WTI Oil Trades Bullish as API Reports Decline in US Crude Inventories

Continuing a week-long rally, WTI crude oil prices are on the rise in early trading on Wednesday over increased optimism about an

Continuing a week-long rally, WTI crude oil prices are on the rise in early trading on Wednesday over increased optimism about an improvement in oil demand, boosted by the API report which revealed a decline in US crude inventories. At the time of writing, WTI crude oil is trading at around $58.25 per barrel.

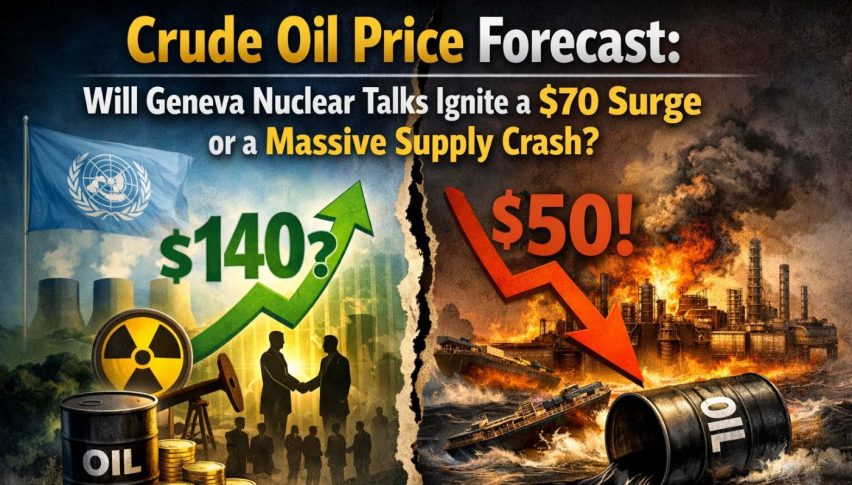

During the previous session, WTI crude oil gained almost 1% of its value and touched the highest level seen since 13 months. Oil prices have been strengthening in recent sessions as markets hope for the vaccine rollout to control the pandemic, helping oil demand recover around the world.

In addition, the API report which released on Tuesday showed that crude stockpiles in the US reduced by 3.5 million barrels during the past week to around 474.1 million barrels. The data went against economists’ forecast for a build of 985k barrels instead and supported the optimism surrounding an uptick in oil demand.

While crude oil prices have been improving since November 2020 on the back of the rollout of COVID-19 vaccines across the world, Saudi Arabia’s decision to cut crude supply by an additional 1 million bpd during February and March have helped support the bullish sentiment further. Other OPEC countries and allies have also extended their commitment to keep supply lower to balance oil markets in the near future.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM