- Home /

- Forex Brokers /

- XLibre

XLibre Review

- Overview

- Fees, Spreads, and Commission

- Minimum Deposit and Account Types

- How to Open an XLibre Account

- Safety and Security

- Trading Platforms and Tools

- Markets Available for Trade

- Bonus Offers and Promotions

- Deposit and Withdrawal

- Partnership Options

- XLibre Educational Articles

- Customer Support

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Discussions and Forums about XLibre

- Pros and Cons

- In Conclusion

XLibre is a trustworthy and Popular Broker choice that offers access to a full range of financial instruments. It is ideal for both beginners and professional traders, and it has a trust score of 70 out of 99.

★★ | Minimum Deposit: $0 Regulated by: FCA, FSC Crypto: Yes |

| Broker | XLibre |

| Minimum Deposit | None |

| Spreads | From 0 pips |

| Leverage | 1:2000 |

| Fees Commissions | Commission-free on most accounts, with competitive spreads |

| Regulation | 🇬🇧 FCA 🇲🇺 FSC |

| Open an Account |

Overview

XLibre promotes trader-focused values by combining expert-led innovation, robust security, and personalized support. Regulated in both the Republic of 🇲🇺 Mauritius and 🇿🇦 South Africa, the broker delivers a transparent and protected trading environment that empowers clients to trade confidently.

Frequently Asked Questions

What makes XLibre secure for traders?

XLibre safeguards client funds via segregated accounts and implements modern security protocols like SSL encryption, two‑factor authentication, and regular audits. Its regulation under 🇲🇺 Mauritius FSC and 🇿🇦 FSCA further enhances fund protection and transparency.

How does XLibre support traders personally?

XLibre combines cutting‑edge market analysis tools with around‑the‑clock, tailored customer support. Traders benefit from expert insights and responsive assistance suited to their unique trading needs and strategies.

Our Insights

XLibre stands out as a trader‑centric broker, offering strong regulatory oversight, advanced security protocols, and tailored support. While relatively new, its commitment to transparency, innovation, and safety positions it as a compelling option for both novices and experienced traders.

★★ | Minimum Deposit: $0 Regulated by: FCA, FSC Crypto: Yes |

Fees, Spreads, and Commission

XLibre offers highly competitive trading conditions, with spreads starting from 1.2 pips on standard accounts and as low as 0.7 pips on VIP accounts. Commissions are generally zero on standard forex pairs, and the broker provides flexible swap-free options, making trading cost-efficient for all levels of traders.

| Feature | CENT/Pro | Raw | VIP |

| Spreads From | 1.2 pip | 0 on Forex | 0.7 pip |

| Max Leverage | 1:2000 | 1:2000 | 1:2000 |

| Commission | None | None | None |

| Swap-Free Option | Yes | Yes | Yes |

Frequently Asked Questions

What are XLibre’s typical spreads and commissions?

XLibre provides tight spreads starting at 1.2 pips on CENT and Pro accounts, 0 on Raw accounts for Forex, and 0.7 pips on VIP accounts. Commissions are waived on most forex trades, and swap-free accounts are available for clients requiring Islamic-compliant trading.

Does XLibre charge hidden fees?

XLibre is transparent about all fees. Standard trading costs are reflected in spreads, and there are no hidden commissions beyond those explicitly listed. Traders are advised to review account-specific terms as fees may vary depending on market conditions.

Our Insights

XLibre ensures cost-effective trading with low spreads and minimal commissions. Transparency in fees and flexible trading options, including swap-free accounts, make it suitable for both beginner and experienced traders seeking efficient market access.

★★ | Minimum Deposit: $0 Regulated by: FCA, FSC Crypto: Yes |

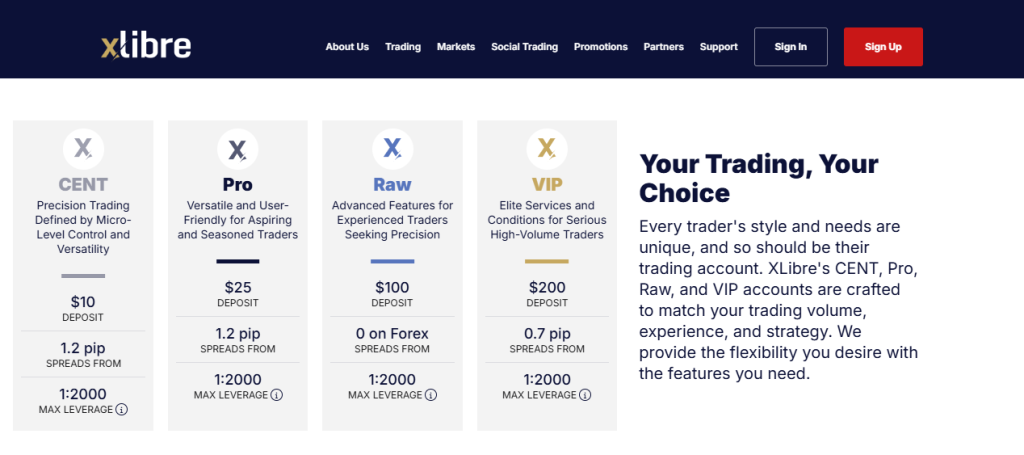

Minimum Deposit and Account Types

XLibre accommodates all types of traders with four tailored account types: CENT, Pro, Raw, and VIP. Minimum deposits range from $10 for beginner traders to $200 for high-volume VIP accounts, offering features and leverage that match trading experience and goals.

| Feature | CENT | Pro | Raw | VIP |

| Minimum Deposit | $10 | $25 | $100 | $200 |

| Spreads From | 1.2 pip | 1.2 pip | 0 on Forex | 0.7 pip |

| Max Leverage | 1:2000 | 1:2000 | 1:2000 | 1:2000 |

| Stop Out Level | 30% | 30% | 20% | 20% |

| Open an Account |

Frequently Asked Questions

Which XLibre account is best for beginners?

The CENT account is ideal for beginners with a $10 minimum deposit. It provides standard spreads, maximum leverage of 1:2000, and essential trading tools to start learning without committing large capital.

What account should high-volume traders consider?

The VIP account caters to experienced traders needing tight spreads from 0.7 pips, maximum leverage, and advanced tools. With a $200 minimum deposit, it offers elite conditions for precision trading and higher-volume strategies.

Our Insights

XLibre’s diverse account offerings provide flexibility for all trading levels. From micro CENT accounts to elite VIP accounts, the broker accommodates beginners and professionals, ensuring trading conditions align with capital, experience, and strategy.

★★ | Minimum Deposit: $0 Regulated by: FCA, FSC Crypto: Yes |

How to Open an XLibre Account

Opening an account with XLibre is a straightforward process designed to get you started quickly. Whether you’re a beginner or an experienced trader, the registration steps are simple and user-friendly. Here’s a step-by-step guide to help you set up your XLibre trading account.

1. Step 1: Visit Registration Page

Go to the XLibre website and click “Open an Account” or “Start Trading.”

2. Step 2: Fill Out Form

Enter your country, email, secure password, optional partner code, and US citizenship declaration if applicable.

3. Step 3: Verify Email

Check your inbox and click the verification link sent by XLibre.

4. Step 4: Complete KYC

Upload a valid ID and proof of address to complete verification.

5. Step 5: Fund Account

Deposit using a credit/debit card, bank transfer, or cryptocurrency; minimum depends on account type.

6. Step 6: Start Trading

Access the platform and begin trading with the account type that fits your style.

Verification may take up to 24 hours, and customer support is available if needed.

★★ | Minimum Deposit: $0 Regulated by: FCA, FSC Crypto: Yes |

Safety and Security

XLibre prioritizes the security of client funds through strict regulatory adherence and advanced protection technologies. By using segregated accounts, negative balance protection, and state-of-the-art cybersecurity, the broker ensures a secure trading environment that gives traders peace of mind and confidence in every transaction.

| Feature | Description | Benefit | Availability |

| Segregated Accounts | Client funds separate from company capital | Extra layer of security | All account types |

| Negative Balance Protection | Account balance cannot drop below zero | Limits exposure in volatile markets | All account types |

| Cybersecurity Technology | Advanced encryption and secure servers | Protects assets and personal data | All trading platforms |

| Regulatory Compliance | Adheres to international financial standards | Ensures stable and legal trading | Global |

Frequently Asked Questions

How does XLibre protect client funds?

XLibre safeguards assets using segregated accounts, negative balance protection, and advanced cybersecurity protocols. This ensures client funds remain separate from company capital, protected from operational risks, and secure from potential threats, allowing traders to focus on their strategies with confidence.

Is XLibre regulated to ensure fund safety?

Yes, XLibre strictly adheres to international financial regulations. This commitment provides traders with a stable and secure environment, where compliance with legal standards safeguards their investments and enhances transparency across all trading activities.

Our Insights

XLibre demonstrates a strong commitment to fund safety through regulatory compliance, segregated accounts, and innovative security measures. Traders can operate confidently knowing their investments are protected and that negative balance protection limits risk in volatile markets.

★★ | Minimum Deposit: $0 Regulated by: FCA, FSC Crypto: Yes |

Trading Platforms and Tools

XLibre empowers traders with the ability to trade seamlessly across multiple devices. With MT5 Desktop, Mobile, and WebTrader platforms, users can respond to market movements instantly. The broker’s flexible access ensures trading convenience, speed, and efficiency, whether at home or on the go.

| Platform | Device Type | Key Feature | Accessibility |

| MT5 Desktop | PC | Full-feature trading at home | Download required |

| MT5 Mobile | Smartphone | On-the-go trading | iOS and Android |

| MT5 WebTrader | Browser | No download needed, ready to trade | Any internet browser |

Frequently Asked Questions

Which platforms does XLibre offer for trading?

XLibre provides three MT5 platforms: Desktop for home use, Mobile for trading on the go, and WebTrader for browser-based access. Each platform delivers full trading functionality, allowing traders to execute strategies efficiently across any device without compromising performance.

Can I trade on XLibre while traveling?

Yes, XLibre’s Mobile and WebTrader platforms are designed for flexibility. Traders can monitor the market, place orders, and manage positions anywhere with an internet connection, ensuring timely responses to market changes without being tied to a single device.

Our Insights

XLibre ensures a versatile trading experience through its MT5 Desktop, Mobile, and WebTrader platforms. Traders benefit from seamless access on any device, allowing them to trade efficiently, react quickly to market changes, and maintain consistent control over their investments anywhere.

★★ | Minimum Deposit: $0 Regulated by: FCA, FSC Crypto: Yes |

Markets Available for Trade

XLibre offers a wide range of trading instruments across five asset classes, giving traders the flexibility to diversify their portfolios. By including Forex, Commodities, Shares, Indices, and Crypto, the broker empowers clients to explore opportunities, manage risk, and capitalize on market volatility efficiently.

| Asset Class | Instruments Available | Key Benefit | Accessibility |

| Forex | Major minor exotic pairs | 24/5 market access | All account types |

| Commodities | Oil energies metals | Hedge and diversify | All account types |

| Shares | Global stocks | Portfolio expansion | All account types |

| Indices | Major global indices | Broad market exposure | All account types |

| Crypto | Bitcoin Ethereum Litecoin | Access to high volatility | All account types |

Frequently Asked Questions

Which asset classes can I trade with XLibre?

XLibre provides access to Forex, Commodities, Shares, Indices, and Cryptocurrencies. This diverse selection allows traders to diversify their portfolios, hedge risk, and explore multiple markets without needing separate accounts or platforms.

Can beginners trade all asset types on XLibre?

Yes, XLibre caters to traders of all experience levels. While some instruments like Forex and Commodities are beginner-friendly, others, such as Crypto or Indices, may require more experience. Educational resources and trading tools are available to support learning across all asset classes.

Our Insights

XLibre offers a robust variety of trading instruments across five key asset classes. This range enables traders to diversify, hedge risk, and capitalize on market volatility, making the broker suitable for both new and experienced traders seeking flexible portfolio opportunities.

★★ | Minimum Deposit: $0 Regulated by: FCA, FSC Crypto: Yes |

Bonus Offers and Promotions

XLibre offers a variety of promotions designed to enhance trading potential and reward clients. From welcome bonuses to competitive trading contests, these offers give traders the chance to increase capital, participate in challenges, and enjoy exclusive prizes, all while trading in a secure environment.

| Promotion Name | Type | Key Benefit | Availability |

| Battle of the Legends | Trading Competition | Win monthly prizes | All clients |

| 50% Tradable Bonus | Deposit Bonus | Increase trading capital | Eligible clients |

| 30% Tradable Bonus | Deposit Bonus | Extra capital on first three deposits | New clients |

| 100% Welcome Bonus | New Client Bonus | Boost initial trading capital | New clients |

Frequently Asked Questions

What types of promotions does XLibre offer?

XLibre provides welcome bonuses, tradable deposit bonuses, and competitive trading contests like Battle of the Legends. These promotions allow clients to increase trading capital, access exclusive opportunities, and compete for prizes ranging from cash rewards to high-value items.

Who is eligible for XLibre promotions?

Promotions are generally available to all registered clients, although some bonuses may be limited to new traders or specific deposit levels. Traders should review terms and conditions for each offer to ensure eligibility and maximize the benefits available.

Our Insights

XLibre’s promotions provide significant opportunities for traders to boost their capital and engage in competitive events. With options ranging from deposit bonuses to trading competitions, clients can enhance their trading experience while enjoying the safety and support XLibre delivers.

★★ | Minimum Deposit: $0 Regulated by: FCA, FSC Crypto: Yes |

Deposit and Withdrawal

XLibre provides quick and secure funding options for traders, ensuring deposits are instant or processed within minutes, while withdrawals are efficiently handled in 1-7 business days. With minimal fees and strict compliance, the broker offers a safe, transparent, and convenient funding experience for all account types.

| Transaction Type | Methods Available | Processing Time |

| Deposit | Credit/Debit Card | Up to 10 minutes |

| Deposit | Online Bank Transfer | Instant |

| Deposit | QR Code | Instant |

| Withdrawal | Bank Transfer | 1-7 business days |

| Withdrawal | Debit Card | 2-7 business days |

Frequently Asked Questions

What deposit methods does XLibre support?

XLibre accepts credit/debit cards, online bank transfers, QR code payments, and local bank transfers. Most deposits are processed instantly or within 10 minutes, and the broker covers any processing fees applied by payment providers, ensuring clients can fund their accounts quickly and safely.

How long do withdrawals take on XLibre?

Withdrawal times vary by method, ranging from 1-7 business days. Debit card withdrawals are limited to the sum of deposits, while bank transfers handle amounts exceeding initial deposits. XLibre ensures secure processing and recommends contacting support for guidance on large or complex withdrawals.

Our Insights

XLibre ensures that funding your account is fast, transparent, and secure. With multiple deposit methods, minimal fees, and regulated transaction processing, traders can manage deposits and withdrawals confidently while focusing on trading without unnecessary delays.

★★ | Minimum Deposit: $0 Regulated by: FCA, FSC Crypto: Yes |

Partnership Options

XLibre offers one of the most competitive partnership programs in the trading industry. With high commissions for affiliates and Introducing Brokers, dedicated support, and flexible plans, partners can maximize earnings while accessing advanced marketing tools, real-time reporting, and personalized guidance for long-term success.

| Partnership Type | Commission Potential | Key Benefits | Support Availability |

| Affiliate Partner | Up to $1000 CPA | Marketing tools referral earnings | 24/5 |

| Introducing Broker (IB) | Up to $15 per lot | Dedicated account management, co-branded marketing | 24/5 |

| Flexible Plans | Negotiable | Tailored agreements, personalized guidance | 24/5 |

| Real-Time Reporting | N/A | Track performance and earnings | 24/5 |

Frequently Asked Questions

What types of partnerships does XLibre offer?

XLibre provides two main partnership types: Affiliate Partners, earning up to $1000 CPA for client referrals, and Introducing Brokers, earning up to $15 per lot. Both options include dedicated support, marketing resources, and tailored plans to help partners grow their business effectively.

How can I join the XLibre partnership program?

To join, first submit an online application. Then the XLibre team will discuss the best partnership type for your goals. Once approved, partners receive a welcome package and access to all resources, enabling them to start collaborating and earning commissions efficiently.

Our Insights

XLibre’s partnership programme stands out for its high commissions, flexible options, and comprehensive support. Affiliates and Introducing Brokers benefit from tailored plans, marketing resources, and real-time reporting, making it an attractive choice for anyone seeking to monetize trading referrals professionally.

★★ | Minimum Deposit: $0 Regulated by: FCA, FSC Crypto: Yes |

XLibre Educational Articles

XLibre offers a comprehensive library of educational articles designed to enhance traders’ skills. Covering topics from forex fundamentals to advanced strategies, these insights help traders make informed decisions, manage risk effectively, and optimize their trading performance in both volatile and stable markets.

Frequently Asked Questions

What topics are covered in XLibre educational articles?

XLibre’s articles cover a wide range of trading subjects, including economic indicators, risk-reward ratios, CFD trading, market liquidity, trading psychology, leverage, and copy trading. Each article is designed to equip traders with practical knowledge to improve performance and decision-making.

How can traders benefit from these educational resources?

Traders can enhance their skills, understand market dynamics, and develop informed strategies. By studying these articles, clients can improve risk management, track progress, and gain insights from expert analyses, making them better prepared for real-world trading scenarios.

Our Insights

XLibre’s educational resources are an essential tool for traders of all levels. With timely insights and practical guidance on strategy, risk, and market analysis, these articles empower traders to make smarter decisions and consistently refine their trading skills.

★★ | Minimum Deposit: $0 Regulated by: FCA, FSC Crypto: Yes |

Customer Support

XLibre provides responsive and professional customer support for all traders. Whether clients have questions about accounts, platforms, or trading conditions, the support team ensures timely guidance, clear communication, and problem resolution, helping traders maintain confidence and continuity in their trading activities.

Frequently Asked Questions

How can I contact XLibre support?

Traders can reach XLibre support via email at [email protected], by phone, or through the online contact form. The team responds to queries promptly, typically within 24 hours, ensuring assistance is accessible and reliable whenever needed.

What type of support does XLibre offer?

XLibre offers account assistance, platform guidance, and answers regarding trading conditions. Support staff provide clear instructions, troubleshooting advice, and personalized solutions to help traders navigate any challenges efficiently.

Our Insights

XLibre’s customer support is professional, accessible, and timely. With multiple contact channels and a commitment to quick responses, traders can rely on expert guidance and personalized assistance, ensuring a smooth and confident trading experience.

★★ | Minimum Deposit: $0 Regulated by: FCA, FSC Crypto: Yes |

Insights from Real Traders

⭐⭐⭐⭐

XLibre Global has been a great supporter of growth and financial freedom. The journey has been a great one, from the educational value given to the timely response from their support, fast execution, and the ability to trade on the go. –

Adewale

⭐⭐⭐⭐⭐

Deposits and withdrawals with XLibre are fast and smooth, and I always know exactly what fees to expect. The transparency and secure environment make me confident to trade larger positions without worry. –

Michael

⭐⭐⭐

XLibre offers a huge variety of trading instruments from forex to cryptocurrencies. I especially love the charting tools and technical indicators—they help me plan strategies efficiently. Trading has never felt this professional and easy.

Joy

★★ | Minimum Deposit: $0 Regulated by: FCA, FSC Crypto: Yes |

Customer Reviews and Trust Scores

XLibre has garnered mixed feedback from users and review platforms. Some traders praise fast execution, low fees, and reliable withdrawals, while others describe withdrawal issues and label the broker as untrustworthy. The review landscape reflects divergent experiences, highlighting the importance of individual due diligence.

| Source | Score/Feedback Highlights | Key Notes |

| FXEmpire | Overall 3.4 Trust 2.5 Fees 4.1 Deposit Withdrawal 4.9 | Fast execution diverse accounts regulated |

| Trustpilot Reviews | Both “scam” complaints and “best broker” praise | Conflicting user experiences |

Trust scores and user feedback vary widely, from ratings above 4 in execution and deposit reliability to disputes over customer support, so caution and further research are advisable.

★★ | Minimum Deposit: $0 Regulated by: FCA, FSC Crypto: Yes |

Discussions and Forums about XLibre

Online forums and discussion boards show limited chatter about XLibre. Most traders focus on more established brokers, making firsthand peer insights scarce. Without abundant user-generated content, impressions are largely shaped by formal reviews rather than community discussion.

| Platform | Discussion Volume | Common Themes |

| Reddit/Forums | Very few mentions | Traders discuss reliability issues |

| Forex Blogs | Moderate coverage | Focus on regulation and speed |

| Social Media | Occasional posts | Promotions and execution feedback |

Due to minimal community engagement, prospective users should rely more on formal reviews and potentially test with smaller deposits to assess the service personally.

★★ | Minimum Deposit: $0 Regulated by: FCA, FSC Crypto: Yes |

Pros and Cons

| ✓ Pros | ✕ Cons |

| Dual regulation in Mauritius and South Africa | Lacks Tier-1 regulatory oversight |

| Wide range of financial instruments (over 1,000) | Wider spreads on minor cryptocurrencies and exotic currency pairs |

| Competitive spreads on major currency pairs | High commissions on shares and cryptocurrencies in Standard and Pro accounts |

| MetaTrader 5 platform is available across desktop, web, and mobile | No support for MetaTrader 4 or other platforms |

References:

In Conclusion

XLibre operates globally but places particular emphasis on serving clients in Mauritius and South Africa. They maintain physical or regional operations in these markets, providing localized support and adherence to local regulation, helping build trust and responsiveness for clients in those regions.

Countries with XLibre Local Offices or Customer Support:

- 🇲🇺 Mauritius

- 🇿🇦 South Africa

XLibre combines its international trading services with on-the-ground presence in these markets, supported by 24/5 live chat, email, and contact form channels, as well as language-specific support, to ensure clients receive timely and relevant assistance.

Faq

The broker only provides the MetaTrader 5 (MT5) platform, accessible on desktop, online, and mobile.

The Cent Account has a minimum deposit of $10, whereas the Standard and Raw Accounts don’t have a minimum deposit requirement. The Pro Account has a higher minimum deposit of $2,000.

Yes. However, the broker has certain limits on scalping and other strategies.

The broker accepts deposits and withdrawals using VISA, MasterCard, SWIFT, online bank transfers, QR codes, and local transfers.

Yes, the Cent Account charges a $0.05 commission each lot on Forex and commodities, while the Standard and Pro Accounts charge a 1% commission on stocks and cryptocurrency. The Raw Account charges a $5 fee per lot for Forex, commodities, and indices.

- Overview

- Fees, Spreads, and Commission

- Minimum Deposit and Account Types

- How to Open an XLibre Account

- Safety and Security

- Trading Platforms and Tools

- Markets Available for Trade

- Bonus Offers and Promotions

- Deposit and Withdrawal

- Partnership Options

- XLibre Educational Articles

- Customer Support

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Discussions and Forums about XLibre

- Pros and Cons

- In Conclusion