PhillipCapital Review

- Overview

- How to Open a PhillipCapital Account

- US Equities and Options

- Global Futures Market Access

- Customer Segregated Funds and Security

- Fees and Policies

- Introducing Brokers Program

- Customer Support

- Customer Reviews and Trust Scores

- Discussions and Forums about PhillipCapital

- Employee Overview: Working for PhillipCapital

- Pros and Cons

- In Conclusion

PhillipCapital stands out as a globally recognized broker offering access to Forex, CFDs, commodities, and equities. With strong regulatory oversight, competitive spreads, and advanced trading platforms, Phillip Capital ensures that both beginners and experienced traders can confidently trade diverse markets with reliability, transparency, and efficiency.

★★★ | Minimum Deposit: $5,000 Regulated by: MAS, FINRA, SEC, CFTC, SEBI, FCA Crypto: Yes |

Overview

PhillipCapital provides seamless access to US securities, global futures, and derivatives markets, leveraging advanced technology and robust compliance. The broker supports both retail and institutional traders by combining reliable liquidity, transparent clearing, and extended trading opportunities, ensuring strategies are executed with confidence and precision.

Frequently Asked Questions

Does PhillipCapital provide access to global futures markets?

Yes, PhillipCapital connects traders to leading futures and derivative exchanges, including CME Group, ICE, EUREX, and SGX. This broad coverage provides access to commodities, equity indexes, interest rates, and currencies, with fast execution, reliable technology, and a global clearing infrastructure designed for security.

Can Introducing Brokers partner with PhillipCapital?

PhillipCapital values Introducing Brokers as long-term partners, emphasizing shared principles of customer focus and service excellence. With strong financial standing, a respected reputation, and responsive support, the firm offers a solid foundation for Introducing Brokers seeking reliable collaboration and diversified market opportunities.

Our Insights

PhillipCapital stands out for combining global market access with strong compliance standards and advanced trading infrastructure. The broker suits both active retail traders and large institutions by offering securities, futures, and derivative solutions, while also fostering valuable partnerships with Introducing Brokers through transparency and reliability.

★★★ | Minimum Deposit: $5,000 Regulated by: MAS, FINRA, SEC, CFTC, SEBI, FCA Crypto: Yes |

How to Open a PhillipCapital Account

Opening a PhillipCapital account is simple and mostly online. You can register for a demo or upgrade to a live account, complete identity checks, and fund your account to start trading on PhillipCapital’s web or mobile platforms.

1. Step 1: Visit the PhillipCapital registration page

Click Sign Up or Open Demo on the site to begin your application.

2. Step 2: Complete the online form

Enter your personal details, country of residence, phone number, email, and create a secure password; fill out the short trading experience questionnaire.

3. Step 3: Confirm your email

Open the verification email and click the activation link to access your client area.

4. Step 4: Submit KYC documents

Upgrade to a live account and upload a valid government ID and proof of residence to complete identity verification.

5. Step 5: Fund your account and choose a platform

Go to Money Management, select a deposit method, fund your account (minimums vary by region), then choose web or mobile to start trading.

This process is quick; however, KYC review times may vary by jurisdiction.

★★★ | Minimum Deposit: $5,000 Regulated by: MAS, FINRA, SEC, CFTC, SEBI, FCA Crypto: Yes |

US Equities and Options

PhillipCapital provides comprehensive trading, clearing, and custody solutions for US equities and options, designed for institutional and professional clients. The broker combines advanced market access, algorithmic tools, and fractional share trading to optimize execution and enhance portfolio flexibility for serious traders.

| Feature | Markets Covered | Key Strengths | Client Type Supported |

| US Equities Options | 8,800+ US-listed securities | Fractional share trading, full clearing | Institutional Professional |

| Market Access | Premarket regular extended overnight | 24x5 trading, continuous engagement | Active traders |

| Algorithmic Trading | US equities and options | Optimized execution, white-labeled algos | Professional traders |

| Fixed Income Securities Lending | US Government Securities/borrowed securities | Institutional-grade performance, portfolio enhancement | Institutions High-net-worth clients |

Frequently Asked Questions

Can I trade fractional shares with PhillipCapital?

Yes, PhillipCapital allows trading of fractional shares across over 8,800 US securities. This feature gives investors greater portfolio flexibility, enabling precise allocation of capital and the ability to diversify even with smaller investments while maintaining access to the full range of US-listed stocks.

Does PhillipCapital support extended market hours?

Absolutely. PhillipCapital provides 24×5 access, including premarket, regular, extended-hour, and overnight sessions. This ensures continuous engagement across nearly the entire trading week, allowing professional clients to react quickly to market movements and optimize their trading strategies.

Our Insights

PhillipCapital stands out as a robust broker for US equities and options, offering advanced market access, algorithmic trading, and fractional share capabilities. Institutional and professional traders benefit from flexible execution, comprehensive clearing, and custody solutions, making it a highly reliable option for sophisticated portfolio management.

★★★ | Minimum Deposit: $5,000 Regulated by: MAS, FINRA, SEC, CFTC, SEBI, FCA Crypto: Yes |

Global Futures Market Access

PhillipCapital provides comprehensive access to global futures and derivatives markets across North America, Asia Pacific, Europe, and the Middle East. The broker combines advanced execution platforms with multi-exchange connectivity, allowing professional and institutional clients to trade futures with confidence and precision.

| Feature | Regions/Exchanges | Key Strengths | Client Type Supported |

| North America | 🇺🇸 Cboe Futures Exchange CME Group 🇺🇸 ICE Futures US Coinbase Derivatives MIAX 🇨🇦 Montreal Exchange | Multi-exchange coverage institutional-grade execution | Institutional Professional |

| Asia Pacific | 🇦🇺 ASX 🇲🇾 Bursa Malaysia 🇭🇰 HKFE 🇸🇬 SGX 🇰🇷 KRX 🇯🇵 Japan Exchange Group 🇹🇼 TAIFEX Thailand TFEX | Broad APAC access low-latency execution | Professional traders |

| Europe Middle East | 🇦🇪 Dubai Mercantile Exchange Dubai Gold/ Commodities 🇪🇺 EUREX Euronext 🇬🇧 LME ICE Europe ICE Abu Dhabi | Diverse regional access reliable platforms | Institutional Professional |

| Execution Platforms | CQG Rithmic Sierra Chart | Advanced trading technology low-latency execution | Active futures traders |

Frequently Asked Questions

Which global futures exchanges can I access with PhillipCapital?

PhillipCapital connects clients to major futures exchanges, including 🇺🇸 CME Group, 🇺🇸 Cboe Futures Exchange, 🇨🇦 Montreal Exchange, 🇸🇬 Singapore Exchange, and 🇬🇧 London Metal Exchange. This multi-region coverage enables traders to diversify across asset classes and geographic markets efficiently.

What execution platforms does PhillipCapital offer for futures trading?

PhillipCapital provides access to advanced execution platforms such as CQG, Rithmic, and Sierra Chart. These platforms offer reliable connectivity, low-latency execution, and advanced trading technology to optimize professional futures and derivatives trading strategies.

Our Insights

PhillipCapital excels in providing global futures and derivatives market access with professional-grade trading technology. Its multi-exchange coverage, execution platforms, and regional presence make it ideal for institutions and sophisticated traders seeking diversified, responsive, and transparent trading opportunities.

★★★ | Minimum Deposit: $5,000 Regulated by: MAS, FINRA, SEC, CFTC, SEBI, FCA Crypto: Yes |

Customer Segregated Funds and Security

PhillipCapital keeps all client funds separate from its own house funds, ensuring a high level of security. Customer assets are held in segregated accounts with top-tier banks and clearing houses, and are only invested in highly liquid and low-risk instruments to protect client capital.

| Fund Allocation Source | Percentage |

| CME Clearing House Cash | 75% |

| ICE EU Clearing House Cash | 9% |

| ICE US Clearing House Cash | 4% |

| US Treasuries | 3% |

| Other Registered FCMs | 3% |

| BMO Harris Cash | 5% |

| Citibank Cash | 1% |

| Remaining Bank Accounts Non-trading Funds | 0% |

Frequently Asked Questions

How are customer funds protected at PhillipCapital?

PhillipCapital deposits all client funds in segregated accounts, separate from its own funds. These accounts are held with regulated banks or clearing organizations, ensuring that clients’ assets remain safe and cannot be used for proprietary trading or operational expenses.

Where are segregated funds invested?

While held in segregated accounts, client funds are only invested in highly liquid and low-risk assets such as cash at banks, CME and ICE clearing houses, US Treasuries, and top-quality money market funds. This ensures security while maintaining liquidity for client withdrawals.

Our Insights

PhillipCapital demonstrates a strong commitment to client fund security through segregated accounts and conservative investments. This approach minimizes risk, ensures transparency, and maintains regulatory compliance, making it a reliable choice for institutional and professional traders seeking secure trading environments.

★★★ | Minimum Deposit: $5,000 Regulated by: MAS, FINRA, SEC, CFTC, SEBI, FCA Crypto: Yes |

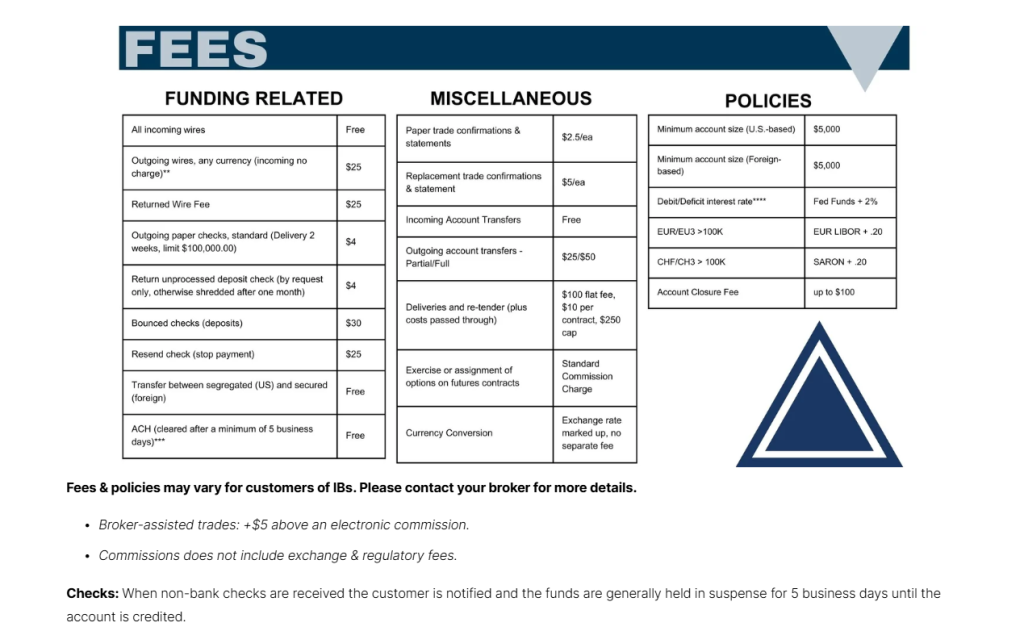

Fees and Policies

PhillipCapital applies transparent fees across all trading services, including commissions, broker-assisted trades, and exchange costs. While rates may vary by region and introducing broker relationships, the broker ensures regulatory compliance and passes exchange-related fees directly to clients without markup.

| Fee Type | Amount/Details | Region/Exchange | Notes |

| Broker-assisted trades | +$5 per trade | All | Above electronic commission |

| Commission | Per contract varies | 🇺🇸 US Exchanges | NYSE/LIFFE CFE CME |

| NFA Fee | $0.02 per lot each way | 🇺🇸 US | Applies to all US Exchanges |

| CME Fee | $0.03 per lot each way | 🇺🇸 US | NYSE/LIFFE CFE trades |

| Exchange Pass-through Fees | Variable | SGX, HKEX, Bursa | Custody drop copy and other fees |

Frequently Asked Questions

What are the typical commission fees at PhillipCapital?

PhillipCapital charges commissions per contract or trade, depending on the exchange. In the 🇺🇸 US, NFA fees are $0.02 per lot each way, while CME fees for NYSE/LIFFE and CFE trades are $0.03 per lot each way. Additional fees from exchanges are passed through without markup.

Are there fees for broker-assisted trades or check withdrawals?

Yes, broker-assisted trades incur an additional $5 above the electronic commission. Non-bank checks are held in suspense for up to 5 business days, and PhillipCapital may substitute ACH for check withdrawals at its discretion without fee. Bank details must be on file to avoid delays.

Our Insights

PhillipCapital maintains a clear and structured fee policy, ensuring clients are aware of commissions, exchange fees, and broker-assisted trade costs. Its transparent approach and adherence to regulatory requirements make it reliable for institutional and professional traders while passing savings from direct exchange fee handling.

★★★ | Minimum Deposit: $5,000 Regulated by: MAS, FINRA, SEC, CFTC, SEBI, FCA Crypto: Yes |

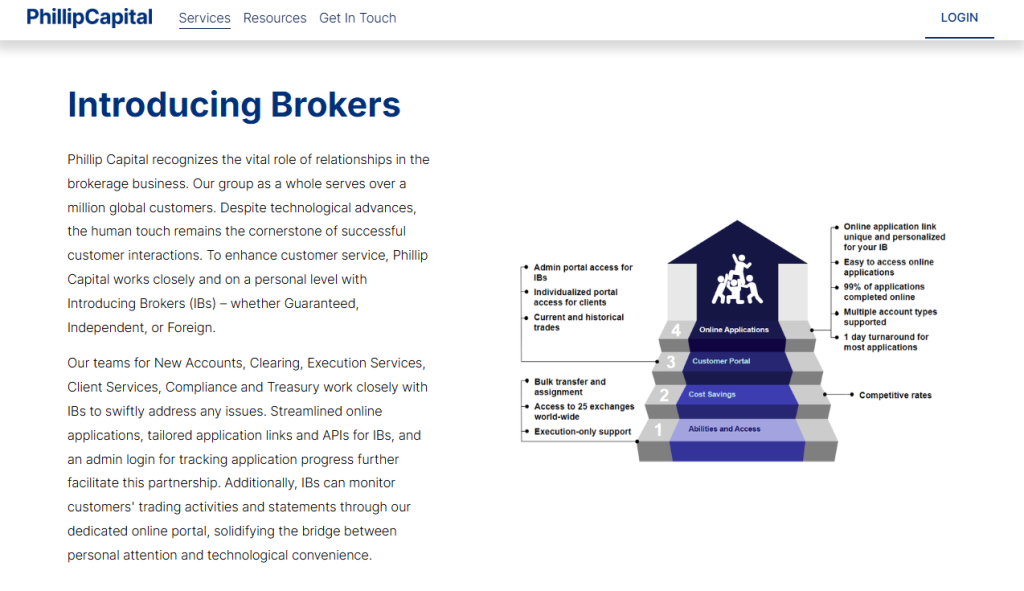

Introducing Brokers Program

PhillipCapital places a high value on its relationships with Introducing Brokers (IBs), providing personal support and advanced technological tools. The broker offers dedicated portals, tailored APIs, and multi-asset clearing capabilities, ensuring that IBs can manage client accounts efficiently while benefiting from global market access and revenue-sharing opportunities.

| Feature | Details |

| Account Management | Streamlined applications, admin portal, API access |

| Market Access | Over 25 futures exchanges globally |

| Platforms | Multiple authorized trading platforms |

| Support | 24/5 trade desk and technical support |

| Revenue Model | Competitive and adaptable revenue sharing |

| Operational Assistance | Give-up/give-in clearing, EFPS, multi-currency funding |

Frequently Asked Questions

How does PhillipCapital support Introducing Brokers?

PhillipCapital provides IBs with streamlined online applications, tailored links, admin logins, and dedicated portals to monitor client accounts. Support spans New Accounts, Clearing, Execution Services, Client Services, Compliance, and Treasury, allowing IBs to address client needs swiftly while combining personal attention with technological convenience.

What benefits are available for IB partners?

IB partners enjoy bulk account transfers, flexible revenue-sharing models, access to over 25 global futures exchanges, multi-currency funding, execution and clearing for give-ups and give-ins, tailored trade reporting, and 24/5 global trade desk and technical support to enhance operational efficiency and client satisfaction.

Our Insights

PhillipCapital’s Introducing Brokers program combines personal service with robust technological solutions, enabling partners to manage clients effectively and access global markets. Its comprehensive support, multi-asset capabilities, and flexible revenue options make it an attractive choice for brokers seeking professional collaboration.

★★★ | Minimum Deposit: $5,000 Regulated by: MAS, FINRA, SEC, CFTC, SEBI, FCA Crypto: Yes |

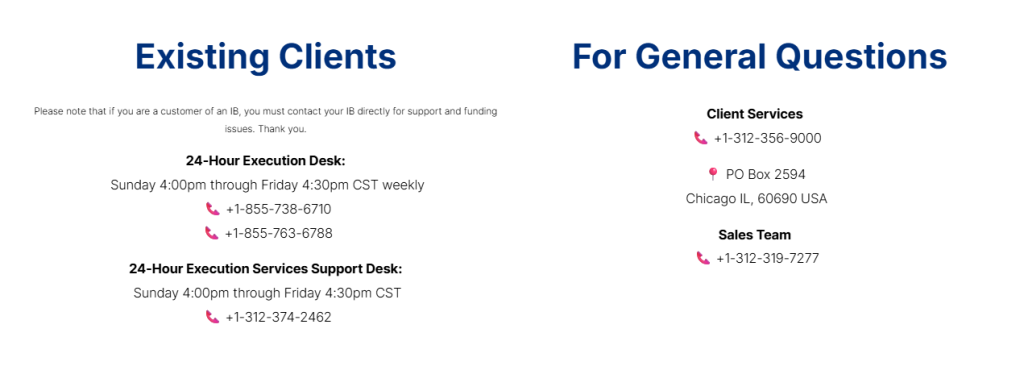

Customer Support

PhillipCapital provides robust client support with dedicated desks for trading, execution, and general inquiries. The broker ensures round-the-clock assistance for active traders and professional clients while offering direct communication channels, including phone, email, and postal contact, enhancing service accessibility and responsiveness.

Frequently Asked Questions

What are the customer support hours at PhillipCapital?

PhillipCapital offers a 24-hour execution desk from Sunday 4:00 pm through Friday 4:30 pm CST. Support is available for both trading and execution inquiries, ensuring professional clients can receive assistance across US and global market hours.

How can I contact PhillipCapital for general inquiries?

Clients can reach PhillipCapital via phone at +1-312-356-9000, email at [email protected], or by postal mail at PO Box 2594, Chicago, IL 60690, USA. Dedicated lines are also available for sales and execution support to provide specialized assistance.

Our Insights

PhillipCapital offers responsive, multi-channel support tailored to professional and institutional clients. Its combination of 24-hour execution desks, direct phone lines, and email access ensures reliable assistance for trading, funding, and general inquiries, reinforcing client confidence and operational efficiency.

★★★ | Minimum Deposit: $5,000 Regulated by: MAS, FINRA, SEC, CFTC, SEBI, FCA Crypto: Yes |

Customer Reviews and Trust Scores

PhillipCapital is generally regarded as a trustworthy broker, earning a commendable Trust Score of 95 out of 100. This high rating reflects its strong regulatory standing and positive client feedback.

| Source | Trust Score | Number of Reviews | Regulatory Status |

| TrustFinance | 4.02/5 | 39 | Not specified |

| BrokerChooser | N/A | N/A | Regulated by the SEC |

These ratings underscore PhillipCapital’s commitment to providing secure and reliable trading services.

★★★ | Minimum Deposit: $5,000 Regulated by: MAS, FINRA, SEC, CFTC, SEBI, FCA Crypto: Yes |

Discussions and Forums about PhillipCapital

Online forums and discussions about PhillipCapital are relatively limited, with few user-generated reviews available. This scarcity makes it challenging to gauge the broader trader community’s experiences.

| Forum/Source | User Sentiment | Number of Posts | Topics Discussed |

| Trustpilot | Negative | 1 | Customer service issues |

| TrustFinance | Mixed | 39 | General feedback |

| BrokerChooser | Neutral | N/A | Regulatory information |

The limited online discourse suggests that potential clients should conduct thorough research and consider reaching out directly to PhillipCapital for more information.

★★★ | Minimum Deposit: $5,000 Regulated by: MAS, FINRA, SEC, CFTC, SEBI, FCA Crypto: Yes |

Employee Overview: Working for PhillipCapital

Employee reviews of PhillipCapital indicate a mixed work environment. While some appreciate the supportive colleagues and work-life balance, others cite concerns about management and career advancement opportunities.

| Source | Overall Rating | Work-Life Balance | Career Opportunities |

| Glassdoor | 3.3/5 | 3.5/5 | 3.1/5 |

| Indeed | Mixed | Positive | Limited advancement |

| JobStreet | Supportive | Balanced | Repetitive tasks |

These insights suggest that while PhillipCapital offers a stable work environment, there may be areas for improvement in employee development and management practices.

★★★ | Minimum Deposit: $5,000 Regulated by: MAS, FINRA, SEC, CFTC, SEBI, FCA Crypto: Yes |

Pros and Cons

| ✓ Pros | ✕ Cons |

| Wide access to US securities | High risk in leveraged trading |

| Strong compliance and regulation | Not suitable for all investors |

| Access to top global futures exchanges | Products availability varies by location |

| Reliable execution and liquidity | Complex products may overwhelm beginners |

| Strong support for Introducing Brokers | No FDIC insurance for investment products |

References:

In Conclusion

PhillipCapital maintains a notable global presence, operating from its headquarters in Singapore and stretching across major financial hubs worldwide. Through this extensive network, the firm ensures customer support and regional access, serving diverse markets with local offices tailored to each area’s financial ecosystem.

- 🇦🇺 Australia

- 🇰🇭 Cambodia

- 🇨🇳 China

- 🇭🇰 Hong KongSAR

- 🇮🇳 India

- 🇮🇩 Indonesia

- 🇯🇵 Japan

- 🇲🇾 Malaysia

- 🇸🇬 Singapore

- 🇪🇸 Spain

- 🇹🇭 Thailand

- 🇹🇷 Turkey

- 🇬🇧 United Kingdom

- 🇦🇪 United Arab Emirates

- 🇺🇸 United States

- 🇻🇳 Vietnam

These offices foster localized customer support, regulatory alignment, and convenient regional service. With these strategic locations, PhillipCapital sustains its commitment to providing comprehensive and responsive financial services across the globe.

Faq

Yes, PhillipCapital provides forex trading in various major, minor, and exotic currency pairings.

PhillipCapital’s withdrawal processing timeframes vary depending on the method selected, ranging from a few business days for bank wire transfers to rapid processing for some electronic payment options.

The minimum deposit on the Cash Plus Account is $5,000. However, this can vary significantly based on the currency and account type selected.

Yes, there are. Leverage constraints may differ based on the regulatory requirements in the countries where PhillipCapital operates.

Yes, PhillipCapital is regarded as a safe broker, having been regulated by recognized organizations like the MAS, FINRA, and SEC.

- Overview

- How to Open a PhillipCapital Account

- US Equities and Options

- Global Futures Market Access

- Customer Segregated Funds and Security

- Fees and Policies

- Introducing Brokers Program

- Customer Support

- Customer Reviews and Trust Scores

- Discussions and Forums about PhillipCapital

- Employee Overview: Working for PhillipCapital

- Pros and Cons

- In Conclusion