10 Best Managed Forex Accounts

We have highlighted the 10 Best Managed Forex Accounts that offer hands-free trading solutions for investors seeking professional management of their capital. These accounts provide transparent performance reporting, reputable oversight, and strategic risk management, ensuring that both beginners and experienced traders can benefit from expert-driven Forex trading with greater confidence and convenience.

10 Best Managed Forex Accounts (2026)

- MultiBank Group – Overall, The Best Managed Forex Account

- FP Markets – Competitive pricing with tight spreads

- AvaTrade – Unique AvaProtect risk management tool

- Pepperstone – Strong multi-jurisdictional regulation

- FxPro – Emphasizes security and provides various educational resources

- Swissquote – Exceptionally fast trade execution

- BlackBull Markets – No minimum deposit policy

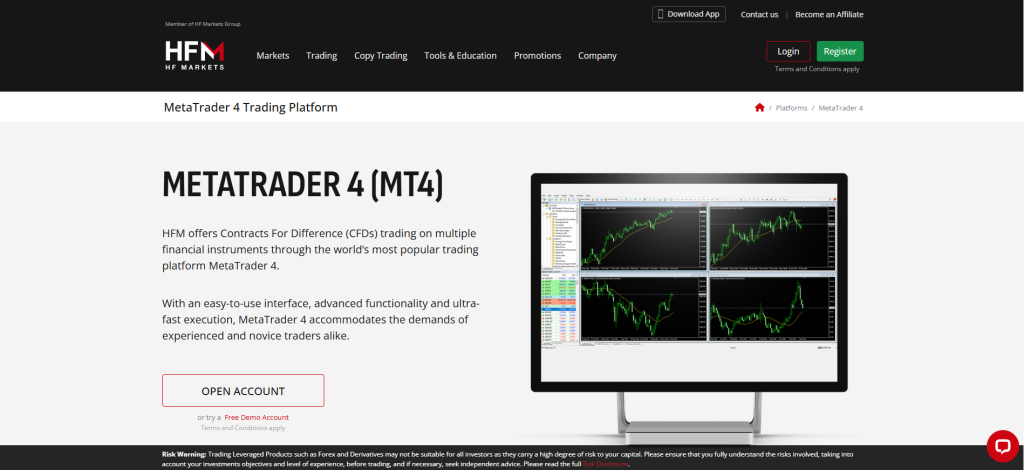

- HFM – Competitive trading conditions with low spreads

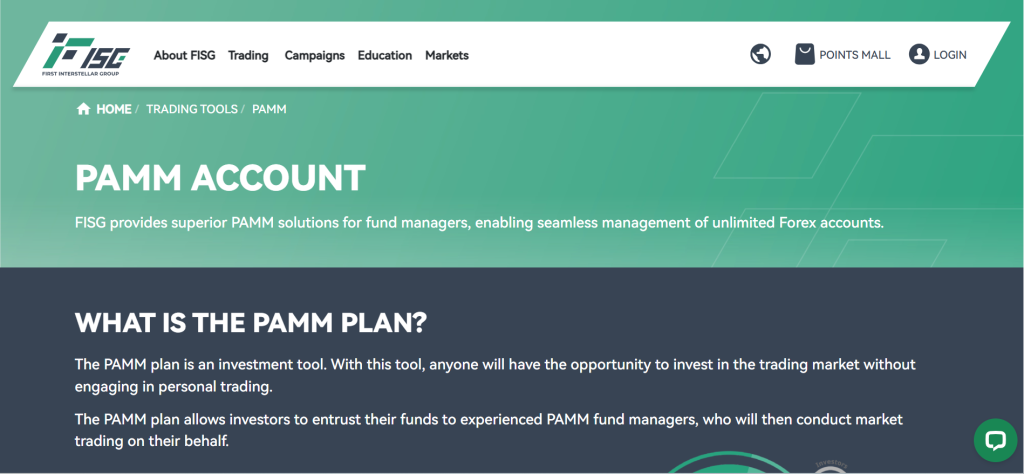

- FISG – Strong regulatory compliance

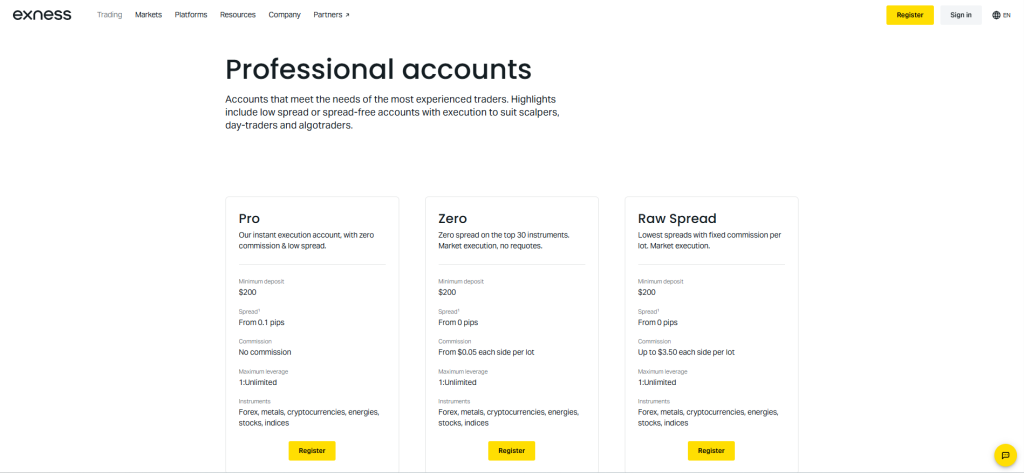

- Exness – Stable and tight spreads, flexible leverage

Top 10 Forex Brokers (Globally)

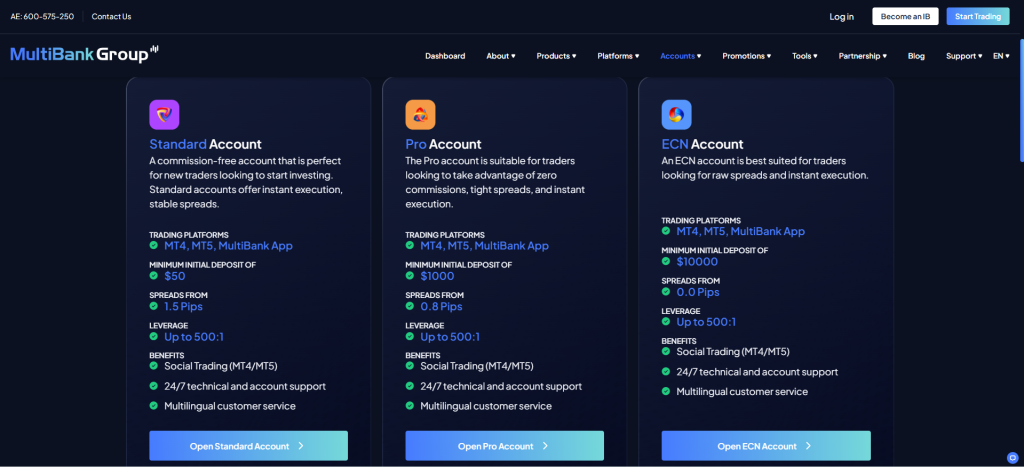

1. MultiBank Group

MultiBank Group offers access to some of the best managed forex account solutions, providing investors with professionally managed trading options through transparent performance monitoring, diversified strategies, and regulated account structures. This makes MultiBank Group a suitable choice for users seeking hands-free Forex investing supported by experienced portfolio managers.

Frequently Asked Questions

What is the minimum deposit for a managed account with MultiBank Group?

MultiBank Group offers MAM/PAMM managed accounts, and while the minimum deposit to open a standard account is $50, the specific minimum required to invest in a managed portfolio is set by the money manager you choose, and is often higher.

Can beginners use MultiBank Group managed accounts?

While MultiBank Group offers MAM/PAMM accounts, beginners should be cautious. Managed accounts shift trading risk to the money manager. While convenient, the high leverage and CFD focus of the broker mean that this product carries significant risk for new investors.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and regulated across multiple jurisdictions | Managed accounts often require higher minimum deposits |

| Access to professionally managed Forex strategies | Performance depends on the manager’s skill and market conditions |

| Transparent performance monitoring tools | Limited control over individual trade decisions |

| Diverse risk-adjusted trading approaches | Possible management and performance fees |

| Suitable for beginners seeking hands-free trading | Not ideal for traders who prefer active participation |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

MultiBank Group’s authorized managed forex accounts offer investors a convenient, professionally run trading solution with structured strategies and transparent oversight. While minimum deposits and fees may apply, they provide an accessible hands-free option for both beginners and experienced traders.

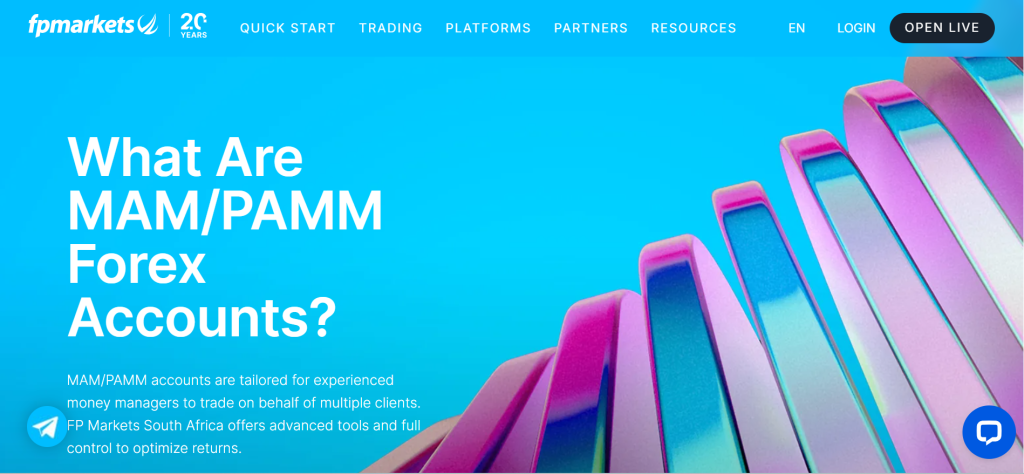

2. FP Markets

FP Markets provides leading managed forex account options, featuring professional traders, transparent reporting, and regulated oversight. This offers investors a reliable, hands-free way to access diversified strategies with strong risk controls.

Frequently Asked Questions

Is FP Markets a legit provider of managed Forex accounts?

Yes, FP Markets is considered a legitimate and reliable provider. They are multi-regulated (ASIC, CySEC, FSCA) and offer transparent MAM/PAMM managed accounts. This strong regulatory framework and long industry track record (since 2005) make them a trusted choice.

What types of managed accounts does FP Markets offer?

FP Markets primarily offers two types of managed accounts: MAM (Multi-Account Manager) and PAMM (Percent Allocation Management Module). These options allow investors to leverage the expertise of professional money managers who trade funds on their behalf.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and strongly regulated global broker | Minimum deposits may be higher for managed accounts |

| Access to professional MAM/PAMM managers | Results depend on the manager’s performance |

| Transparent performance monitoring | Investors have limited control over trades |

| Competitive spreads and fast execution | Management or performance fees may apply |

| Suitable for hands-free Forex investing | Not ideal for active, self-directed traders |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms, and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

FP Markets offers legit managed Forex account solutions backed by strong regulation, expert managers, and transparent performance tracking. While fees and minimum deposits may vary, these accounts provide an accessible, hands-free trading option for new and experienced investors.

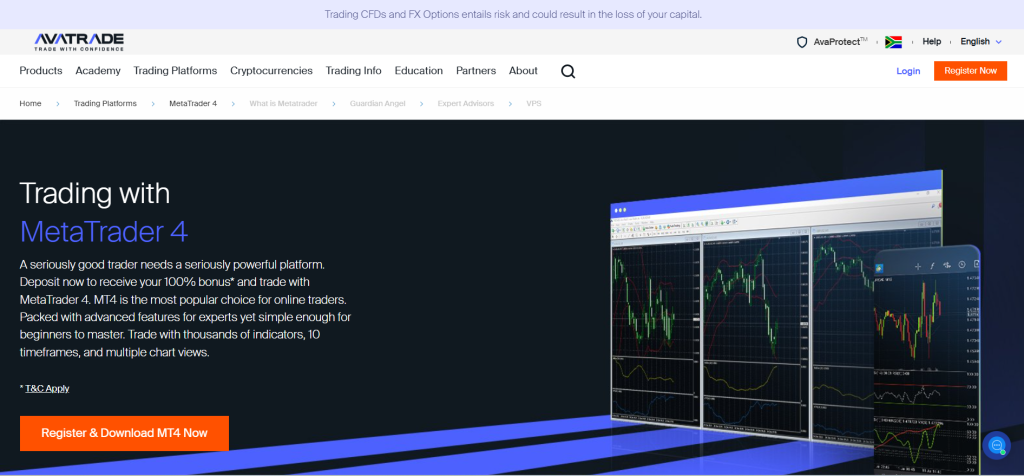

3. AvaTrade

AvaTrade offers competitive managed forex options through MT4 MAM accounts and various copy-trading platforms like AvaSocial, DupliTrade, and ZuluTrade. These services allow for automated, professionally managed trading strategies. The broker is well-regulated, making its managed accounts a credible choice for investors seeking expert-managed Forex exposure.

Frequently Asked Questions

What managed account solutions does AvaTrade offer?

AvaTrade offers MT4 MAM (Multi-Account Manager) accounts for fund managers. They also provide comprehensive copy-trading solutions through integrated platforms like AvaSocial and DupliTrade, which automate the replication of expert traders’ strategies.

Are managed accounts suitable for new traders?

Managed accounts can suit new traders as they are hands-free. However, beginners must be aware of the high risk and leverage associated with Forex trading. They are best for investors with capital who understand the potential for loss.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Fully legal and globally regulated broker | Managed accounts may require higher deposits |

| Offers MAM and various copy-trading platforms | Performance depends on selected managers |

| Transparent performance tracking | Limited control over individual trades |

| User-friendly tools for passive investing | Some copy-trading services may charge fees |

| Suitable for beginners seeking managed solutions | Not ideal for active or manual traders |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

AvaTrade offers regulated managed Forex accounts supported by expert traders and transparent oversight. These accounts provide beginners and passive investors with a convenient way to access professional Forex trading strategies, although fees and performance may vary.

Top 3 Best Managed Forex Account – MultiBank Group vs FP Markets vs AvaTrade

4. Pepperstone

Pepperstone provides reliable MAM (Multi-Account Manager) and PAMM solutions through MetaTrader 4. These managed accounts support EA trading and offer diverse allocation methods for fund managers. The strong regulation by the ASIC and FCA significantly boosts credibility. This makes the broker a highly reliable choice for hands-off, professionally managed Forex investing with added security.

Frequently Asked Questions

What managed account solutions does Pepperstone offer?

Pepperstone provides reliable MAM (Multi-Account Manager) and PAMM solutions through MetaTrader 4. These managed accounts support EA trading and offer diverse allocation methods for fund managers.

Is Pepperstone suitable for passive Forex investors?

Yes, Pepperstone is suitable for passive investors through its MAM/PAMM managed account solutions and Copy Trading offerings. These features allow you to automatically replicate strategies of experienced traders without having to trade actively yourself.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and regulated under top tier authorities | Managed accounts may require higher deposits |

| Offers MAM/PAMM managed account structures | Results depend on the performance of selected managers |

| Fast execution with low spreads | Limited direct control over trades |

| Supports algorithmic and professional trading strategies | Management or performance fees apply |

| Transparent reporting and allocation methods | No built-in copy trading platform |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Pepperstone’s approved managed Forex accounts offer professional management with strong regulatory oversight and fast execution. This provides a reliable, hands-free solution for both new and experienced investors.

5. FxPro

FxPro offers compelling managed Forex account options, including a PAMM (Percentage Allocation Money Management) system and MAM through MetaTrader’s multi-terminal. With strong regulation (FCA, CySEC, etc.) and flexible allocation methods, FxPro is an attractive choice for investors looking for professionally managed Forex exposure.

Frequently Asked Questions

What managed account options does FxPro offer?

FxPro offers PAMM (Percentage Allocation Management Module) accounts for investors seeking passive income by pooling funds with a professional manager. While they focus on the PAMM structure, Copy Trading may also be available via cTrader, depending on the region.

Are FxPro’s managed accounts suitable for beginners?

FxPro’s managed accounts can be suitable for passive beginners who want hands-off investing. However, given the high leverage in Forex and the risk of capital loss, new traders must fully understand the inherent risk involved.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Registered and regulated across multiple top-tier jurisdictions | Higher minimum deposits may apply |

| Offers PAMM and MAM account structures | Performance depends on the selected manager’s skill |

| Strong platform support (MT4, MT5, cTrader) | Limited control over individual trades |

| Transparent allocation and performance monitoring | Manager or performance fees may vary |

| Suitable for passive investors seeking expert management | No built-in social copy-trading platform |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

FxPro offers regulated managed Forex accounts that provide expert trading oversight with flexible allocation options. These accounts deliver a reliable, hands-free investing experience for both beginners and experienced investors, though fees and results depend on the individual manager.

6. Swissquote

Swissquote offers advanced managed Forex account solutions, including MAM, LAMM, and PAMM systems for professional money managers. This broker is ideal for investors seeking expertly allocated Forex exposure.

Its deep liquidity pools and institutional infrastructure, backed by a highly regulated Swiss banking group, ensure top-tier service.

Frequently Asked Questions

Is Swissquote authorized to offer managed Forex accounts?

Yes, as a highly regulated Swiss banking group, Swissquote is authorized to offer professional account services, including Expert Advisors (EAs) and Portfolio Management tools like their Smart Portfolios, which provide professionally managed, diversified investment exposure.

What managed account options does Swissquote provide?

Swissquote offers Smart Portfolios and Invest Easy (auto-rebalanced, professionally managed portfolios, often in partnership with BlackRock). They also provide MAM, LAMM, and PAMM systems for professional money managers to trade on behalf of clients.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Fully authorized Swiss banking group | Higher minimum deposits may apply |

| Offers MAM, PAMM, and LAMM systems | Designed more for professional or high net-worth investors |

| High-level security and deep liquidity | Limited control over trade execution |

| Strong institutional grade infrastructure | Management and performance fees may vary |

| Transparent performance and reporting tools | Complex tools may overwhelm beginners |

Final Score

| # | Criteria | Score |

| 1. | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2. | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3. | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4. | Research and Education | ⭐⭐⭐⭐☆ |

| 5. | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6. | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7. | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8. | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9. | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10. | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Swissquote’s authorized managed accounts provide institutional-grade tools and expert fund allocation. Backed by strong regulation, they offer a secure, professional environment for long-term, hands-off Forex investing.

7. BlackBull Markets

BlackBull Markets offers competitive managed Forex via a robust MT4 MAM (Multi-Account Manager) solution. This enables professional traders to efficiently manage multiple client accounts from a single terminal.

With strong execution infrastructure and seamless allocation methods (equity, balance, or percentage), BlackBull is ideal for investors seeking expert-led, hands-off Forex management.

Frequently Asked Questions

What type of managed accounts does BlackBull Markets offer?

BlackBull Markets primarily offers the MT4 MAM (Multi-Account Manager) solution. This system allows professional fund managers to efficiently manage multiple client accounts and allocate trades from a single trading terminal.

Can beginners use BlackBull Markets’ managed account services?

BlackBull Markets’ MAM accounts can be suitable for passive beginners who seek expert management. However, due to the high leverage in Forex, new traders must fully understand and accept the significant risk of capital loss.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and regulated international broker | Minimum deposits may be higher for managed accounts |

| Offers MT4 MAM for professional management | Performance varies by selected manager |

| Flexible allocation methods (equity, balance, percentage) | Limited control over trades |

| Fast execution and deep liquidity | Manager or performance fees may apply |

| Suitable for passive Forex investors | No built-in social or copy-trading platform |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

BlackBull Markets offers legitimate managed Forex accounts with professional management, fast execution, and flexible allocation tools. Though investor control is limited and fees vary, it provides a reliable, hands-free option for both beginners and experienced traders seeking expert management.

8. HFM

HFM offers reputable managed Forex account solutions, featuring a PAMM (Percent Allocation Management Module) program where experienced traders manage pooled funds via MetaTrader. With flexible options for both risk management and the fee structure, this system is a strong contender.

It offers transparent performance tracking for professionally managed Forex exposure.

Frequently Asked Questions

Is HFM’s managed Forex account service legal?

Yes, HFM is a globally regulated broker with licenses from authorities like the FCA, CySEC, and FSCA. They legally offer managed investment solutions like PAMM and Copy Trading under the terms and conditions of their licensed entities.

Are HFM’s managed accounts suitable for beginners?

HFM’s Copy Trading is generally suitable for beginners as a passive investment. Their PAMM accounts are also an option, but new traders must acknowledge the high risk and leverage associated with Forex before investing capital.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legal and regulated global broker | Performance depends on chosen manager |

| Offers a transparent PAMM investment structure | Limited control over trading decisions |

| Easy performance tracking for investors | Minimum deposits may apply for PAMM investing |

| Managed by experienced professional traders | Potential performance or management fees |

| Flexible risk and fee settings | No MAM option, PAMM only |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

HFM offers regulated PAMM managed Forex accounts with professional traders and transparent performance reporting. Despite limited control and varying fees, it provides beginners and passive investors an accessible, hands-free way to engage in Forex trading confidently.

9. FISG

FISG (First InterStellar Group) offers regulated managed Forex accounts with copy-trading and MAM/PAMM allocation via MetaTrader platforms. Regulated by CySEC and FSA, it provides robust oversight, advanced technology, and transparent performance tracking for investors.

Frequently Asked Questions

Is FISG an approved provider of managed Forex accounts?

Yes, FISG is an approved and regulated broker offering managed-style solutions through copy-trading and MAM/PAMM-type allocation systems.

Are FISG’s managed accounts suitable for beginners?

Yes, beginners can benefit because approved professionals execute trades on their behalf while investors maintain full account transparency.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and regulated by reputable authorities | Performance varies based on manager selection |

| Offers copy-trading and MAM/PAMM-style allocation | Limited control over trading decisions |

| Transparent performance monitoring | Minimum deposits may apply |

| Supports MT4/MT5 platforms | Fees or profit-share structures can differ |

| Suitable for passive Forex investors | Fewer manager options compared to larger brokers |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms, and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Options | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Market Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

FISG provides approved managed Forex account solutions through copy-trading and multi-account allocation tools, delivering professional oversight and transparency. While performance varies by manager, it offers a reliable hands-free trading option for both beginners and experienced investors.

10. Exness

Exness provides managed-style Forex exposure through its Portfolio Management and Copy Trading services, enabling investors to allocate funds to strategy providers or portfolio managers for automated, hands-free trading with flexible control over investments.

Exness supports both MT4 and MT5 accounts, offering real-time performance tracking and advanced trading tools, making it a strong choice for hands-off, professionally managed Forex investing with flexible platform options.

Frequently Asked Questions

Is Exness a registered provider of managed-style Forex services?

Yes, Exness is a registered and regulated broker offering managed-style Forex features through portfolio management and copy-trading platforms.

What managed account options does Exness provide?

Exness offers Portfolio Management, Copy Trading, and strategy-provider systems that allow investors to follow professional traders and allocate funds automatically.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Registered and regulated | Performance varies by strategy provider |

| Offers copy trading and portfolio management options | Limited control over trade decisions |

| Real-time performance tracking tools | Some strategies charge performance fees |

| Supports MT4 and MT5 accounts | Not a traditional MAM/PAMM structure for all regions |

| Flexible risk controls for investors | High-risk strategies may appear alongside safer ones |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐☆☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Exness delivers registered managed Forex solutions via copy trading and portfolio management, ensuring transparency, platform versatility, and expert supervision. Though control is limited and performance varies, it offers beginners and advanced investors a convenient, hands-off trading alternative.

What are Managed Forex Accounts?

Managed Forex Accounts are investment accounts where a professional trader or money manager trades on behalf of the investor.

The investor deposits funds into their own trading account, grants trading authorization (not withdrawal access), and the manager executes trades using agreed strategies. Profits and losses are reflected directly in the investor’s account, and managers typically earn a fee or performance-based share.

These accounts are designed for individuals who want exposure to Forex markets without trading themselves, offering a hands-free approach managed by experienced professionals.

Criteria for Choosing Managed Forex Accounts

| Criteria | Description | Importance |

| Regulation & Broker Reputation | Ensures the broker and money manager operate under strict financial oversight. | ⭐⭐⭐⭐⭐ |

| Manager Track Record | Reviews the manager’s historical performance, risk levels, and consistency. | ⭐⭐⭐⭐⭐ |

| Fee Structure | Includes management fees, performance fees, and any hidden costs. | ⭐⭐⭐⭐☆ |

| Trading Strategy Transparency | Clarity on the approach used (scalping, swing, automated, etc.). | ⭐⭐⭐⭐☆ |

| Risk Management Practices | Measures like stop loss, diversification, and risk controls. | ⭐⭐⭐⭐⭐ |

| Minimum Deposit Requirements | The amount required to start investing in a managed account. | ⭐⭐⭐☆☆ |

| Platform & Tools | Platforms offered (MT4, MT5, copy systems) and reporting tools. | ⭐⭐⭐⭐☆ |

| Withdrawals & Account Control | Investor retains full control of deposits and withdrawals. | ⭐⭐⭐⭐⭐ |

| Performance Reporting | Real-time monitoring and transparent performance statistics. | ⭐⭐⭐⭐☆ |

| Customer Support | Availability and quality of support channels. | ⭐⭐⭐☆☆ |

Top 10 Best Managed Forex Accounts – A Direct Comparison

What Real Traders Want to Know!

Explore the Top Questions asked by real traders across the Globe. From fees to withdrawal time, we provide straightforward answers to help you understand managed forex accounts and choose the right broker confidently.

Q: What is the minimum investment amount for a managed Forex account? – John M.

A: The minimum investment varies significantly by broker and the chosen manager’s strategy. While some brokers allow you to start with $100 to $250 for copy trading, most traditional PAMM/MAM accounts require a higher minimum, often starting from $1,000 to $5,000.

Q: What fees are typically charged for managed Forex accounts? – David K.

A: Managed accounts usually charge two main fees: a small management fee (fixed yearly charge) and a performance fee. The performance fee is the main charge, typically ranging from 20% to 35% of any profits generated.

Q: Can I withdraw or stop the managed account anytime? – Emily R.

A: Typically, yes, you can withdraw your funds anytime. Investors retain full control and ownership of the capital. However, some managers or platforms may impose fixed withdrawal windows or exit fees for early termination, so always check the agreement.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Professional Management | Performance Fees |

| Hands-Off Approach | Potential for Losses |

| Diversification Options | Requires Trust in the Manager |

| Transparent Performance Tracking | Minimum Deposit Requirements |

| No Withdrawal Access for Managers | Less Control Over Trading Decisions |

You Might also Like:

- MultiBank Group Review

- FP Markets Review

- AvaTrade Review

- Pepperstone Review

- FxPro Review

- Swissquote Review

- BlackBull Markets Review

- HFM Review

- FISG Review

- Exness Review

In Conclusion

Managed Forex accounts offer a hands-off way to participate in currency trading by relying on professional managers. They suit beginners or busy investors, but fees, risks, and trust in the manager’s strategy should always be carefully considered before investing.

Faq

Yes, you keep ownership and control of your capital. The funds remain in your segregated account, and only you can deposit or withdraw money. The fund manager only receives trading authorization (limited power of attorney).

No, they are different. A managed account (PAMM/MAM) gives the manager limited trading authority over your funds in a segregated account. Copy trading automatically replicates a manager’s trades into your account without giving them direct control.

Managers are primarily paid through a Performance Fee, which is a percentage of the profits they generate, typically 20% to 35%. Some may also charge a smaller, fixed Management Fee based on the total assets under management (AUM).

Managed Forex accounts carry significant risk due to market volatility and leverage. While the funds are held safely in your name, the risk of capital loss is high. Always choose a manager with a regulated broker and a proven, verifiable track record.

Yes. You can lose a portion or even all of your invested capital in a managed Forex account. The use of high leverage and inherent market volatility means losses are a significant and constant risk.

Managed Forex accounts are for passive investors with capital who lack the time or expertise to trade actively. They are only suitable for those who fully understand and accept the high risk of significant capital loss.

Yes, reputable brokers provide real-time performance tracking via a secure online portal or through platforms like MT4/MT5. This allows you to monitor the manager’s trades, equity curve, and drawdowns as they occur.

Managers typically use scalping or intraday trading for high-frequency returns, or swing trading and trend following strategies for longer-term growth. The specific strategy is detailed in their verifiable performance record.

Regulations vary widely by jurisdiction. The broker and manager must be licensed by a relevant financial authority (like ASIC, FCA, or CySEC). The investor signs a Limited Power of Attorney (LPOA), which is the key legal instrument governing the account.

Fees are only worth it if the manager generates net returns (after fees) that significantly outweigh the high risk taken. Always compare the fee structure against the manager’s verified, long-term performance record before investing.