Skilling Review

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a Skilling Account

- Safety and Security

- Trading Platforms and Tools

- Markets available for Trade

- Deposits and Withdrawals

- Customer Support

- Customer Reviews and Trust Scores

- Discussions and Forums about Skilling

- Employee Overview: Working at Skilling

- Pros and Cons

- In Conclusion

Skilling is a low-risk broker with a strong Trust Score of 90/100. Licensed by two Tier-1 regulators, it ensures high security and reliability. Traders can choose from four retail account types – Standard, Premium, MT4, and MT4 Premium – designed to suit different trading needs and experience levels.

★★★★ | Minimum Deposit: €100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Overview

Skilling stands out as a modern fintech broker founded in 2016 by Scandinavian entrepreneurs. With headquarters in 🇨🇾 Cyprus and offices in 🇲🇹 Malta and 🇪🇸 Spain, it delivers access to over 1,000 markets, competitive pricing, and award-winning trading platforms designed for both beginners and professionals.

Frequently Asked Questions

What makes Skilling different from other brokers?

Skilling differentiates itself by offering a proprietary trading platform alongside MetaTrader, ensuring quick execution and reliability. With competitive pricing, transparent operations, and regulation under 🇨🇾 CySEC, it provides a trusted environment where traders can access over 1,000 global markets with efficiency and confidence.

Is Skilling safe and regulated?

Yes. Skilling is fully authorised and regulated by the 🇨🇾 Cyprus Securities and Exchange Commission (CySEC) under CIF licence No. 357/18. Its strong regulatory framework, client-centric approach, and secure fund protection measures make it a trusted choice for both beginner and professional traders.

Our Insights

Skilling successfully blends Scandinavian entrepreneurship with international expertise, delivering secure, transparent, and client-focused trading solutions. With strong leadership, innovative technology, and global reach, Skilling continues to attract traders seeking reliability, accessibility, and growth opportunities in today’s fast-moving financial markets.

★★★★ | Minimum Deposit: €100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Fees, Spreads, and Commissions

Skilling maintains a transparent fee structure across its trading accounts. Clients face commission charges on Premium FX and Spot Metals, while all traders pay taker fees on crypto. With clearly defined swap rates and conversion rules, Skilling provides traders with clarity, although costs vary depending on asset type.

| Asset Type | Account Type | Fee Structure | Notes |

| FX and Spot Metals | Premium only | From $35 per million USD traded | Commission per side |

| Crypto CFDs | All accounts | From 0.05% per side | Swap-free option available |

| Indices and Shares | All accounts | Based on Libor + markup | Markup reduced on Premium accounts |

| Currency Conversion | All accounts | Conversion fee applied | Reflected in realized profit and loss |

Frequently Asked Questions

What trading fees does Skilling charge on Forex and Spot Metals?

Skilling charges commissions on Premium accounts for FX and Spot Metals, starting from $35 per million USD traded. The fee is calculated through a conversion formula based on the trade size, base currency, and exchange rate. Standard account holders avoid these commission costs.

How are swap charges applied at Skilling?

Swap charges apply daily at 22:00 GMT, except on Wednesdays when triple charges account for weekends. These fees vary depending on the instrument, position type, and interbank rates. Swaps may be positive or negative, meaning traders can either pay or earn depending on their open positions.

Our Insights

Skilling offers competitive trading fees, especially for crypto, with taker charges starting as low as 0.05%. While swaps and conversion costs add complexity, transparent formulas ensure fairness. Overall, Skilling appeals to traders seeking flexible asset access and a clear understanding of how costs are applied across markets.

★★★★ | Minimum Deposit: €100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Minimum Deposit and Account Types

Skilling provides multiple account types tailored to different trading needs. Standard accounts suit beginners with zero commission trading, while Premium accounts offer tighter spreads and volume-based fees. MT4 accounts appeal to forex-focused traders, and corporate or professional accounts cater to experienced clients with higher requirements and broader conditions.

Frequently Asked Questions

What is the difference between Skilling Standard and Premium accounts?

The Standard account starts at €100 with zero commissions and spreads from 0.8 pips, making it beginner-friendly. The Premium account starts at €5000 and features spreads from 0.1 pips, plus commissions of $35–40 per million traded, suitable for higher-volume traders.

Does Skilling offer professional and corporate accounts?

Yes, Skilling provides professional and corporate account options. Professional accounts allow higher leverage of up to 1:200, while corporate accounts are registered under a legal entity and can be Standard, Premium, or MT4 accounts depending on requirements. Application is processed via customer support.

Our Insights

Skilling covers a wide spectrum of traders with its account range. Standard accounts are cost-effective for new traders, Premium accounts deliver tight spreads for active professionals, and MT4 suits forex traders. Corporate and professional options add flexibility, ensuring that both individual and institutional clients find a fitting solution.

★★★★ | Minimum Deposit: €100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

How to Open a Skilling Account

Opening a Skilling account is quick and simple. Follow these steps to get started:

1. Step 1: Visit the Website

Go to Skilling and click “Sign up.”

2. Step 2: Register Your Details

Enter your name, email, country, and create a password.

3. Step 3: Confirm Email

Open the confirmation message, verify your email, and then proceed.

4. Step 4: Log In to Dashboard

Access your client area to manage settings and accounts.

5. Step 5: Complete Profile

Provide the requested personal information and trading experience.

6. Step 6: Verify Identity

Upload Proof of Identity (passport, national ID, or driver’s license) and Proof of Address (recent utility bill or bank statement).

7. Step 7: Choose Platform

Select Skilling Trader, MetaTrader 4, or cTrader.

8. Step 8: Fund Your Account

Deposit funds from your own payment method in the dashboard; minimum deposit of 100 EUR. Third-party deposits are not accepted.

9. Step 9: Download Platform

Install your chosen platform and log in with your credentials.

10. Step 10: Start Trading

Place your first trade once verified and funded.

★★★★ | Minimum Deposit: €100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Safety and Security

Skilling secures client assets and privacy through strict oversight by the 🇨🇾 Cyprus (CySEC) and 🇸🇨 Seychelles (FSA). It maintains segregated accounts, provides negative balance protection, employs SSL encryption, and includes investor compensation coverage up to €1 million. These measures combine to offer traders a safe environment.

| Security Feature | Description |

| Regulation | CySEC (Cyprus) and FSA (Seychelles) |

| Client Fund Protection | Segregated accounts and negative balance cover |

| Encryption | SSL encryption protects data and transactions |

| Compensation Scheme | Up to €1 million insurance for retail clients |

Frequently Asked Questions

Is Skilling regulated and safe for clients?

Yes, Skilling is regulated by both the 🇨🇾 Cyprus CySEC and 🇸🇨 Seychelles FSA. It ensures client fund segregation, negative balance protection, and uses SSL encryption. Retail clients also receive automatic investor compensation coverage up to €1 million.

Has Skilling experienced any security breaches or disclosures?

There are no major reports of security breaches. However, one regulatory disclosure was issued by Spain’s CNMV in 2024 for an unauthorised clone operation, which did not involve Skilling’s licensed entities.

Our Insights

Skilling delivers robust safety measures through layered protection. With dual regulation, fund segregation, negative balance safety, encryption, and investor compensation coverage, it offers a secure trading environment for most clients and maintains a strong reputation in the industry.

★★★★ | Minimum Deposit: €100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Trading Platforms and Tools

Skilling equips traders with three powerful platforms: the intuitive proprietary Skilling Trader, the advanced cTrader, and the familiar MetaTrader 4. Together, they support fast execution, technical analysis tools, demo access, and broad device compatibility, making them versatile choices for both beginners and experienced traders.

| Platform | Key Features |

| Skilling Trader | User-friendly one-click trading charting |

| cTrader | Advanced tools Level II pricing automation |

| MetaTrader 4 | Robust charting Expert Advisors indicators |

| Mobile/Demo | Cross-device support virtual fund testing |

Frequently Asked Questions

Which trading platforms does Skilling support?

Skilling offers three platforms: Skilling Trader (user-friendly, with advanced charting and one-click trading), cTrader (advanced features including Level II pricing), and MetaTrader 4 (extensive Expert Advisors and indicators).

Does Skilling provide demo accounts and mobile support?

Yes. Traders can use a demo account with virtual funds to test strategies on the web, desktop, or mobile. The platforms support technical indicators, real-time alerts, and fast order execution across devices.

Our Insights

Skilling delivers a diverse toolkit suited for various skill levels. The combination of intuitive proprietary software, professional cTrader, and industry-standard MT4, along with strong mobile support and demo accounts, equips traders with flexibility and confidence in execution.

★★★★ | Minimum Deposit: €100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

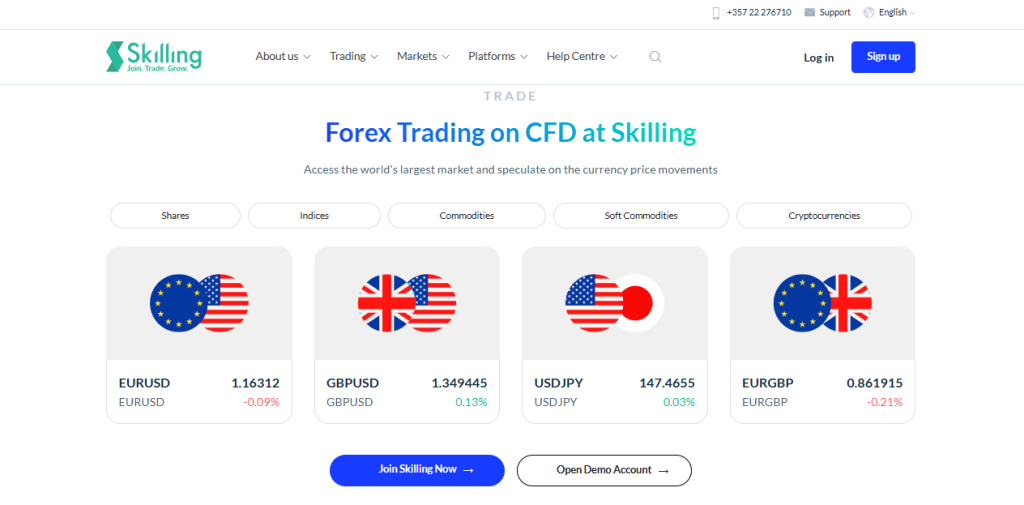

Markets available for Trade

Skilling supports over 800 instruments across forex, stocks, indices, commodities, and crypto CFDs. It offers competitive pricing, with spreads from 0.1 pips and execution under 0.05 seconds. This wide range ensures traders gain access to diverse markets with efficient and reliable trading conditions.

| Asset Class | Market Coverage |

| Forex | 70+ pairs with spreads from 0.1 pips |

| Shares | 700+ global stocks across major exchanges |

| Indices Commodities | Broad CFD coverage with competitive pricing |

| Cryptocurrencies | Leading crypto CFDs among available assets |

Frequently Asked Questions

What asset classes can you trade on Skilling?

Skilling allows trading across seven asset classes, including forex, shares, indices, commodities, cryptocurrencies, and soft commodities, totalling over 800 CFD instruments.

How competitive are Skilling’s market conditions?

Skilling offers tight spreads starting from 0.1 pips on premium accounts, fast execution times averaging 0.05 seconds, and reliable trade filling across 24/5 market hours.

Our Insights

Skilling provides broad market access and superior trading conditions. With an extensive range of instruments, low spreads, and ultra-fast execution, it serves both beginners and active traders well by balancing depth of markets with cost-effective, reliable performance.

★★★★ | Minimum Deposit: €100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Deposits and Withdrawals

Skilling ensures traders enjoy convenient deposit and withdrawal options. The broker supports multiple international and country-specific payment methods, processed in the account’s base currency. While bank transfers and e-wallets like Skrill and Neteller are popular, fees and processing times vary. Importantly, Skilling operates under the regulation of 🇨🇾 CySEC, providing transparency and reliability.

| Feature | Details |

| Supported Methods | Bank transfer Cards E-wallets |

| Base Currency Processing | Yes |

| Withdrawal Limit | One free daily (except wires) |

| Regulation | 🇨🇾 CySEC |

Frequently Asked Questions

What payment methods does Skilling support?

Skilling supports bank transfers, cards, and e-wallets such as Skrill and Neteller. Certain country-specific methods may also be available when you log in to your account. All transactions are processed in your account’s base currency, ensuring clarity and consistency in deposits and withdrawals.

Are there any fees for deposits or withdrawals at Skilling?

Deposits via bank transfers are free from Skilling’s side, although banks may charge independently. E-wallets like Skrill and Neteller may incur fees of up to 2.9 percent. Withdrawals through bank wires carry flat fees depending on SEPA or SWIFT transfer methods.

Our Insights

Skilling provides a versatile payment system tailored to traders’ needs. With support for multiple methods and a clear fee structure, the process remains efficient and transparent. However, traders should note potential third-party fees, especially with e-wallets or multiple withdrawals per day.

★★★★ | Minimum Deposit: €100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

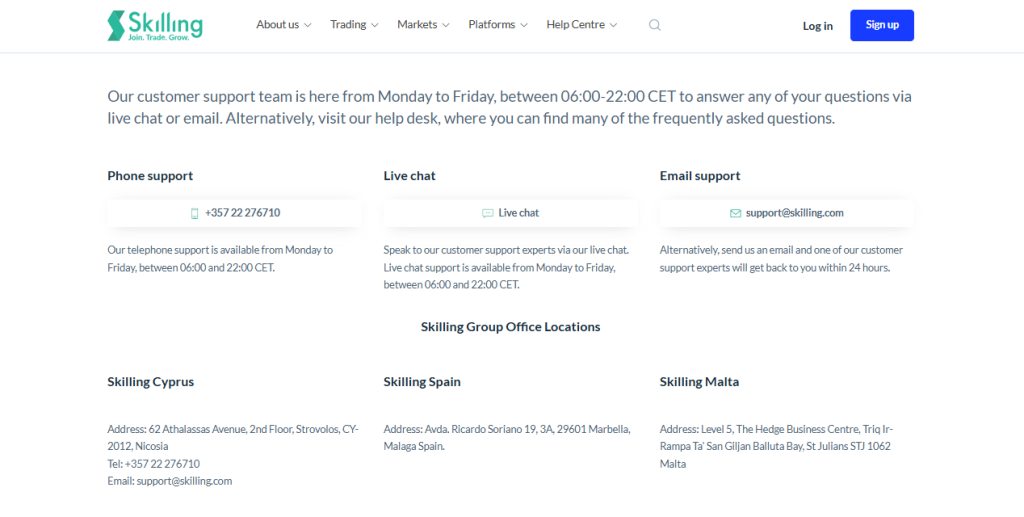

Customer Support

Skilling provides multilingual customer support with extended weekday availability. Traders can connect via phone, live chat, or email from Monday to Friday between 06:00 and 22:00 CET. With offices in 🇨🇾 Cyprus, 🇪🇸 Spain, and 🇲🇹 Malta, Skilling ensures global accessibility and a responsive service experience.

Frequently Asked Questions

When is Skilling’s customer support available?

Customer support operates Monday to Friday, from 06:00 to 22:00 CET. During these hours, traders can reach Skilling via phone, live chat, or email. Queries sent outside these times are usually addressed promptly the next working day.

How can I contact Skilling’s support team?

You can reach Skilling by phone at +357 22 276710, through live chat on their platform, or via email at [email protected]. Each method provides direct access to trained support specialists, ensuring quick and accurate assistance.

Our Insights

Skilling offers dependable customer service across multiple channels. With extended weekday coverage and offices in three European countries, the broker ensures reliable support for its clients. However, the absence of weekend availability may limit urgent assistance for some traders.

★★★★ | Minimum Deposit: €100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Customer Reviews and Trust Scores

A quick look at Skilling through the lens of user reviews shows a generally positive sentiment, especially on mainstream platforms.

| Platform | Score/Notes |

| Trustpilot | 4.1 - 4.3 (80% 5-star, positive on support and reliability) |

| ForexPeaceArmy | 3.7 (few reviews; includes occasional serious complaints) |

Skilling earns a solid reputation for transparency and service, though a few reviews raise caution. It’s worth reading both praise and criticism to get a full picture.

★★★★ | Minimum Deposit: €100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Discussions and Forums about Skilling

Although there aren’t large dedicated threads about Skilling, it’s mentioned in general forex communities and review forums, offering valuable insights and cautionary tales.

| Platform | Nature of Mention |

| Reddit r/Forex | Common forums like Forex Peace Army, TradingView, and others are used for sharing broker experiences |

| ForexPeaceArmy | Some users accuse Skilling of high handed practices like voiding wins, while others appreciate resolution and transparency |

These forums are useful for gauging real-world experiences—but always balance any single review with broader feedback.

★★★★ | Minimum Deposit: €100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Employee Overview: Working at Skilling

Inside insights from Skilling employees reveal a dynamic, modern workplace with mostly positive feedback and a few caveats.

| Metric | Score/Notes |

| Glassdoor Rating | ~4.4 ⁄5 from 17 reviews - about 20% above financial services average |

| Highlights | “Sophisticated, emotionally intelligent management,” “flexibility,” “great team,” “chill environment” |

| Minor Concerns | Management changes, fast-paced startup environment, occasional structural gaps |

Skilling seems to foster a supportive and ambitious culture, with great colleagues and leadership – though rapid growth can bring growing pains.

★★★★ | Minimum Deposit: €100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Pros and Cons

| ✓ Pros | ✕ Cons |

| High Trustpilot ratings | Some complaints about withdrawals |

| Transparent fee structure | Few FPA negative posts |

| Strong Glassdoor employee reviews | Rapid changes in management |

| Flexible work environment | Limited user generated forum discussion |

| Licensed and regulated | Education resources less extensive |

References:

In Conclusion

Skilling maintains a European footprint with physical offices in Cyprus, Spain, and Malta, complemented by a Seychelles presence. Their customer support is available through multiple channels across those regions, enhancing accessibility and trust. Countries with Offices and Customer Support include:

- CY Cyprus

- ES Spain

- MT Malta

- SC Seychelles

Skilling’s international office network underscores its commitment to localized support, enhancing trust and operational transparency across key jurisdictions. If you’d like, I can also check their support languages or hours by region – just say the word!

Faq

Yes, Skilling provides trading applications for Android and iOS smartphones.

Skilling’s withdrawal processing time normally varies between a few hours and several business days, depending on the withdrawal method and any extra verification procedures.

The minimum deposit needed to create a Skilling trading account varies by account type, ranging from 25 EUR for the Standard account to 5,000 EUR for the Premium and MT4 Premium accounts.

Yes, Skilling provides MetaTrader 4 (MT4) and their own Trader platform and cTrader. This allows you to choose a familiar and well-supported platform.

Yes, Skilling is regarded as a secure broker regulated by respected bodies like the FCA, CySEC, and FSA Seychelles.

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a Skilling Account

- Safety and Security

- Trading Platforms and Tools

- Markets available for Trade

- Deposits and Withdrawals

- Customer Support

- Customer Reviews and Trust Scores

- Discussions and Forums about Skilling

- Employee Overview: Working at Skilling

- Pros and Cons

- In Conclusion