Bitcoin Plunges 19% to $79,000 as Extreme Fear Grips Market, Analysts Eye Potential Bottom

Bitcoin (BTC) has entered a significant corrective phase, falling below $80,000 and shedding nearly 37% from its all-time high of $109,000

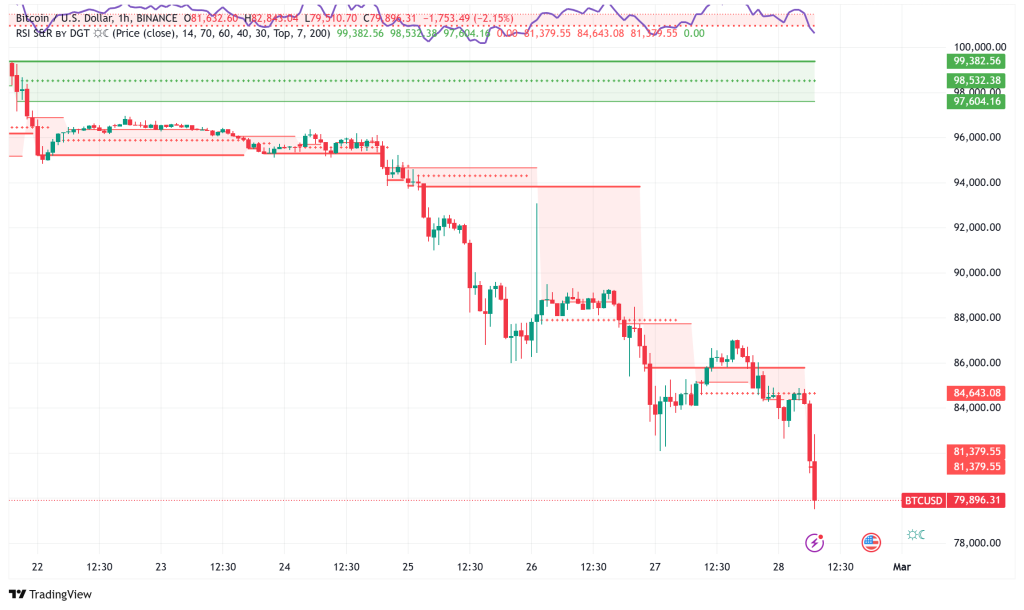

Live BTC/USD Chart

Bitcoin (BTC) has entered a significant corrective phase, falling below $80,000 and shedding nearly 37% from its all-time high of $109,000 set during Trump’s January 20th inauguration. Market sentiment has deteriorated dramatically, with the Crypto Fear & Greed Index recently touching an “Extreme Fear” score of 10—its lowest level in over two years.

Bitcoin’s Slide Bottoming Soon?

Several observers think Bitcoin might be nearing a cyclical lowest point. Capriole Investment’s founder, Charles Edwards, said given the “significant level of fear and liquidations” in the market, a “near-term floor” could be developing even with weak macroeconomic data.

According to Sistine Research, the chances are almost 30% that the bottom point of this correction—that of Bitcoin’s latest decline to $79,000 level—marks They caution, meanwhile, that ongoing stock market volatility might bring Bitcoin down to $73,000—a level not seen since early November.

While Thomas Perfumo, global economist for Kraken, thinks structural data point to “the broader crypto market still has room to run,” CryptoQuant CEO Ki Young Ju has voiced optimism that Bitcoin is unlikely to dip below $77,000.

Macroeconomic Factors Weighing on Bitcoin

The broader market decline appears driven by:

- Macroeconomic uncertainty under the new Trump administration

- Concerns over Trump’s proposed tariffs on China, Mexico, and Canada

- Correlation with traditional risk assets, as Bitcoin has become increasingly sensitive to stock market movements and liquidity conditions

- The S&P 500 falling 4.13% over the past five trading days

BTC/USD Technical Indicators Point to Capitulation

Technical analysis reveals Bitcoin BTC/USD has developed a bearish “three-blind mice” pattern on daily chart, breaching below the set $90,000-$110,000 zone. BTC struggles to create bullish momentum while probing the fair value gap around $82,000.

Bitcoin’s futures and ETF markets are showing signs of capitulation:

- Spot Bitcoin ETFs experienced $3.4 billion in outflows during February

- February 25th marked the largest single-day ETF outflow of $1.13 billion since inception

- CME futures basis has fallen below 5%, prompting many market participants to unwind positions

- Futures open interest has declined steadily, indicating low investor confidence

Crypto analyst Adam notes an interesting counter-indicator: historically, significant ETF inflows or outflows have frequently preceded price moves in the opposite direction. Of 14 instances of major ETF flows, Bitcoin price has aligned with the direction of those flows only once—following Trump’s election victory.

Bitcoin’s Long-Term Outlook: Strategic Reserves, Rising Adoption

On the regulatory front, there are encouraging changes notwithstanding the volatility of the present market. Approved by the Texas Senate Banking Committee unanimously 9-0, Texas Senate Bill 21 creating a Bitcoin and cryptocurrency strategic reserve now moves to the Senate floor. States seeking to diversify financial reserves have similar bills outstanding in Oklahoma, Arizona, and Utah.

Head of digital assets analysis for Standard Chartered Geoffrey Kendrick has a very positive long-term view, forecasting Bitcoin will reach $200,000 this year and maybe $500,000 before Trump’s second term ends. Key accelerators Kendrick notes include increased institutional acceptance and the possibility for regulatory clarity; “as the industry becomes more institutionalized, it should be safer.”

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account