IC Markets Minimum Deposit Review

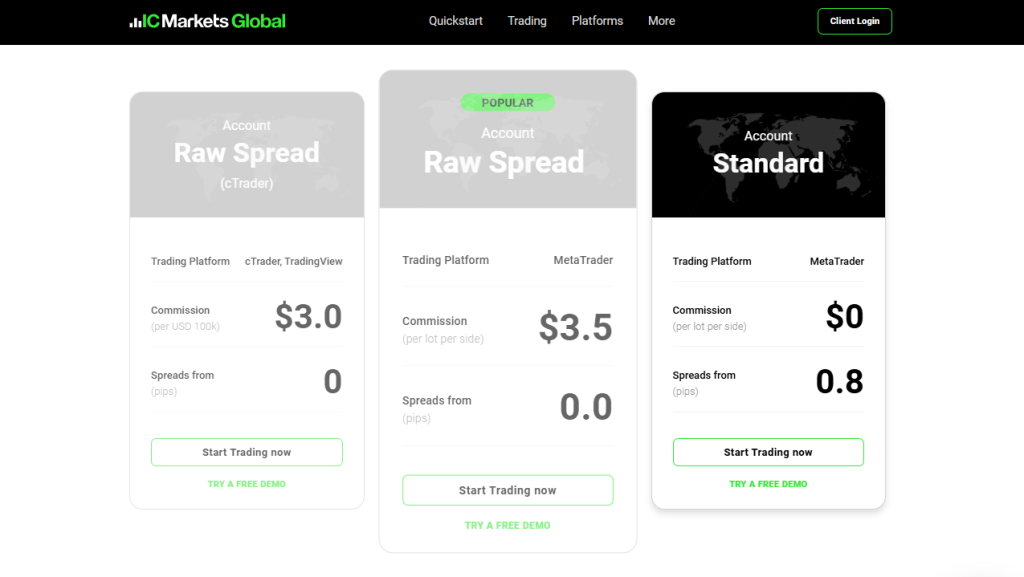

The minimum deposit required to open an IC Markets Account is USD 200. IC Markets provides 3 different live trading accounts: cTrader, Raw Spread, and Standard.

★★★ | Minimum Deposit: $200 Regulated by: FSA Crypto: Yes |

Minimum Deposit and Account Types

IC Markets Global offers a versatile range of account types tailored to different trading styles – from scalpers and algo traders to beginners. With Raw Pricing, deep liquidity, and access to top platforms like MetaTrader, cTrader, and TradingView, the broker provides an institutional-grade trading environment for all levels.

Frequently Asked Questions

Which IC Markets Global account is best for scalping?

The Raw Spread account on MetaTrader is designed for scalpers and expert advisors. It features spreads from 0.0 pips, $3.50 commission per side, and low-latency execution via the NY4 data center, ideal for fast-paced, high-frequency trading strategies.

Is there a commission-free option for beginners?

Yes. The Standard Account on MetaTrader comes with zero commissions and spreads starting from 0.8 pips. It’s ideal for new traders who prefer simple cost structures and are just starting out in Forex or CFD trading.

Our Insights

IC Markets Global supports every trader with tailored account options. It offers raw pricing for algo traders and straightforward setups for discretionary traders. The broker also delivers fast execution, tight spreads, and reliable infrastructure, all under strong regulatory oversight, ensuring a secure and efficient trading experience.

★★★ | Minimum Deposit: $200 Regulated by: FSA Crypto: Yes |

How To Open an IC Markets Account

To register an account with IC Markets, follow these easy steps:

- Navigate to the IC Markets Website and choose the green “Open a Live Account” option.

- Choose the account that best suits your requirements.

- Complete the application form.

- Fund your account

- Download Your Trading Platform

Select your desired platform and download the program to your computer or mobile device.

★★★ | Minimum Deposit: $200 Regulated by: FSA Crypto: Yes |

Deposit and Withdrawal

IC Markets Global provides a user-friendly funding and withdrawal system that supports bank transfers, cards, e-wallets, and crypto wallets. With no internal fees and secure transaction handling, it’s designed to give traders fast, reliable access to funds with minimal friction and maximum flexibility.

| Method | Available For | Fees (IC Markets) | Typical Speed |

| Bank Wire | Deposit Withdraw | None | 2–5 business days |

| Credit/Debit Cards | Deposit Withdraw | None | 1–3 business days |

| E-Wallets | Deposit Withdraw | None | Within 24 hours |

| Crypto Wallets | Deposit Withdraw | None | Within 24 hours (varies) |

Frequently Asked Questions

Does IC Markets Global charge any fees for deposits or withdrawals?

No, IC Markets Global does not charge internal fees on deposits or withdrawals. However, traders should be aware that external fees from banks or payment providers may still apply depending on the method chosen.

How fast are withdrawals processed at IC Markets Global?

Withdrawal speed depends on the payment method. While bank wires and cards may take 2–5 business days, crypto and e-wallet transactions are typically processed within 1 business day, offering faster access to funds.

Our Insights

IC Markets Global distinguishes itself by offering zero fees and numerous funding methods. Whether traders prefer traditional banks or digital wallets, the broker ensures secure and efficient transactions. As a result, it ranks as one of the most convenient options for managing trading capital smoothly and reliably.

★★★ | Minimum Deposit: $200 Regulated by: FSA Crypto: Yes |

Getting Started Essentials – A Quick Q&A

5 Frequently Asked Questions about the IC Markets minimum deposit, withdrawal process, and sign-up perks.

Q: What’s the minimum deposit to open an IC Markets account? – Lucas, Brazil

A: IC Markets requires a minimum deposit of 200 USD (or equivalent), which applies across all live account types, including Standard, Raw, and cTrader formats.

Q: How quickly can I withdraw funds from IC Markets? – Aisha, UAE

A: Withdrawal requests submitted before 12:00 AEST/AEDT are processed the same business day. Withdrawals via credit or debit card typically reach you within 3–5 business days, though some banks may take up to 10 days. PayPal, Neteller, and Skrill withdrawals are instant once processed. International bank transfers can take up to 14 days and may include intermediary fees.

Q: Does IC Markets charge fees for deposits or withdrawals? – Mark, Canada

A: IC Markets does not impose any fees for deposits or withdrawals. However, your own bank or payment provider may apply charges.

Q: Can I withdraw profits to a different method than my deposit method? – Priya, India

A: Not always. IC Markets requires the withdrawal of deposited funds via the same method used for deposit. Profits or amounts exceeding the original deposit must be withdrawn via another previously used deposit method in your name.

Q: What perks come with signing up at IC Markets? – John, UK

A: IC Markets offers institutional-quality trading infrastructure with ultra-tight raw spreads, fast execution via Equinix servers in NY and London, multiple platform options including MT4, MT5, and cTrader, Islamic (swap-free) accounts, access to over 2,000 CFD instruments, flexible leverage up to 1:500, transparent commission structures, no inactivity fees, and robust regulatory confidence with segregated client fund protection.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Ultra-tight spreads from 0.0 pips | Regulated only by FSA (Seychelles) |

| Supports MT4, MT5, cTrader, TradingView | No cent accounts |

| Leverage up to 1:1000 | Overnight holding fee on Islamic accounts |

| No deposit or inactivity fees | Some features/platforms may be complex for beginners |

| Broad asset selection & copy trading options | Limited stock CFD offering compared to equity brokers |

You might also like:

In Conclusion

IC Markets requires a minimum deposit of 200 USD and offers three live accounts – Standard, Raw Spread, and cTrader – designed for different trading styles. With institutional-grade liquidity, advanced platforms, and zero internal funding fees, IC Markets delivers fast execution, tight spreads, and a secure, high-performance trading experience for traders worldwide.

Faq

No. Due to legal limits, IC Markets seldom offers deposit incentives. However, they provide periodic incentives or reward programs like cashback rebates to active traders and partners.

IC Markets often processes deposits as usual during important market occurrences. However, they may give cautions regarding anticipated volatility and margin requirements during these times.

While IC Markets has mechanisms to manage incorrect deposits, the process might take time. To avoid such scenarios, double-check your account information before making any deposits.

IC Markets primarily allows deposits in active, prominent cryptocurrencies. Deposits in stopped or delisted coins may be refused or require additional processing.