Daily 62% Retracement In View For The EUR/USD

As we head toward the Friday Non-Farm Payrolls Report (July), a key support level is setting up for the EUR/USD.

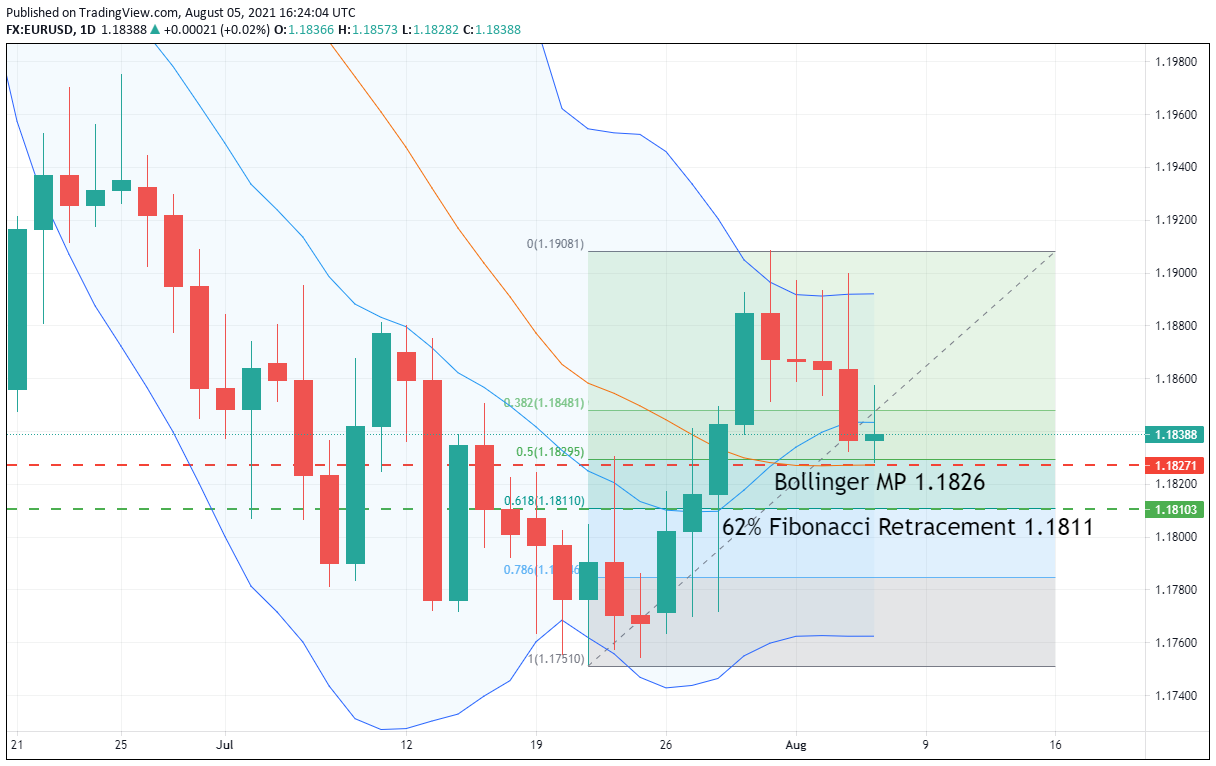

It has been a whipsaw forex session for the EUR/USD featuring heavy two-way action near the 1.1825 quarter-handle. And, it appears as though this pair may snap its four session losing streak. As we head into the late-day hours, the formation of a daily Doji candlestick is a possibility.

On the economic news front, today has brought the weekly U.S. jobs numbers. With Non-Farm Payrolls on deck for tomorrow, this collection of stats is thought provoking:

Event Actual Projected Previous

Challenger Job Cuts (July) 18.942K NA 20.476K

Continuing Jobless Claims 2,930K 3,260K 3,296K

Initial Jobless Claims 385K 384K 399K

Trade Balance (June) -75.70B -74.10B -71.00B

With the enhanced unemployment benefits set to expire next month, the U.S. jobs numbers are improving. Both Continuing and Initial Jobless Claims are down week-over-week, a solid sign with NFP coming out tomorrow. On the other hand, the U.S. Trade Balance for June fell by 4.5 billion from May.

On Friday, July’s NFP numbers will be released to the public. Analysts are expecting a 20,000 gain from June and a final tally of 870,000. No matter what happens with NFP, be ready for short-term volatility to hit the EUR/USD.

Key Fibonacci Support Level In View For The EUR/USD

As we head toward the Friday NFP report, a key support level is setting up for the EUR/USD.

Here are two levels to watch for this pair as the day progresses:

- Support(1): Bollinger MP, 1.1826

- Support(2): 62% Fibonacci Retracement, 1.1811

Bottom Line: Unti elected, I’ll have buy orders in the EUR/USD queue from above the daily 62% Fibonacci Retracement at 1.1819. With an initial stop loss at 1.1784, this trade produces 35 pips profit on a standard 1:1 risk vs reward ratio.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account