TRADE.com Review

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a Trade.com Account

- Safety and Security

- Trading Platforms and Tools

- Markets available for Trade

- Deposit and Withdrawal

- Customer Support

- Customer Reviews and Trust Scores

- Discussions and Forums about Trade.com

- Employee Overview of Working for Trade.com

- Pros and Cons

- In Conclusion

Trade.com is a global online trading platform offering access to over 1,200 instruments, including forex, stocks, indices, commodities, and cryptocurrencies. The broker provides multiple account types, advanced trading platforms like MetaTrader 5, and features such as zero-commission trading on shares and CFDs.

| Feature | Details |

| Regulation | 🇸🇨 FSA (Seychelles) |

| Base Currencies | EUR USD GBP |

| Spreads | From 0.1 pips |

| Leverage | 1:300 |

| Currency Pairs | 55+ |

| Minimum Deposit | 100 USD |

| Inactivity Fee | Yes |

| Commissions | From 0.08% (Exclusive Account) |

Overview

Trade.com positions itself as a broker focused on accessibility, transparency, and simplicity. Authorized and regulated by 🇨🇾 CySEC in Cyprus and 🇲🇺 FSC in Mauritius, the platform offers intuitive trading via WebTrader, MT4, and mobile apps, giving traders reliable execution, diverse assets, and expert support for confident market participation.

Frequently Asked Questions

What trading platforms does Trade.com provide?

Trade.com offers WebTrader, MT4, and mobile/tablet applications. These platforms are designed for ease of use, quick order execution, and seamless access across devices, making trading more flexible for both beginners and experienced traders.

Is Trade.com regulated?

Yes, Trade.com is regulated in multiple jurisdictions. 🇨🇾 CySEC oversees Trade Capital Markets (TCM) Ltd in Cyprus, while 🇲🇺 FSC regulates Lead Capital Global Ltd in Mauritius, ensuring compliance with established financial standards and market integrity.

Our Insights

Trade.com delivers a balanced trading experience with a diverse asset range, multiple platforms, and reliable execution. With strong regulatory oversight and 24/5 support, it is suitable for traders seeking accessible, professional-grade tools while maintaining intuitive and transparent trading conditions.

Fees, Spreads, and Commissions

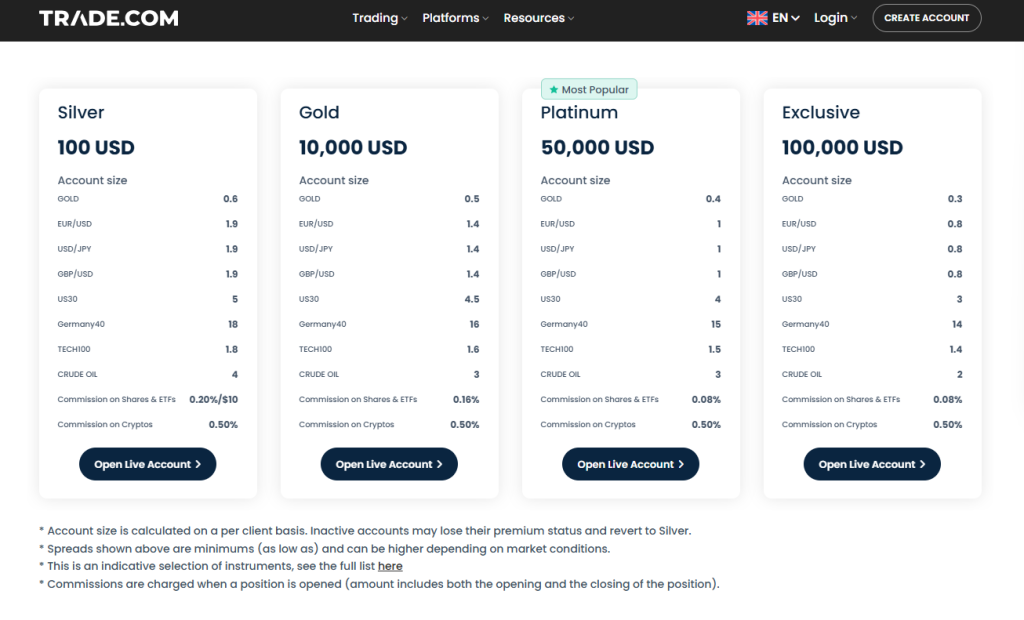

Trade.com offers competitive spreads and structured commissions across its account types. Minimum spreads on EUR/USD range from 0.3 pips to 0.6 pips, depending on account tier, while commissions on shares, ETFs, and cryptocurrencies are clearly outlined. The broker ensures transparency and predictable trading costs.

| Account Type | EUR/USD Spread | US30 Spread | Commission on Shares/ETFs |

| Silver | 0.6 | 5 | 0.20% / $10 |

| Gold | 0.5 | 4.5 | 0.16% |

| Platinum | 0.4 | 4 | 0.08% |

| Exclusive | 0.3 | 3 | 0.08% |

Frequently Asked Questions

What are Trade.com’s commissions on shares and ETFs?

Commissions vary by account type. Silver accounts are charged 0.20% or $10 per trade, Gold 0.16%, and Platinum or Exclusive accounts 0.08% per trade.

How low can spreads go on Trade.com?

Spreads start from 0.3 pips for EUR/USD on Exclusive accounts, while Silver accounts start at 0.6 pips. Other instruments, such as US30, have wider spreads ranging from 3 to 5 points.

Our Insights

Trade.com offers clear and competitive pricing, with tight spreads and structured commissions across four account tiers. Traders benefit from predictable costs and transparency, making it suitable for both intermediate and professional traders seeking reliable execution.

Minimum Deposit and Account Types

Trade.com provides four main account types to suit different trading experience levels and capital sizes. Minimum deposits start at 100 USD for Silver accounts, scaling up to 100,000 USD for Exclusive accounts. Each tier offers tiered spreads, commissions, and premium features to match trader needs.

Frequently Asked Questions

What is the minimum deposit for Trade.com accounts?

The Silver account requires only 100 USD to open, while Gold, Platinum, and Exclusive accounts require 10,000 USD, 50,000 USD, and 100,000 USD, respectively.

Which account is best for beginners?

Silver accounts are designed for beginner or intermediate traders, offering standard spreads, basic trading tools, and an accessible deposit requirement.

Our Insights

Trade.com’s account structure offers flexible entry points, from Silver to Exclusive accounts, allowing traders to scale as their skills and capital grow. Each account tier provides progressively better spreads, commissions, and premium services for a customized trading experience.

How to Open a Trade.com Account

Opening a Trade.com account is fast and mostly online. You can register for a demo or upgrade to a live account, complete identity checks, and fund your account to begin trading on WebTrader, MT5, or the mobile app.

1. Step 1: Start registration

Go to the Trade.com homepage and click Open Account or Create Demo to begin the sign-up process.

2. Step 2: Complete the online form

Enter your personal information, country of residence, contact details, and create a secure password, then complete the short trading experience questionnaire.

3. Step 3: Verify your email

Open the verification email sent to you and click the activation link to access the secure client area.

4. Step 4: Upload KYC documents

To activate a live account, upload a valid government ID and proof of residence to complete the verification process required under compliance rules.

5. Step 5: Fund your account

Choose a platformDeposit funds using a supported payment method, select your preferred platform, such as WebTrader or MT5, and begin trading once your account is approved.

You may also start with a demo account if you wish to practice using real-time market conditions before trading live.

Safety and Security

Trade.com prioritizes client protection through robust policies and regulations. Regulated by 🇲🇺 Financial Services Commission of Mauritius, the broker maintains segregated accounts, adheres to AML and KYC rules, and provides investor compensation coverage, ensuring transparent, secure, and compliant trading across multiple financial instruments.

| Feature | Details | Protection | Regulation |

| Money and Assets | Segregated client accounts | ICF coverage | 🇲🇺 Financial Services Commission of Mauritius |

| Policies | Terms Risk Privacy Conflict of Interest AML/KYC | Full transparency | Compliant trading rules |

| Account Security | Secure trading platform | Investor fund protection | Licensed and regulated |

| Instruments | Forex CFDs Commodities Indices | Policy-backed safety | Regulatory oversight |

Frequently Asked Questions

Is Trade.com fully regulated?

Yes, Trade.com is regulated by 🇲🇺 Financial Services Commission of Mauritius. This regulation guarantees transparent operations, segregated client funds, and compliance with financial laws, helping traders feel confident that their money is secure while trading across multiple asset classes.

How does Trade.com protect client funds?

Trade.com protects client funds through segregated accounts, adherence to AML/KYC policies, and coverage under the Investor Compensation Fund. These measures ensure that clients’ money and assets remain secure, even in unexpected market or operational events.

Our Insights

Trade.com offers a highly secure and transparent trading environment. With strong regulation, client fund protection, and clear policies, it is well-suited for traders seeking a reliable platform across diverse financial instruments while maintaining compliance and safety standards.

Trading Platforms and Tools

Trade.com delivers fast, flexible, and intuitive trading through its mobile app, WebTrader, and MT5 platform. Traders can react instantly with real-time market data, smart tools, portfolio tracking, alerts, and seamless execution on any device for a complete trading experience.

| Platform | Key Benefit | Device Type | Best For |

| Trade.com App | Real-time data one-tap trading | Mobile | Trading on the go |

| WebTrader | No downloads instant access | Browser | Fast execution anywhere |

| MT5 | Advanced charting automation | Desktop or Mobile | Technical and automated trading |

Frequently Asked Questions

What makes the Trade.com app useful for active traders?

The Trade.com app offers live price updates, alerts, charting tools, and one-tap execution for rapid decision-making. Traders can track performance, manage positions, and react instantly to market changes without delays, which helps maintain control in fast-moving conditions.

How does WebTrader compare to MT5 on Trade.com?

WebTrader focuses on speed and simplicity through a browser, while MT5 provides advanced charting, automation, and wider market access. Traders who want powerful tools and strategy automation often prefer MT5, although WebTrader is ideal for fast, no-download trading on any device.

Our Insights

Trade.com delivers a seamless trading experience for every style with its mobile app, WebTrader, and MT5 options. The platforms offer speed, mobility, and pro-level tools that support smarter decisions. This makes Trade.com suitable for traders who want flexibility, control, and an all-in-one trading environment.

Markets available for Trade

Traders using Trade.com gain access to a broad spectrum of asset classes. The broker offers over 850 instruments spanning Forex, shares, indices, ETFs, commodities, and cryptocurrencies, along with real-time quotes, commission-free trading, and one login to access all markets.

| Asset Class | Description | Typical Opportunity | Key Consideration |

| Forex | Major and minor currency pairs | High liquidity and 24-hour trading | Requires focus on spreads |

| Shares Stocks | CFDs on global companies | Participation in individual equity moves | Company-specific risk applies |

| Indices | Major global market indices | Broad market exposure | Subject to macroeconomic events |

| Commodities | Metals energy agriculture | Diversification across raw asset types | Can be volatile |

| ETFs | Exchange-traded funds | Diversified basket exposure | Performance depends on underlying |

| Cryptocurrencies | Leading digital currencies | Access to fast-moving emerging market | High risk and leverage possible |

Frequently Asked Questions

What asset types can I trade on Trade.com?

You can trade Forex, shares, indices, ETFs, commodities, and cryptocurrencies through Trade.com. The platform supports more than 850 tradable instruments and provides a unified entry point to all these markets.

Are there any trading fees or commissions for these assets?

There are no commissions for many instruments at Trade.com, and the platform offers real-time pricing and competitive spreads. However, spreads, overnight rollover costs, and margin requirements will vary depending on the asset class.

Our Insights

Trade.com offers a comprehensive asset menu that empowers traders to diversify across Forex, equities, indices, commodities, ETFs, and cryptocurrencies using one platform. With broad coverage and integrated toolsets, it suits traders seeking multi-asset access, though each class still demands careful risk management.

Deposit and Withdrawal

Trade.com offers a streamlined funding process that lets traders deposit for free across multiple methods and withdraw funds with minimal fees and relatively low minimums. The support for cards, e-wallets, and bank transfers ensures flexible access to funds and reliable liquidity.

Frequently Asked Questions

How long do deposits and withdrawals take at Trade.com?

Deposits are often instant when using cards or e-wallets, while bank transfers can take longer. Withdrawals usually take between one and seven business days, depending on the chosen method and the processing times of payment providers or banks.

Does Trade.com charge fees for funding or withdrawals?

Trade.com does not charge internal fees for deposits or withdrawals, which helps traders keep more of their capital. However, payment providers or banks may still apply their own charges, especially for international transfers or wire transactions, based on their policies.

Our Insights

Trade.com delivers a reliable and user-friendly funding experience that suits active and long-term traders. The platform provides fast deposits, flexible withdrawal options, and no broker-side fees, although bank timelines and provider charges may still impact the total processing time.

Customer Support

Trade.com provides multiple communication channels to assist traders quickly and professionally. Users can reach support by email, WhatsApp, or live chat during the trading week. The team is available from Sunday night to Friday night, offering guidance, technical help, and account-related assistance when needed.

Frequently Asked Questions

How can I contact Trade.com support?

You can reach Trade.com through email, WhatsApp, or live chat. Support is available from Sunday at 22:00 GMT until Friday, making it easy to get help throughout the global trading week with fast responses during active market hours.

Is live chat faster than email at Trade.com?

Live chat and WhatsApp provide quicker responses for urgent matters, while email is suited for longer or formal inquiries. Although support responds during the same hours, messaging channels typically deliver faster turnaround times than email during the trading week.

Our Insights

Trade.com offers a responsive and well-structured support system with quick access through live chat, WhatsApp, and email. The service is fast and helpful during the trading week, though weekend support is not available. Overall, traders benefit from reliable assistance when markets matter most.

Customer Reviews and Trust Scores

Trade.com receives widely varying feedback from clients, reflecting both satisfaction and serious concerns. Some traders report smooth trading and clear conditions, whereas others raise alarm about withdrawals and pushy sales behaviour. Overall, the trust landscape appears mixed.

| Metric | What users report | Summary |

| Trustpilot rating | Score around 2.3 out of 5 stars | Mixed reviews overall |

| Review themes | Complaints of withdrawal delays and pressure to deposit | Key negative patterns observed |

| Honourable mentions | Positive comments about wide asset range and platform choices | Positive platform feedback |

| Independent trust score | A “Trust Score” of 92/100 claimed by one review site | Mostly positive platform reliability |

Despite positive data around asset offering, the volume of withdrawal complaints means trust remains a live issue for many clients.

Discussions and Forums about Trade.com

Online forums show robust discussion around Trade.com, with users sharing experiences, warnings, and tips. The narrative often centres on access, regulations, and execution while also raising questions around transparency.

| Forum/Platform | Key topics raised | Sentiment summary |

| Reddit r/Forex | Promotional deposits, basic trading education commentary | Mixed – some curiosity, some caution |

| ForexPeaceArmy | Thread titles alleging “scam” experiences | Highly critical |

| Broker safety review sites | Analysis of regulation and risk | Balanced to negative |

These discussions suggest that many traders approach Trade.com with caution and emphasise doing thorough due diligence.

Employee Overview of Working for Trade.com

Reviews from current and former employees of Trade.com reveal a mix of positive culture aspects and workload challenges. The employer brand appears decent for entry‑level roles, but some internal criticisms persist.

| Review Source | Key positive feedback | Key negative feedback |

| Glassdoor | Good environment, fair for beginners | Workload heavy in peak months |

| Indeed | Teams described as friendly and welcoming | Some reviews mention unclear advancement paths |

| Overall rating | Around 4.0 average in some reviews | Salary and incentives considered average |

For staff seeking a dynamic trading‑firm environment, Trade.com offers opportunities, but aspiring senior staff may encounter limitations in incentive structure and growth speed.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Wide range of tradable assets | Trust and withdrawal complaints |

| Multiple platform choices (MT4/MT5/WebTrader) | Mixed customer review sentiment |

| Entry‑level career opportunities for employees | Workload and incentive concerns internally |

| Multiple discussion forums reference its brand | Not always top tier regulation clarity |

| Competitive features for beginners | Asset spreads and fees can be less favourable |

References:

In Conclusion

Trade.com provides regional support through several international offices, allowing traders in key jurisdictions to access assistance in their own time zones. The broker maintains a physical or local support presence in the following countries:

- 🇲🇺 Mauritius

- 🇨🇾 Cyprus

- 🇬🇧 United Kingdom

- 🇪🇸 Spain

- 🇩🇪 Germany

This network strengthens its global service coverage while all other regions are supported through its central online helpdesk, ensuring that traders worldwide can still reach the broker when needed.

Faq

Trust varies: some traders praise its functionality and asset coverage, others highlight problems with withdrawals and communications. Review averages are low, and caution is advised.

Yes. Users actively discuss Trade.com on Reddit, ForexPeaceArmy, and other forums, often sharing first‑hand experiences, both positive and negative.

Employees cite a friendly environment and fair entry roles, but some mention heavy workloads, average pay, and limited advancement incentives.

Yes. Primary complaints focus on withdrawal difficulties, account management pressure and inconsistent customer support follow‑through.

It can be, due to its asset range and platform variety. However beginners should thoroughly understand fees, conditions and risk before engaging fully.

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a Trade.com Account

- Safety and Security

- Trading Platforms and Tools

- Markets available for Trade

- Deposit and Withdrawal

- Customer Support

- Customer Reviews and Trust Scores

- Discussions and Forums about Trade.com

- Employee Overview of Working for Trade.com

- Pros and Cons

- In Conclusion