JustMarkets Minimum Deposit Review

The Minimum Deposit amount required to register a JustMarkets live trading account ranges from USD 10 to USD 100, depending on the account option chosen. The broker provides multiple account types, including Standard, Pro, Raw Spread, and Standard Cent accounts.

★★★★★ | Minimum Deposit: $10 Regulated by: FSA, CySEC, FSCA, FSC Crypto: Yes |

Minimum Deposit and Account Types

JustMarkets offers four flexible account types, from micro-lot Cent accounts to high-volume Pro options. With low deposits starting at just $10, traders at any level can find a tailored fit to match their strategy, risk, and experience.

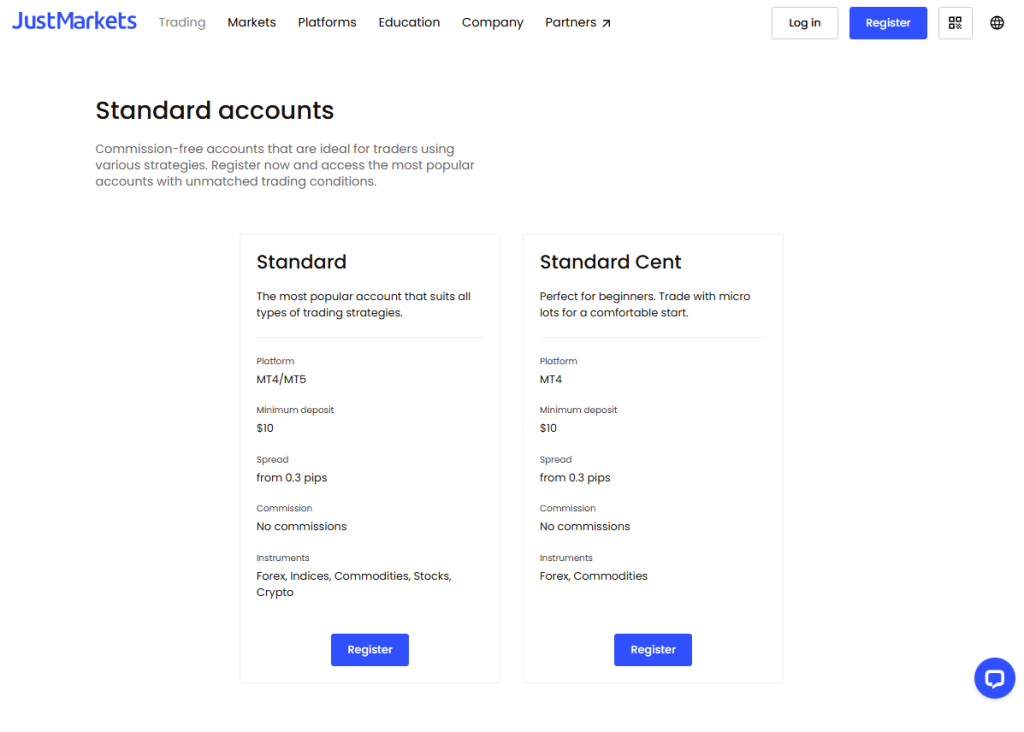

Standard and Cent Accounts

JustMarkets offers commission-free Standard accounts that cater to both beginners and seasoned traders. With competitive spreads, low entry costs, and broad instrument access, these accounts provide a balanced blend of accessibility, flexibility, and powerful features.

★★★★★ | Minimum Deposit: $10 Regulated by: FSA, CySEC, FSCA, FSC Crypto: Yes |

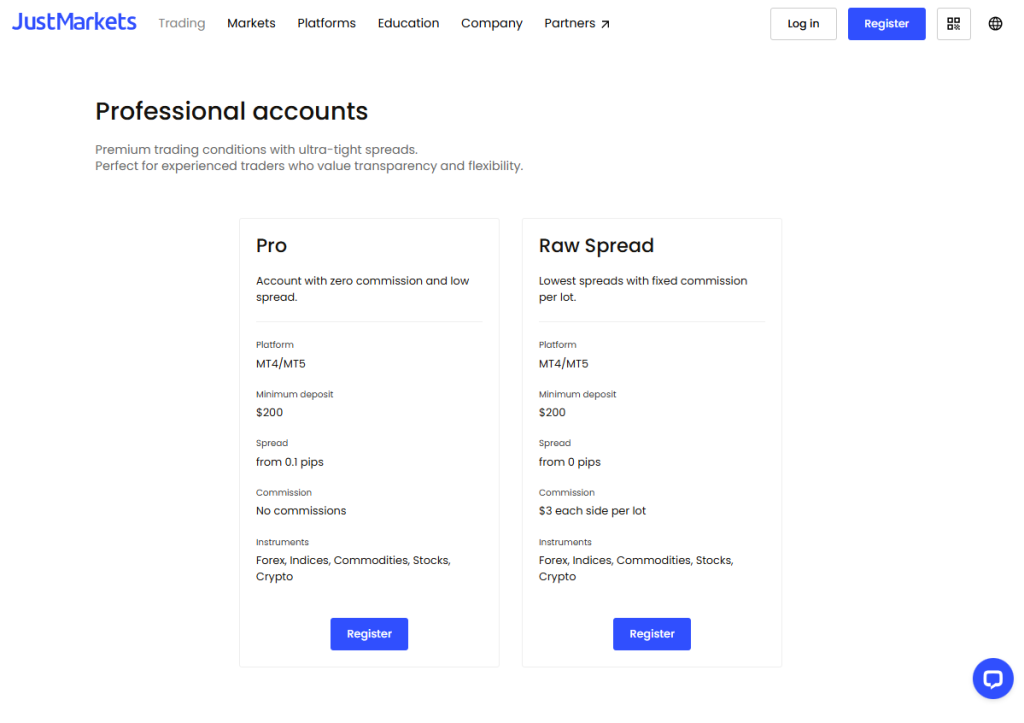

Professional Accounts

JustMarkets’ professional accounts are tailor-made for advanced traders seeking razor-sharp spreads, market execution, and transparency. With low fees and flexible platforms, Pro and Raw Spread accounts deliver premium trading power for serious market participants.

★★★★★ | Minimum Deposit: $10 Regulated by: FSA, CySEC, FSCA, FSC Crypto: Yes |

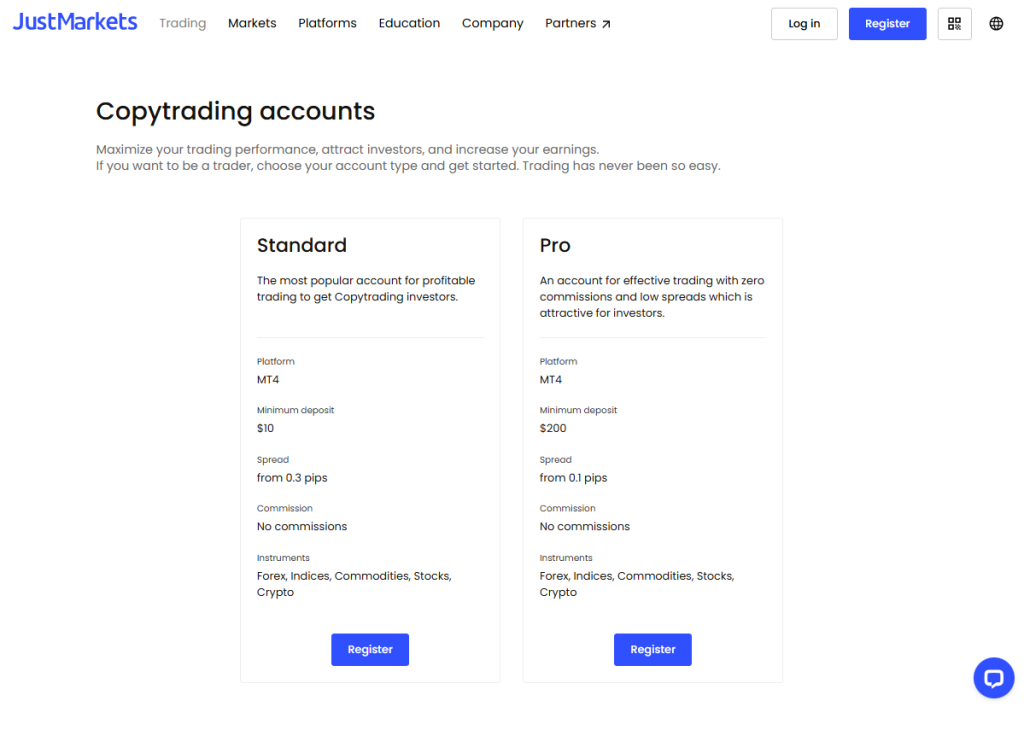

Copytrading Accounts

Whether you’re a beginner looking to follow top-performing traders or a pro aiming to attract investors, JustMarkets Copytrading accounts offer flexible platforms, tight spreads, and zero commissions, making copy-based trading accessible, rewarding, and scalable for all.

Frequently Asked Questions

What’s the minimum deposit to open a JustMarkets account?

You can start trading with as little as $10 on Standard and Cent accounts. Pro and Raw Spread accounts require a $200 minimum, ideal for traders seeking tighter spreads and enhanced trading conditions.

Which JustMarkets account type is best for beginners?

The Standard Cent account is perfect for beginners. It allows micro-lot trading and lower exposure, making it easier to practice trading strategies with minimal financial risk while benefiting from real market conditions.

Our Insights

Whether you’re just beginning or trading professionally, JustMarkets provides an account structure that supports your journey—from Cent and Standard to Pro and Raw Spread. All options offer competitive leverage and user-friendly conditions.

★★★★★ | Minimum Deposit: $10 Regulated by: FSA, CySEC, FSCA, FSC Crypto: Yes |

Islamic, Swap-Free Trading Account

For traders who follow Islamic principles, JustMarkets offers swap-free accounts compliant with Sharia law. These accounts eliminate overnight interest charges, allowing positions to stay open indefinitely – ideal for long-term strategies without compromising faith or market opportunity.

Frequently Asked Questions

What makes JustMarkets’ Islamic accounts Sharia-compliant?

JustMarkets Islamic accounts are swap-free, meaning they exclude overnight interest fees. This aligns with Sharia law, which prohibits earning or paying interest. Traders can hold positions overnight or long term without paying swaps.

Can any account type become Islamic at JustMarkets?

Yes, clients can request swap-free status for their Standard Cent, Standard, Pro, or Raw Spread accounts. This must be done through the support team, which will review eligibility and apply the conversion.

Our Insights

JustMarkets’ Islamic accounts offer a practical and faith-compliant way to trade, preserving full trading functionality across all major account types, without swaps. A perfect balance of ethical trading and modern market access.

★★★★★ | Minimum Deposit: $10 Regulated by: FSA, CySEC, FSCA, FSC Crypto: Yes |

Demo Account

JustMarkets provides free demo accounts for beginners and strategy testers alike. These accounts simulate real trading conditions on MetaTrader platforms, letting users gain experience and confidence without risking capital or committing to a live environment.

Frequently Asked Questions

What can I do with a JustMarkets demo account?

A demo account lets you practice trading, explore MetaTrader tools, and test strategies risk-free. It mimics real trading conditions, providing a valuable hands-on experience before moving to live markets.

Is the JustMarkets demo account truly realistic?

Yes, demo accounts replicate real trading environments closely. While quotes are nearly identical to live accounts, trades execute in a simulated liquidity environment, meaning execution speed and depth may differ slightly.

Our Insights

JustMarkets demo accounts are a smart, safe way to sharpen trading skills, explore different account types, and gain confidence. Ideal for beginners and seasoned traders testing strategies, all without risking a cent.

★★★★★ | Minimum Deposit: $10 Regulated by: FSA, CySEC, FSCA, FSC Crypto: Yes |

How to Open a JustMarkets Account

Go to www.justmarkets.com and click on the “Open Account” or “Sign Up” button at the top of the homepage to begin the registration process.

Step 1: Complete the Registration Form

Enter your full name, email address, password, and country of residence. Accept the terms and conditions, then submit the form to create your client area account.

Step 2: Verify Your Email

Check your inbox for a confirmation email from JustMarkets. Click the verification link provided to activate your client portal.

Step 3: Fill in Personal Details

Log in to your client area and complete your profile by providing your date of birth, address, phone number, and tax residence information.

Step 4: Upload Verification Documents

Submit a valid government-issued ID (passport, national ID, or driver’s license) and a recent proof of address document (such as a utility bill or bank statement dated within the last 3 months).

Step 5: Choose an Account Type

Select from Standard Cent, Standard, Pro, or Raw Spread accounts. You may also opt to open a demo account to practice without financial risk.

Step 6: Set Account Preferences

Pick your trading platform (MT4 or MT5), account currency (USD, EUR, etc.), and preferred leverage (up to 1:3000).

Step 7: Fund Your Account

Head to the “Deposit” section and select your preferred payment method. Deposit at least $10 for Standard and Cent accounts, or $200 for Pro and Raw Spread accounts.

Step 8: Download the Trading Platform

Install MetaTrader 4 or MetaTrader 5 on your device. Use your login details provided by JustMarkets to connect your trading account.

Once logged in, you’re ready to begin trading Forex, commodities, indices, stocks, or crypto based on the account type and platform you selected.

★★★★★ | Minimum Deposit: $10 Regulated by: FSA, CySEC, FSCA, FSC Crypto: Yes |

Deposit and Withdrawal

JustMarkets streamlines your funding experience with instant, secure deposits and withdrawals. Featuring local and international payment options, zero internal fees, and robust safety protocols, it ensures both convenience and peace of mind for global traders.

| Feature | Details |

| Speed | Instant deposits and withdrawals from JustMarkets’ side¹ |

| Fees | Zero commissions by JustMarkets² |

| Security | PCI DSS certified, OTP for withdrawals, multiple protection layers |

| Account Safety | Segregated client accounts |

| Payment Methods | Local and global options available |

| Deposit Process | Register → Choose method → Click “Deposit” |

| Availability | 24/7 transaction access |

| Customer Protection | No use of third-party or relative payment accounts allowed |

¹ JustMarkets processes deposits and withdrawals instantly on their end (within 1 minute). However, delays may occur depending on the payment provider.

² Some third-party payment systems may charge fees independently of JustMarkets, which are outside the broker’s control.

Frequently Asked Questions

Are there any fees for deposits and withdrawals on JustMarkets?

JustMarkets charges no internal fees for deposits or withdrawals. However, certain external payment providers may apply their charges, which are beyond JustMarkets’ control and are disclosed when applicable.

How does JustMarkets secure financial transactions?

All transactions are protected by multi-layered security, including PCI DSS-certified systems, segregated client accounts, and OTP verification for withdrawals. This approach ensures your funds and personal data remain safe throughout every transfer process.

Our Insights

JustMarkets provides a reliable and user-friendly funding process with instant internal processing, strong security, and zero hidden charges. It’s an ideal choice for traders who prioritize both speed and trust in financial transactions.

★★★★★ | Minimum Deposit: $10 Regulated by: FSA, CySEC, FSCA, FSC Crypto: Yes |

Getting Started Essentials – A Quick Q&A

5 Frequently Asked Questions about the JustMarkets minimum deposit, withdrawal process, and sign-up perks.

Q: What’s the minimum deposit to open a JustMarkets account? – Maria, Brazil

A: JustMarkets offers flexible account options. Standard and Standard Cent accounts require a minimum deposit of $10, while Pro and Raw Spread accounts require $200. These options cater to both beginners and experienced traders, providing accessible entry points for different trading strategies.

Q: How quickly can I withdraw funds from JustMarkets? – Ahmed, UAE

A: Withdrawal processing times depend on the payment method. Cryptocurrency withdrawals are typically processed within 2 hours. Bank transfers may take up to 1 business day, while e-wallet and card withdrawals are generally processed within 24 hours. Processing times can vary depending on the provider.

Q: Does JustMarkets charge fees for deposits or withdrawals? – Sophie, Canada

A: JustMarkets does not charge any fees for deposits or withdrawals. However, third-party payment providers such as banks or card issuers may apply their own transaction or conversion fees depending on the method used.

Q: Can I withdraw profits to a different method than my deposit method? – Raj, India

A: JustMarkets allows withdrawals to a different method than the original deposit. However, for smooth processing and compliance with regulations, it is recommended to use the same method used for the initial deposit whenever possible.

Q: What perks come with signing up at JustMarkets? – Emma, UK

A: JustMarkets provides multiple account types to suit different trading strategies, access to popular platforms like MT4 and MT5, leverage up to 1:3000, swap-free accounts, and a wide range of instruments including Forex, indices, commodities, stocks, and cryptocurrencies. The broker offers competitive spreads and commissions with a low $10 minimum deposit.

★★★★★ | Minimum Deposit: $10 Regulated by: FSA, CySEC, FSCA, FSC Crypto: Yes |

Pros and Cons

| ✓ Pros | ✕ Cons |

| MAM accounts | US clients not accepted |

| Excellent Education | High Spreads |

| Low Minimum Deposit | Limited Regulation |

| High Leverage | Limited Investor Protection Schemes |

You might also like:

In Conclusion

JustMarkets provides a flexible trading environment with minimum deposits ranging from $10 to $200, depending on the account type. Offering Standard, Pro, Raw Spread, and Cent accounts, the broker caters to all experience levels, delivering competitive spreads, leverage up to 1:3000, swap-free options, and access to diverse trading instruments.

Faq

Yes. JustMarkets offers a 30 USD no-deposit bonus and a 50% deposit bonus. The no-deposit bonus is strictly for newly registered traders, while the 50% deposit is for new and existing clients.

JustMarkets will immediately convert your deposited funds to your account’s base currency at the current exchange rate.

Yes. The minimum deposit amount can vary depending on the payment type. The JustMarkets deposit and withdrawal page lists the precise restrictions for each method.

Yes. JustMarkets might impose deposit limitations based on your account type and verification status. For further information, please go to their terms & conditions or contact customer service.