- Home /

- Forex Brokers /

- XTB

XTB Review

- Overview

- XTB Video Overview

- Fees, Spreads, and Commissions

- How to Open a XTB Account

- XTB Investment Plans

- Trading Platform and Tools

- Affiliate Program

- Global Support, Local Presence

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Employee Insights: Working at XTB

- Discussions and Forums: What Traders Are Saying

- Pros and Cons

- In Conclusion

XTB is a trusted and reputable broker recognized for its intuitive platform and extensive trading tools, boasting a trust score of 95 out of 99. XTB has gained the trust of over 1 million traders worldwide with regulations by top-tier authorities like the FCA, CySEC, and KNF.

★★★★ | Minimum Deposit: $0 Regulated by: FCA, KNF, IFSC, CySEC Crypto: Yes |

Overview

XTB stands out as a global fintech leader with over 20 years of experience and more than 1.6 million clients. It offers a powerful proprietary platform, xStation, and access to a wide range of CFD instruments, stocks, ETFs, and savings products – all within one streamlined app.

Frequently Asked Questions

Is XTB safe and regulated?

Yes, XTB is highly regulated by major authorities including 🇵🇱 KNF, 🇬🇧 FCA, 🇨🇾 CySEC, 🇦🇪 DFSA, and FSC 🇧🇿 Belize. It also features Two-Factor Authentication (2FA), ensuring secure client access across its trading and investment services.

What can I trade or invest in with XTB?

With XTB, you can trade CFDs on currencies, indices, commodities, stocks, and ETFs. You can also invest directly in stocks and ETFs or use Investment Plans to grow your savings passively. Everything is accessible via the intuitive xStation platform.

Our Insights

XTB delivers a comprehensive, award-winning platform that caters to traders and investors globally. Its local presence, strong regulatory framework, and in-house technology make it a top-tier choice for both beginners and experienced users looking for secure, multi-asset exposure.

★★★★ | Minimum Deposit: $0 Regulated by: FCA, KNF, IFSC, CySEC Crypto: Yes |

XTB Video Overview

Get a quick, visual introduction to XTB’s powerful trading platform and services. This video highlights key features, tools, and benefits that make XTB a top choice for traders worldwide. Whether you’re a beginner or experienced, see how XTB simplifies trading across global markets.

★★★★ | Minimum Deposit: $0 Regulated by: FCA, KNF, IFSC, CySEC Crypto: Yes |

Fees, Spreads, and Commissions

XTB keeps its pricing model impressively clear, with no account maintenance or deposit fees, no minimum deposit, and zero commission on CFDs. For stock investing, fees remain competitive. The broker supports instant funding, secure withdrawals, and swap-free trading options for qualifying accounts.

| Feature | Details |

| Minimum Deposit | None |

| Withdrawal Fee (>$50) | Free |

| CFD Commission | 0% |

| Currency Conversion Fee | 0.5% |

Frequently Asked Questions

Is there a minimum deposit required to open an XTB account?

No, XTB does not require a minimum deposit. This flexibility allows traders of all levels to get started at their own pace. Whether you’re a beginner or experienced investor, XTB’s no-barrier entry is designed to be accessible.

What are the withdrawal fees and conditions at XTB?

Withdrawals over $50 are completely free of charge. XTB processes payouts to bank accounts in the client’s name within one business day. While XTB does not charge fees, bank-related charges may still apply based on your provider.

Our Insights

XTB offers one of the most transparent and cost-effective pricing structures in online trading. With zero commissions on CFDs, free account maintenance, and no hidden fees on most services, XTB is built for flexibility and trust, especially appealing to both new and active traders.

★★★★ | Minimum Deposit: $0 Regulated by: FCA, KNF, IFSC, CySEC Crypto: Yes |

How to Open a XTB Account

Applying for a trading account with XTB is quick, secure, and beginner-friendly. Whether you’re new to investing or experienced in the markets, opening an account is as simple as completing a short form and uploading basic verification documents. Here’s a step-by-step guide:

1. Step 1: Fill in the Online Application

Visit XTB’s website and complete the short registration form. You’ll gain immediate access to their platforms while your details are being verified.

2. Step 2: Verify Your Identity

Upload the required documents in your Client Office. Typically, this includes proof of identity (e.g., passport) and a bank statement or utility bill to confirm your address.

3. Step 3: Fund Your Account and Start Trading

Once your application is approved, deposit funds through one of XTB’s secure online payment options.

Now you’re ready to trade across more than 1,500 instruments.

★★★★ | Minimum Deposit: $0 Regulated by: FCA, KNF, IFSC, CySEC Crypto: Yes |

XTB Investment Plans

XTB’s Investment Plans make passive investing easier than ever. With automated contributions, zero-commission investing, and access to over 1,400 ETFs, it’s designed for everyone, from beginners to seasoned savers. Whether you’re saving for retirement, a holiday, or your next gadget, this plan offers a streamlined, affordable solution.

| Feature | Details |

| Minimum Investment | 15 USD or account equivalent |

| Commission-Free Limit | €100,000/month turnover |

| ETFs Available | Over 1,400 |

| Auto-Invest Option | Yes (set amount, period, method) |

Frequently Asked Questions

What is the minimum investment amount for an XTB Investment Plan?

You can start an Investment Plan with as little as 15 USD or the equivalent in your account currency. This low barrier makes it accessible for new investors who want to grow their savings gradually and consistently.

Is there a commission on ETF transactions under the Investment Plan?

XTB offers zero commission for monthly ETF investments up to €100,000. Above that threshold, a 0.2% fee (min. €10) applies. If you’re investing in foreign ETFs, a 0.5% currency conversion fee may be charged.

Our Insights

XTB’s Investment Plans are ideal for goal-based investors who value automation, simplicity, and affordability. With no high entry barriers and the ability to start with just 15 USD, users can invest regularly in ETFs with minimal fees and full transparency. It’s flexible, scalable, and easy to manage.

★★★★ | Minimum Deposit: $0 Regulated by: FCA, KNF, IFSC, CySEC Crypto: Yes |

Trading Platform and Tools

XTB’s modern trading platform brings together 6,000+ global instruments, real-time market updates, and powerful tools, all in a sleek, intuitive interface. From stop-loss to sentiment analysis, it’s designed to help you invest confidently and stay ahead in ever-changing markets.

| Feature | Details |

| Instruments Available | 6,000+ Stocks, ETFs, CFDs |

| Platform Access | Desktop iOS Android |

| Risk Tools | Stop Loss Take Profit Sentiment |

| Language Support | English Dedicated Support Channels |

Frequently Asked Questions

Can I access the XTB platform on mobile devices?

Yes. The XTB platform is fully compatible with iOS and Android, allowing you to invest, monitor, and manage your portfolio on the go. Whether on desktop or mobile, you get full access to features, tools, and market insights.

Does the platform offer educational resources for beginners?

Absolutely. XTB provides hundreds of hours of educational content, including courses, tutorials, and market insights. Whether you’re a beginner or an experienced trader, you can learn and grow directly within the platform.

Our Insights

XTB’s trading platform combines power with simplicity, offering 6,000+ instruments, seamless mobile access, and smart risk tools. It’s ideal for traders who want an efficient, all-in-one solution to stay informed, invest with ease, and manage positions confidently.

★★★★ | Minimum Deposit: $0 Regulated by: FCA, KNF, IFSC, CySEC Crypto: Yes |

Affiliate Program

XTB’s affiliate program offers more than commissions – it’s a gateway for financial content creators, influencers, and trading educators to grow their brands while monetizing their audience. With 10,000+ instruments, multilingual sales support, and flexible payment plans, it’s built for real results.

| Feature | Details |

| Commission Type | CPA Spreadshare |

| Max CPA | Up to $600 |

| Required Min Deposit | $400 |

| Client Qualification | Based on region instrument traded |

Frequently Asked Questions

Who can join the XTB affiliate program?

Anyone with a finance-related audience, trading educators, influencers, financial portals, or social media pages, can join. Whether you’re a blogger or run a large platform, XTB provides tools and multilingual support to help you convert traffic into revenue.

What is the CPA payment structure?

The CPA (Cost Per Acquisition) structure varies by country group and asset type. You can earn up to $600 per referral if they meet criteria like a minimum $400 deposit and trade FX, commodities, or indices. Crypto and Stocks/ETFs have different rates.

Our Insights

XTB’s partnership program is a high-conversion opportunity for finance-focused content creators and marketers. With up to $600 CPA, advanced tracking tools, and a multilingual support team, affiliates can scale their income while providing access to a world-class broker.

★★★★ | Minimum Deposit: $0 Regulated by: FCA, KNF, IFSC, CySEC Crypto: Yes |

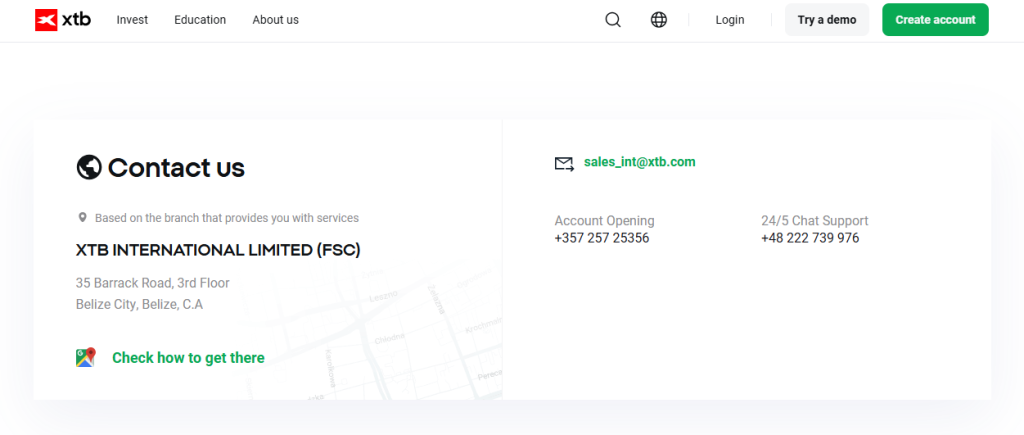

Global Support, Local Presence

XTB offers professional, multilingual customer support from offices around the world. Whether you’re opening an account, need trading help, or want to connect with a regional representative, XTB’s dedicated support lines and global network ensure help is just a call or click away.

Frequently Asked Questions

Which XTB branch handles international clients?

International clients are served by 🇧🇿 XTB International Limited, based in Belize. For inquiries, use [email protected], or call the account opening line at +357 257 25356 for immediate assistance.

Is support available in multiple languages?

Yes, XTB offers multilingual support across more than a dozen countries, including 🇵🇱 Poland, 🇩🇪 Germany, 🇫🇷 France, 🇪🇸 Spain, 🇵🇹 Portugal, 🇹🇭 Thailand, 🇻🇳 Vietnam, and 🇦🇪 UAE. Regional offices provide support in your native language where available.

Our Insights

XTB provides a robust customer service infrastructure, making it easy for clients to get answers fast. With dedicated account lines, 24/5 chat support, and branches in multiple countries, you’re never far from help when you need it most.

★★★★ | Minimum Deposit: $0 Regulated by: FCA, KNF, IFSC, CySEC Crypto: Yes |

Insights from Real Traders

⭐⭐⭐⭐

I’ve been using XTB for a few months now, and I couldn’t be happier. The platform is incredibly easy to navigate, even for someone like me who’s new to trading. I love the variety of assets available, and the real-time market data and daily news keep me well informed. – Michael

⭐⭐⭐⭐⭐

As an experienced trader, I’ve used many platforms, but none have matched XTB’s customer service. The support team is always quick to respond and very helpful, whether it’s a technical issue or a question about a trade. – James

⭐⭐⭐⭐

XTB’s platform has everything I need to succeed. The variety of tools, such as the Investment Plans and the position management features, allows me to control my investments with ease. I especially love the market sentiment indicators and the investment calculator—these tools help me make informed decisions. – Emily

★★★★ | Minimum Deposit: $0 Regulated by: FCA, KNF, IFSC, CySEC Crypto: Yes |

Customer Reviews and Trust Scores

XTB enjoys a solid reputation among retail traders, driven by its responsive support and user-friendly trading platform. Independent ratings confirm that most users are satisfied, although a few issues, such as withdrawal processing delays, are noted.

| Review Source | Score | Key Feedback |

| Trustpilot | 4.0/5 (1,984 reviews) | Excellent support, smooth platform use; occasional withdrawal delays |

Overall, XTB is considered trustworthy and easy to use, especially for beginner and intermediate-level traders. It performs well in key categories like client support and platform execution.

★★★★ | Minimum Deposit: $0 Regulated by: FCA, KNF, IFSC, CySEC Crypto: Yes |

Employee Insights: Working at XTB

XTB employees often describe the work culture as modern, collaborative, and supportive. The company offers good career growth opportunities, though some mention internal complexity in operations and processes.

| Review Source | Rating | Highlights |

| Glassdoor | 3.7/3.8 | Positive culture, international team, decent work-life balance |

| GetApp | 4.5 | Efficient platform tools, helpful tech team, some backend complexity |

Employees appear to enjoy working at XTB overall. The firm is praised for being structured and responsive to feedback, with space for professional development and innovation.

★★★★ | Minimum Deposit: $0 Regulated by: FCA, KNF, IFSC, CySEC Crypto: Yes |

Discussions and Forums: What Traders Are Saying

Conversations across trading forums and Reddit threads reflect mixed opinions. Many appreciate XTB’s asset range and ease of use, but there are concerns around CFD transparency, stop-loss execution, and withdrawal timelines.

| Platform | Sentiment | Common Topics |

| Mixed | CFD vs real stocks, platform transparency, fees |

|

| Forex Peace Army | Cautionary | Withdrawal delays, order execution issues |

| ForexFactory | Neutral | Broker comparisons, platform trustworthiness |

Community feedback shows that traders like XTB’s user interface and product variety. However, some demand better communication, especially regarding withdrawals and understanding CFD mechanics.

★★★★ | Minimum Deposit: $0 Regulated by: FCA, KNF, IFSC, CySEC Crypto: Yes |

Pros and Cons

| ✓ Pros | ✕ Cons |

| Negative balance protection | Limited managed account options |

| Islamic (swap-free) accounts available | Support response times may vary |

| Strong educational resources | VPS hosting for specific accounts only |

| Demo account available | Complex fee structure |

| Good customer support | Margin requirements can be high |

| No withdrawal fees | May have complex fee structure |

References:

In Conclusion

XTB is widely trusted and delivers a strong platform experience for both users and employees. It’s a robust broker with high potential for long-term reliability. XTB operates local offices and offers customer support in numerous countries across Europe, the Middle East, Latin America, and Asia-Pacific, allowing clients to receive tailored assistance in their region.

- 🇧🇿 Belize

- 🇧🇷 Brazil

- 🇨🇿 Czech Republic

- 🇨🇾 Cyprus

- 🇩🇪 Germany

- 🇪🇸 Spain

- 🇫🇷 France

- 🇭🇺 Hungary

- 🇮🇹 Italy

- 🇵🇱 Poland

- 🇵🇹 Portugal

- 🇷🇴 Romania

- 🇸🇰 Slovakia

- 🇬🇧 United Kingdom

- 🇦🇪 United Arab Emirates

- 🇹🇷 Turkey

- 🇨🇱 Chile

- 🇨🇴 Colombia

- 🇲🇽 Mexico

- 🇦🇷 Argentina

- 🇵🇪 Peru

- 🇮🇩 Indonesia

- 🇿🇦 South Africa

XTB maintains local offices and customer service channels in these locations, backed by regulatory oversight and 24/5 support, to ensure responsive, region-specific client engagement.

Faq

You can easily open an account through their website or app by completing a registration form.

XTB charges fees on certain services, but it offers competitive pricing and often runs promotions, such as zero-commission investing.

XTB offers an extensive library of educational materials, including articles and videos.

Yes, XTB adheres to strict regulatory standards and employs advanced cybersecurity measures.

XTB provides customer support in 18 languages via email, chat, and phone.

- Overview

- XTB Video Overview

- Fees, Spreads, and Commissions

- How to Open a XTB Account

- XTB Investment Plans

- Trading Platform and Tools

- Affiliate Program

- Global Support, Local Presence

- Insights from Real Traders

- Customer Reviews and Trust Scores

- Employee Insights: Working at XTB

- Discussions and Forums: What Traders Are Saying

- Pros and Cons

- In Conclusion