WTI Crude Oil Edges Higher After Touching Five-Month Lows

WTI crude oil prices finally edged higher, rising from the five-month lows it had touched over worsening market sentiment.

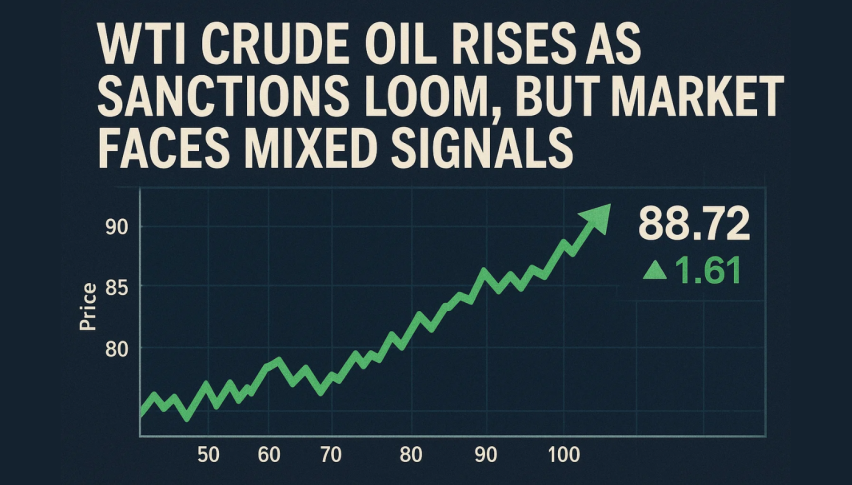

On Friday, WTI crude oil prices finally edged higher, rising from the five-month lows it had touched over worsening market sentiment. The main driver? Optimism over US-Mexico trade talks and a possibility of OPEC+ members agreeing to extend supply cuts beyond June.

At the time of writing, WTI is trading at around $53.28 per barrel over reports that US may be planning to delay the tariff hikes on Mexican goods. However, its gains remain limited since uncertainty continues over the trade war causing a possible slowdown in global economy.

In addition, on Thursday, the US Treasury Department further tightened Venezuelan crude oil supplies by announcing that recipients of oil from its state owned oil company could be subject to US sanctions. In May, Venezuela’s oil exports declined by over 17% due to these sanctions. In the coming weeks, the US is expected to take more economic actions against Venezuela, which could worsen the situation.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account