We have listed the 5 Best FTSE 250 Brokers for trading leading UK mid-cap stocks across diverse industries. These brokers provide competitive fees, strong regulatory protection, and user-friendly platforms, ensuring both beginners and experienced traders can efficiently access and trade FTSE 250 companies with confidence.

5 Best FTSE 250 Brokers (2026)

- Plus500 – Overall, The Best FTSE 250 Broker

- IG – Robust educational resources

- Saxo Bank – Award-winning trading platforms

- CMC Markets – Dedicated client support

- City Index – user-friendly proprietary WebTrader platform

Top 10 Forex Brokers (Globally)

1. Plus500

| Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC Crypto: Yes | |

Plus500 is a regulated online broker that offers access to FTSE 250 trading through CFDs. It provides a user-friendly platform, competitive spreads, and risk management tools, making it suitable for beginners and experienced traders interested in UK mid-cap stocks.

Frequently Asked Questions

Can I trade FTSE 250 with Plus500?

Yes, you can trade the FTSE 250 with Plus500. It is one of the many global indices available as a CFD on their platform, allowing you to speculate on the price movements of the UK’s top 250 mid-cap companies.

Does Plus500 charge commissions on FTSE 250 trades?

No, Plus500 doesn’t charge commissions on FTSE 250 trades. Instead, it makes money through the spread, which is the difference between the bid and ask price. This spread is a single cost included in the price of the trade.

| Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC Crypto: Yes | |

Pros and Cons

Final Score

Our Insights

Plus500 is an authorized broker offering access to FTSE 250 trading through CFDs. With competitive spreads and a beginner-friendly platform, it provides a secure environment, though its focus on CFDs may limit advanced trading needs.

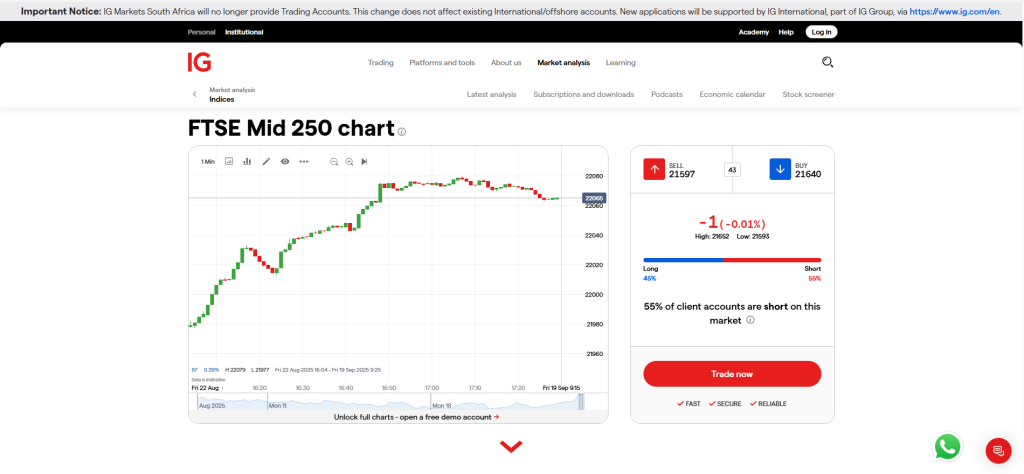

2. IG

| Minimum Deposit: $250 Regulated by: FCA, ASIC, CFTC, NFA, BaFin Crypto: Yes | |

IG is a trusted and regulated broker that offers access to FTSE 250 trading through shares and CFDs. With competitive pricing, advanced platforms, and educational resources, IG provides both beginners and professionals efficient exposure to UK mid-cap stocks.

Frequently Asked Questions

Is IG a legit broker?

Yes, IG is a highly legitimate and well-established broker. It is a publicly traded company and is regulated by multiple top-tier financial authorities globally, including the FCA in the UK, ASIC in Australia, and the CFTC in the US.

Does IG provide tools for FTSE 250 trading?

Yes, IG offers numerous tools for trading the FTSE 250, including a powerful proprietary platform with advanced charts, over 28 technical indicators, trading signals, and customizable alerts to help you analyze and act on market movements.

| Minimum Deposit: $250 Regulated by: FCA, ASIC, CFTC, NFA, BaFin Crypto: Yes | |

Pros and Cons

Final Score

Our Insights

IG is a legit broker offering FTSE 250 trading through shares and CFDs, backed by strong regulation, advanced platforms, and research tools. It’s a reliable choice, though beginners may find its features slightly complex at first.

3. Saxo Bank

| Minimum Deposit: $0 Regulated by: FSA, FCA Crypto: Yes | |

Saxo Bank is a regulated broker offering multiple ways to trade the FTSE 250, including shares, CFDs, and ETFs. It provides advanced platforms, competitive pricing, and robust research tools, making it a strong choice for trading UK mid-cap stocks.

Frequently Asked Questions

Does Saxo Bank provide tools for FTSE 250 traders?

Yes, Saxo Bank offers comprehensive tools for trading the FTSE 250. This includes advanced charting with over 40 technical indicators, fundamental analysis tools, and expert market research to help you make informed decisions.

Is Saxo Bank a legal broker?

Yes, Saxo Bank is a legal and highly reputable broker. It is a licensed European bank regulated by top-tier financial authorities in multiple jurisdictions, including the Danish FSA, UK’s FCA, and ASIC in Australia.

| Minimum Deposit: $0 Regulated by: FSA, FCA Crypto: Yes | |

Pros and Cons

Final Score

Our Insights

Saxo Bank is a legal broker providing FTSE 250 access through shares, CFDs, and ETFs. With professional tools and strong regulation, it suits advanced traders, though beginners may find its requirements and platforms demanding.

Top 3 FTSE 250 Brokers – Plus500 vs IG vs Saxo Bank

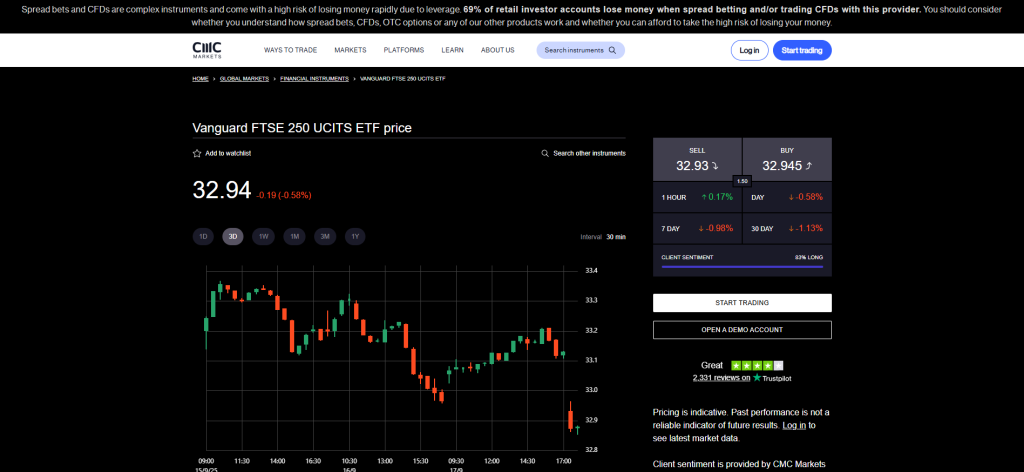

4. CMC Markets

| Minimum Deposit: $0 Regulated by: BaFin, FCA, ASIC, MAS, FMA, IIROC, DFSA Crypto: Yes | |

CMC Markets is a regulated broker offering access to FTSE 250 trading through CFDs and spread betting. It features competitive spreads, advanced trading platforms, and comprehensive market analysis tools, catering effectively to both beginner and professional UK mid-cap stock traders.

Frequently Asked Questions

Can I trade FTSE 250 with CMC Markets?

Yes, CMC Markets allows you to trade the FTSE 250 through CFDs and spread betting. This provides exposure to UK mid-cap companies without owning the underlying assets, and you can go long or short on the index.

Is CMC Markets a legal broker?

Yes, CMC Markets is a legitimate and highly-regulated broker. It is a publicly-traded company listed on the London Stock Exchange and holds licenses from top-tier authorities like the FCA in the UK and ASIC in Australia.

| Minimum Deposit: $0 Regulated by: BaFin, FCA, ASIC, MAS, FMA, IIROC, DFSA Crypto: Yes | |

Pros and Cons

Final Score

Our Insights

CMC Markets is a legal broker offering FTSE 250 trading via CFDs and spread betting. With advanced platforms, tight spreads, and research tools, it suits active traders, though beginners may face challenges navigating its complexity.

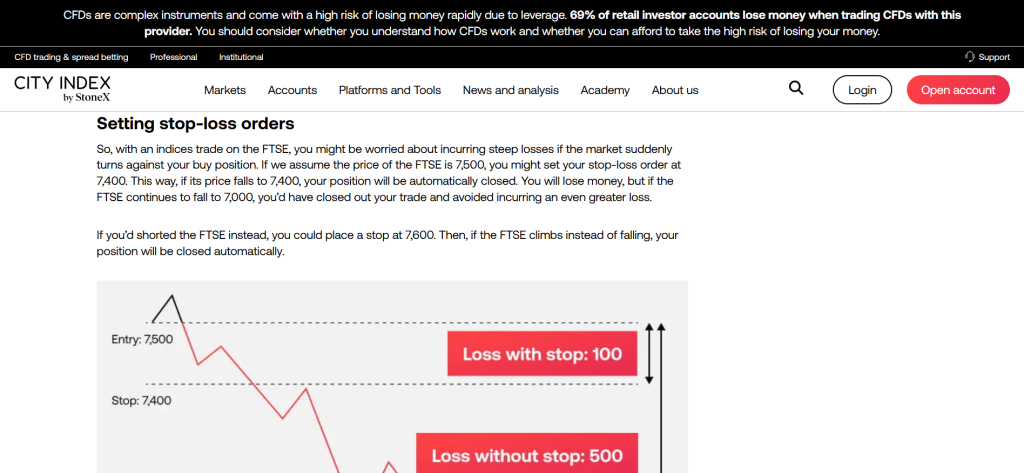

5. City Index

| Minimum Deposit: $150 Regulated by: CIRO, CySEC, NFA, CFTC, CIMA, FCA, SFC, FSA, MAS, ASIC Crypto: No | |

City Index is a regulated broker where you can trade the FTSE 250 via CFDs and spread betting. It’s known for its competitive pricing, reliable platforms, and solid research tools, making it a secure choice for accessing UK mid-cap stocks.

Frequently Asked Questions

Is City Index a registered broker?

Yes, City Index is a highly regulated and registered broker. It holds licenses from multiple top-tier financial authorities, including the FCA in the UK, ASIC in Australia, and MAS in Singapore.

Does City Index provide tools for FTSE 250 trading?

Yes, City Index provides numerous tools for FTSE 250 trading. These include advanced charting with over 80 indicators, a research portal with real-time trade ideas, and an economic calendar to track market-moving events.

| Minimum Deposit: $150 Regulated by: CIRO, CySEC, NFA, CFTC, CIMA, FCA, SFC, FSA, MAS, ASIC Crypto: No | |

Pros and Cons

Final Score

Our Insights

City Index is a registered broker offering FTSE 250 trading through CFDs and spread betting. With secure regulation, competitive pricing, and research tools, it provides reliable access for traders, though beginners may prefer simpler platforms.

What is a FTSE 250 Broker?

A FTSE 250 broker is a financial services provider that gives traders and investors access to buy, sell, or trade shares and derivatives linked to the FTSE 250 index. The FTSE 250 represents the 101st to 350th largest companies listed on the London Stock Exchange, often referred to as UK mid-cap stocks.

These brokers may offer different ways to trade the FTSE 250, including:

- Direct share dealing (owning the actual shares)

- CFDs (Contracts for Difference)

- Spread betting

- ETFs or index funds

A good FTSE 250 broker is usually regulated, reliable, and provides competitive fees, trading platforms, research tools, and market access, making it easier for traders to participate in this important part of the UK stock market.

Criteria for Choosing a FTSE 250 Broker

Top 5 Best FTSE 250 Brokers – A Direct Comparison

What Real Traders Want to Know!

Explore the Top Questions asked by real traders across the Globe. From minimum deposits to beginners, we provide straightforward answers to help you understand FTSE 250 and choose the right broker confidently.

Q: Can I trade the FTSE 250 index with CFDs on most brokers? – Sarah M.

A: Yes, most reputable CFD brokers offer the FTSE 250 as a tradable index. It’s a popular choice, alongside major indices like the FTSE 100 and S&P 500, allowing you to speculate on the performance of UK’s mid-cap companies.

Q: Are there commission fees when trading FTSE 250 CFDs? – David L.

A: Commission fees on trading FTSE 250 CFDs are not standard across all brokers. Most brokers, like Plus500, CMC Markets, and IG, use a spread-only model for index CFDs, meaning the cost is built into the bid/ask price. Others may charge a small commission.

Q: Can beginner traders efficiently use FTSE 250 brokers? – Oliva W.

A: Yes, beginners can efficiently use FTSE 250 brokers, but it requires caution. Many reputable brokers offer user-friendly platforms, educational resources, and demo accounts that help new traders learn to manage risk before using real funds.

Q: What is the minimum deposit for trading FTSE 250 on popular brokers? – Mark S.

A: The minimum deposit for FTSE 250 trading varies. Some brokers, like CMC Markets and City Index, have no official minimum, but a recommended deposit of around £100-£250 is needed to place a trade. Others, like IG, require a minimum deposit of £250.

Q: Are there spread betting options for FTSE 250? – Chloe K.

A: Yes, many regulated brokers offer spread betting on the FTSE 250. Popular UK brokers like CMC Markets, IG, and City Index provide this tax-efficient way to speculate on the index’s price movements.

Pros and Cons

In Conclusion

Reputable FTSE 250 brokers provide leveraged access to the index through CFDs and spread betting. They offer a secure environment with professional tools, making them a solid choice for speculating on UK mid-cap companies.

You Might also Like: