Gold Price Analysis: Key Factors Influencing XAU/USD Dynamics and Technical Outlook

In the Asian trading session on Thursday, Gold price (XAU/USD) experienced a slight uptrend, yet failed to consistently surpass the signific

In the Asian trading session on Thursday, GOLD price (XAU/USD) experienced a slight uptrend, yet failed to consistently surpass the significant $2,000 benchmark. The prevailing positive risk sentiment is identified as the primary constraint for the metal’s upward movement. Nonetheless, the commodity remains positioned above the recent low of approximately $1,970-1,969, suggesting caution for those anticipating a sharp decline.

Declining US Treasury bond yields and the US Dollar’s weakening trajectory, in anticipation that the Federal Reserve may have concluded its rate hikes, offer some stability to Gold’s non-yielding value. Additionally, the rising tensions in the Israel-Hamas situation and deteriorating economic circumstances in China act as buffers against a substantial decline for the haven asset, XAU/USD.

Despite a modest intraday gain, Gold struggles to make significant headway due to the prevailing risk appetite and ambiguity surrounding the Federal Reserve’s rate adjustment plans. After maintaining overnight interest rates unchanged for two consecutive instances, the Federal Reserve indicated that the current financial conditions might sufficiently address inflation concerns.

Consequently, market projections now align with a potential rate cut by the US central bank in June 2024. This anticipation further pressures US Treasury bond yields and weakens the US Dollar. Notably, the yield for the rate-sensitive two-year US government bond has dropped to its nadir since September 8, while the primary 10-year Treasury yield retracts from the 5% mark. The Federal Reserve has enhanced its economic outlook, recognizing the US economy’s unforeseen robustness, thereby leaving room for potential rate hikes.

In terms of geopolitics, Bolivia has severed its diplomatic relationship with Israel, citing civilian casualties due to what it perceives as excessive military actions in Gaza. Attention now turns to the upcoming US employment data – the NFP report – scheduled for Friday, anticipated to offer substantial direction to Gold.

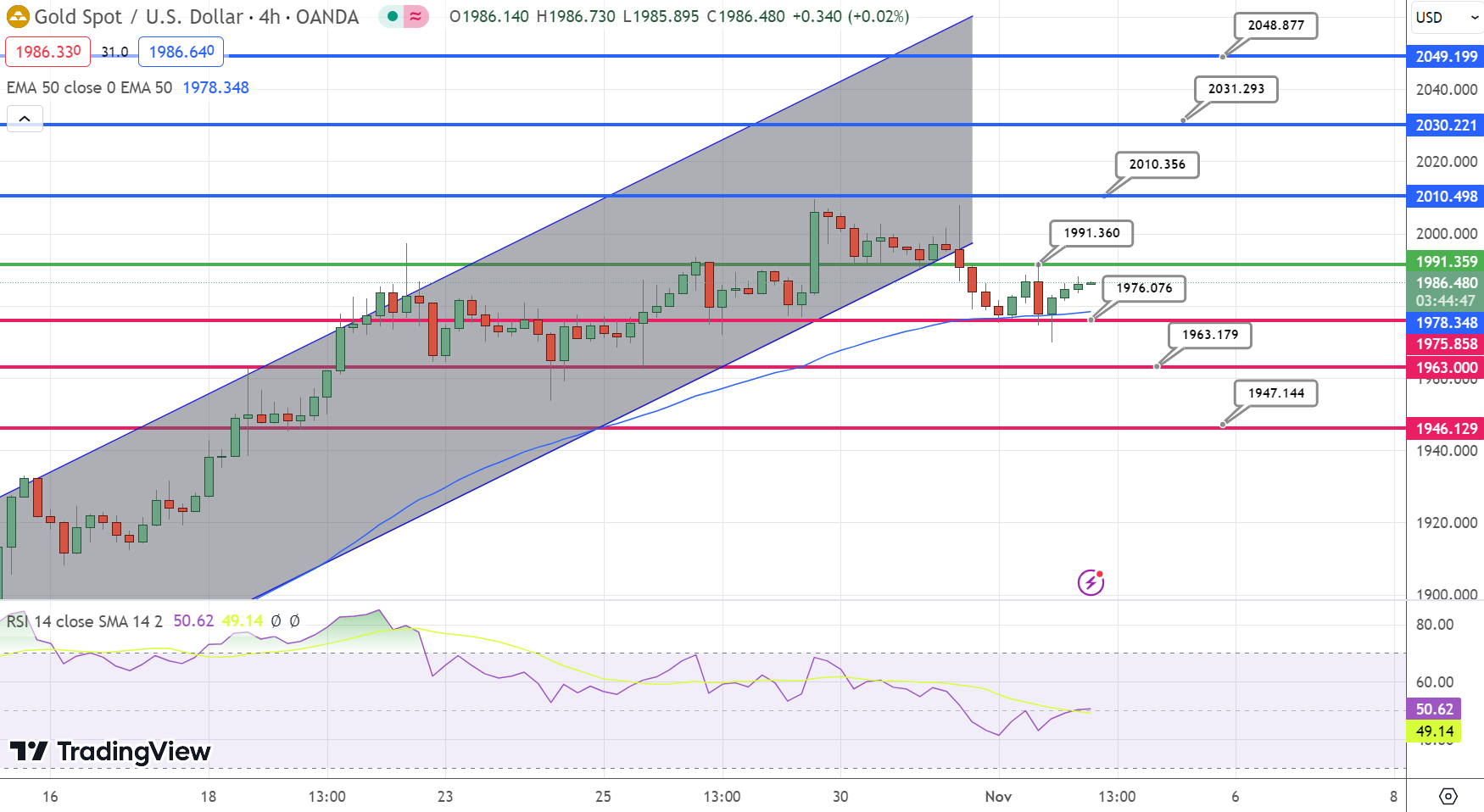

Gold Technical Insights

Gold Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM