweden. This ensures that traders operate in a highly safeguarded environment.

| Feature | Details |

| Primary Regulator | 🇨🇾 CySEC (License 214/13) |

| Additional Recognition | 🇬🇷 HCMC 🇪🇸 CNMV 🇭🇺 MNB 🇳🇴 FINANSTILSYNET 🇫🇷 ACPR 🇵🇱 KNF 🇩🇪 BaFin 🇸🇪 FI |

| Investor Protection | Member of Investor Compensation Fund (ICF) |

| Security Measures | AES, MD5, SSL, TLS encryption + segregated accounts |

Frequently Asked Questions

Why is FxGrow’s regulatory framework important for traders?

FxGrow’s regulatory framework provides traders with a secure and transparent trading environment. Since it is regulated by 🇨🇾 CySEC and recognized across major European financial authorities, traders benefit from strict oversight, reliable fund segregation, and the assurance that their investments are well protected.

How does FxGrow ensure the safety of client funds?

FxGrow enforces strict fund segregation by keeping client deposits in independent bank accounts with reliable institutions. Additionally, advanced encryption techniques such as AES, SSL, and TLS safeguard communication and transactions, ensuring that traders’ data and money remain protected against fraud and unauthorized access.

Our Insights

FxGrow positions itself as a trustworthy broker with multi-jurisdictional recognition, transparent fund handling, and strong safety protocols. Its membership in the ICF and adherence to strict European laws reinforce investor confidence, making it a secure choice for those seeking regulated trading conditions and long-term financial protection.

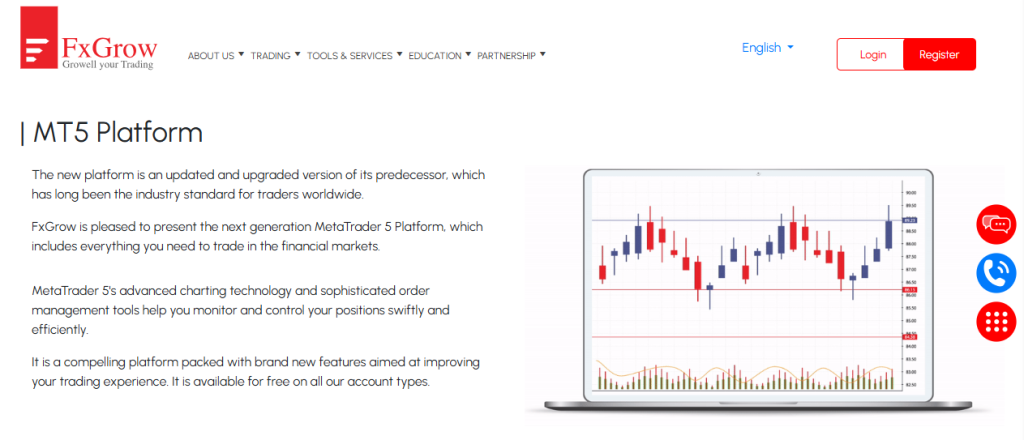

Trading Platforms and Tools

FxGrow introduces the advanced MetaTrader 5 (MT5) platform, designed to elevate trading efficiency with upgraded tools and intuitive features. This next-generation platform offers powerful charting, order management, and automated trading capabilities across devices, ensuring traders have a seamless experience.

| Device Type | Key Functions | Installation Steps |

| Computers (PC/Mac) | Advanced charting, automation, trailing stops | Download file install login |

| Smartphones (iOS) | Real-time quotes 30+ indicators trade history | App Store → MT5 → Login |

| Tablets/Android | Chart trading stop-loss pending orders | Play Store → MT5 → Login |

Frequently Asked Questions

What makes the FxGrow MT5 platform different from its predecessor?

FxGrow MT5 offers significant improvements over MetaTrader 4, including advanced charting, a wider range of order types, trailing stop-loss features, and the ability to use Expert Advisors for automated trading. Additionally, its multilingual support and integrated newsfeeds make it more versatile for global traders.

Can I use FxGrow MT5 on both desktop and mobile devices?

Yes, FxGrow MT5 is available for both desktop and mobile trading. On computers, it provides powerful analytical tools, custom indicators, and automation features. Meanwhile, on smartphones and tablets, it delivers real-time quotes, chart-based trading, order management, and portability for traders on the go.

Our Insights

FxGrow’s MT5 platform stands out as a versatile, efficient, and user-friendly trading solution. With advanced functions, automation, and full device compatibility, it empowers traders to control their strategies effectively. Therefore, it is an excellent choice for traders seeking flexibility, advanced tools, and smooth performance across all devices.

Trading Instruments

FxGrow gives traders access to a wide range of financial instruments, including over 60 forex pairs, indices, commodities, metals, energies, and CFDs on futures. The broker combines competitive spreads, fast execution, and transparency, allowing traders to diversify portfolios efficiently while using the advanced MetaTrader 5 platform.

| Asset Class | Availability | Trading Advantage |

| Forex | 60+ currency pairs | Tight spreads micro volume trading |

| Indices Commodities | 17+ global cash instruments | Access to major global markets |

| Metals Energies | 7+ symbols | Trade bullion and energy assets |

| CFDs on Futures | 34+ contracts | Portfolio diversification |

Frequently Asked Questions

What types of instruments can I trade with FxGrow?

FxGrow provides a broad range of instruments across multiple asset classes. Traders can access 60+ forex currency pairs, 17+ cash indices and commodities, 7+ metals and energies, and 34+ CFDs on futures. This variety ensures excellent portfolio diversification opportunities for all trading strategies.

How competitive are FxGrow’s trading conditions?

FxGrow offers tight spreads starting from 0 pips with execution speeds of less than one second. In addition, traders benefit from full transparency, micro-lot trading, and 24/7 customer support, ensuring smooth and efficient access to global markets without hidden fees or extra markups.

Our Insights

FxGrow delivers a robust selection of trading instruments supported by strong conditions, fast execution, and reliable support. Whether trading forex, indices, or commodities, the broker offers flexibility and transparency that appeals to both beginners and experienced traders. It is a balanced choice for diversified trading strategies.

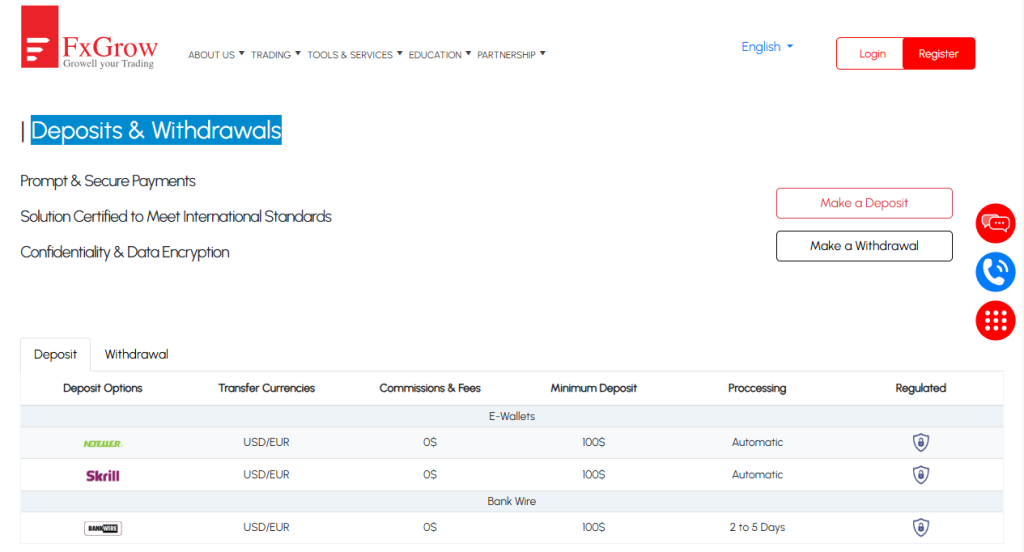

Deposits and Withdrawals

FxGrow ensures deposits and withdrawals are fast, secure, and compliant with international standards. Clients benefit from encrypted transactions, multiple payment options, and no additional broker charges. With automatic e-wallet processing and reliable bank transfers, FxGrow maintains transparency and safeguards client funds under strict regulatory oversight.

| Payment Method | Currencies | Fees | Processing Time |

| Neteller | USD / EUR | $0 | Automatic |

| Skrill | USD / EUR | $0 | Automatic |

| Bank Wire | USD / EUR | $0 | 2–5 business days |

Frequently Asked Questions

What payment options are available for deposits and withdrawals at FxGrow?

FxGrow supports e-wallets like Neteller and Skrill, as well as traditional bank wire transfers. All transactions are processed securely with no fees charged by FxGrow. However, payment providers may apply their own charges depending on their fee structures.

How long do FxGrow deposits and withdrawals take to process?

Deposits via e-wallets such as Neteller and Skrill are processed automatically, while bank wire transfers may take between 2 to 5 business days. FxGrow processes all payment requests during business hours from 9:00 am to 6:00 pm (GMT+2), ensuring reliability and efficiency.

Our Insights

FxGrow delivers a safe, efficient, and transparent payment system for traders worldwide. With no internal fees, automatic e-wallet processing, and strict regulatory backing, the broker provides convenient funding and withdrawal methods. This makes it an attractive choice for traders who value security and speed.

Introducing Brokers and Affiliates

FxGrow offers lucrative partnership opportunities through its Introducing Broker (IB) and Affiliate programs. With unlimited earning potential, daily rebate withdrawals, and dedicated account support, partners can earn commissions by referring traders. These programs are designed for both experienced professionals and beginners, backed by real-time reporting and marketing tools.

| Partnership Type | Best For | Key Benefit |

| Introducing Broker | Experienced partners | Unlimited rebates on client activity |

| Affiliate Program | Beginners/marketers | Commission from referral traffic |

Frequently Asked Questions

What is the difference between the FxGrow IB program and the Affiliate program?

The IB program is best suited for seasoned partners with trading expertise who can guide clients directly. Earnings are based on rebates from trading activity without limits. Meanwhile, the Affiliate program suits beginners, allowing them to earn commissions by directing online traffic to FxGrow’s platform.

How does FxGrow support its partners?

FxGrow provides partners with extensive support, including a next-generation IB portal, real-time reporting, dedicated account managers, and a variety of marketing tools. Affiliates and IBs also receive resources, how-to guides, and transparent analytics to maximize performance while enjoying flexible rebate payouts.

Our Insights

FxGrow’s IB and Affiliate programs combine high earning potential with strong support tools and transparency. With daily rebate withdrawals, advanced reporting, and flexible commission structures, these programs empower both newcomers and seasoned partners to grow alongside one of the industry’s trusted brokers.

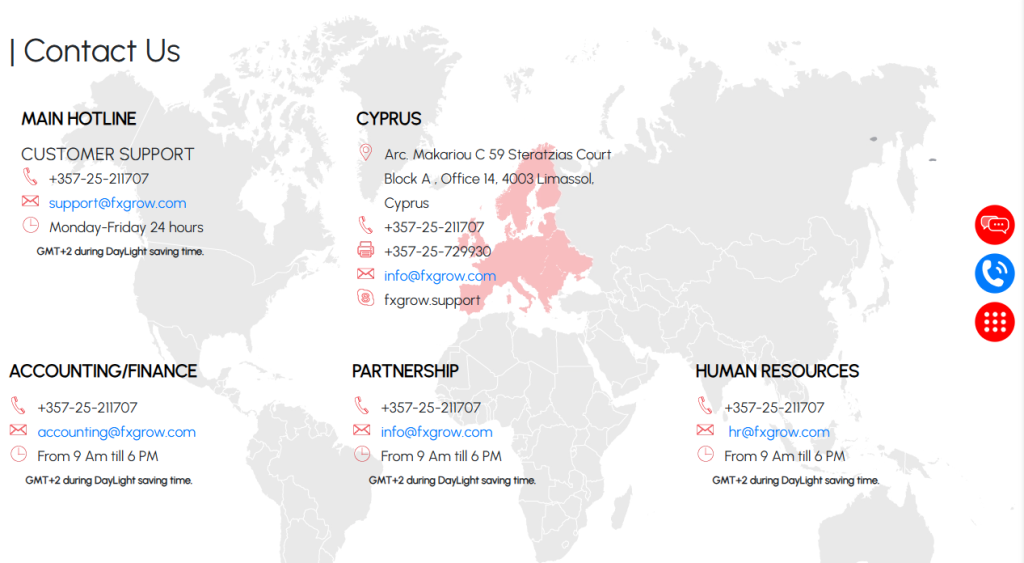

Customer Support

FxGrow offers comprehensive support through multiple channels, including phone, email, and Skype. The broker maintains dedicated departments for customer support, accounting, partnerships, and human resources. With 24-hour service for client inquiries and structured business hours for specific departments, traders can access timely and professional assistance.

Frequently Asked Questions

How can I contact FxGrow customer support?

FxGrow provides 24-hour customer support via phone at +357-25-211707 and email at [email protected] during weekdays. Clients can also reach out via Skype for direct assistance. Support is available in multiple languages, ensuring global accessibility and fast response times.

Are there dedicated contacts for different departments?

Yes, FxGrow has separate contacts for accounting, partnerships, and human resources. Accounting queries can be sent to [email protected], partnership inquiries to [email protected], and HR matters to [email protected], all available during business hours from 9 AM to 6 PM (GMT+2).

Our Insights

FxGrow provides a reliable and professional support system with multiple channels and dedicated departments. With 24-hour general support and specific contacts for finance, partnerships, and HR, the broker ensures clients and partners can receive prompt assistance whenever needed.

Customer Reputation and Trust Scores

FXGrow earns a solid regulatory reputation and positive trust metrics thanks to its long-standing operations and European oversight. The broker is regulated by both CySEC and VFSC, holds a trust score of 85/100, and is widely regarded as reliable by industry watchlists.

| Feature | Details |

| Regulation | CySEC (Cyprus) and VFSC (Vanuatu) |

| Trust Score | 85 out of 100 |

| Operation Since | Founded in 2008, over 15 years |

While FXGrow impresses with its regulatory background and high trust score, prospective clients should still evaluate its execution speed and support responsiveness before committing.

Discussions and Forums on FXGrow

Trader forums offer a range of opinions on FXGrow. Many praise fast ECN execution, low spreads, and reliable withdrawals – while others report occasional withdrawal delays or support lapses.

| Source | Feedback Summary | Tone |

| Forex Peace Army | “ECN Plus account … orders executed very fast without delays.” | Positive |

| Forex Peace Army | “Never faced any slippages … withdrawals done on time.” | Positive |

| Forex Peace Army | A user had a withdrawal error but it was resolved with support. | Mixed |

Trader sentiments lean positive regarding FXGrow’s ECN offerings and spreads. Still, some caution remains due to sporadic support delays.

Employee Overview of Working at FXGrow

Publicly available data about working at FXGrow is scarce. However, industry reports highlight a compact and dedicated team based in Cyprus, suggesting a focused, responsive workplace culture.

| Insight Area | Details |

| Team Size | Over 50 employees handling global client operations |

| Company Culture | Celebrated for transparency, reliability, and client focus |

| Awards | Named “Most Reliable Broker” at Cyprus Expo 2022 |

Although direct employee reviews are missing, FXGrow’s recognition and lean structure paint a picture of a committed team that values clarity and trust.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Regulated by CySEC and VFSC | No top-tier regulation like FCA or ASIC |

| Long operational history (since 2008) | Mixed reviews on customer support |

| Competitive ECN spreads | Some traders report withdrawal delays |

| Strong trust score (85/100) | Limited public insight into culture |

| Recognized transparency and awards | Website inaccessible at times |

References:

In Conclusion

FXGrow operates primarily out of its headquarters in Cyprus, and it does not list any additional physical office locations in other countries. Global clients are supported via international contact channels, but the company maintains a single office location.

-

🇨🇾 Cyprus

Although FXGrow claims to serve clients in over 100 countries, the only confirmed local office is in Cyprus. Traders elsewhere rely on the broker’s international support lines and online assistance rather than regional offices.

Faq

FXGrow provides customer assistance by live chat, email, phone, and a contact form on their website.

Withdrawals from FXGrow normally take 3 to 5 business days, depending on the withdrawal method and the client’s bank processing timeframes.

Yes, FXGrow offers a variety of instructional tools, including webinars, market research, a blog, and other materials to help traders learn. These tools may assist traders of all skill levels to enhance their knowledge of the markets.

Yes, FXGrow offers demo accounts for traders to practice trading methods and get comfortable with the platform in a risk-free environment. Demo accounts use virtual money to imitate real-world market situations.

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open an FXGrow Account

- Safety and Security

- Trading Platforms and Tools

- Trading Instruments

- Deposits and Withdrawals

- Introducing Brokers and Affiliates

- Customer Support

- Customer Reputation and Trust Scores

- Discussions and Forums on FXGrow

- Employee Overview of Working at FXGrow

- Pros and Cons

- In Conclusion