Bitcoin Stumbles: Will the Bullish “Banana Zone” Arrive Soon?

Bitcoin (BTC) has been on a rollercoaster ride lately, failing to recapture its previous glory above $70,000. Analysts are divided on the

Bitcoin (BTC) has been on a rollercoaster ride lately, failing to recapture its previous glory above $70,000. Analysts are divided on the immediate future, with some predicting a surge into a “Banana Zone” of euphoria, while others warn of a potential correction.

Obstacles on the Road to the Banana Zone

CryptoQuant analyst IT Tech believes three key hurdles need to be overcome before Bitcoin enters a bullish phase:

- Reduced Bitcoin Miner Selling: Since Bitcoin mining revenue dropped significantly, miners have been selling more to recoup losses. A decrease in this selling pressure is crucial for a price increase.

- Increased Stablecoin Inflows: The lack of new stablecoin issuance is hindering liquidity and price stability. More stablecoin inflows are needed to fuel a sustained rally.

- Lower Outflows from Bitcoin ETFs: Outflows from Bitcoin ETFs like those from Fidelity and Grayscale signify selling pressure. A decrease in these outflows would indicate renewed investor confidence.

BTC/USD Technical Indicators Flash Caution

Bitcoin’s current price movement suggests a period of consolidation. Some analysts, like Rekt Capital, believe a break above a specific downtrend line could trigger a price reversal. However, others warn of a potential drop to $61,000 if buying momentum doesn’t pick up.

Market Uncertainty Fuels Volatility

Global economic concerns and reduced summer liquidity are contributing to broader market volatility, impacting Bitcoin as well. This uncertainty might lead to significant price swings in either direction in the coming months.

A Silver Lining for Bulls?

Despite the current slump, there are reasons for Bitcoin bulls to be cautiously optimistic. CryptoQuant’s data suggests the retail investor crowd hasn’t fully entered the market yet, potentially indicating room for further growth. Additionally, long-term holders seem to be providing a solid price support base.

Social Sentiment Mixed

While AMBCrypto observed a rise in social volume and active addresses for Bitcoin, suggesting continued investor interest, Bitcoin holders recently experienced their biggest 3-day drop in non-empty wallets, hinting at some fear.

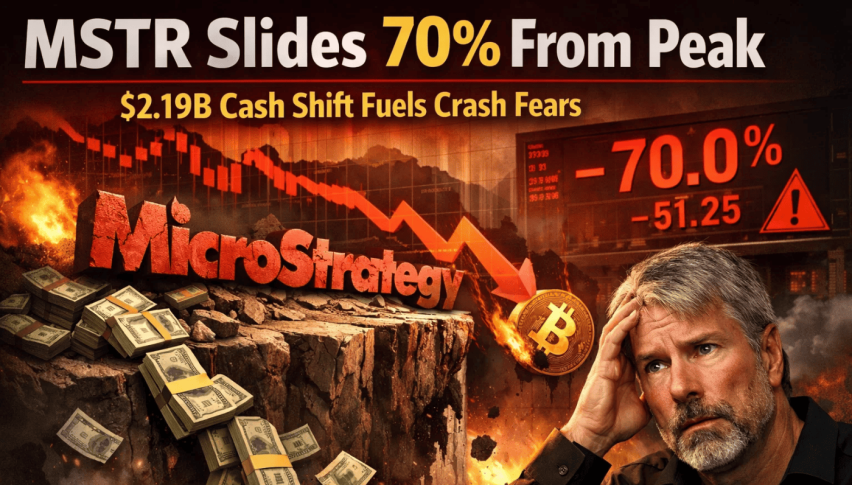

The MicroStrategy Connection

Economist Peter Schiff highlighted the interconnected risks between Bitcoin and MicroStrategy (MSTR), suggesting that a Bitcoin price crash could trigger a decline in MSTR stock price as well.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account