NIKKEI Gets a Boost from China’s Real Estate Stimulus Plan

The NIKKEI225 gained 1.15% this morning after the CCP decided to add yuan 1,000 billion ($138 billion) in supplementary loans.

NIKKEI Gets a Boost from China’s Real Estate Stimulus Plan

The NIKKEI225 gained 1.15% this morning after the CCP decided to add yuan 1,000 billion ($138 billion) in supplementary loans.

Stock markets open the weak on a bullish note on expectations of imminent central bank interest rates cuts. The ECB is expected to cut rates as early as June. While the broader market is still expecting the Fed to start cutting rates before the end of the year.

The NIKKEI225 hooked on to the bullish sentiment across the globe, spurred by China’s help in the domestic real estate market. The weak yen has also contributed to the rally that started at the beginning of 2024.

Wednesday we’re expecting trade data and for Friday inflation figures. The weak yen has been fuelling inflation and weighing down on consumer demand. The BoJ is watching the situation and concerns that the central bank may intervene are rising.

The central bank may look at forex intervention, which the bank has never officially recognized. The speculation of previous bouts to prop up the yen have always led to temporary yet sharp increases in the yen’s value to other currencies.

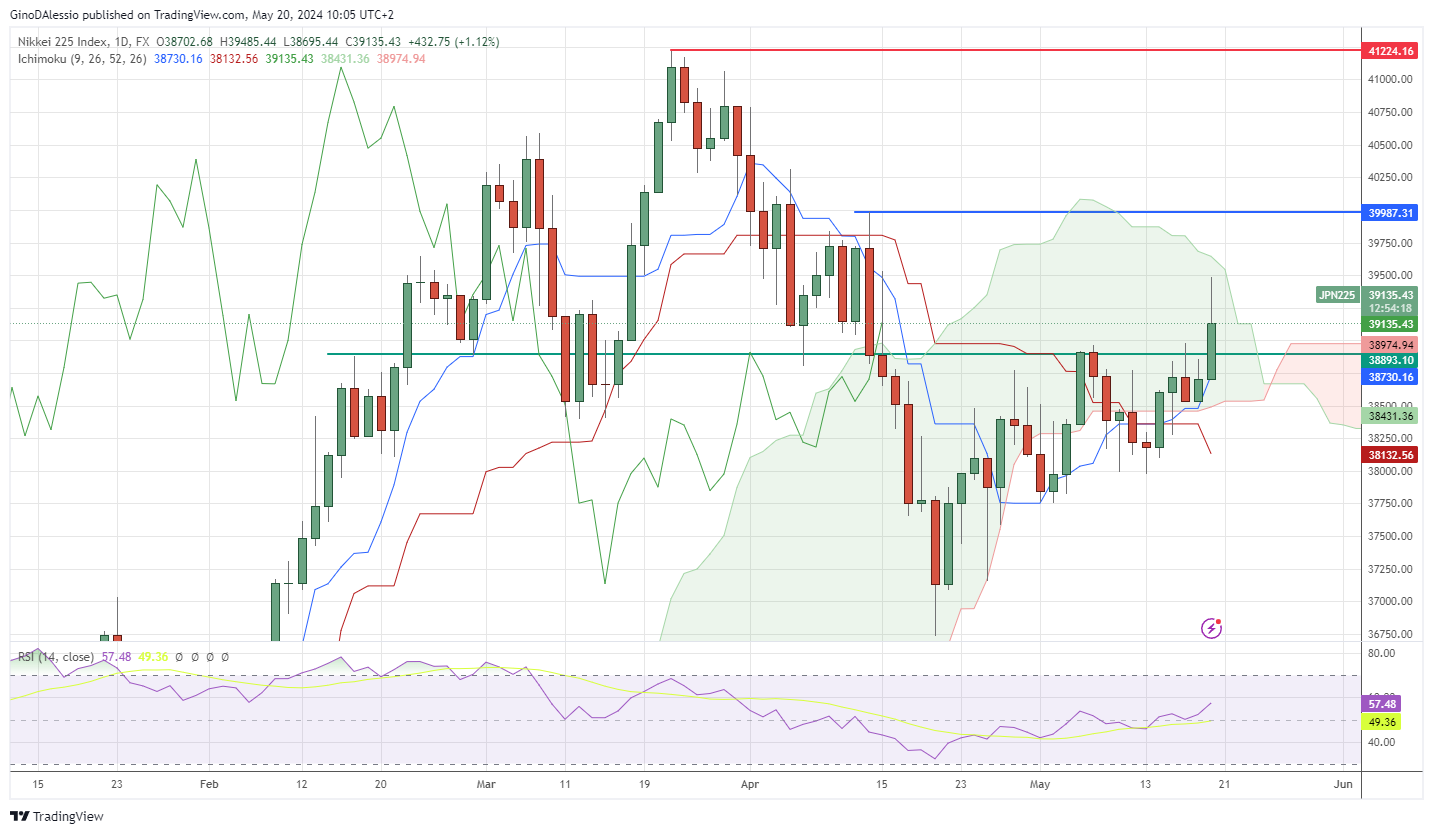

Technical View

The day chart below for the NIKKEI225 shows a bullish trend that has retraced into the Ichimoku cloud. Today’s rally saw resistance at the top of the cloud. For now, the bullish trend is still intact as the market has failed to break below the cloud on several attempts.

From here the next resistance level is at a high set on April 12, of 39987 (blue line). While the support level is at 38893 (green line), if that break, the market will find support from the lower side of the cloud.

For the bullish trend to regain momentum, we need to see the market break through the top side of the cloud, and close higher than the resistance level (blue line).

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM