Key Levels for Asian Traders

The sentiment of the day has certainly been a bullish one as across the board there’s a lot of green on the screens.

The FOMC interest rate decision has sparked markets around the globe and put pressure on the USD.

In Thursday trade the Australian ASX200 is currently up 0.4% on the day, while the Nikkei 225 is also up 0.4%.

The major Asian currency pairs are also showing strength today, with the AUD/USD and NZD/USD rallying on the back of a dovish Fed.

As the week continues to unfold here’s some levels to watch out for.

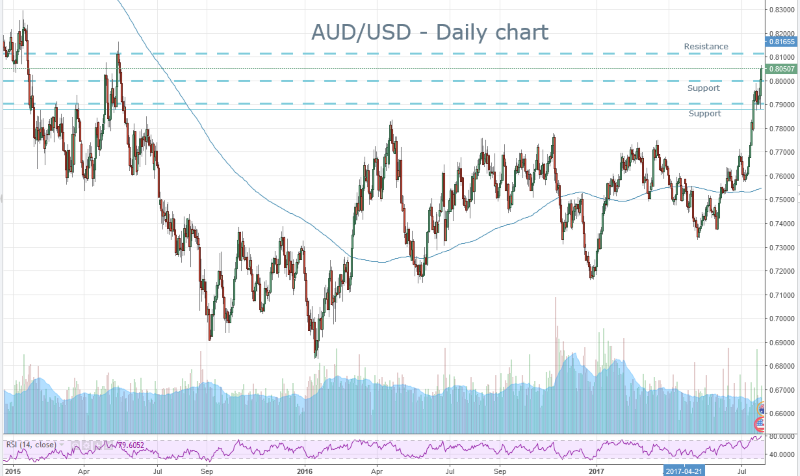

AUD/USD

The Aussie dollar has made light work of the key 80 cent resistance level today. It managed to shrug of a weaker than expected CPI and some dovish comments from the RBA’s Lowe to power ahead, after the FOMC sparked it back into action.

The ASX200 was up 0.4% and dragged the currency higher after Chinese industrial data came out above expectations.

Next Key Target: 0.8100

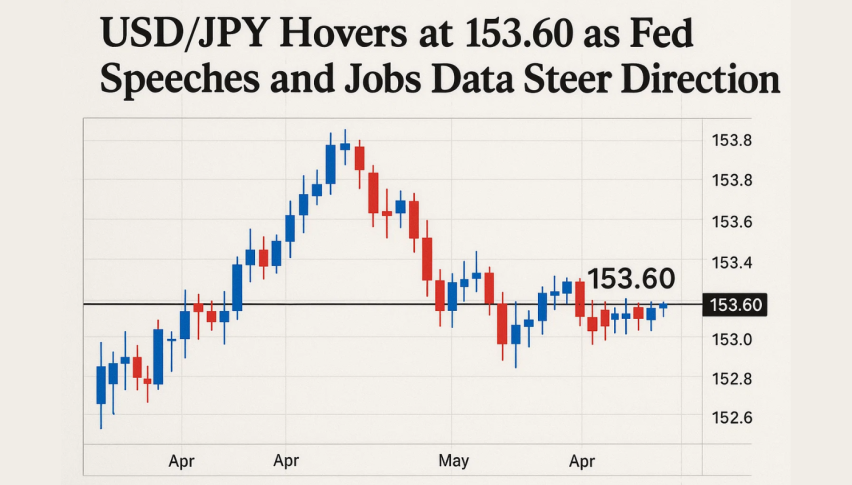

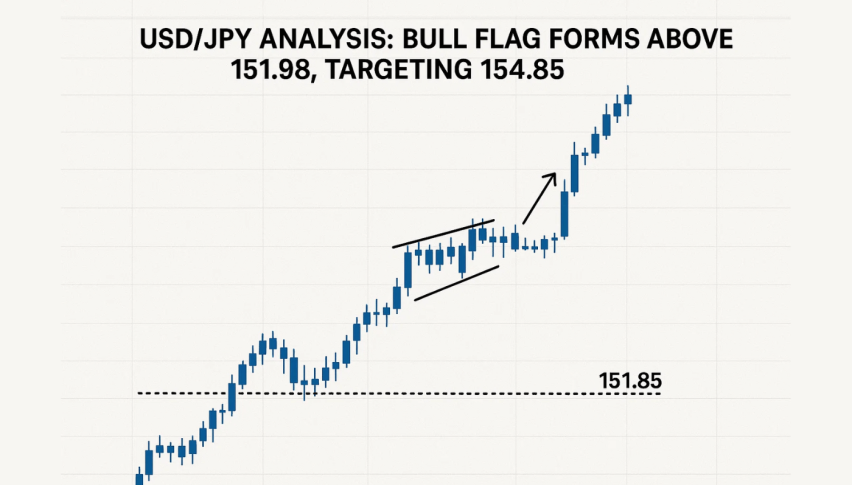

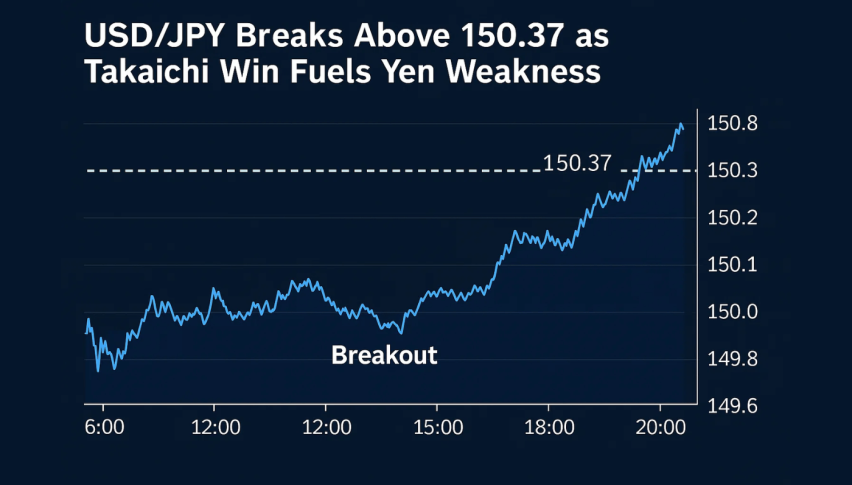

USD/JPY

The Yen has been red for 10 of the last 13 sessions and the FOMC did its part to continue to put on the downward pressure.

The Nikkei 225 has been strong today, and has been in a gradual uptrend for a number of months.

Next Key Target: 109.50

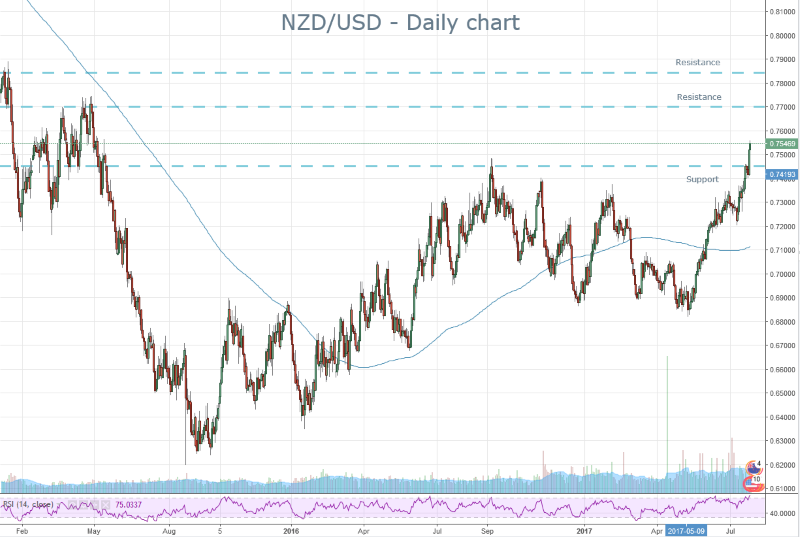

NZD/USD

All the news the last few days has been on the AUD however the Kiwi Dollar has been showing real strength and has taken out a number of key levels.

It powered through the most recent resistance level and now is firmly on track to take out 0.77.

Next Key Target: 0.7700

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account