JP Markets’ primary jurisdiction and support hub is South Africa. It also serves markets in Namibia, Eswatini, Lesotho, Kenya, Pakistan, and Bangladesh – showing a notable reach across Africa and into parts of Asia.

dow

JP Markets Review

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a JP Markets Account

- Safety and Security

- Trading Platforms and Tools

- Markets Available for Trade

- Deposit and Withdrawal

- Partnership Options

- Customer Support

- Customer Reviews and Trust Snapshot

- Discussions and Forum Buzz

- Employee and Internal Insights

- Pros and Cons

- In Conclusion

dow

JP Markets earns a solid Trust Score of 80/100. Licensed by one Tier-2 regulator, the broker offers five retail accounts. Standard, Premium, VIP, Islamic, and Zero Stop-Out, plus two bonus accounts, Draw-Down Bonus and JPM Bonus 300, providing traders with diverse and flexible trading options.

★★★ | Minimum Deposit: $100 Regulated by: FSCA Crypto: No |

| Broker | JP Markets |

| Minimum Deposit | 100 ZAR |

| Base Currencies | USD ZAR |

| Spreads | From 0.5 pips |

| Leverage | Up to 1:2000 |

| Inactivity Fee | 150 ZAR after three months of inactivity |

| Regulation | FSCA |

| Open an Account |

Overview

JP Markets is a leading South African broker that provides personalised trading solutions to over 400,000 clients across Africa. The broker emphasises innovation, offering MT5 and other advanced platforms to simplify trading while catering to both beginners and experienced traders.

Frequently Asked Questions

What types of financial instruments can I trade with JP Markets?

JP Markets offers a diverse range of instruments, including Forex, Stocks, Indices, and Commodities. Each instrument is accessible through intuitive platforms designed for analysis, while clients benefit from flexible, user-friendly features that support both short-term and long-term trading strategies.

Is JP Markets regulated and safe for trading?

Yes, JP Markets 🇿🇦 holds both an ODP license for derivatives and an FSP license for financial services. These licenses ensure compliance with South African regulations and provide clients with added security while trading across multiple financial markets.

Our Insights

JP Markets 🇿🇦 combines strong regulation, innovative platforms, and personalised services to create a competitive trading environment. The broker is suitable for traders seeking diverse instruments, advanced tools, and reliable support. Overall, it represents a credible option for both African and global clients.

★★★ | Minimum Deposit: $100 Regulated by: FSCA Crypto: No |

Fees, Spreads, and Commissions

JP Markets provides transparent trading conditions across all account types, combining competitive spreads, commission options, and flexible swap policies. Traders can choose accounts that match their strategy, balancing cost efficiency with leverage and trade execution quality.

| Account Type | Spreads From | Commissions | Swap |

| VIP | 0.5 pips | 3 USD | Yes |

| Premium | 1 pip | None | Yes |

| Islamic | 1.5 pips | None | None |

| Zero Stop-Out | 3 pips | None | Yes |

Frequently Asked Questions

What are the typical spreads and commissions at JP Markets?

JP Markets offers spreads starting from 0.5 pips on VIP accounts and 1 pip on Premium accounts. Some accounts include commissions, such as 3 USD per trade for VIP, while others remain commission-free, allowing traders to select cost-efficient options.

Are swaps and margin calls applied to all accounts?

Most accounts at JP Markets apply swaps, except for Islamic accounts, which are swap-free. Margin calls and stop-out levels vary by account type, ranging from 30% to 100% for drawdown protection, giving traders flexibility in managing risk.

Our Insights

JP Markets delivers competitive spreads and transparent commission structures, supporting both low-cost and high-leverage strategies. Traders can easily match account features with their trading style to optimise costs and risk management.

★★★ | Minimum Deposit: $100 Regulated by: FSCA Crypto: No |

Minimum Deposit and Account Types

JP Markets 🇿🇦 offers a wide range of account types, from beginner-friendly micro accounts to VIP and bonus accounts. Minimum deposits start at R100, while VIP accounts require R5000. This variety allows traders to find accounts that suit capital, risk tolerance, and strategy.

Frequently Asked Questions

What is the minimum deposit required to open an account?

JP Markets accounts vary in minimum deposit: micro and bonus accounts start at R100, while VIP accounts require R5000. This structure enables both new traders and professionals to access markets according to their investment capacity.

Which account types include bonuses?

Bonus accounts like JPM Bonus 300 and 25% Drawdown Bonus provide extra trading capital ranging from 25% to 300%. Other accounts, such as VIP, Premium, and Islamic, do not offer bonuses but feature tighter spreads or swap-free conditions.

Our Insights

JP Markets caters to a wide range of traders with flexible account options and low entry barriers. Bonus accounts and high-leverage options provide extra opportunities, while standard accounts ensure accessible, straightforward trading for beginners and seasoned traders alike.

★★★ | Minimum Deposit: $100 Regulated by: FSCA Crypto: No |

How to Open a JP Markets Account

Opening a JP Markets account is quick: register on their site, complete the short profile and KYC, fund your account (minimum of 100 ZAR on many plans), then trade via demo or live platform.

1. Step 1: Visit the Website

Go to jpmarkets.co.za and click “Start Trading” or “Create an Account.”

2. Step 2: Fill the Registration Form

Enter your name, email, password, and accept the terms to create your client portal.

3. Step 3: Confirm Your Email

Open the verification email and click the link to activate your account.

4. Step 4: Complete Your Profile

Log in to the dashboard and finish the financial questionnaire and profile details as requested.

5. Step 5: Upload KYC Documents

Upload a valid government ID (passport, ID card, or driver’s license) and a proof of address (recent utility bill or bank statement) to verify your account.

6. Step 6: Pick Account Type and Platform

Choose the retail account you want and decide whether to use the live account or demo to test the platform.

7. Step 7: Fund Your Account

Deposit via the available local and online payment methods listed in your client area; the minimum is commonly 100 ZAR for many account types.

8. Step 8: Practice or Start Trading

Use the demo (virtual funds) to practice, then switch to live trading once verified.

After verification and funding, your account will be fully active – with access to both demo and real trading options.

★★★ | Minimum Deposit: $100 Regulated by: FSCA Crypto: No |

Safety and Security

JP Markets maintains robust regulatory compliance with both ODP and FSP licenses, ensuring safe trading for African clients. The broker applies standard security measures, including identity verification and encrypted transactions, to protect funds and sensitive data for all account holders.

| Feature | Details | Regulatory Status | Security Measures |

| Licenses | ODP FSP | Regulated | Segregated Funds |

| Account Verification | KYC required | Yes | Encrypted Data |

| Deposit Protection | Standard security protocols | Compliant | Two-factor Authentication |

| Transaction Safety | Secure processing | Yes | SSL Encryption |

Frequently Asked Questions

Is JP Markets regulated and trustworthy?

JP Markets 🇿🇦 holds an ODP license for derivatives and an FSP license for financial services, meeting South African regulatory standards. These licenses ensure clients trade within a secure framework with legal oversight and transparent procedures.

How does JP Markets protect client funds?

The broker separates client funds from company assets and uses secure payment methods. In addition, identity verification and encrypted transactions safeguard personal information, helping reduce risks of fraud or unauthorised access.

Our Insights

JP Markets 🇿🇦 offers strong safety and security standards, with regulated operations and encrypted systems. Traders benefit from verified accounts and segregated funds, providing peace of mind while trading diverse markets.

★★★ | Minimum Deposit: $100 Regulated by: FSCA Crypto: No |

Trading Platforms and Tools

JP Markets 🇿🇦 equips traders with MT5, a powerful platform supporting advanced technical and fundamental analysis. The broker provides intuitive interfaces, real-time data, and user-friendly tools to enhance trade execution and market research for both beginners and professional traders.

| Platform | Device Support | Tools Available | Order Execution |

| MT5 | Web Desktop Mobile | Charting Indicators Alerts | Market |

| MT5 | Web Desktop Mobile | Automated Trading Expert Advisors | Market |

| MT5 | Web Desktop Mobile | Economic Calendar News Feed | Market |

| MT5 | Web Desktop Mobile | Risk Management Tools | Market |

Frequently Asked Questions

Which platforms does JP Markets support?

JP Markets primarily offers MT5, accessible on web, desktop, and mobile devices. The platform includes advanced charting, technical indicators, automated trading options, and a variety of order types to support diverse trading strategies.

Are there tools for analysis and research?

Yes, JP Markets provides integrated market news, technical indicators, charting tools, and economic calendars. These features help traders make informed decisions while monitoring trends, risks, and potential opportunities.

Our Insights

JP Markets provides professional-grade trading platforms and comprehensive tools. MT5 enhances analytical capabilities and trade execution, making it suitable for traders seeking advanced strategies or efficient daily trading experiences.

★★★ | Minimum Deposit: $100 Regulated by: FSCA Crypto: No |

Markets Available for Trade

JP Markets offers a broad range of markets, including Forex, Stocks, Indices, and Commodities. Clients can diversify their portfolios and access high-liquidity assets, while the broker ensures seamless execution across all instruments for both short-term and long-term strategies.

| Market Type | Instruments Offered | Minimum Trade | Leverage |

| Forex | Major and Minor Pairs | 0.01 lots | Up to 500 |

| Stocks | Global Shares | 0.01 lots | Up to 500 |

| Indices | Major Global Indices | 0.01 lots | Up to 500 |

| Commodities | Metals, Energy, Agriculture | 0.01 lots | Up to 500 |

Frequently Asked Questions

What types of markets can I trade at JP Markets?

Traders can access Forex pairs, global Stocks, major Indices, and Commodities. This variety allows portfolio diversification, hedging strategies, and flexible trading across multiple sectors and regions.

Are trading conditions the same across all markets?

No, spreads, leverage, and minimum trade sizes vary depending on the market and account type. However, JP Markets ensures consistent execution quality and access to real-time market data for all instruments.

Our Insights

JP Markets provides a wide range of tradable markets, supporting both retail and professional strategies. Its diversified offering enables clients to explore opportunities in Forex, Stocks, Indices, and Commodities while benefiting from competitive execution and reliable tools.

★★★ | Minimum Deposit: $100 Regulated by: FSCA Crypto: No |

Deposit and Withdrawal

JP Markets ensures smooth deposits and withdrawals with a wide range of secure methods. Funds are held in segregated accounts at top-tier banks, allowing clients to transact with confidence. The broker supports traditional banking, e-wallets, mobile payments, and cryptocurrency options for convenience and speed.

| Feature | Details | Processing Time | Security |

| Payment Methods | Bank transfers, e-wallets, mobile payments, cards, QR codes, cryptocurrencies | Deposits: instant Withdrawals: hours | Segregated accounts, encrypted data |

| Currency Options | Multiple fiat currencies and cryptocurrencies | Instant for deposits | Top-tier banks |

| Technology | Automated EFT and payment gateways | 24/7 deposit support | Secure integration |

| Regional Coverage | Africa-focused payment options | Fast local processing | Risk management |

Frequently Asked Questions

What deposit and withdrawal methods are available at JP Markets?

Clients can use bank transfers, digital wallets, mobile money, cards, QR codes, and Instant EFT. JP Markets also supports cryptocurrencies and multiple fiat currencies, providing flexible and convenient options for both retail and professional traders.

How fast are deposits and withdrawals processed?

Deposits are credited instantly 24/7, while withdrawals typically take only a few hours. The broker leverages secure payment gateways and automated EFT solutions to ensure quick, reliable, and safe fund transfers for all clients.

Our Insights

JP Markets provides highly efficient deposit and withdrawal systems with strong security measures. Clients benefit from instant deposits, fast withdrawals, and versatile payment options, allowing seamless fund management for both new and experienced traders.

★★★ | Minimum Deposit: $100 Regulated by: FSCA Crypto: No |

Partnership Options

JP Markets offers a rewarding Introducing Broker (IB) program that allows individuals and businesses to earn by referring new clients. Partners benefit from real-time commission tracking, personal support, and tiered structures, making it an attractive opportunity for those in the trading industry.

| Feature | Details | Benefit | Support Level |

| IB Commission | Earn from referred client trades | Consistent payments | Real-time tracking |

| Smart Dashboard | Monitor clients trades, and commissions | Transparent reporting | 24/7 access |

| Sub-IB Program | Master IBs earn from sub-IB referrals | Tiered income model | Extended network |

| Partner Support | Account manager and marketing material | Business growth | Personal guidance |

Frequently Asked Questions

How does the JP Markets IB program work?

As an IB partner, you refer clients to JP Markets and earn commissions from their trading activity. You gain access to a smart dashboard, instant withdrawals, and even the chance to build sub-IB networks, maximizing your potential earnings.

What support does JP Markets provide to IB partners?

Partners receive dedicated account managers, marketing materials such as merchandise and seminar venues, and reliable commission payments. This ensures both business growth and client satisfaction through strong professional support.

Our Insights

The JP Markets Partner Program provides a structured way for IBs to grow income while helping clients trade securely. With strong support, fast payouts, and scalable opportunities, this program stands out as one of the most competitive in Africa’s trading space.

★★★ | Minimum Deposit: $100 Regulated by: FSCA Crypto: No |

Customer Support

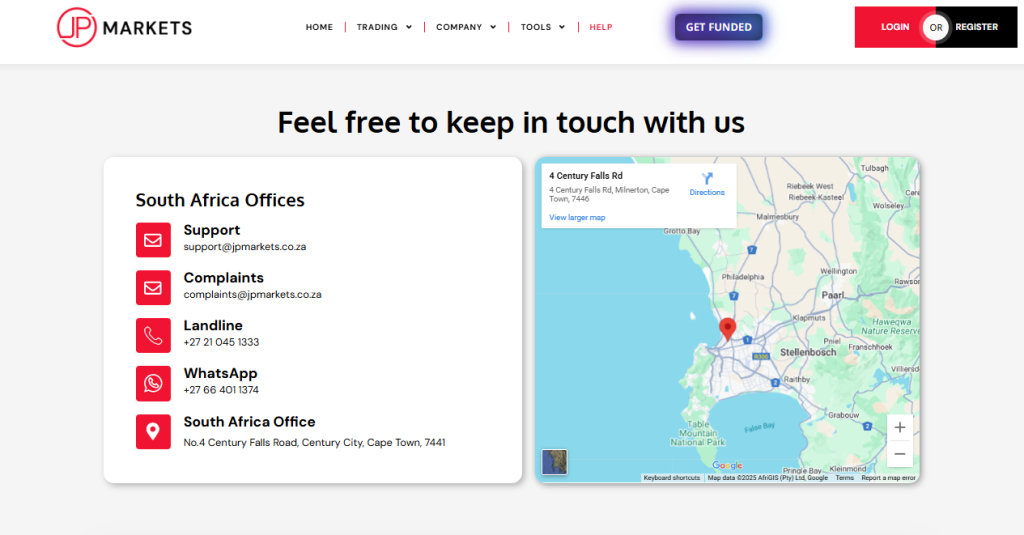

JP Markets ensures traders have multiple ways to connect with its support team. From email and phone to WhatsApp and social media, clients can resolve queries quickly. Convenient local offices and responsive communication channels strengthen trust and accessibility.

Frequently Asked Questions

How can I contact JP Markets for support?

Clients can reach the JP Markets support team via email, landline, or WhatsApp. With offices located in Cape Town, 🇿🇦 South Africa, the broker ensures reliable communication for both general inquiries and complaints, offering traders a responsive customer care experience.

Does JP Markets provide local office support?

Yes, JP Markets has a dedicated office in Century City, Cape Town 🇿🇦, where clients can reach the team directly. This physical presence adds credibility and allows traders to trust that help is always available beyond digital channels.

Our Insights

JP Markets offers a wide range of support options to ensure traders always stay connected. With email, phone, WhatsApp, and a physical office, the broker demonstrates commitment to accessibility and transparency, making it reliable for client assistance.

★★★ | Minimum Deposit: $100 Regulated by: FSCA Crypto: No |

Customer Reviews and Trust Snapshot

JP Markets presents a mixed reputation – while some users praise the platform’s features and local regulation, many others raise serious concerns about transparency and fund access.

| Metric | Details |

| Regulation | Regulated by South Africa’s FSCA, but license was revoked in 2020 and legal action pursued |

| Trustpilot Rating | High score around 4.8/5, mostly positive reviews |

| Forex Peace Army Rating | Average rating about 3.8/5, with complaints about withdrawals and support |

| Common Complaints | Hidden fees, account freezes, withdrawal issues, ambiguous T&Cs |

Despite some positive feedback, the prevalence of negative reports—particularly around fund access and regulatory reliability – casts doubt on JP Markets’ overall trustworthiness.

★★★ | Minimum Deposit: $100 Regulated by: FSCA Crypto: No |

Discussions and Forum Buzz

In trader communities and forums, JP Markets is frequently criticized—with recurring themes of withdrawal obstacles, alleged trade manipulation, and scam warnings.

| Platform | Key Discussion Points |

| Forex Peace Army | Allegations of B-Book trading, blocking lucrative trades, and refusing withdrawals. |

| Forex Forum | Traders claim trade manipulation and commission contradictions; one said, “Scam broker Everything said or shown is fake.” |

| Broker Watch Dog | Testimonials like “PURE SCAM!!!! … almost impossible to withdraw funds.” and reports of losing significant sums despite believing it was a legit platform. |

Discussions across multiple platforms reveal a strong current of distrust and warnings among traders toward JP Markets.

★★★ | Minimum Deposit: $100 Regulated by: FSCA Crypto: No |

Employee and Internal Insights

Concrete information from employees about working at JP Markets is scarce. While little is publicly shared about internal operations, a few observations can still be made.

| Insight Area | Observations |

| Team Transparency | Very limited: the company mainly names its founder, with minimal detail on experience or other team members. |

| Internal Culture | Not publicly documented, but opaque communication and lack of clarity on policies suggest poor transparency. |

| Regulation Impact | Revoked license and legal actions likely hinder internal morale and operational stability. |

Given the lack of internal disclosures and mounting external criticism, JP Markets appears to lack a transparent and robust corporate culture.

★★★ | Minimum Deposit: $100 Regulated by: FSCA Crypto: No |

Pros and Cons

| ✓ Pros | ✕ Cons |

| Locally regulated by FSCA | License revoked and legal action taken |

| Offers MT4, wide asset range | Withdrawal delays, freezes, or denials |

| Demo accounts and educational tools | Hidden fees and vague terms/conditions |

| High leverage and low deposit needs | Trade manipulation allegations |

| Bonus offers available | Poor transparency and trust concerns |

References:

In Conclusion

JP Markets is headquartered in South Africa, where it offers full national support. Beyond this, the broker maintains a presence and provides support in several additional countries – offices and services span across parts of Africa and Asia. Countries with local offices or support:

- 🇿🇦 South Africa

- 🇸🇿 Eswatini (formerly Swaziland)

- 🇳🇦 Namibia

- 🇱🇸 Lesotho

- 🇰🇪 Kenya

- 🇵🇰 Pakistan

- 🇧🇩 Bangladesh

Faq

Yes, JP Markets charges an inactivity fee of 150 ZAR per month after three consecutive months of no account activity.

Withdrawal processing periods at JP Markets vary based on the payment type and may range from immediate to a few days.

Yes, JP Markets is regulated by the FSCA, implying strict regulatory control.

The minimum deposit necessary to start an account with JP Markets varies by account type, with the Standard Account needing a minimum of 100 ZAR.

JP Markets uses MetaTrader 5.

CONTENT

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a JP Markets Account

- Safety and Security

- Trading Platforms and Tools

- Markets Available for Trade

- Deposit and Withdrawal

- Partnership Options

- Customer Support

- Customer Reviews and Trust Snapshot

- Discussions and Forum Buzz

- Employee and Internal Insights

- Pros and Cons

- In Conclusion

Sidebar rates

HFM

HFM rest

Related Posts

Pu Prime

XM

Best Forex Brokers

Join 350 000+ traders receiving Free Trading Signals