10 Best Short Selling Forex Brokers

We have listed the 10 Best Short Selling Forex Brokers that allow traders to profit from falling currency prices through advanced trading tools and flexible leverage options. These brokers offer tight spreads, strong regulatory oversight, and reliable platforms, ensuring that both beginners and experienced traders can execute short-selling strategies efficiently and with confidence.

10 Best Short Selling Forex Brokers (2026)

- MultiBank Group – Overall, The Best Short Selling Forex Broker

- Exness – Highly flexible, and unlimited leverage

- OANDA – Powerful TradingView charting tools

- AvaTrade – Advanced trading platforms

- HFM – Variety of account types (including Zero, Premium, and copy trading)

- Pepperstone – Recognized for its strong regulation

- IC Markets – Ultra-fast execution and deep liquidity

- IG – Advanced trading platform with professional tools

- XTB – User-friendly xStation 5 platform

- eToro – Social trading platform CopyTrader

Top 10 Forex Brokers (Globally)

1. MultiBank Group

MultiBank Group is a registered forex and CFD broker that allows short selling on major currency pairs. Known for its strong regulation, competitive spreads, and advanced trading platforms, MultiBank Group provides traders with secure and efficient access to global markets.

Frequently Asked Questions

Is MultiBank Group an authorized forex broker?

Yes, MultiBank Group is authorized and heavily regulated worldwide. It is overseen by multiple top-tier financial regulators, including ASIC (Australia), BaFin (Germany), MAS (Singapore), and CySEC (Cyprus), ensuring a high level of client security.

Can I short sell currencies with MultiBank Group?

Yes, you can short sell currencies with MultiBank Group. Short selling is an intrinsic part of Forex trading, as every ‘Sell’ order on a currency pair is essentially a short sale of the base currency against the quote currency.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and regulated | Higher minimum deposit for some account types |

| Supports short selling across various asset classes | Limited educational resources for beginners |

| Tight spreads and fast execution speeds | Inactivity fees may apply |

| Advanced trading platforms (MT4 & MT5) | No crypto deposit options |

| 24/7 multilingual customer support | Platform may be complex for new traders |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

MultiBank Group is an authorized forex broker offering reliable short-selling opportunities with tight spreads, advanced platforms, and strong global regulation. It’s a trusted choice for traders seeking professional execution and robust trading conditions.

2. Exness

Exness is an authorized forex and CFD broker that supports short selling on major and minor currency pairs. Known for its transparent pricing, tight spreads, and reliable platforms, Exness provides traders with secure and flexible access to global forex markets.

Frequently Asked Questions

Can I short sell with Exness?

Yes, you can short sell with Exness. When you trade forex or CFDs on other instruments like stocks and indices, placing a Sell order is how you take a short position.

What types of accounts does Exness offer?

Exness offers Standard and Professional accounts. Standard accounts include Standard and Standard Cent (great for beginners). Professional accounts are Pro, Raw Spread, and Zero, suited for experienced traders.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and strictly regulated | Limited educational content for new traders |

| Allows short selling across forex and CFDs | No fixed spread accounts |

| Tight spreads and low trading costs | Customer support not 24/7 in all languages |

| Fast deposits and withdrawals | Limited product range beyond forex and CFDs |

| User-friendly platforms (MT4 & MT5) | Regional restrictions may apply |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐☆☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Exness is a legit forex broker offering short selling, tight spreads, and advanced platforms. With strong regulation and transparent trading conditions, it’s an excellent choice for traders seeking flexibility and trusted market access.

3. OANDA

OANDA is a legit and authorized forex broker that supports short selling on major and minor currency pairs. Renowned for its strong regulation, transparent pricing, and reliable trading platforms, OANDA offers traders secure and efficient access to global forex markets.

Frequently Asked Questions

Is OANDA a legal forex broker?

Yes, OANDA is widely considered a legal and trusted forex broker. They operate globally with entities regulated by top-tier financial bodies like the CFTC/NFA (US), FCA (UK), ASIC (Australia), and others, ensuring strong regulatory oversight.

Can I short sell with OANDA?

Yes, you can short sell with OANDA. As a forex and CFD broker, their platform allows you to “go short” by opening a sell position to speculate on a decrease in the asset’s price.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legal and regulated in multiple jurisdictions | Limited range of CFDs beyond forex |

| Supports short selling on forex pairs | No fixed spread accounts |

| Transparent pricing with no hidden fees | Higher spreads during volatile periods |

| Excellent market research and analysis tools | Customer support not available 24/7 globally |

| Reliable trading platforms and mobile app | Inactivity fees may apply |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐☆☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

OANDA is a legal and highly regulated forex broker that offers short selling, advanced platforms, and transparent pricing. It’s an ideal choice for traders seeking reliability, security, and fair market access worldwide.

Top 3 Short Selling Forex Brokers – MultiBank Group vs Exness vs OANDA

4. AvaTrade

AvaTrade is a legal and regulated forex and CFD broker that supports short selling on major and minor currency pairs. Known for its global regulation, competitive spreads, and user-friendly platforms, AvaTrade provides secure and efficient access to short selling in forex markets.

Frequently Asked Questions

Can I short sell with AvaTrade?

Yes, you can short sell with AvaTrade. As a CFD broker, they allow you to “go short” by opening a sell position on instruments like forex, stocks, and commodities to profit from falling prices.

What account types does AvaTrade offer?

AvaTrade primarily offers a Standard Account for retail traders and a Professional Account for eligible, high-volume traders. They also offer Islamic (Swap-Free) accounts and an AvaOptions account for options trading.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and regulated | Limited product range beyond forex and CFDs |

| Supports short selling across forex and CFDs | Inactivity fees may apply |

| User-friendly platforms (MT4, MT5, AvaTradeGO) | No cent accounts for beginners |

| Fixed and variable spreads available | Slower withdrawal times in some regions |

| Comprehensive educational tools and resources | Customer support not 24/7 in all languages |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

AvaTrade is an approved and reputable forex broker offering short selling, strong regulation, and advanced trading tools. It’s an excellent choice for traders seeking secure, transparent, and flexible short-selling opportunities in global markets.

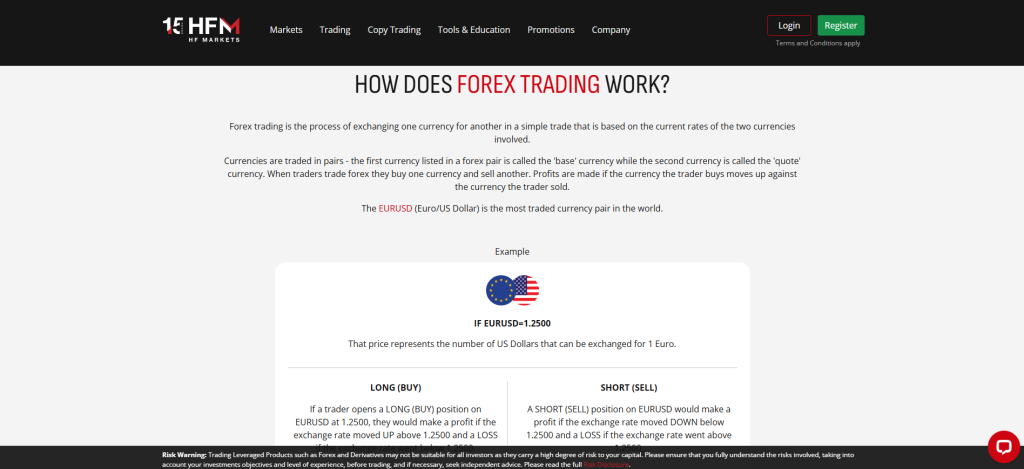

5. HFM

HFM is an approved and regulated forex and CFD broker that supports short selling on major, minor, and exotic currency pairs. Known for tight spreads, strong oversight, and reliable platforms, HFM offers secure and efficient short-selling opportunities for global traders.

Frequently Asked Questions

Is HFM a registered forex broker?

Yes, HFM is a registered forex broker with multiple entities regulated globally. Regulators include the FCA, CySEC, DFSA, FSCA, and the FSC.

What types of accounts does HFM offer?

HFM offers a variety of trading accounts including Cent, Zero, Premium, Pro, and Pro Plus. They also provide specialized accounts like Islamic (Swap-Free) and Copy Trading accounts.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Registered and regulated | Limited product selection beyond forex and CFDs |

| Supports short selling on forex and CFDs | No fixed spread account options |

| Competitive spreads and low trading costs | Inactivity fees apply |

| Variety of account types for all experience levels | Platform interface may be complex for beginners |

| Excellent customer support and educational tools | Regional restrictions on some account features |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

HFM is a registered and trusted forex broker offering short selling with tight spreads, advanced platforms, and solid regulation. It’s an ideal choice for traders seeking secure, efficient, and flexible forex trading conditions.

6. Pepperstone

Pepperstone is a registered and regulated forex and CFD broker that supports short selling on major and minor currency pairs. Known for its low spreads, fast execution, and trusted regulation, Pepperstone offers secure and efficient short-selling opportunities for traders worldwide.

Frequently Asked Questions

Is Pepperstone an authorized forex broker?

Yes, Pepperstone is an authorized forex broker, regulated by multiple top-tier financial bodies globally. These include the FCA (UK), ASIC (Australia), CySEC (Cyprus), BaFin (Germany), and DFSA (Dubai), among others, depending on the client’s entity.

Can I short sell with Pepperstone?

Yes, you can short sell with Pepperstone. Since they offer Contracts for Difference (CFDs) on various assets, including Forex, shares, and indices, you can “sell” to open a position to profit from falling market prices.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and regulated in multiple jurisdictions | Limited product range beyond forex and CFDs |

| Supports short selling on forex and CFDs | No proprietary trading platform |

| Ultra-low spreads and fast ECN execution | Inactivity fees after a period of no trading |

| Multiple platforms including MT4, MT5, and cTrader | Customer support not 24/7 in all regions |

| Excellent customer service and educational support | Leverage varies depending on jurisdiction |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Pepperstone is an authorized forex broker offering short selling with low spreads, advanced platforms, and reliable regulation. It’s a top choice for traders seeking fast execution, transparency, and secure global trading conditions.

7. IC Markets

IC Markets is an authorized and regulated forex and CFD broker that supports short selling on major, minor, and exotic currency pairs. Renowned for its ultra-low spreads, fast execution, and secure platforms, IC Markets provides reliable and efficient short-selling opportunities for global traders.

Frequently Asked Questions

Is IC Markets a legit forex broker?

Yes, IC Markets is widely considered a legitimate and trustworthy forex broker. It is regulated by several authorities, including the ASIC (Australia) and CySEC (Cyprus), and is known for its competitive spreads and fast execution.

Can I short sell with IC Markets?

Yes, you can short sell with IC Markets. Since they offer CFD trading on various assets like forex, stocks, and indices, you can profit from falling prices by opening a “sell” position.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and regulated in multiple jurisdictions | Limited product range outside forex and CFDs |

| Supports short selling across forex and CFDs | No fixed spread account option |

| Ultra-low spreads and ECN execution | Inactivity fees may apply |

| Fast order processing and high liquidity | Customer support not fully 24/7 in all languages |

| Advanced trading platforms (MT4, MT5, cTrader) | Complex features may challenge beginners |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

IC Markets is a legit forex broker offering short selling, ECN execution, and tight spreads. With trusted regulation and advanced platforms, it’s a reliable choice for traders seeking professional and transparent trading conditions.

8. IG

IG is a legit and authorized forex and CFD broker that supports short selling on major and minor currency pairs. Known for its strong regulation, transparent pricing, and advanced trading platforms, IG provides secure and efficient short-selling opportunities for global traders.

Frequently Asked Questions

What trading platforms does IG offer?

IG offers its own powerful proprietary web platform and mobile app. Additionally, they provide access to popular third-party platforms like MetaTrader 4 (MT4), ProRealTime for advanced charting, and L2 Dealer for Direct Market Access (DMA) share trading.

Can I short sell with IG?

Yes, you can short sell with IG primarily through CFDs (Contracts for Difference) and spread betting. This allows you to open a ‘sell’ position to profit if the asset’s price falls, without owning the underlying asset.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legal and regulated | Higher minimum spreads on some pairs |

| Supports short selling across forex and CFDs | Inactivity fees may apply |

| Transparent pricing and competitive spreads | Customer support not 24/7 globally |

| Wide range of trading instruments | No cent accounts for beginners |

| Comprehensive educational and market analysis tools | Complex platform features for new traders |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐⭐ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

IG is a legal and highly regulated forex broker offering short selling, transparent pricing, and reliable platforms. It’s ideal for traders seeking secure, flexible, and well-regulated access to global forex and CFD markets.

9. XTB

XTB is a legal and regulated forex and CFD broker that supports short selling on major and minor currency pairs. Known for its transparency, low spreads, and award-winning xStation platform, XTB offers secure and efficient short-selling opportunities for traders worldwide.

Frequently Asked Questions

Can I short sell with XTB?

Yes, you can short sell with XTB, primarily by trading CFDs (Contracts for Difference) on various assets like indices, commodities, forex, and stocks. Simply click the “Sell” button in their trading platform.

What types of instruments does XTB offer?

XTB offers a diverse range of instruments, including real stocks and ETFs, alongside leveraged CFDs on Forex, indices, commodities, cryptocurrencies, stocks, and ETFs, providing options for both trading and investing.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and regulated | No fixed spread accounts |

| Supports short selling on forex and CFDs | Limited availability in some regions |

| Award-winning xStation trading platform | Inactivity fees after long periods |

| Transparent pricing and low spreads | Customer support not 24/7 in all languages |

| Strong educational resources and market analysis | Limited automation tools compared to other brokers |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐⭐ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

XTB is an approved and trusted forex broker offering short selling, low spreads, and an intuitive platform. It’s an excellent choice for traders seeking transparency, regulation, and reliable short-selling opportunities across global markets.

10. eToro

eToro is an approved and regulated forex and CFD broker that supports short selling on major and minor currency pairs. Known for its social trading platform, strong regulation, and transparent pricing, eToro offers secure and user-friendly short-selling opportunities for traders worldwide.

Frequently Asked Questions

Can I short sell with eToro?

Yes, you can short sell on eToro. Short positions are opened by selecting “Sell” on the trade screen, which is facilitated through Contracts for Difference (CFDs) on various assets.

What makes eToro different from other brokers?

eToro pioneered social trading, allowing users to automatically copy the trades of successful investors with its CopyTrader feature. This, along with its emphasis on community and a wide range of assets including crypto, sets it apart.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Registered and regulated | Higher spreads compared to ECN brokers |

| Supports short selling on forex and CFDs | Limited platform customization options |

| Innovative CopyTrading and social trading features | Withdrawal fees apply |

| User-friendly web and mobile platforms | No support for MT4 or MT5 |

| Transparent pricing with no hidden commissions | Limited advanced tools for professional traders |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐☆☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

eToro is a registered and reputable forex broker offering short selling, social trading, and strong regulation. It’s ideal for traders seeking a transparent, community-driven platform with secure access to global forex and CFD markets.

What is a Short Selling Forex Broker?

A Short Selling Forex Broker is a trading platform that allows traders to profit from falling currency prices. When short selling in forex, traders borrow a currency pair and sell it at the current market price, aiming to buy it back later at a lower price.

These brokers provide tools, leverage, and execution systems that support selling positions, enabling traders to take advantage of both rising and declining markets efficiently.

Criteria for Choosing a Short Selling Forex Broker

| Criteria | Description | Importance |

| Regulation & Licensing | Ensure the broker is registered and regulated by reputable authorities such as the FCA, ASIC, or CySEC to guarantee fund safety and transparency. | ⭐⭐⭐⭐⭐ |

| Short Selling Availability | Confirm the broker allows short selling across major, minor, and exotic currency pairs with proper liquidity. | ⭐⭐⭐⭐⭐ |

| Spreads & Fees | Look for brokers with tight spreads and low commissions to reduce trading costs when short selling. | ⭐⭐⭐⭐☆ |

| Leverage Options | Evaluate the leverage provided, as higher leverage can amplify both profits and losses in short selling. | ⭐⭐⭐⭐☆ |

| Trading Platforms | Choose brokers offering reliable, fast platforms like MT4, MT5, or cTrader for efficient short selling. | ⭐⭐⭐⭐☆ |

| Execution Speed | Fast execution helps minimize slippage and ensures accurate order fulfillment in volatile markets. | ⭐⭐⭐⭐☆ |

| Risk Management Tools | Check for stop-loss, take-profit, and margin alerts to manage risks effectively when short selling. | ⭐⭐⭐⭐⭐ |

| Customer Support | Reliable, multilingual support ensures assistance during technical or trading issues. | ⭐⭐⭐⭐☆ |

| Educational Resources | Educational tools help traders understand short selling strategies and risk management. | ⭐⭐⭐☆☆ |

| Deposit & Withdrawal Options | Look for brokers with fast, secure, and low fee payment methods. | ⭐⭐⭐⭐☆ |

Top 10 Best Short Selling Forex Brokers – A Direct Comparison

What Real Traders Want to Know!

Explore the Top Questions asked by real traders across the Globe. From special considerations to requiremwnts, we provide straightforward answers to help you understand short selling and choose the right broker confidently.

Q: What special considerations are there for short selling forex? – Isla B.

A: Short selling Forex involves simultaneously selling the base currency and buying the quote currency. Key considerations are the potentially unlimited risk from price rises and overnight financing (swap) costs due to interest rate differentials between the two currencies.

Q: What requirements must I meet to short sell? – Brian B.

A: You must open a margin account with your broker and meet their minimum margin requirements (collateral) and maintenance levels. The broker must also be able to locate the shares you wish to borrow.

Q: What is naked short selling and is it legal? – Ava T.

A: Naked short selling is selling shares without first borrowing them or ensuring they can be borrowed. Abusive naked short selling is largely illegal in the U.S. and many jurisdictions, as it can be a form of market manipulation.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Profit in falling markets | High risk exposure |

| Market flexibility | Leverage danger |

| Hedging opportunities | Margin calls |

| Leverage benefits | Limited availability |

| High liquidity | Market volatility |

You Might also Like:

- MultiBank Group Review

- Exness Review

- OANDA Review

- AvaTrade Review

- HFM Review

- Pepperstone Review

- IC Markets Review

- IG Review

- XTB Review

- eToro Review

In Conclusion

Short selling forex brokers allow traders to profit from falling currency prices using leverage and advanced platforms. While offering flexibility and opportunity, it carries higher risks, making proper risk management and broker regulation essential for safe trading.

Faq

In forex, short selling means to sell the base currency of a pair, anticipating its value will fall relative to the quote currency. You effectively sell high first, then buy it back lower for a profit.

Yes, short selling is an integral and legal part of forex trading. Since currencies are traded in pairs, selling a pair simply means you are selling one currency and simultaneously buying the other, betting the sold currency will decline.

No, not all forex brokers allow short selling, although it is a standard feature for most major and regulated brokers. Short selling is fundamental to trading currency pairs. However, specific local regulations or broker models might impose restrictions.

Short selling is widely supported across major platforms offering Contracts for Difference (CFDs), forex, futures, options, and margin trading on stocks. Popular platforms include MetaTrader 4/5, cTrader, and proprietary broker platforms

The main risk in short selling forex is the potential for unlimited losses, as a currency pair’s value can theoretically rise indefinitely. Other risks include leverage magnifying losses and margin calls forcing position closure.

Yes, beginners can short sell forex, as the mechanics are straightforward (clicking ‘sell’). However, it’s highly advised to use a demo account first because the unlimited loss potential and leverage make it very high-risk for inexperienced traders.

Short selling in forex utilizes the same leverage as long trades, often high, ranging from 10:1 to 500:1 depending on the broker and region’s regulations. Leverage determines the trade’s size relative to your margin.

Unlike stock shorting, you generally don’t need a special margin account for forex. Since currencies are always traded in pairs (selling one to buy the other), most standard leveraged forex trading accounts allow you to easily “sell” or “go short.”

Yes, short selling is highly suitable for day trading. It allows traders to profit from falling prices, providing opportunities in both bearish and bullish markets, but involves significant, unlimited risk.

Look for a broker with strong regulatory oversight (e.g., FCA, ASIC) and low, transparent spreads. Ensure they offer short selling via CFDs/options with competitive overnight financing costs.