10 Best Trailing Stop Loss Orders Forex Brokers

We have listed the 10 Best Trailing Stop Loss Orders Forex Brokers. These brokers provide robust trading platforms, tight spreads, and strong regulatory oversight, ensuring that traders can efficiently manage risk and lock in profits while trading with confidence.

10 Best Trailing Stop Loss Orders Forex Brokers (2026)

- MultiBank Group – Overall, The Best Trailing Stop Loss Orders Forex Broker

- Vantage – Fast execution powered by Equinix servers

- RoboForex – Zero-commission accounts and tight spreads

- Moneta Markets – Award-winning platforms (MT5 and PRO Trader)

- BlackBull Markets – No minimum deposit on some accounts

- Pepperstone – Competitive pricing with tight spreads

- IC Markets – Ultra-fast execution and deep liquidity

- Tickmill – Low-cost trading with tight spreads

- FBS – Demo account, and robust educational tools

- FP Markets – Reliable customer support, and a variety of payment options

Top 10 Forex Brokers (Globally)

1. MultiBank Group

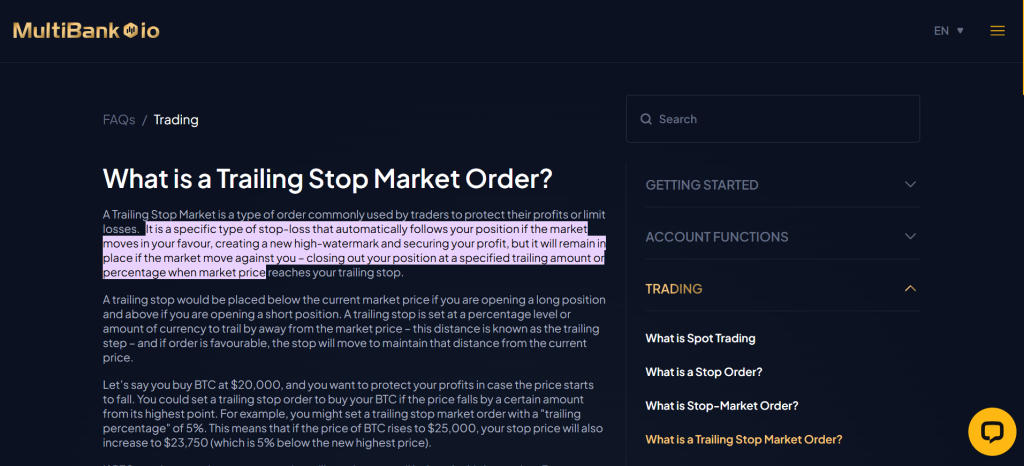

MultiBank Group is a regulated forex and CFD broker offering advanced trading tools, including trailing stop loss orders. This feature allows traders to automatically adjust stop levels as prices move in their favor, helping secure profits while minimizing risk.

Frequently Asked Questions

Does MultiBank Group support trailing stop loss orders?

Yes, MultiBank Group does. Since they offer the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, you can utilize the built-in trailing stop functionality for your forex trades.

Can beginners use trailing stop loss orders with MultiBank Group?

Yes, beginners can use trailing stop-loss orders with MultiBank Group, as the feature is available on the beginner-friendly MT4/MT5 platforms. However, understanding how to set the distance correctly is crucial, as an improper setting can cause premature trade exits.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and regulated | Minimum deposit requirements may vary by region |

| Offers trailing stop loss for advanced risk management | Limited availability in some jurisdictions |

| Competitive spreads and fast execution | Inactivity fees may apply |

| Multiple trading platforms | Complex product range for beginners |

| Excellent customer support and educational tools | Withdrawal times can vary based on method |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

MultiBank Group is an authorized forex broker offering trailing stop loss orders to enhance trade management. Its strong regulation, advanced platforms, and risk-control tools make it a solid choice for both beginners and experienced traders.

2. Vantage

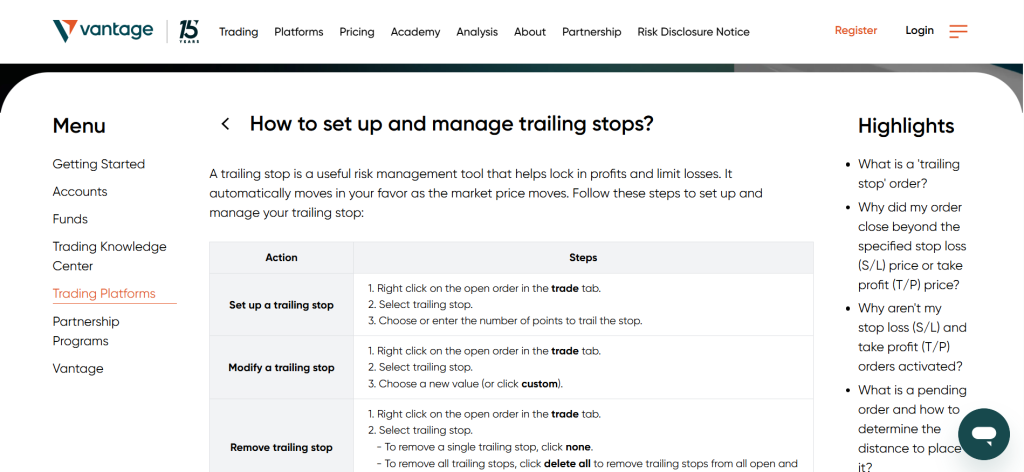

Vantage is a regulated forex and CFD broker that provides advanced risk management features, such as trailing stop loss orders. This tool enables traders to have their stop levels automatically adjusted in line with price movements, thereby helping to safeguard profits and limit potential losses.

Frequently Asked Questions

Is Vantage a legit forex broker?

Yes, Vantage is considered a legit and well-regulated broker. It is overseen by multiple authorities, including Tier-1 regulators like ASIC and the FCA, and offers segregated client funds for safety.

Does Vantage offer trailing stop loss orders?

Yes, Vantage does. This dynamic risk management tool is available on their MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, and their own SmartTrader Tools.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and regulated | Limited product range in some regions |

| Offers trailing stop loss for effective risk management | Withdrawal fees may apply depending on method |

| Competitive spreads and fast execution speeds | Inactivity fees for dormant accounts |

| Supports MetaTrader 4 and MetaTrader 5 platforms | High leverage may increase risk for beginners |

| Excellent educational tools and customer support | Limited in-person support options |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐☆☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐☆☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐☆☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Vantage is a legit forex broker offering trailing stop loss orders to help traders manage risk and secure profits automatically. With solid regulation, low spreads, and reliable platforms, it suits both novice and professional traders.

3. RoboForex

RoboForex is a legit and regulated forex broker offering advanced trading tools, including trailing stop loss orders. This feature enables traders to automatically adjust stop levels as prices move, helping to protect profits and minimize trading risks.

Frequently Asked Questions

Does RoboForex offer trailing stop loss orders?

Yes, RoboForex does. This feature is available on their MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, as well as on their proprietary R Trader platform, allowing for automated profit protection.

Is the trailing stop loss feature suitable for beginners?

The feature is beneficial for beginners as it automates risk management and secures profits. However, new traders should practice setting the correct trailing distance on a demo account first.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legal and regulated | Some bonuses may have strict conditions |

| Offers trailing stop loss for smart risk control | Limited availability in certain regions |

| Tight spreads and fast trade execution | Withdrawal fees on some methods |

| Supports multiple platforms | High leverage increases risk for new traders |

| Wide range of account types and assets | Customer support may vary by language |

Final Score

| # | Criteria | Score |

| 1. | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2. | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐⭐ |

| 3. | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4. | Research and Education | ⭐⭐⭐☆☆ |

| 5. | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6. | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7. | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8. | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9. | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10. | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

RoboForex is a legal forex broker offering trailing stop loss orders to help traders manage risk and protect profits automatically. With strong regulation, flexible accounts, and reliable platforms, it caters to both beginners and experienced traders.

Top 3 Trailing Stop Loss Orders Forex Brokers – MultiBank Group vs Vantage vs RoboForex

4. Moneta Markets

Moneta Markets is a regulated forex and CFD broker offering advanced trading tools, including trailing stop loss orders. This feature allows traders to automatically adjust stop levels as prices move, helping to secure profits and manage risk effectively.

Frequently Asked Questions

Is Moneta Markets an approved forex broker?

Yes, Moneta Markets is a regulated forex broker. They operate under various entities, including one regulated by the FSCA in South Africa and another by the FSA in Seychelles, providing an approved status.

Does Moneta Markets offer trailing stop loss orders?

Yes, Moneta Markets does. This feature is typically available on their trading platforms like MetaTrader 4 (MT4) and their proprietary ProTrader, helping traders automatically lock in profits as the market moves favourably.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and regulated | Limited product range |

| Supports trailing stop loss for better risk management | Inactivity fees may apply |

| Competitive spreads and fast execution speeds | Some regions have restrictions |

| Multiple trading platforms | No cryptocurrency funding options |

| Excellent customer service and educational resources | Limited phone support hours |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Moneta Markets is an approved forex broker offering trailing stop loss orders for smart risk control. With solid regulation, fast execution, and user-friendly platforms, it provides a reliable trading environment for both new and experienced traders.

5. BlackBull Markets

BlackBull Markets is a regulated forex and CFD broker offering trailing stop loss orders to help traders manage risk effectively. This feature automatically adjusts stop levels as prices move, allowing traders to protect profits and minimize potential losses.

Frequently Asked Questions

Is BlackBull Markets a registered forex broker?

Yes, BlackBull Markets is a registered broker. Its New Zealand entity, Black Bull Group Limited, is regulated by the FMA (Financial Markets Authority), and another entity is regulated by the FSA of Seychelles.

Does BlackBull Markets offer trailing stop loss orders?

Yes, BlackBull Markets does. This dynamic risk management tool is available on their trading platforms, including MetaTrader 4 (MT4), which automatically adjusts the stop-loss level as the trade’s price moves in your favour.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Registered and regulated | Minimum deposit may be higher for some accounts |

| Offers trailing stop loss for automated profit protection | Limited in-person support |

| Tight spreads and fast ECN execution | No proprietary trading platform |

| Supports MetaTrader 4 and MetaTrader 5 platforms | Inactivity fees may apply |

| Excellent customer service and educational tools | Limited availability in some regions |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

BlackBull Markets is a registered forex broker offering trailing stop loss orders for better trade management. With reliable regulation, tight spreads, and advanced trading platforms, it suits both beginners and professional traders seeking efficient risk control.

7. Pepperstone

Pepperstone is a regulated and trusted forex broker that offers trailing stop loss orders on its trading platforms. This automatic feature helps traders protect profits and manage risk by adjusting the stop level as the price moves in their favour.

Frequently Asked Questions

Does Pepperstone offer trailing stop loss orders?

Yes, Pepperstone offers it on its trading platforms, including MetaTrader 4/5. This dynamic risk management tool automatically adjusts your stop level to secure profits as the market moves favourably.

Are trailing stop loss orders suitable for beginners on Pepperstone?

Trailing stop orders are generally better suited for intermediate to advanced traders on Pepperstone. While they automate profit protection, beginners should first master fixed stop-loss orders and basic technical analysis for optimal placement.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and regulated | No proprietary trading platform |

| Offers trailing stop loss for automated risk control | Inactivity fees may apply |

| Tight spreads and fast ECN execution | Limited product range |

| Supports multiple platforms | No fixed spread accounts |

| Excellent customer support and education | Crypto trading not available in all regions |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐☆☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐☆☆ |

Our Insights

Pepperstone is an authorized forex broker offering trailing stop loss orders to help traders manage risk and secure profits automatically. With strong regulation, tight spreads, and powerful platforms, it’s ideal for all experience levels.

7. IC Markets

IC Markets is an authorized and regulated forex broker offering trailing stop loss orders on its platforms. This feature automatically adjusts stop levels as prices move, helping traders protect profits and manage trading risk efficiently.

Frequently Asked Questions

Is IC Markets an approved forex broker?

Yes, IC Markets is a regulated forex broker. They operate globally with oversight from several financial authorities, including the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC).

Can beginners use trailing stop loss orders with IC Markets?

It is available on IC Markets’ platforms like MetaTrader. While they are a useful risk management tool for securing profits, beginners should first master fixed stop-loss and understand market volatility to set the trailing distance correctly.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Approved and regulated | No proprietary trading platform |

| Offers trailing stop loss for effective risk management | Limited educational content for advanced users |

| Ultra-low spreads | Inactivity fees may apply |

| Supports MT4, MT5, and cTrader platforms | No fixed spread account options |

| Fast ECN execution and deep liquidity | Cryptocurrency trading not available in all regions |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐☆☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐☆ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

IC Markets is an approved forex broker providing trailing stop loss orders for automated profit protection. With strong regulation, fast execution, and low spreads, it’s an excellent choice for both beginner and professional traders.

8. Tickmill

Tickmill is a regulated and approved forex broker offering trailing stop loss orders on its trading platforms. This feature automatically adjusts stop levels as prices move, helping traders secure profits and effectively manage market risk.

Frequently Asked Questions

Does Tickmill offer trailing stop loss orders?

Yes, Tickmill offers it on their MetaTrader 4 (MT4) and MetaTrader 5 (MT5) desktop platforms. They are an advanced tool for securing profits as a trade moves in your favor.

Is Tickmill a registered forex broker?

Yes, Tickmill is a registered and multi-regulated forex broker with entities overseen by several financial authorities. These include the FCA (UK), CySEC (Cyprus), FSCA (South Africa), and FSA (Seychelles).

Pros and Cons

| ✓ Pros | ✕ Cons |

| Registered and regulated | Limited product range outside forex and CFDs |

| Offers trailing stop loss for automated risk control | No proprietary trading platform |

| Tight spreads | Inactivity fees may apply |

| Supports MetaTrader 4 and MetaTrader 5 | Cryptocurrency trading unavailable in some regions |

| Fast ECN execution and transparent pricing | Customer support not 24/7 |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms, and Tools | ⭐⭐⭐⭐☆ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Options | ⭐⭐⭐⭐☆ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

Tickmill is a registered forex broker offering trailing stop loss orders for efficient trade and risk management. With tight spreads, fast execution, and strong regulation, it’s ideal for both new and professional traders.

8. FBS

FBS is a regulated forex broker that supports it on its platforms. This feature automatically adjusts the stop level to lock in profits and effectively manage trading risk as the market price moves favorably.

Frequently Asked Questions

Is FBS an authorized forex broker?

Yes, FBS is an authorized forex broker with entities regulated by several bodies. These include the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC), and the Financial Services Commission (FSC) of Belize.

Can beginners use trailing stop loss orders with FBS?

Yes, beginners can use it with FBS. They are a great risk management tool to automatically protect profits. It’s highly recommended to first practice using them on an FBS demo account.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Authorized and regulated | Limited product range |

| Offers trailing stop loss for automated risk control | High leverage increases potential risk |

| Low minimum deposit and flexible account types | Some bonus conditions can be restrictive |

| Supports MetaTrader 4 and MetaTrader 5 | No proprietary trading platform |

| Comprehensive educational and support resources | Customer support not available 24/7 |

Final Score

| # | Criteria | Score |

| 1. | Overall Rating and Trust Score | ⭐⭐⭐⭐☆ |

| 2. | Range of Investments, Platforms and Tools | ⭐⭐⭐⭐☆ |

| 3. | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4. | Research and Education | ⭐⭐⭐⭐☆ |

| 5. | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6. | Customer Support and Regulatory Compliance | ⭐⭐⭐☆☆ |

| 7. | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8. | Execution Speed and Order Types | ⭐⭐⭐⭐☆ |

| 9. | Risk Management and Safety Measures | ⭐⭐⭐⭐☆ |

| 10. | Markets Analysis and Trading Tools | ⭐⭐⭐⭐☆ |

Our Insights

FBS is an authorized forex broker offering trailing stop loss orders to help traders manage risk automatically. With solid regulation, flexible accounts, and user-friendly tools, it’s suitable for both beginner and experienced traders.

10. FP Markets

FP Markets is a regulated forex broker that provides trailing stop loss orders on its platforms. This feature automatically adjusts the stop level to help traders secure profits and manage their trading risk effectively as prices move favorably.

Frequently Asked Questions

Is FP Markets a legit forex broker?

Yes, FP Markets is a legitimate and multi-regulated broker. It is authorized by reputable bodies like ASIC (Australia) and CySEC (Cyprus), has a long operational history since 2005, and is generally well-regarded.

Does FP Markets offer trailing stop loss orders?

Yes, FP Markets offers it orders on their MetaTrader 4 (MT4) and MetaTrader 5 (MT5) desktop platforms, as well as via the Traders Toolbox Mini Terminal.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Legit and regulated | No proprietary trading platform |

| Offers trailing stop loss for smart risk management | Limited cryptocurrency trading options |

| Tight spreads | Inactivity fees may apply |

| Supports MT4, MT5, and cTrader platforms | Some account types require higher deposits |

| Excellent customer service and educational resources | Customer support not available 24/7 |

Final Score

| # | Criteria | Score |

| 1 | Overall Rating and Trust Score | ⭐⭐⭐⭐⭐ |

| 2 | Range of Investments, Platforms, and Tools | ⭐⭐⭐⭐⭐ |

| 3 | Commissions, Fees, and Bonus Offers | ⭐⭐⭐⭐☆ |

| 4 | Research and Education | ⭐⭐⭐⭐☆ |

| 5 | Mobile Trading and User Experience | ⭐⭐⭐⭐☆ |

| 6 | Customer Support and Regulatory Compliance | ⭐⭐⭐⭐⭐ |

| 7 | Deposit and Withdrawal Option | ⭐⭐⭐⭐⭐ |

| 8 | Execution Speed and Order Types | ⭐⭐⭐⭐⭐ |

| 9 | Risk Management and Safety Measures | ⭐⭐⭐⭐⭐ |

| 10 | Markets Analysis and Trading Tools | ⭐⭐⭐⭐⭐ |

Our Insights

FP Markets is a legit forex broker offering trailing stop loss orders for better risk management. With strong regulation, low spreads, and advanced platforms, it provides a secure and efficient environment for all traders.

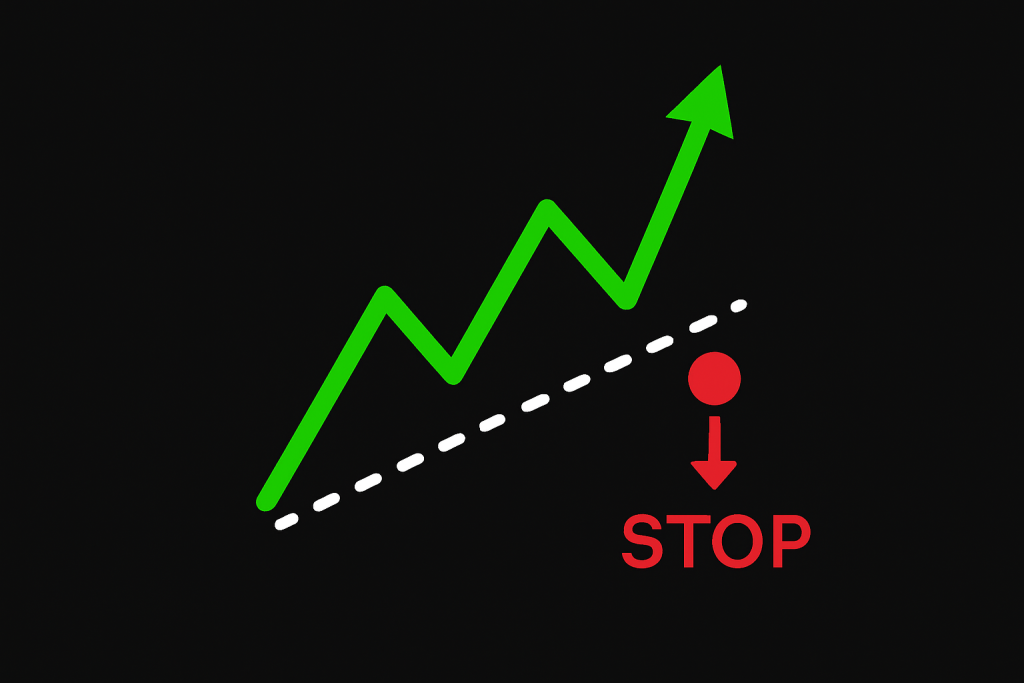

What is a Trailing Stop Loss Order?

A Trailing Stop Loss Order is a type of risk management tool that automatically adjusts your stop loss level as the market price moves in your favor. Unlike a fixed stop loss, which stays at a set price, a trailing stop “trails” the market by a specified distance (for example, 20 pips).

If the market continues moving positively, the stop loss moves with it, locking in more profit. But if the market reverses by that set distance, the trade closes automatically, protecting your gains while limiting losses.

Criteria for Choosing a Trailing Stop Loss Orders Forex Broker

| Criteria | Description | Importance |

| Regulation & Authorization | Ensure the broker is regulated by reputable authorities to guarantee fund safety and fair trading practices. | ⭐⭐⭐⭐⭐ |

| Platform Support | Check if the broker’s platforms (like MT4, MT5, or cTrader) fully support trailing stop loss orders and other risk tools. | ⭐⭐⭐⭐☆ |

| Execution Speed | Fast trade execution helps trailing stops adjust accurately during volatile markets, reducing slippage risk. | ⭐⭐⭐⭐☆ |

| Spreads & Fees | Lower spreads and transparent fees improve profitability and make active risk management more efficient. | ⭐⭐⭐⭐☆ |

| Ease of Use | User-friendly interfaces help traders set and modify trailing stops quickly without errors. | ⭐⭐⭐⭐☆ |

| Account Types & Leverage | Multiple account options and flexible leverage allow better customization for different trading strategies. | ⭐⭐⭐☆☆ |

| Customer Support | Responsive and knowledgeable support helps resolve platform or order related issues quickly. | ⭐⭐⭐⭐☆ |

| Reputation & Reviews | Positive feedback and a solid track record indicate reliability and trustworthy service. | ⭐⭐⭐⭐☆ |

| Educational Resources | Quality tutorials and guides on using trailing stops help beginners understand effective risk management. | ⭐⭐⭐☆☆ |

| Deposit & Withdrawal Options | Convenient, fast, and secure funding options support seamless trading experiences. | ⭐⭐⭐☆☆ |

Top 10 Best Trailing Stop Loss Forex Brokers – A Direct Comparison

What Real Traders Want to Know!

Explore the Top Questions asked by real traders across the Globe. From what is a trailing stop to how to set it up on MT4/MT5, we provide straightforward answers to help you understand trailing stop loss orders and choose the right broker confidently.

Q: What’s the best way to trail my stop loss when trading Forex? – Taylor L.

A: The best way to trail your stop loss is often using the Average True Range (ATR) indicator to base the distance on current market volatility. Alternatively, trail below swing highs/lows or use a Moving Average to stay in strong trends.

Q: What exactly is a trailing stop? – Ava V.

A: A trailing stop is a dynamic order that automatically adjusts a stop-loss price to lock in profits as a trade moves favorably, but it remains fixed if the price reverses, limiting potential losses.

Q: How do I set a trailing stop on MT4 or MT5? – Edward C.

A: In MT4/MT5 desktop, right-click your open position in the Trade/Terminal window. Select “Trailing Stop” and then choose or enter a custom distance in points. Your platform must remain open for it to work.

Pros and Cons

| ✓ Pros | ✕ Cons |

| Automated Risk Management | Requires Continuous Market Connection |

| Profit Protection | Can Trigger Prematurely |

| Emotion Control | Limited Customization |

| Effective in Volatile Markets | Not Ideal for All Strategies |

| Available on Most Platforms | Dependent on Broker Technology |

You Might also Like:

- MultiBank Group Review

- Vantage Review

- RoboForex Review

- Moneta Markets Review

- BlackBull Markets Review

- Pepperstone Review

- IC Markets Review

- Tickmill Review

- FBs Review

- FP Markets Review

In Conclusion

Trailing stop loss orders are excellent for managing risk and securing profits automatically, but traders should choose reliable brokers with fast execution and stable platforms to maximize their effectiveness.

Faq

A regular stop loss is a fixed price that closes a trade to limit loss. A trailing stop is dynamic; it automatically moves to lock in profits as the price moves favorably but remains fixed if the price reverses.

No, not all forex brokers offer trailing stop loss orders. While many do, especially on popular platforms like MetaTrader, some brokers or specific account types may only offer standard stop loss orders or other basic order types.

Popular platforms supporting trailing stop loss orders include MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and many proprietary broker platforms like TradingView, ThinkTrader, and those from Interactive Brokers.

Traders should use trailing stop loss orders because they automatically lock in profits as the price moves favorably while limiting potential losses if the market reverses, promoting discipline and reducing the need for constant monitoring.

Your trailing distance should adapt to the asset’s volatility and your risk tolerance. Use a percentage or the Average True Range (ATR) multiplier (e.g., 2x ATR) to allow normal price swings without premature stops.

Your trailing distance should adapt to the asset’s volatility and your risk tolerance. Use a percentage or the Average True Range (ATR) multiplier (e.g., 2x ATR) to allow normal price swings without premature stops.

Yes, they can be good for beginners. Trailing stops automatically lock in profits and limit losses on winning trades, helping to automate risk management and reduce emotional decision-making.

No, they are best suited for trending markets. In sideways or ranging markets, a trailing stop is likely to be hit by normal price fluctuations, causing premature exits and resulting in small losses or missed opportunities.

No, trailing stop losses do not guarantee profits. They are a risk management tool designed to lock in potential gains as the price moves favorably and limit losses if the price reverses. Slippage can cause the execution price to be worse than the stop price.

Generally, no, you cannot use trailing stop losses on all account types. Availability often depends on your brokerage’s platform and specific offerings. Some brokers limit them to certain advanced platforms or exclude them for volatile assets like options in some accounts.