Trade247 Review

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a Trade247 Account

- Safety and Security

- Trading Platforms

- Markets available for Trade

- Deposit and Withdrawal

- Educational Material and Trading Tools

- Customer Support

- Customer Reviews and Trust Scores

- Discussions and Forums about Trade247

- Pros and Cons

- In Conclusion

Trade247 is a Dubai-based broker launched in 2025, offering commission-free trading through the MetaTrader 5 platform. It provides regulated services, competitive spreads, and fast withdrawals. It has a trust score of 85 out of 99.

Overview

Trade247, launched in 2025, has quickly established itself as a regulated, commission-free broker. Using MetaTrader 5 provides over 2,000 tradable instruments across forex, indices, crypto, stocks, and commodities. Traders benefit from tight spreads, fast withdrawals, and round-the-clock support despite its limited advanced tools.

Frequently Asked Questions

Is Trade247 a regulated broker?

Yes. 🇦🇪 SCA (UAE) and 🇲🇺 FSC (Mauritius) regulate Trade247, providing oversight beyond typical offshore brokers. This ensures a safer trading environment for clients while maintaining operational transparency and adherence to local financial laws.

Which trading platform does Trade247 support?

Trade247 primarily uses MetaTrader 5 (MT5), a globally recognized platform. It offers traders a reliable and intuitive interface for forex and CFD trading, making it suitable for beginners and experienced traders seeking simplicity without sacrificing execution speed.

Our Insights

Trade247 is a young but promising broker, ideal for traders prioritizing execution and cost efficiency. While advanced features and proprietary tools are missing, its regulation, commission-free trading, and fast withdrawals make it a strong choice for traders focused on straightforward, reliable market access.

Fees, Spreads, and Commissions

Trade247, regulated by the SCA (UAE) and 🇲🇺 FSC (Mauritius), provides a highly transparent, zero-commission pricing model. Forex spreads start from 0.2 pips, while commodities, indices, stocks, and crypto remain competitively priced. There are no deposit, withdrawal, or inactivity fees, and standard swap charges apply unless an Islamic account is used.

| Feature | Details | Notes |

| Commission | None | Applies to all accounts |

| Forex Spreads | From 0.2 pips (EUR/USD) | Very tight for zero commission model |

| Inactivity Fees | None | Safe for long-term traders |

| Swap Fees | Standard | Swap-free for Islamic accounts |

Frequently Asked Questions

Does Trade247 charge commissions or fees?

No. Trade247 offers commission-free trading. Additionally, there are no deposit, withdrawal, or inactivity fees, making it cost-effective for traders who want to maximize returns without hidden costs.

How tight are Trade247’s spreads?

Trade247 provides very tight spreads, with EUR/USD starting from 0.2 pips. Other assets like commodities, indices, stocks, and crypto are described as competitive, allowing traders low-cost execution across a wide variety of instruments.

Our Insights

Trade247’s pricing is transparent and trader-friendly. Zero commissions, no inactivity fees, and tight Forex spreads make it ideal for active or long-term traders. It provides affordable market access while maintaining simplicity and clarity in its cost structure.

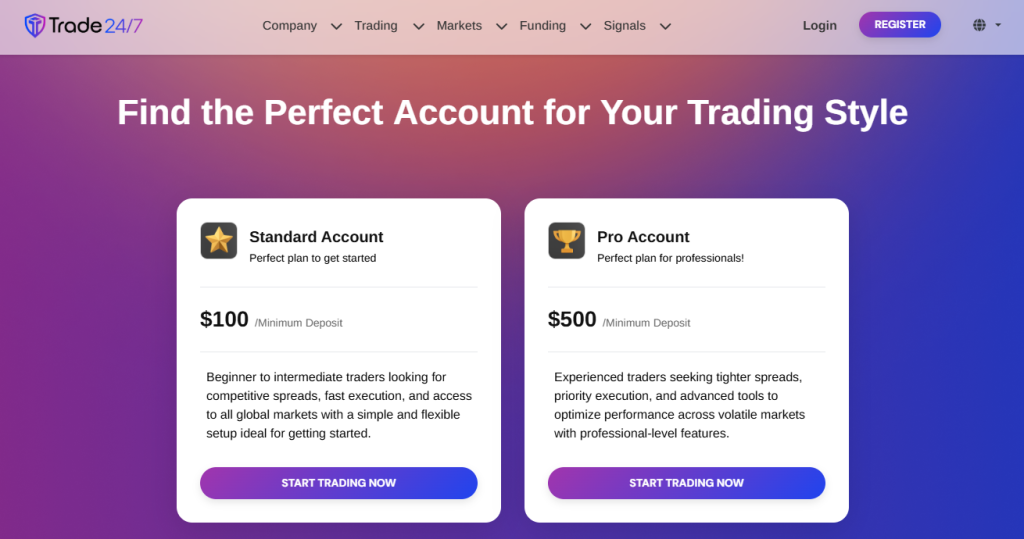

Minimum Deposit and Account Types

Trade247, regulated by the SCA (UAE) and 🇲🇺 FSC (Mauritius), offers four clearly defined accounts: Standard, Pro, Islamic, and Demo. Each caters to different trading styles, with differences in execution, spreads, and swap conditions. The demo account is unlimited, and all live accounts remain commission-free.

| Account Type | Key Features | Target Traders | Notes |

| Standard | Commission-free, spreads from 0.2 pips, leverage up to 1:500 | Entry-level | Access to all instruments |

| Pro | Tighter spreads, Direct Market Execution (DMA), no commission | Experienced traders | Suitable for active trading |

| Islamic | Swap-free, Sharia-compliant, mirrors Standard/Pro | Traders requiring Sharia compliance | No hidden admin fees |

| Demo | Unlimited duration, mirrors live conditions | Beginners or EA testing | Perfect for practice |

Frequently Asked Questions

What types of trading accounts does Trade247 offer?

Trade247 provides four account types: Standard, Pro, Islamic, and Demo. Each account targets a specific trader group, from beginners to active professionals, offering a straightforward structure without unnecessary complexity.

What is the minimum deposit requirement?

While Trade247 doesn’t publicly list the exact minimum deposit, the Standard account is designed for entry-level traders. This suggests a low starting point, making it accessible for new traders looking to start small.

Our Insights

Trade247’s account structure is simple, flexible, and beginner-friendly. With no commissions across all accounts, an unlimited demo, and a transparent Sharia-compliant Islamic account, traders can access a range of instruments without worrying about hidden fees or complicated conditions.

How to Open a Trade247 Account

Opening a Trade247 account is straightforward and can be completed online in a few simple steps. Whether you’re starting with a demo or upgrading to a live account, the process is quick and secure.

1. Step 1: Visit the Trade247 Registration Page

Navigate to the official Trade247 website and click on “Sign Up” to begin your application.

2. Step 2: Complete the Online Form

Enter your personal details, including your name, email, country of residence, phone number, and create a secure password.

3. Step 3: Confirm Your Email

Check your inbox for a verification email from Trade247 and click the activation link to access your client area.

4. Step 4: Submit KYC Documents

Upgrade to a live account and upload a valid government-issued ID and proof of residence to complete identity verification.

5. Step 5: Fund Your Account and Choose a Platform

Go to the “Money Management” section, select a deposit method (such as card, wire transfer, Skrill, or Neteller), fund your account (minimum deposit is $100), and choose your preferred trading platform (MetaTrader 5) to start trading.

This process can be completed in minutes for registration, although KYC verification times may vary.

Safety and Security

Trade247 maintains responsible regulatory coverage under the 🇦🇪 SCA (UAE) and 🇲🇺 FSC (Mauritius). The broker enforces client fund segregation and negative balance protection, demonstrating transparency and accountability despite not holding top-tier global licenses.

| Feature | Details | Regulatory Body | License Number |

| Regulation | 🇦🇪 SCA (UAE) | Securities and Commodities Authority | 1419455 |

| Regulation | 🇲🇺 FSC (Mauritius) | Financial Services Commission | C216567 |

| Account Security | Segregated client accounts | N/A | N/A |

| Investor Protection | No insurance scheme | N/A | N/A |

Frequently Asked Questions

Is Trade247 a regulated broker?

Yes. Trade247 is authorized by the 🇦🇪 SCA in the UAE and the 🇲🇺 FSC in Mauritius. Both regulators impose essential safeguards, including client fund segregation, KYC enforcement, and consistent financial reporting standards, ensuring the broker operates with a regulated framework and accountable oversight.

How secure are client funds with Trade247?

Trade247 secures client funds in segregated bank accounts, which keeps trader deposits separate from company operational funds. This practice minimizes misuse risks and reinforces financial transparency, giving traders added peace of mind when managing their capital within the platform.

Our Insights

Trade247 provides a reasonable level of security through dual regulation and clear client fund protection. While it lacks high-tier investor insurance, its transparency and negative balance protection position it as a safer choice compared to unregulated brokers in emerging markets.

Trading Platforms

Trade247 focuses entirely on MetaTrader 5 (MT5), avoiding unnecessary complexity and extra tools. This choice delivers a stable, professional-grade platform trusted by global traders. While there are no proprietary add-ons, MT5’s speed, automation, and multi-asset access make it a complete trading solution for skilled users.

| Feature | Platform | Supported Assets | Key Advantage |

| Platform Type | MetaTrader 5 (MT5) | FX Stocks Indices Metals Cryptos | Multi-asset access |

| Order Management | Advanced (Hedging, Netting, Partial Fills) | All account types | Flexible order control |

| Charting Tools | 38+ Indicators, 44 Drawing Tools | Technical traders | Deep analysis |

| Automation | Expert Advisors (EAs) + Custom Indicators | MQL5 Scripting | Strategy optimization |

Frequently Asked Questions

What is Trade247’s trading platform?

Trade247 exclusively offers MetaTrader 5, a global benchmark for professional trading. Though it lacks proprietary applications, MT5 provides advanced charting, automation through EAs, and seamless multi-asset execution, making it a powerful choice for both retail and institutional-level traders.

What can I trade on MT5 through Trade247?

Through a single MT5 login, traders can access Forex, stocks, indices, metals, and cryptocurrencies. This versatility enables efficient portfolio management and cross-asset trading without switching platforms, appealing to those who prefer a unified and streamlined trading environment.

Our Insights

Trade247’s decision to offer only MT5 reflects focus and confidence in a proven trading platform. Despite lacking proprietary enhancements or copy trading features, MT5’s depth, speed, and flexibility make it ideal for self-directed traders seeking a professional and efficient trading experience.

Markets available for Trade

Trade247 impresses with its extensive market coverage of over 2,000 instruments across Forex, stocks, indices, commodities, metals, energy, and crypto CFDs. This broad range supports both diversification and specialized trading, giving traders access to global opportunities from one powerful MetaTrader 5 platform.

| Asset Class | Description | Highlights | Example Instruments |

| Forex | Major minor exotic pairs | Spreads from 0.2 pips | EUR/USD GBP/JPY |

| Stocks | Global shares as CFDs | Access to US, EU, and Asia markets | Apple Tesla |

| Indices | Global benchmark indices | Diversified regional coverage | S&P 500 DAX Nikkei |

| Commodities | Softs oil precious metals | Includes energy trading | Gold Brent Oil |

| Crypto CFDs | Leading digital assets | Competitive spreads | Bitcoin Ethereum |

Frequently Asked Questions

What types of markets can I trade on Trade247?

Trade247 provides access to Forex pairs, global stocks as CFDs, major and regional indices, commodities such as gold and oil, crypto CFDs including Bitcoin and Ethereum, plus leveraged metals and energy products. This variety allows traders to build diverse portfolios and explore multiple strategies with one broker.

How is trade execution handled on Trade247?

All trading on Trade247 runs natively on MetaTrader 5, ensuring direct, efficient, and accurate execution without reliance on web-based pricing engines or intermediaries. This streamlined setup enhances speed and consistency, giving traders smooth execution across every available asset class.

Our Insights

Trade247’s market range is a standout strength, especially for a newer broker. Its wide selection of over 2,000 instruments on MT5 gives traders flexibility and choice across global asset classes, making it ideal for those seeking a one-stop solution for diverse trading opportunities.

Deposit and Withdrawal

Trade247 simplifies funding with instant, fee-free deposits and reliable global coverage. Offering Visa, Mastercard, and Bank Transfer options, the broker ensures quick and transparent transactions without hidden costs. While crypto and PayPal funding are missing, Trade247’s current setup delivers speed, accessibility, and efficiency.

| Method | Currencies Supported | Fees | Processing Speed |

| Visa | USD AED EUR | Free | Instant deposits / 2–3 business days withdrawal |

| Mastercard | USD AED EUR | Free | Instant deposits / 2–3 business days withdrawal |

| Bank Transfer | USD EUR GBP | Free | 2–5 working days for both deposit and withdrawal |

Frequently Asked Questions

What deposit methods does Trade247 offer?

Trade247 supports Visa, Mastercard, and Bank Transfers. Deposits via Visa and Mastercard are instant and free, available in USD, AED, and EUR. Bank Transfers, supporting USD, EUR, and GBP, remain fee-free but take between two and five working days to process.

How fast are withdrawals on Trade247?

Withdrawals via Visa or Mastercard are approved within one to three hours, with funds typically arriving in two to three business days. Bank Transfers may take two to five working days. All withdrawal options are free, maintaining consistency across funding methods.

Our Insights

Trade247’s deposit and withdrawal process is efficient, transparent, and globally accessible. Although it lacks PayPal and crypto options, instant card deposits and quick payouts make it user-friendly. Its commitment to fee-free transactions strengthens its appeal for traders seeking reliability and convenience.

Educational Material and Trading Tools

Trade247 currently offers limited educational resources, with no webinars, tutorials, or structured courses available. While the broker plans to introduce a blog and host webinars in the future, its current setup primarily serves experienced traders who are already confident using MetaTrader 5.

| Category | Availability | Planned Additions | Suitable For |

| Webinars | Not yet available | Planned | Intermediate traders |

| Tutorials Courses | None | Future development | Beginners |

| Market Insights | Not available | Blog and updates planned | All traders |

| Platform Guides | Not available | To be added for MT5 | MT5 users |

Frequently Asked Questions

Does Trade247 offer any educational resources for traders?

At present, Trade247 does not feature live educational tools such as webinars, trading academies, or tutorials. Although these are mentioned in the broker’s development roadmap, there is no active learning portal, making it less ideal for beginners seeking guided education.

Is there any beginner-friendly content available?

No, Trade247 does not yet provide beginner content, platform guides, or structured lessons. The platform mainly appeals to seasoned traders who already understand trading strategies, MT5 functionality, and risk management principles.

Our Insights

Trade247’s educational resources are currently underdeveloped, limiting its appeal to new traders. However, its transparency and plans for expansion show potential. Once the broker launches its blog and webinars, it could offer meaningful value to both beginner and intermediate-level traders.

Customer Support

Trade247 delivers responsive customer support with real-time service available 24/7 through live chat, WhatsApp, phone, and email. The absence of bots or ticket systems ensures genuine human interaction. Although limited to English and Arabic, the service remains efficient, professional, and globally accessible.

Frequently Asked Questions

What customer support options does Trade247 offer?

Trade247 provides round-the-clock customer assistance through live chat on its website, WhatsApp messaging, email at [email protected], and phone at +971 58 847 0281. These direct channels ensure fast responses and a personal approach to resolving client inquiries efficiently.

Is Trade247’s support system ticket-based or real-time?

No, Trade247 does not rely on ticketing or automated systems. Instead, all inquiries are managed in real time by human agents, allowing faster resolutions and a more personalized support experience for traders seeking immediate help.

Our Insights

Trade247’s customer support stands out for its speed, human interaction, and 24/7 accessibility. While it lacks Telegram and regional phone coverage, its reliable service and fast response times make it a dependable option for traders seeking direct, real-time communication.

Customer Reviews and Trust Scores

Trade247 has garnered mixed feedback online, often praised for certain features but also flagged by some reviewers for risk or dissatisfaction. It appears fairly new, which means fewer data points, and evaluations differ significantly depending on the review site.

| Source | Trust/Rating Score | What Users Like | What Users Criticize |

| Trustpilot | ~4.3 / 5 based on ~9 reviews | Fast withdrawals, helpful support, low spreads | Limited number of reviews; mostly positive so far, which may indicate bias or early adopter advantages |

| Traders Union | 4.58 / 10 (“higher-than average risk”) | Transparency in conditions; broad instrument offering, platform usability | Many clients report dissatisfaction; broker considered somewhat risky by this metric |

It seems that while many customers report positive experiences, there are serious caution signals in some assessments that potential users should take into account.

Discussions and Forums about Trade247

In broader trader communities and forums, the conversation around Trade247 includes both praise and skepticism. While not overly abundant, some threads suggest concerns about legitimacy or consistency, while others highlight satisfaction with service.

| Forum/Source | Nature of Discussion | Key Positive Themes | Key Concerns |

| Reddit Complaints Boards | Mixed; some users voicing concerns, others asking general questions | People discuss comparing Trade247 to other brokers; some mention smooth deposits/withdrawals when their experience works well | Allegations in some cases of misleading promises, poor responses to withdrawal issues, concerns about fake reviews or over-hyping features |

| Broker Review Sites Blogs | More structured reviews, often mixed or leaning cautious | Noted features like MT5 platform, speed of service, regulatory licensing are appealing | New broker warnings, limited history, risk of being less stable; some “scam” allegations or warnings from less formal blogs |

| Social Media Word-of-Mouth | Scattered and less formal | Positive feedback when things go right, especially around support responsiveness | Strong negative feedback mostly when users have issues withdrawing funds or dealing with customer support delays or unclear claims |

In short, discussions reflect that Trade247 has supporters, but there is also wariness—especially among more experienced traders – about the risk of unfulfilled promises.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Tight spreads from 0.2 pips | No educational content currently live |

| Zero commission on all account types | $100/$500 minimum deposit may limit accessibility |

| MT5-only focus keeps platform clean | No investor protection scheme in place |

| Fast withdrawal processing (1–3 hrs) | No proprietary mobile app |

| Regulated by two jurisdictions | Limited funding options (no crypto, PayPal) |

| 24/7 live human support | No copy or social trading features |

References

In Conclusion

Trade247 is still new, but it’s come out swinging with a trading environment that’s clean, fast, and honest. There’s no bonus baiting, loyalty ladders, or unnecessary platform clutter. Just MT5, solid execution, tight spreads, and decent regulation.

It’s not ideal for complete beginners yet because there’s no education, and the $100 deposit might turn casual traders away. But for traders who already know the ropes and want a no-nonsense place to get trades done? It’s already delivering the essentials.

If Trade247 follows through on their roadmap by adding education, a stronger funding setup, and a mobile experience, the broker could grow from “solid option” to real competitor status. It’s a clean platform with plenty of room to evolve.

Faq

Over 2,000+ CFDs covering forex, indices, stocks, metals, crypto, and commodities.

Once approved, most withdrawals are processed within 1–3 hours, depending on the method.

The minimum deposit is $100 for a Standard Account and $500 for the Pro Account.

Yes, both are fully supported via MT5’s order execution and risk management features.

Only if you already know how to use MT5. Without tutorials or a learning hub, total beginners might find it challenging.

No, funds are segregated but not protected under a compensation scheme.

Visa, MasterCard, Skrill, Neteller, and bank transfers.

- Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a Trade247 Account

- Safety and Security

- Trading Platforms

- Markets available for Trade

- Deposit and Withdrawal

- Educational Material and Trading Tools

- Customer Support

- Customer Reviews and Trust Scores

- Discussions and Forums about Trade247

- Pros and Cons

- In Conclusion