- Home /

- Forex Brokers /

- LBX

LBX Review

- Overview

- LBX Fee Breakdown

- Account Breakdown - Features and Benefits

- LBX Account Registration Guide for New Traders

- Is LBX a Safe Broker? Regulation and Fund Protection Explained

- Comprehensive List of LBX Trading Instruments and Markets

- Exploring LBX Trading Platforms

- Trading Tools and Market Analysis Features

- Deposits and Withdrawals

- LBX Partner Program

- LBX vs SimpleFX vs IUX - A Comparison

- How LBX Handles Client Support and Assistance

- Pros and Cons

- Broker Review Summary and Insights

LBX was established in 2024 and operates under the Libertex Group. LBX gives you access to more than 200 CFDs across forex, equities, bonds, index futures, indices, metals, energies, cryptocurrencies, and commodities. You can use MetaTrader 4 or MetaTrader 5 on the web, Desktop (Windows and Mac), and iOS and Android apps.

★★★★★ | Minimum Deposit: $20 Regulated by: FSC Mauritius Crypto: Yes |

Overview

LBX was established in 2024 and operates under the Libertex Group, a trading name that has won numerous global awards and serves millions of clients. The group’s reach extends across more than 120 countries, and LBX operates under the regulation of the FSC in Mauritius.

LBX gives you access to more than 200 CFDs across forex, equities, bonds, index futures, indices, metals, energies, cryptocurrencies, and commodities.

You can use MetaTrader 4 or MetaTrader 5 on the web, Desktop (Windows and Mac), and iOS and Android apps. These are two platforms trusted worldwide for reliability, automation tools, and technical analysis.

LBX’s background in the Libertex Group means access to more than two decades of trading infrastructure, A-list sports partnerships, including the latest collaboration with the KICK Sauber F1 Team, and recognitions such as “Best CFD Broker – LATAM” (Global Forex Awards 2025) and “Best IB Programme” (World Finance Awards 2025)

★★★★★ | Minimum Deposit: $20 Regulated by: FSC Mauritius Crypto: Yes |

LBX Fee Breakdown

LBX displays its pricing under “CFD specification,” where traders can view live pricing and swaps. You can also see what you can expect to pay according to the account you use.

What are LBX’s spreads?

LBX quotes floating spreads that adjust according to live market liquidity. You can view the latest pricing on the website under “CFD specification,” which updates in real time. Typical spreads across common instruments look like this (subject to change):

| Instrument | Typical Spread |

| EUR/USD | 1.1 pips |

| GBP/USD | 1.3 pips |

| Brent | 5 pips |

| Gold/USD | 3 pips |

| Silver/USD | 70 pips |

| Cocoa | 1,450 pips |

| Nasdaq 100 | 21 pips |

| BTC/USD | 23.99 pips |

Frequently Asked Questions

Does LBX charge commission fees?

Yes, but only on the Raw Spread account. The commission is $6 per lot round-trip, which suits experienced traders who want tighter pricing and prefer to pay a fixed fee per volume instead of wider spreads. Standard accounts skip commissions altogether.

What Overnight fees can I expect?

Overnight, or swap, fees apply when you keep a position open past the daily rollover. The platform debits or credits your account depending on whether your position is long or short, and each instrument has rates listed in-platform under its specification.

Swaps apply at the end-of-day platform time (GMT+3), with triple-day swaps generally midweek for Forex.

| Instrument | Swap Long | Swap Short |

| EUR/USD | -11.68 | 3.18 |

| GBP/USD | -5.32 | -3.77 |

| Brent | -0.64 | -2.87 |

| Gold/USD | -60.51 | 18.09 |

| Silver/USD | -3.9 | -77.7 |

| Cocoa | 1.87 | -10.07 |

| Nasdaq 100 | -7.28 | 1.36 |

| Crypto | -35.0 | -15.0 |

What happens to inactive accounts?

LBX marks an account inactive after 90 days without trades or balance activity.

- The inactivity fee is $10 per month per inactive account.

- If the account balance is below $10, only the remaining balance is deducted.

- LBX checks accounts monthly for inactivity.

If at least one account in your profile stays active, no inactivity fees apply to the others.

★★★★★ | Minimum Deposit: $20 Regulated by: FSC Mauritius Crypto: Yes |

Account Breakdown – Features and Benefits

Every trader has a preferred setup, and LBX understands this. Whether your edge comes from scalping micro-movements or managing broader positions, you can choose between two distinct account types that deliver professional-grade conditions.

Live Account Comparison

| Feature | Standard Account | Raw Spread Account |

| Supported Platforms | MT4 MT5 | MT4 MT5 |

| Spread | From 1.4 pips | From 0.0 pips |

| Commission | None | $6 |

| Execution | Market execution | Market execution |

| Leverage | Up to 1:1000 | Up to 1:1000 |

| Minimum Lot Size | 0.01 | 0.01 |

| Maximum Lot Size | 100 lots (Indices up to 1000) | 100 lots (Indices up to 1000) |

| Stop-Out Level | 30% | 30% |

| Margin Call | 50% | 50% |

Benefits of the Standard Account

- Easier cost tracking with zero commissions.

- Ideal for those who prefer wider spreads over trade-based fees.

- Access to MT4 and MT5 with full Expert Advisor compatibility.

- Suitable for traders focused on consistency and simplicity in pricing.

Benefits of the Raw Spread Account

- Tighter pricing that improves entry precision.

- Transparent commission per lot, with no hidden markups.

- Preferred by active or high-volume traders.

- Optimised for algorithmic and professional trading setups.

LBX Demo Account

A demo account lets you experience LBX trading conditions without financial risk. You start with $100,000 in virtual funds and access to both MT4 and MT5 platforms.

The account mirrors live pricing, execution speed, and trading conditions. You can trade forex, metals, energies, indices, and crypto while refining your strategy. There’s no expiration limit, which gives you unlimited practice time.

★★★★★ | Minimum Deposit: $20 Regulated by: FSC Mauritius Crypto: Yes |

LBX Account Registration Guide for New Traders

Every stage of LBX’s sign-up process is an introduction to the trading environment that you’ll use. If this is your first time opening a trading account, you can follow these steps:

1. Step 1: Register on the LBX Website

Visit the LBX website and click “Sign Up”. Enter your first and last name, select your country, add your mobile number, and set your password.

Confirm it, then review and tick the boxes to agree to the Terms & Conditions, Risk Disclosure, Privacy & Cookies Policy, and other required declarations before continuing.

2. Step 2: Complete Your KYC Verification

- Log in to your LBX account and open “Profile” and then “Profile Verification”.

- Select your country and document type, then upload the front and back of your ID.

- Wait for the confirmation email once verification is complete.

3. Step 3: Open a Live Trading Account

From your dashboard, select Open Live Account. Choose your account type, preferred leverage, and base currency. Your credentials (account number and password) will be displayed on-screen and sent to your email once approved.

4. Step 4: Request a Raw Spread Account (Optional)

If you want Raw Spread conditions, submit a Raw account request through support or email. It’s processed within about three business days.

5. Step 5: Fund Your Wallet and Transfer to Your Account

- Deposit through your approved payment method (bank, card, or crypto).

- Only payments in your own name are accepted.

- Move funds from your Wallet into your live trading account.

6. Step 6: Connect via MT4 or MT5

Download MetaTrader 4 or 5 (available on desktop, Mac, iOS, or Android) or use the web-based platform. You can also explore LBX’s copy trading features.

Use your LBX login credentials and select the correct server from your dashboard to connect and start trading.

★★★★★ | Minimum Deposit: $20 Regulated by: FSC Mauritius Crypto: Yes |

Is LBX a Safe Broker? Regulation and Fund Protection Explained

Yes, it is. When it comes to trading, trader confidence often starts with trust. LBX understands that protecting client money and personal data isn’t a selling point but the very foundation. LBX is overseen by a recognised regulator and adheres to transparent fund-handling procedures. Here are the details:

- Operated by MAEX LIMITED, registered in the Republic of Mauritius (Registration No. 158250 C1/GBL).

- Regulated and supervised by the Financial Services Commission (FSC) of Mauritius, under License No. C118023400.

- Client funds are segregated from LBX’s operational accounts, ensuring money is held separately.

- Negative balance protection prevents client losses from exceeding deposits.

- Strict KYC verification process requiring proof of identity, address, and, when needed, a liveness check.

- No third-party payments; deposits and withdrawals must match the account holder’s name.

- Fraud and brand misuse alerts encourage traders to verify they are interacting with the genuine LBX site and provide contact points for reporting suspicious activity.

- Claims or transaction errors can be reported via [email protected], with a processing time of up to seven business days.

- Multiple regional licences referenced for asset safeguarding, reinforcing LBX’s multi-jurisdictional compliance framework.

Moreover, it includes several additional risk management tools like Stop-Loss, Guaranteed Stop-Loss, Margin Calls, OCO Orders, and Trailing Stops.

★★★★★ | Minimum Deposit: $20 Regulated by: FSC Mauritius Crypto: Yes |

Comprehensive List of LBX Trading Instruments and Markets

When you trade with LBX, you get access to more than a couple of market favourites. The lineup includes Forex majors, crypto leaders, global indices, and commodities that matter to traders who trade daily.

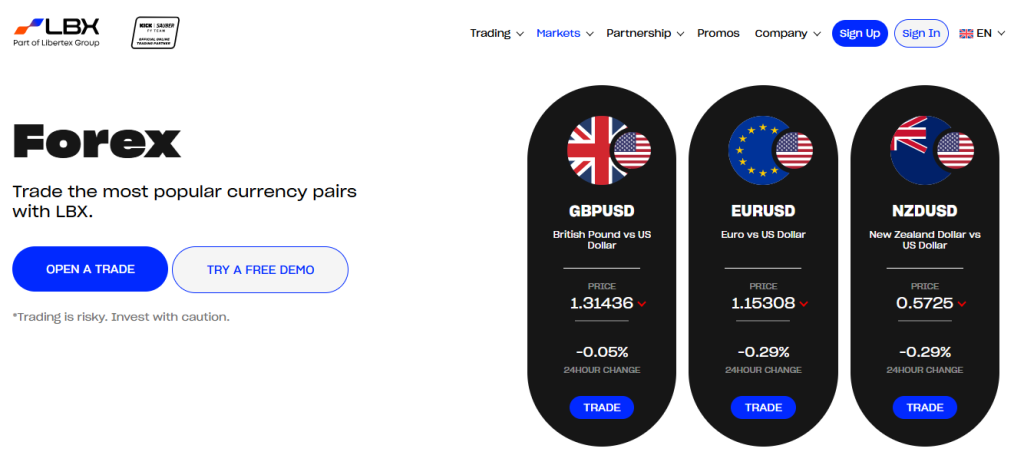

Forex

Trade over 70 currency pairs with leverage up to 1:1000.

- Choose from majors, minors, and exotics from more than 120 countries.

- High-leverage options provide flexibility in trade sizing.

- Tight spreads aim to keep costs efficient across sessions.

- Compatible with automated and manual strategies on MT4 and MT5.

Ideal for traders tracking macro events and cross-currency correlations.

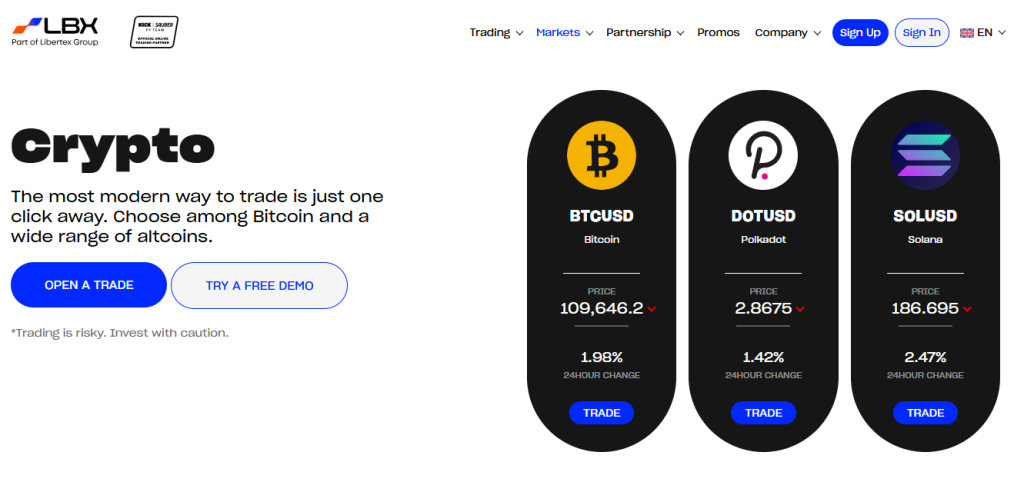

Cryptocurrencies

Access top coins and crypto pairs through CFDs with leverage up to 1:200.

- Trade popular assets like BTC, ETH, XRP, and SOL without wallet management.

- Benefit from liquidity and price depth

- Execute short or long positions depending on sentiment.

- Use volatility as part of a diversified portfolio.

Integrate crypto trading alongside traditional markets in one platform.

Metals

Diversify through precious and industrial metals with leverage up to 1:500.

- Trade gold, silver, platinum, and palladium under one account.

- Access transparent pricing and consistent execution.

- Apply short-term and long-term strategies with ease.

Monitor market sentiment through commodity-linked data feeds.

Indices

Global equity exposure without managing single stocks.

- Access major benchmarks through CFDs, including US500, NASDAQ, GER40, and UK100.

- Leverage up to 1:500 across regions for tactical positioning.

- Trade during overlapping sessions to capture volatility.

- Hedge portfolio exposure or speculate on sector momentum.

Analyse with MT4 and MT5 charting and volume tools.

Energies

Trade energy markets that power the global economy.

- Access Brent, WTI, and natural gas CFDs with leverage up to 1:400.

- Monitor geopolitical and seasonal factors that impact pricing.

- Pair with indices or currencies for correlation strategies.

- Manage margin dynamically as volatility shifts.

Use platform tools to time entries around key inventory reports.

Commodities

Capture trends in agriculture and industrial goods.

- Trade soft and hard commodities like coffee, copper, and corn.

- Leverage up to 1:100.

- Benefit from pricing transparency and stable execution.

- Use commodities as defensive or speculative portfolio elements.

Explore cross-asset strategies linked to inflation and demand cycles.

★★★★★ | Minimum Deposit: $20 Regulated by: FSC Mauritius Crypto: Yes |

Exploring LBX Trading Platforms

LBX understands that your platform isn’t just a dashboard but also your workspace, test lab, and stress test. LBX offers two heavyweight platforms: MetaTrader 4 and 5, available on desktop, web, and iOS/Android.

MetaTrader 4

LBX’s MetaTrader 4 provides a trading foundation. MetaTrader 4 is a reliable and responsive platform that offers tools for both technical and automated trading.

- Advanced charting tools and 30+ built-in indicators for in-depth analysis.

- Automated strategy testing through Expert Advisors.

- Custom scripts for repeatable task automation.

- Secure encryption to protect transactions and data.

- Broad compatibility across desktop, web, and mobile.

MT4 suits traders who prefer a familiar and trusted setup for manual or algorithmic strategies.

MetaTrader 5

LBX’s MetaTrader 5 offers an enhanced toolkit for traders who want more data and instruments, as well as faster testing. It expands on MT4’s core strengths with deeper analytics and improved automation.

- Over 80 technical indicators and 21 timeframes for detailed analysis.

- Multi-threaded backtesting for complex Expert Advisor strategies.

- Market depth view for transparency on liquidity and order flow.

- Enhanced charting and order management tools.

- Strong encryption and optimised performance for stability.

MT5 suits traders who prefer data-driven setups, algorithmic precision, and advanced technical analysis, without requiring them to switch platforms as they improve their skills.

Copy Trading with LBX

Copy trading at LBX provides access to expert-level trading without requiring you to be an expert yourself. You decide how much to allocate, who to follow, and when to stop. The trades happen automatically, but you always have control.

- Access traders specialising in forex, crypto, indices, metals, and more.

- Every trade is copied in real time, matching the provider’s moves.

- Copy trading creates a network of active traders where professionals share strategies and followers can learn.

- You set the parameters: investment size, leverage, and risk tolerance.

- You only pay fees when you make a profit. Providers earn a percentage of gains.

LBX Copy Trading suits investors who want exposure to financial markets without spending hours analysing charts.

★★★★★ | Minimum Deposit: $20 Regulated by: FSC Mauritius Crypto: Yes |

Trading Tools and Market Analysis Features

LBX might offer limited trading tools and analysis, but what is available is enough to help traders plan and refine their trades. Whether you track fundamentals or lean on technical setups, everything is integrated to help you respond to all types of market conditions.

Economic Calendar

LBX’s economic calendar is a live data hub for global events that can move your trades. Every release is tracked and timestamped for you to know what’s coming and when.

- Filter events by country, importance, or date to narrow your focus.

- View actual, forecast, and previous data to gauge market impact.

- Track currency-specific releases that affect your pairs directly.

Use it to plan entries and exits around high-volatility windows.

Market Holidays

Even the best strategy can fail if the market is closed. LBX keeps traders informed with an updated calendar covering global exchange holidays and session changes.

- View all affected dates and instruments in advance.

- Times are listed in GMT+3 to help align your sessions.

- Updates are published as schedules shift or exchanges announce closures.

- Non-affected instruments stay open under regular trading hours.

- Plan positions and margin to avoid execution gaps.

Third-party Tools on MetaTrader 4 and 5

LBX connects directly with MT4 and MT5, giving you professional-grade functionality across devices. The setup supports both technical and automated traders with full analytical depth.

- Over 30 indicators and multiple timeframes for chart analysis.

- Drawing tools to track trends, ranges, and setups.

- Strategy tester for backtesting and optimisation.

- Full Expert Advisor (EA) support for algorithmic execution.

- Price alerts and push notifications across desktop, web, and mobile.

- Custom scripts and indicators for tailored workflows.

Real-time market depth and liquidity view, particularly in MT5.

★★★★★ | Minimum Deposit: $20 Regulated by: FSC Mauritius Crypto: Yes |

Deposits and Withdrawals

LBX offers instant, commission-free deposits and withdrawals across crypto, Neteller, Skrill, and credit or debit cards.

| Payment Method | Deposit Commission | Withdrawal Commission | Processing Time |

| Crypto | 0% | 0% | Instant |

| Neteller | 0% | 0% | Instant |

| Skrill | 0% | 0% | Instant |

| Credit/Debit Card | 0% | 0% | Instant |

How can I fund an LBX Account?

Log in and select “Deposit Funds” from your personal area.

- Choose the wallet you want to fund.

- Select your preferred payment method, such as cryptocurrency, card, or local option.

- Enter the amount, and if using crypto, confirm the currency and network.

- Review your details carefully before submitting.

Remember, only payments in your own name are accepted.

How can I withdraw from LBX?

Move trading profits into your universal wallet before requesting a withdrawal.

- Go to “Funds” and select “Withdraw Funds”.

- Choose your wallet and preferred withdrawal method.

- Upload or verify payment details if it’s a new method.

Enter the amount, review everything, and confirm the request.

★★★★★ | Minimum Deposit: $20 Regulated by: FSC Mauritius Crypto: Yes |

LBX Partner Program

There’s no shortage of partnership programmes in trading, but few give you a reason to stay past the sign-up page. LBX is one of those exceptions. It backs its Introducing Brokers with more than rebates by building a partnership into every tool, reward, and report.

Why do many partner with LBX?

LBX’s IB programme attracts traders and business builders for reasons that go beyond commissions. It provides you with the backing of a global broker, equipped with the numbers and tools to match your ambitions.

- Rebates up to $50 per client trade.

- Daily commission payouts with instant access.

- Transparent 5-tier referral structure.

- Dedicated IB Manager with tailored guidance.

- Access to global events and education support.

- Copy-trading options to scale your reach.

What is the IB Loyalty Programme?

LBX’s IB Loyalty Programme rewards commitment with tangible incentives that reflect your performance level.

| Feature | Description |

| Luxury rewards | Cars watches vacations tech gadgets |

| Recognition | Higher tiers mean higher perks |

| Exclusive access | VIP events F1 experiences gold bullion |

| Cash bonuses | Regular monetary rewards based on volume |

| Tailored perks | Business-growth benefits and custom packages |

| Educational support | Analyst sessions training event sponsorships |

What Promotional Tools do LBX partners get?

LBX equips you with ready-to-use tools that help attract and convert clients.

- Unique partner links for client onboarding.

- Custom landing pages for VIP partners.

- Professionally designed banners and logos.

- Marketing materials tailored to your audience.

Analytics to measure campaign performance.

How does LBX handle IB reporting?

LBX’s IB portal gives you real-time insight into every client and every dollar earned. It’s precise, visual, and ideal for traders who measure progress in data.

- Real-time commission tracking.

- Full trading-activity breakdowns.

- Access to client equity, deposits, and leverage.

- Detailed trade history with open/close data.

- Performance metrics across your network.

- Custom filters for country and account type.

Instant visibility into earnings growth.

★★★★★ | Minimum Deposit: $20 Regulated by: FSC Mauritius Crypto: Yes |

LBX vs SimpleFX vs IUX – A Comparison

★★★★★ | Minimum Deposit: $20 Regulated by: FSC Mauritius Crypto: Yes |

How LBX Handles Client Support and Assistance

Every trader knows that a responsive support team can make or break the trading experience, and LBX doesn’t let traders down.

| Support Channel | Details |

| Help Centre | Online knowledge base with quick answers and guides for all trading and account topics |

| Live Chat | Available on the LBX website for real-time assistance |

| Support Languages | English, Thai, Vietnamese, Spanish |

| Email Support | [email protected], available 24/7 for trading, account, or technical inquiries |

| Phone (Argentina) | +54 341 529 0536 |

| Phone (Thailand) | +66 97 531 0838 |

| Phone (Vietnam) | +84 28 7309 1720 |

| Social Media | Facebook, X, Instagram, LinkedIn, TikTok |

| Overall Quality | Response times are quick, staff are knowledgeable, and availability is decent across time zones. The multilingual, multi channel setup makes LBX’s client support among the more reliable options in its category. |

LBX support is available 24/7, whether you’re managing funding questions, verifying an account, or tracking a withdrawal update.

★★★★★ | Minimum Deposit: $20 Regulated by: FSC Mauritius Crypto: Yes |

Pros and Cons

| ✓ Pros | ✕ Cons |

| Transparent pricing with published CFD specifications | Not available in restricted countries |

| Demo account includes $100,000 virtual balance with no expiry | Lacks education content |

| Multi-award-winning broker under the Libertex Group | Limited in-house trading tools beyond MT4 and MT5 |

| High leverage up to 1:1000 on both accounts | Inactivity fee applies after 90 days |

References:

Broker Review Summary and Insights

LBX is itself a confident, long-standing name under the Libertex Group banner, and its heritage is evident. The setup is seasoned: spreads are transparent, execution is fast, and both MT4 and MT5 give traders access to hundreds of CFDs that cover forex, metals, energies, crypto, and indices, among others.

Regulation and Credibility

Regulation through the FSC in Mauritius, segregated funds, and negative balance protection all add to LBX’s credibility, which many other young brands lack.

Account Types and Trading Conditions

On the practical side, two account types make it easy to match costs with trading style. The Standard Account is fee-free but has wider spreads, while the Raw Spread Account offers tighter pricing at a fixed commission. In addition, funding through cards, crypto, Skrill, or Neteller is instant both ways.

Tools, Education, and Support

The downside is that LBX doesn’t yet offer deeper analytical tools beyond what MetaTrader already provides. The educational content is light, and there’s a lack of regional expansion. Support, though available 24/7, can still be improved in terms of specialist trading knowledge.

Overall Verdict

Overall, LBX’s strengths lie in its balance of trust, technology, and transparent pricing. It’s most appealing to traders who value regulation, liquidity, and platform performance over hype.

Faq

LBX gives you access to over 200 CFDs across forex, metals, energies, indices, cryptocurrencies, and commodities.

Yes, LBX operates under the Financial Services Commission of Mauritius, with client funds held in segregated accounts, subject to KYC verification, and featuring negative balance protection.

LBX offers an economic calendar, market holidays calendar, and built-in analysis tools through MetaTrader 4 and 5 to support trading decisions.

LBX offers 24/7 multilingual support through live chat, email, and phone, with knowledgeable staff and quick response times.

Yes, both MetaTrader 4 and MetaTrader 5 are available on desktop, web, and mobile devices.

LBX requires proof of identity, proof of address, and may include a liveness check before activating a live account.

LBX accepts deposits and withdrawals through crypto, credit or debit card, Neteller, and Skrill, all processed instantly.

Yes, leverage is available up to 1:1000 on most instruments.

You can choose between a Standard Account with no commissions and spreads from 1.4 pips or a Raw Spread Account with $6 commission and spreads from 0.0 pips.

Withdrawals are processed instantly for all supported payment methods.

- Overview

- LBX Fee Breakdown

- Account Breakdown - Features and Benefits

- LBX Account Registration Guide for New Traders

- Is LBX a Safe Broker? Regulation and Fund Protection Explained

- Comprehensive List of LBX Trading Instruments and Markets

- Exploring LBX Trading Platforms

- Trading Tools and Market Analysis Features

- Deposits and Withdrawals

- LBX Partner Program

- LBX vs SimpleFX vs IUX - A Comparison

- How LBX Handles Client Support and Assistance

- Pros and Cons

- Broker Review Summary and Insights