- Home /

- Forex Brokers /

- Nadex

Nadex Review

- Overview

- Account Options

- How to Open a Nadex Account

- Safety and Security

- Trading Platforms and Tools

- Markets available for Trade

- Deposits and Withdrawals

- Education and Resources

- Customer Support

- Customer Reviews and Trust Scores

- Discussions and Forums about Nadex

- Employee Overview of Working for Nadex

- Pros and Cons

- In Conclusion

Nadex is a CFTC-regulated exchange offering short-term, fixed-payout contracts across global markets. Traders place orders directly on the exchange, avoiding broker conflicts and gaining transparent, capped risk.

Overview

Nadex operates as a transparent exchange rather than a traditional broker, which gives traders fixed outcomes and direct market pricing. The model removes conflict of interest by matching orders between participants. Traders gain short-term opportunities with defined risk across forex, indices, commodities, and crypto through an intuitive, accessible platform.

Frequently Asked Questions

Is Nadex safe for traders?

Yes. Nadex operates under 🇺🇸 CFTC regulation and functions as an exchange, not a dealer. Traders benefit from transparent pricing, defined maximum risk, and direct order matching, which removes conflicts of interest and promotes accountability in both pricing and execution.

What can I trade on Nadex?

Traders can access binary options, knock-outs, call spreads, and short-term event contracts across forex, stock indices, commodities, and crypto markets. All contracts are cash-settled with fixed outcomes, which supports measurable trading strategies that avoid the uncertainty of margin-based exposure.

Our Insights

Nadex is a strong choice for active traders who want short-term contracts with fully defined risk. Its regulated structure, capped payouts, and direct exchange pricing offer confidence and control. The platform suits strategy-driven traders seeking clarity, speed, and transparency instead of traditional leveraged speculation.

Account Options

Nadex offers a simple account structure with one live account and a fully mirrored demo environment. Traders get transparent risk, clear payouts, and direct exchange pricing without leverage or margin complexity, which supports disciplined short-term strategies across multiple markets.

| Account Type | Minimum Deposit | Instruments Available | Key Benefit |

| Live Account | None | Binary Options Knock-Outs Call Spreads | Full access with defined risk |

| Demo Account | None | Same as Live | Unlimited practice with virtual balance |

Frequently Asked Questions

Is the Nadex demo account realistic?

Yes. The demo mirrors the live platform with the same instruments, pricing logic, and order behavior. Traders can test strategies, view potential profit and loss before confirming orders, and practice without risk for as long as needed.

Why does the Nadex live account not use leverage?

Nadex is a fully collateralized exchange, which means every trade is funded to its maximum risk. This eliminates margin calls, reduces emotional decision-making, and offers clearer control over exposure, especially for short-term traders who want predictable outcomes.

Our Insights

The Nadex account structure is ideal for traders who want simplicity, transparency, and fixed-risk outcomes. With no minimum deposit, no leverage, and a powerful demo environment, it suits disciplined traders who prefer clarity over speculation and want precise control of risk from trade to trade.

How to Open a Nadex Account

Opening a Nadex account is a straightforward, fully online process. You must verify your identity, confirm your address, and fund your account before placing live trades on the platform.

1. Step 1: Begin Registration

Visit the Nadex sign-up page and choose an Individual Live Account.

2. Step 2: Enter Personal Details

Provide your legal name, email, phone number, date of birth, and create a username and password.

3. Step 3: Submit Identification Information

Enter your taxpayer ID, Social Security Number, or national identification number as required.

4. Step 4: Complete Verification (KYC)

Upload a government ID and proof of address to validate your identity and residence.

5. Step 5: Confirm Eligibility

Accept the user agreement and confirm that you live in an eligible jurisdiction.

6. Step 6: Add a Funding Method

Select debit card, ACH, or wire transfer, and then verify your payment source using a recent bank or card statement.

7. Step 7: Fund and Activate

Deposit funds to cover potential risk and fees, submit your application, and wait for approval.

Once verified, you can start trading immediately or continue practicing on the demo account.

Safety and Security

Nadex operates as a regulated exchange under strict United States oversight, offering traders a centralized and transparent environment. Its clearing structure, rules, and federal supervision ensure confidence, separation of funds, and minimized counterparty exposure for short-term derivatives traders.

| Category | Regulator | Entity Type | Fund Security |

| Regulation | 🇺🇸 Commodity Futures Trading Commission | DCM and DCO | Segregated bank accounts |

Frequently Asked Questions

Is Nadex fully regulated as an exchange in the United States?

Yes. Nadex is overseen by the 🇺🇸 Commodity Futures Trading Commission as a Designated Contract Market and Derivatives Clearing Organization. Its role as an exchange and clearing entity keeps all listed products and settlement processes under federal supervision for trader protection.

How does Nadex protect client funds and reduce trading risk?

Client capital is held in segregated United States bank accounts, separate from company assets. Mandatory audits, financial reporting, and clearing operations help guarantee contract settlement, which significantly lowers counterparty risk while maintaining system integrity under federal standards.

Our Insights

Nadex offers strong structural and regulatory protection by operating as a federally overseen exchange with its own clearing system. This setup delivers transparency and accountability, making it a reliable option for traders who prioritize fund safety and rule-driven market oversight.

Trading Platforms and Tools

Nadex delivers a unified web and mobile trading experience that focuses on clarity, execution speed, and visible risk. Traders can navigate binaries, knockouts, and call spreads with transparent order tickets and responsive charting tools designed for active decision making in fast markets.

| Platform | Charting | Contract Types | Early Exit |

| Nadex Web | Custom layouts | Binaries knockouts call spreads | Yes |

| NadexGO Mobile | Technical charting | Binaries knockouts call spreads | Yes |

Frequently Asked Questions

Does the Nadex web platform support active short-term trading?

Yes. The platform supports market and limit orders, early exits, and fast execution without pattern day trading rules. The customizable charts and transparent tickets help short-term traders monitor risk, view setups, and react quickly during volatile conditions.

Is NadexGO a fully capable mobile solution for trading?

Yes. NadexGO syncs with the desktop platform and offers identical order ticket functions, contract access, and charting indicators. Traders can execute, manage, and close positions while staying connected to live markets on a responsive Progressive Web App.

Our Insights

Nadex delivers a seamless short-term trading experience with synchronized tools, fast execution, customizable layouts, and transparent risk data. The platform suits active traders who want full control on desktop or mobile without losing access to core functions during live market conditions.

Markets available for Trade

Nadex gives traders access to popular global markets in a defined-risk format. With binaries, knockouts, and call spreads, every position has a capped downside and a fixed duration, which allows traders to speculate or hedge without margin calls or unlimited exposure.

| Market | Examples | Contract Types | Risk Limit |

| Forex | EUR/USD GBP/USD USD/JPY | Binaries knockouts call spreads | Fixed risk |

| Indices | Wall Street 30 US 500 Japan 225 | Binaries knockouts call spreads | Fixed risk |

| Commodities | Gold Silver Crude Oil | Binaries knockouts call spreads | Fixed risk |

| Crypto | Bitcoin Ethereum Litecoin | UpDown contracts | Fixed risk |

Frequently Asked Questions

Which markets can you trade on Nadex?

Nadex offers Forex pairs, United States and global indices, major commodities, and select cryptocurrencies. Traders can choose from binaries, knockouts, or call spreads, and each contract comes with defined risk, a fixed duration, and a transparent cost structure designed for control and clarity.

Why do traders choose Nadex for these markets instead of traditional brokers?

Nadex contracts eliminate unlimited downside, margin calls, and overnight exposure. Traders know maximum risk before execution and can speculate on short-term moves in familiar markets with transparent pricing and a simple contract structure that supports disciplined position sizing and risk planning.

Our Insights

Nadex delivers a clear lineup of global markets with fixed-risk contracts that appeal to short-term and event-driven traders. The structure prioritizes transparency, contract control, and predictable exposure, making it a practical option for those who want to trade major assets with capped downside.

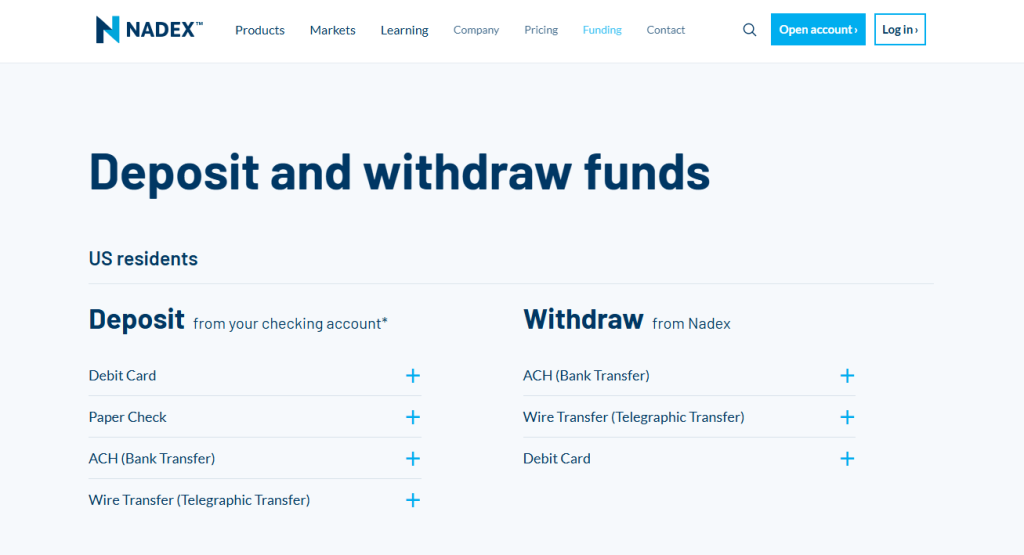

Deposits and Withdrawals

Nadex allows US and international traders to deposit and withdraw funds through mainstream methods. Options include debit cards, ACH or bank transfers, wire transfers, and paper checks. Each method is designed for transparency, speed, and secure access, helping traders focus on markets rather than payment complications.

| Region | Deposit Methods | Withdrawal Methods | Processing Time |

| US | Debit Card ACH Wire Paper Check | Debit Card ACH, Wire | Instant to 5 business days |

| Non-US | Debit Card Wire Transfer | Debit Card Wire | Instant to 1–2 business days |

Frequently Asked Questions

How can I deposit funds into my Nadex account?

Traders can fund Nadex via debit card, ACH or bank transfers, wire transfers, and paper checks (US only). Each method includes clear processing times, with debit cards providing instant deposits. Proper verification ensures smooth withdrawals later.

What withdrawal options are available, and how fast are they processed?

Withdrawals can be made through debit cards, ACH, or wire transfers. Debit card withdrawals are usually instant within funded limits, ACH takes 3–5 business days, and wire transfers are processed the same business day if submitted before cutoff, with a $25 fee for wires.

Our Insights

Nadex offers flexible and secure funding and withdrawal options for both US and international traders. With clear processing times, step-by-step instructions, and verification safeguards, traders can manage deposits and withdrawals efficiently while focusing on market opportunities.

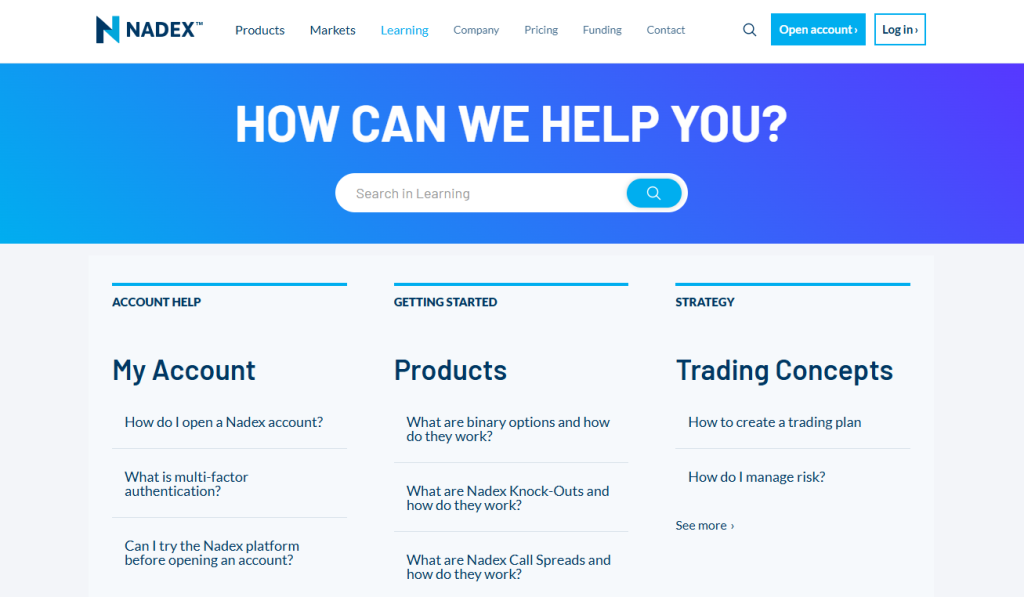

Education and Resources

Nadex provides structured learning tools designed to help traders understand binaries, knock-outs, and call spreads. Through guides, FAQs, webinars, and blog posts, traders gain actionable insights and practical knowledge that bridge theory with platform execution. Education is accessible for both beginners and self-directed learners.

| Resource | Format | Focus | Benefit |

| Glossary | Text | Product-specific terms | Quick reference for platform terminology |

| Learning FAQ | Text | Platform operations | Explains deposits, withdrawals, and trade management |

| Webinars | Live & Recorded | Market analysis strategies | Interactive learning with real-time examples |

| Blog | Articles | Strategy insights updates | Quick educational content and trading ideas |

Frequently Asked Questions

What types of learning resources are available on Nadex?

Traders can access a Glossary for platform terms, a Learning FAQ for practical guidance, live and recorded webinars, and blog articles covering strategies, market insights, and platform updates. Each resource is designed to help traders apply knowledge directly on Nadex.

How can webinars and blog content improve trading skills?

Webinars provide live market commentary, tutorials, and strategy examples on real charts, while blog posts offer practical insights, quizzes, and updates. Together, they allow traders to refine techniques, understand product mechanics, and stay informed about platform enhancements.

Our Insights

Nadex’s education center equips traders with structured, actionable learning. By combining glossaries, FAQs, webinars, and blog content, the platform ensures users can quickly understand products, refine strategies, and confidently manage trades in real market conditions.

Customer Support

Nadex provides direct and knowledgeable customer support for traders needing guidance on accounts, compliance, or platform use. Available through email, live chat, or phone, the team ensures queries are resolved efficiently while maintaining clear communication channels for both US and international users.

Frequently Asked Questions

How can I contact Nadex for customer support?

Traders can reach Nadex via email, live chat on the website, or phone. Email handles general inquiries, live chat provides instant support, and the US toll-free number connects directly to the customer service team for account or trading questions.

Is there a way to contact Nadex regarding legal or compliance matters?

Yes. Traders or affiliates can contact the compliance office directly at (312) 884-0927 or (312) 884-0161. These lines provide guidance on regulatory matters, account verification, and legal inquiries, ensuring clear communication with the exchange’s compliance team.

Our Insights

Nadex offers responsive and professional support through multiple channels. With email, live chat, and direct phone lines to compliance, traders can resolve account or regulatory questions efficiently, enhancing confidence and reliability when trading on the platform.

Customer Reviews and Trust Scores

Nadex has garnered a range of reviews from its users. On Trustpilot, the platform holds a TrustScore of 1.5 out of 5, based on 223 reviews. Some traders commend the platform’s user-friendly interface and educational resources. However, others have reported issues with trade execution and customer support responsiveness.

| Rating | Percentage | Comments |

| 5 stars | 10% | Positive experiences with platform usability |

| 4 stars | 5% | Satisfied with trading features |

| 3 stars | 10% | Neutral feedback |

| 2 stars | 20% | Concerns over trade execution |

| 1 star | 55% | Complaints about customer support and platform issues |

While Nadex offers a regulated trading environment, prospective users should weigh the mixed reviews and consider their individual trading needs.

Discussions and Forums about Nadex

Discussions on platforms like Reddit’s r/binaryoptions and r/Nadex reveal a diverse range of experiences with Nadex. Some traders appreciate the platform’s offerings, especially for U.S. residents, highlighting its accessibility. Others have raised concerns about platform functionality and trade execution.

| Sentiment | Percentage | Comments |

| Positive | 40% | Praises for platform features and accessibility |

| Neutral | 30% | Mixed experiences shared |

| Negative | 30% | Reports of technical issues and concerns |

Engaging with community discussions can provide valuable insights for potential users considering Nadex.

Employee Overview of Working for Nadex

Glassdoor reviews indicate that Nadex offers a dynamic work environment. Employees appreciate the start-up feel combined with corporate backing, competitive pay, and a strong work-life balance. However, some have noted challenges related to internal politics and management practices.

| Rating | Percentage | Comments |

| 5 stars | 50% | Positive feedback on work culture |

| 4 stars | 30% | Satisfaction with compensation and benefits |

| 3 stars | 10% | Neutral experiences |

| 2 stars | 5% | Concerns about management |

| 1 star | 5% | Reports of internal conflicts |

While Nadex provides a supportive work environment for many, prospective employees should consider the varied experiences shared by current and former staff.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Educational webinars, live sessions, and strategy guides available weekly | Education focused mainly on Nadex products rather than general trading |

| No leverage or margin calls since all trades are fully collateralized | Limited customer service hours aligned with Chicago business time |

| Demo account free to open and use indefinitely with full platform access | Withdrawals by wire transfer cost $25 |

| Allows scalping and early exit management without restrictions | No bonus programs or promotional offers |

| Transparent fixed-fee structure per contract with no hidden spreads | Limited asset list compared to multi-asset CFD brokers |

| Secure, compliant clearing and settlement system guarantees payouts | Only accepts traders based in the United States |

References:

In Conclusion

Nadex stands out for its regulatory backbone, operating under the 🇺🇸 Commodity Futures Trading Commission as a Designated Contract Market and Derivatives Clearing Organization. Trades match directly between users, removing counterparty conflicts, and every contract defines risk and payout upfront.

With transparent fees, predictable funding, and strong educational resources, Nadex is ideal for disciplined traders seeking control and U.S. regulatory certainty, though its limited product range and U.S.-only access may not suit those seeking high leverage or global markets.

Faq

Open Nadex’s “Open Your Account” page, select Individual Live Account, and complete your name, contact, and ID details. Upload proof of ID and address, link a funding method, verify it, and fund your account to cover potential risk and fees.

Nadex is a US exchange where trades are matched directly between traders, not against Nadex itself. It removes conflicts of interest and operates under CFTC regulation, offering binary options, knock-outs, and call spreads.

Yes, the Nadex demo account is free, opens without verification, and includes $10,000 in virtual funds. It mirrors the live platform, uses live data simulation, and can be reset anytime.

Knock-Outs are contracts with a fixed floor and ceiling. They close automatically if either level is hit, or settle within that range at expiry.

- Overview

- Account Options

- How to Open a Nadex Account

- Safety and Security

- Trading Platforms and Tools

- Markets available for Trade

- Deposits and Withdrawals

- Education and Resources

- Customer Support

- Customer Reviews and Trust Scores

- Discussions and Forums about Nadex

- Employee Overview of Working for Nadex

- Pros and Cons

- In Conclusion