10 Best Stock Trading Brokers

We have listed the 10 Best Stock Trading Brokers for investing in a diverse range of global equities and markets. These brokers offer competitive commissions, robust regulation, and powerful trading platforms, enabling both beginners and experienced investors to trade stocks efficiently and confidently.

10 Best Stock Trading Brokers (2026)

- IG – Overall, The Best Stock Trading Broker

- OANDA – Global regulation and trustworthiness

- AvaTrade – Unique risk management tool AvaProtect

- HFM – High leverage up to 1:2000

- Octa – Commission-free trading environment

- FxPro – Diverse platform options

- FP Markets – Wide range of educational resources

- JustMarkets – Ultra-tight spreads from 0 pips

- Interactive Brokers – $0 commission on US stocks

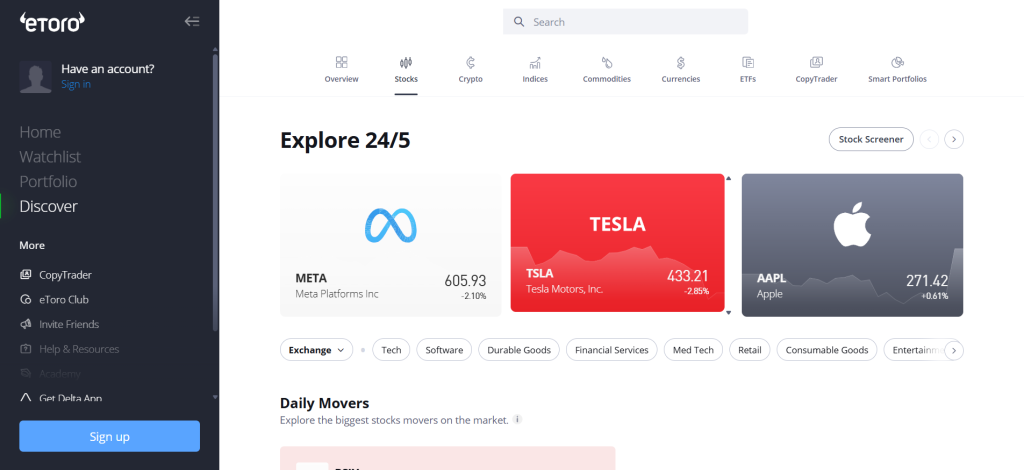

- eToro – Pioneering social trading network

Top 10 Forex Brokers (Globally)

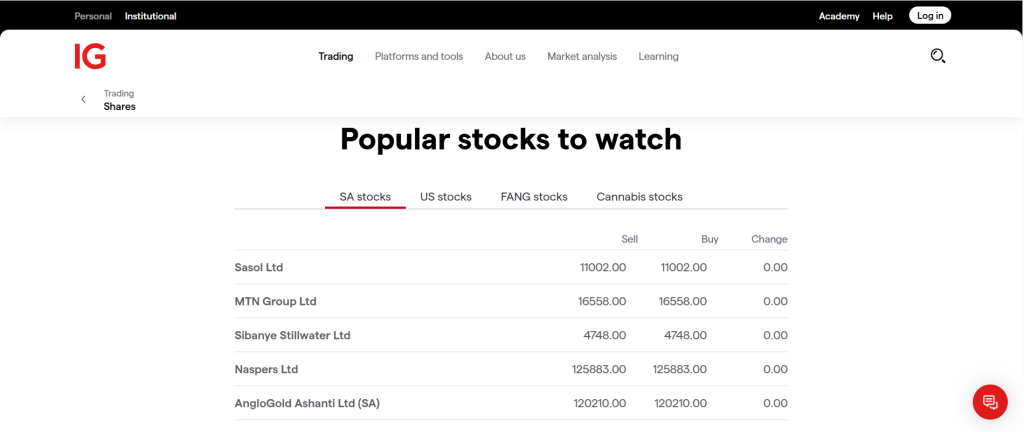

1. IG

IG is a globally regulated broker offering access to thousands of international stocks through user-friendly platforms. Traders benefit from competitive commissions, advanced charting tools, and seamless integration for share dealing and leveraged CFD stock trading.

Frequently Asked Questions

Is IG an authorized stock trading broker?

Yes, IG Group is a fully regulated online trading broker that offers access to various financial instruments, including stocks/shares, across multiple global jurisdictions. They are overseen by top-tier financial regulators like the FCA, ASIC, and BaFin.

What stock markets can I trade with IG?

IG offers trading access to over 12,000 shares and major global stock indices like the FTSE 100, Wall Street (US 30), US 500, US Tech 100, and Germany 40. They also provide extended-hours trading on popular US stocks.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and regulated by multiple top-tier authorities | Inactivity fees may apply |

| Access to a wide range of global stock markets | Limited customer support hours in some regions |

| Advanced and intuitive trading platforms | CFD trading involves higher risk due to leverage |

| Competitive commissions and transparent pricing | Some advanced tools may require experience to use effectively |

| Strong educational resources for traders of all levels | Higher minimum deposits for certain account types |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐⭐ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

IG is an authorized and reputable broker offering powerful stock trading tools, global market access, and strong regulation. It’s ideal for traders seeking reliability, transparency, and advanced features for confident and efficient investing.

2. OANDA

OANDA is an authorized and regulated broker offering stock trading through CFDs on major global equities and indices. Traders benefit from competitive pricing, advanced charting tools, and reliable platforms designed for transparency and precision trading.

Frequently Asked Questions

Can I trade real stocks with OANDA?

Yes, OANDA offers the ability to trade real stocks (shares) from major markets like the US and Europe through its brokerage accounts (often via its subsidiary, OANDA TMS Brokers, in some regions). They also offer Share CFDs.

What platforms does OANDA offer for stock trading?

OANDA provides the OANDA Mobile App and the OANDA Web platform. Additionally, you can trade stocks and CFDs through their partnership with TradingView and on the MetaTrader 5 (MT5) platform.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and highly regulated by multiple global authorities | Limited stock selection compared to specialized brokers |

| Transparent pricing with no hidden fees | No access to physical stock ownership |

| Reliable trading platforms and execution speed | Inactivity fees may apply |

| Competitive spreads on popular stock CFDs | Limited advanced tools for long-term investors |

| Strong reputation and customer trust worldwide | Customer support availability varies by region |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐☆☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

OANDA is a legit and trusted broker offering CFD-based stock trading with transparent pricing and advanced platforms. It’s ideal for traders seeking reliability, regulation, and competitive conditions in global stock markets.

3. AvaTrade

AvaTrade is a legit and authorized online broker offering stock trading through CFDs on leading global companies. Traders enjoy zero commissions, competitive spreads, and user-friendly platforms designed for secure, regulated, and efficient stock market trading.

Frequently Asked Questions

Does AvaTrade charge commissions on stock trading?

AvaTrade typically does not charge commissions for stock trading, as they primarily offer Stock CFDs. Their compensation is built into the spread (the difference between the buy and sell price) for these Contracts for Difference.

What type of stock trading does AvaTrade offer?

AvaTrade primarily offers Stock CFDs (Contracts for Difference), allowing you to speculate on price movements of global stocks like Apple and Tesla without owning the underlying shares. They offer leverage and the ability to go long or short.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legal and well regulated broker across several jurisdictions | Does not offer real stock ownership |

| Commission-free stock CFD trading | Inactivity fees may apply |

| Intuitive and beginner friendly trading platforms | Limited customization for professional traders |

| Access to global stocks and indices | Leverage can increase trading risk |

| Strong educational support and risk management tools | Customer service may vary by region |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

AvaTrade is a legal and regulated broker offering commission-free stock CFD trading. It combines ease of use, strong oversight, and global market access, making it a solid choice for secure and efficient trading.

Top 3 Stock Trading Brokers – IG vs OANDA vs AvaTrade

5. HFM

HFM is a legal and regulated broker offering stock trading through CFDs on major global companies. Traders benefit from flexible leverage, zero commissions, and advanced platforms designed for secure and efficient stock market access.

Frequently Asked Questions

Is HFM an approved broker for stock trading?

Yes, HFM is a highly regulated broker overseen by top-tier bodies like the FCA, CySEC, and FSCA. They are an approved broker offering trading on Stocks/Shares primarily through CFDs and, in some regions, Physical Stocks.

What type of stock trading does HFM offer?

HFM primarily offers trading on Stock CFDs (Contracts for Difference), allowing speculation on global share price movements (long or short) with leverage and without owning the underlying asset. They also offer Direct Market Access (DMA) Stocks in some regulated regions.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and regulated by trusted financial authorities | Does not offer real stock ownership |

| Commission-free stock CFD trading | Limited advanced features for professional traders |

| Access to a wide range of global companies | Leverage increases potential trading risks |

| User-friendly platforms including MetaTrader 4 & 5 | Inactivity fees may apply |

| Strong customer support and educational tools | Regional restrictions may limit some services |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

HFM is an approved and regulated broker providing CFD stock trading with zero commissions, advanced tools, and global market access. It’s ideal for traders seeking secure, user-friendly, and cost-effective online stock trading solutions.

5. Octa

Octa is an approved and regulated online broker offering stock trading through CFDs on leading global companies. Traders benefit from zero commissions, tight spreads, and user-friendly platforms designed for secure and efficient stock market trading.

Frequently Asked Questions

Is Octa a registered broker for stock trading?

Yes, Octa is a registered broker offering trading on various instruments, including over 150 stocks as CFDs and in some cases, physical shares. They are regulated by bodies like the Mwali International Services Authority (MISA) and others, depending on the entity you trade with.

Does Octa charge commissions on stock trading?

Octa typically does not charge commissions for trading on Stock CFDs. Their compensation is generally included in the spread (the difference between the buy and sell price) for those trades, offering a commission-free structure. They also offer no swap fees on any account.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Registered and regulated international broker | Does not support real stock ownership |

| Commission-free stock CFD trading | Limited advanced tools for professionals |

| Easy-to-use trading platforms and mobile app | No 24/7 customer support |

| Competitive spreads with no hidden fees | Regional restrictions may apply |

| Strong reputation for transparency and reliability | Limited variety of stock CFDs compared to larger brokers |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Octa is a registered and regulated broker offering commission-free stock CFD trading with tight spreads and intuitive platforms. It’s ideal for traders seeking transparent, low-cost, and efficient access to global stock markets.

6. FxPro

FxPro is a registered and regulated broker offering stock trading through CFDs on global equities alongside forex, indices, and commodities. Traders gain access via robust platforms with competitive pricing and secure account protections.

Frequently Asked Questions

Is FxPro an authorized broker for stock trading?

Yes, FxPro is an authorized and regulated online broker offering stock trading, primarily through Stock CFDs (Contracts for Difference). They are overseen by top-tier regulators like the FCA (UK) and CySEC (Cyprus), ensuring strong oversight.

What type of stock trading does FxPro offer?

FxPro primarily offers trading on Stock CFDs (Contracts for Difference), allowing speculation on rising or falling share prices of major US, UK, and EU companies without owning the stock. They offer leverage on these positions.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and regulated by multiple top-tier authorities | Does not offer direct stock ownership |

| Commission-free stock CFD trading | Inactivity fees may apply |

| Advanced trading platforms including MetaTrader and cTrader | Leverage can increase potential trading risks |

| Fast trade execution with low latency | Limited product range compared to larger brokers |

| Transparent pricing and reliable customer support | Some regional restrictions apply |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

FxPro is an authorized and well-regulated broker offering stock CFD trading with tight spreads, advanced platforms, and strong security. It’s ideal for traders seeking reliable, transparent, and efficient access to global stock markets.

7. FP Markets

FP Markets is a globally regulated broker offering stock trading via CFDs on thousands of global shares, alongside forex, indices and commodities. Traders benefit from advanced platforms, tight spreads, and access to leading exchanges.

Frequently Asked Questions

What type of stock trading does FP Markets offer?

FP Markets primarily offers trading on Stock CFDs (Contracts for Difference), giving access to over 10,000 shares like Apple and Tesla. This allows you to speculate on price movement with leverage without owning the actual shares.

Does FP Markets charge commissions for stock trading?

FP Markets does charge commissions for trading Stock CFDs on platforms like MT5 and IRESS, though index CFDs are commission-free. US stocks charge $0.02 per share with a minimum, and other markets are based on a percentage of the trade value.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and well regulated by ASIC and CySEC | Stock trading is via CFDs only (no real shares) |

| Access to thousands of global stocks | Inactivity fees may apply |

| Low commissions and tight spreads | Leverage increases trading risk |

| Fast execution and advanced trading platforms | Limited customer support during weekends |

| Strong educational resources and analysis tools | Complex tools may challenge beginners |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms, and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

FP Markets is a legit and regulated broker offering CFD stock trading on global markets. With low commissions, advanced platforms, and reliable execution, it’s ideal for traders seeking a professional and secure trading experience.

8. JustMarkets

JustMarkets is a registered and fully-regulated multi-asset broker offering CFD trading on global stocks alongside forex, indices, and commodities. The platform delivers low spreads, swift execution, and mobile access via MT4/MT5 apps.

Frequently Asked Questions

What type of stock trading does JustMarkets offer?

JustMarkets primarily offers trading on Stock CFDs (Contracts for Difference) for a diverse range of US and EU shares like Apple and Tesla. This allows you to speculate on price movements with leverage and without owning the underlying stock.

Does JustMarkets charge commissions on stock trades?

JustMarkets generally offers commission-free stock CFDs on its Standard and Pro accounts. However, its Raw Spread account is commission-based, charging $3 per side, per lot for all instruments, which would include stock CFDs.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legal and regulated international broker | No real stock ownership available |

| Commission-free stock CFD trading | Limited advanced analysis tools |

| Access to global company shares | Regional restrictions may apply |

| User-friendly MT4 and MT5 platforms | Leverage increases potential risks |

| Fast order execution and transparent pricing | Customer support not available 24/7 |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

JustMarkets is a legal and regulated broker offering CFD stock trading with low spreads, fast execution, and flexible leverage. It’s ideal for traders seeking a secure, transparent, and affordable stock trading experience.

9. Interactive Brokers

Interactive Brokers provides extensive stock trading capabilities, offering access to thousands of global equities, advanced order types, and low, per-share commissions. Their platform ensures secure multi-platform access for both retail and professional investors.

Frequently Asked Questions

Is Interactive Brokers an approved stock trading platform?

Yes, Interactive Brokers is a highly approved and regulated broker globally, overseen by top-tier financial authorities like the SEC and FINRA in the US, the FCA in the UK, and numerous others worldwide.

Does Interactive Brokers charge commissions on stock trades?

Interactive Brokers offers two plans: IBKR Lite provides $0 commission on US-listed stocks/ETFs (US residents only). IBKR Pro uses low, per-share commissions with fixed or tiered pricing, which can be as low as $0.0005 per share, plus regulatory fees.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and regulated by top global authorities | Platform may be complex for beginners |

| Access to over 150 global markets | Inactivity fees may apply |

| Low and transparent commission structure | Higher minimums for certain account types |

| Advanced trading platforms with professional tools | Limited educational content for new traders |

| Strong reputation and high liquidity | Customer support can be slower during peak hours |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐⭐ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

Interactive Brokers is an approved and globally regulated stock trading platform offering access to 150+ markets, low commissions, and advanced tools. It’s ideal for experienced traders seeking a secure, professional, and efficient trading environment.

10. eToro

eToro provides access to over 6,000 stocks from 20+ global exchanges, supporting the purchase of whole or fractional shares. It boasts commission-free trading on many equities, offers dividend payouts, and maintains full regulatory compliance with top-tier authorities.

Frequently Asked Questions

Is eToro a registered broker for stock trading?

Yes, eToro is a fully registered and regulated broker globally. It is overseen by top-tier authorities like the FCA (UK), CySEC (Europe), ASIC (Australia), and FINRA/SEC (US entity for securities), making it approved for stock trading.

Can I buy real stocks on eToro?

Yes, you can buy real stocks on eToro. When you open a non-leveraged BUY (long) position on a stock, you are investing in the underlying asset (the actual share), which is held by eToro on your behalf. If you use leverage or SELL (short) you are trading a CFD.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Registered and regulated by leading financial authorities | Withdrawal fees apply |

| Commission-free real stock trading | Limited advanced tools for professionals |

| Access to over 6,000 global stocks | CFD leverage varies by region |

| User-friendly platform with social trading features | Conversion fees on non-USD accounts |

| Supports fractional share investing | Customer support can be slow at times |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐☆☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐⭐ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐☆☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

eToro is a registered and regulated broker offering commission-free stock trading and fractional investing. With global market access and a social trading platform, it’s ideal for beginners seeking simplicity and transparency in stock trading.

What is a Stock Trading Broker?

A stock trading broker is a licensed financial intermediary that allows individuals and institutions to buy and sell company shares on stock exchanges. These brokers provide trading platforms, market access, research tools, and execution services, often regulated by financial authorities to ensure fairness, transparency, and investor protection.

Criteria for Choosing Stock Trading Brokers

| Criteria | Description | Importance |

| Regulation & Licensing | Choose brokers that are authorized and regulated by reputable financial authorities to ensure safety and transparency. | ⭐⭐⭐⭐⭐ |

| Trading Fees & Commissions | Evaluate spreads, commissions, and hidden costs to ensure affordable and transparent pricing. | ⭐⭐⭐⭐⭐ |

| Trading Platforms | Look for user-friendly, stable, and feature-rich platforms suitable for both beginners and professionals. | ⭐⭐⭐⭐☆ |

| Market Access | Ensure the broker offers access to a wide range of global stock markets and instruments. | ⭐⭐⭐⭐☆ |

| Customer Support | Reliable, multilingual support helps resolve trading or account issues quickly and efficiently. | ⭐⭐⭐⭐☆ |

| Deposit & Withdrawal Options | Check for secure, fast, and low-fee payment methods for funding and withdrawals. | ⭐⭐⭐⭐☆ |

| Educational Resources | Educational tools and training materials help traders improve their stock trading knowledge and skills. | ⭐⭐⭐☆☆ |

| Account Types & Minimum Deposit | Flexible account options and reasonable minimum deposits make trading more accessible. | ⭐⭐⭐☆☆ |

| Execution Speed & Reliability | Fast and stable trade execution ensures better pricing and minimal slippage. | ⭐⭐⭐⭐☆ |

| Additional Tools & Research | Access to market analysis, stock screeners, and portfolio tracking adds value for informed decisions. | ⭐⭐⭐⭐☆ |

Top 10 Best Stock Trading Brokers – A Direct Comparison

What Real Traders Want to Know!

Q: What should I consider when choosing a stock broker? – Gary L.

A: Prioritize Regulation and Security (e.g., FCA, SEC), Costs (commissions/fees/spreads), the Trading Platform’s usability and tools, the Investment Selection (markets/products offered), and Customer Support quality.

Q: How do broker fees affect my trading strategy? – Rachel G.

A: Broker fees directly reduce your net profit, especially for frequent traders (scalping/day trading) or those with small account sizes. High fees force you to choose a longer-term strategy to allow gains to outweigh costs, or to trade less frequently to preserve capital.

Q: Can I trade international stocks through my broker? – David S.

A: Yes, many major global brokers like Interactive Brokers, Fidelity, and Charles Schwab allow clients to trade international stocks on foreign exchanges. Others offer international exposure through ADRs (American Depositary Receipts) or Stock CFDs.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Market Access | Fees & Commissions |

| Regulation & Security | Platform Complexity |

| Advanced and user friendly platforms | Market Risk |

| Research & Analysis Tools | Hidden Costs |

| Customer Support & Education | Leverage Risks (CFDs) |

You Might also Like:

- IG Review

- OANDA Review

- AvaTrade Review

- HFM Review

- Octa Review

- FxPro Review

- FP Markets Review

- JustMarkets Review

- Interactive Brokers Review

- eToro Review

In Conclusion

Stock trading brokers offer secure platforms, global access, and expert tools for investors. However, traders should watch out for fees, complex interfaces, and market risks to ensure a balanced and informed trading experience.

Faq

Some multi-asset forex brokers now offer trading of physical shares alongside currency trading, particularly via specific account types or subsidiaries. However, many traditional forex brokers only offer Stock CFDs.

Yes, the best ones are fully regulated as multi-asset brokers by top-tier authorities like the FCA, CySEC, ASIC, or SEC/FINRA. Always verify the specific entity and regulator under which your account is opened, as regulatory protection varies by jurisdiction.

Forex brokers offering stocks typically use MetaTrader 5 (MT5), which supports both Forex and stocks/CFDs, or their own proprietary web and mobile platforms. Some also integrate with popular third-party charting tools like TradingView or use cTrader for its multi-asset capabilities.

Yes, beginners can trade stocks with multi-asset forex brokers, especially those offering real stock trading or user-friendly Stock CFDs. Many provide demo accounts and extensive educational resources to help new traders learn the basics and manage risk before trading with real money.

Stock CFDs (Contracts for Difference) are agreements to exchange the difference in a stock’s value between the trade’s open and close. You speculate on price movement (up or down) without owning the underlying shares and typically use leverage.

The fee structure varies. Many multi-asset forex brokers offer commission-free trading on Stock CFDs (Contracts for Difference), where they profit from the spread. However, brokers offering direct access or Raw Spread accounts often charge a low commission per trade.

The leverage offered for Stock CFDs typically depends on the regulator. In strictly regulated regions like the EU (ESMA) and Australia (ASIC), retail leverage is capped at a maximum of 5:1 for individual stocks, meaning a 20% margin. Offshore or professional accounts may offer higher leverage, often up to 20:1 or more.

Yes, stock trading through regulated multi-asset forex brokers is legal (usually as CFDs or physical shares). Legality depends on the broker’s regulation (e.g., FCA, SEC license) and your local jurisdiction’s laws regarding securities and derivatives trading.

You don’t own the underlying stock with a CFD, so you don’t earn a traditional dividend. Instead, if you hold a long (buy) CFD over the ex-dividend date, your account receives a dividend adjustment credit. If you hold a short (sell) CFD, you are debited the adjustment.

Yes, most modern multi-asset forex brokers offer mobile stock trading via dedicated apps for iOS and Android. These apps support trading on Stock CFDs and, increasingly, physical shares, often using platforms like MetaTrader 5 (MT5) or a broker’s own proprietary mobile app.