Bitcoin Soars Past $93,000 as Institutional Giants Enter the Arena

Bitcoin (BTC) is maintaining its position above the $93,000 level, consolidating after a significant recent surge. BTC/USD's price strength

Quick overview

- Bitcoin is currently consolidating above $93,000, driven by significant institutional inflows into US spot ETFs and the launch of Twenty One Capital, a new Bitcoin Treasury company.

- Twenty One Capital aims to rival MicroStrategy by debuting with 42,000 Bitcoin and plans to go public through a merger with Cantor Equity Partners.

- Recent data shows record inflows into Bitcoin ETFs, indicating a resurgence in demand and positioning them as key players in the market.

- Technical analysis suggests a potential resistance level at $96,100 before Bitcoin targets the psychologically significant $100,000 milestone.

Bitcoin (BTC) is maintaining its position above the $93,000 level, consolidating after a significant recent surge. The cryptocurrency’s price strength is being driven by a dramatic increase in institutional inflows into US spot ETFs and the emergence of a new corporate player aiming to rival Strategy in the Bitcoin treasury space.

Institutional Capital Floods In as Twenty One Capital Challenges MicroStrategy

Founded Strike, a Bitcoin payments startup, Jack Mallers has revealed the establishment of Twenty One Capital, a new Bitcoin Treasury company supported by industry heavyweights including Tether, SoftBank, and Cantor Fitzgerald. Positioned as the third-largest corporate Bitcoin holder behind MicroStrategy and MARA Holdings, the ambitious business intends to debut with 42,000 Bitcoin (value around $3.9 billion).

Specifically declaring its aim to replace Michael Saylor’s MicroStrategy as the “superior vehicle for investors seeking capital-efficient Bitcoin exposure,” the company Following finalizing agreements to fund $525 million through convertible bonds and equity financing, Twenty One Capital intends to go public via a blank-check merger with Cantor Equity Partners, trading under the ticker XXI on Nasdaq.

“Our goal is straightforward: we want to be the most profitable company in Bitcoin, the most worthwhile financial prospect available right now. Mallers said, outlining the endeavor as “a public stock, built by Bitcoiners, for Bitcoiners,” not here to beat the market but rather here to create a new one.

Spot Bitcoin ETF Inflows Shatter Records

U.S. spot institutional funding With inflows of $912 million in a single day—more than 500 times the daily average for 2025— Bitcoin ETFs underwent a dramatic turn-around on April 22 Data from Glassnode shows this to be “the largest daily inflow since November 11, 2024, marking a notable resurgence in demand.”

“The spot bitcoin ETFs went Pac-Man mode yesterday,” said Bloomberg ETF analyst Eric Balchunas, pointing out that most of the eleven ETFs saw inflows spread rather than concentrated in BlackRock’s iShares Bitcoin Trust (IBIT).

Bitcoin ETFs “have become ‘the marginal buyer’ in Bitcoin since January 2024,” European head of research at asset management company Bitwise noted, and may “actually determine whether you see negative or positive net buying volumes on BTC spot exchanges.”

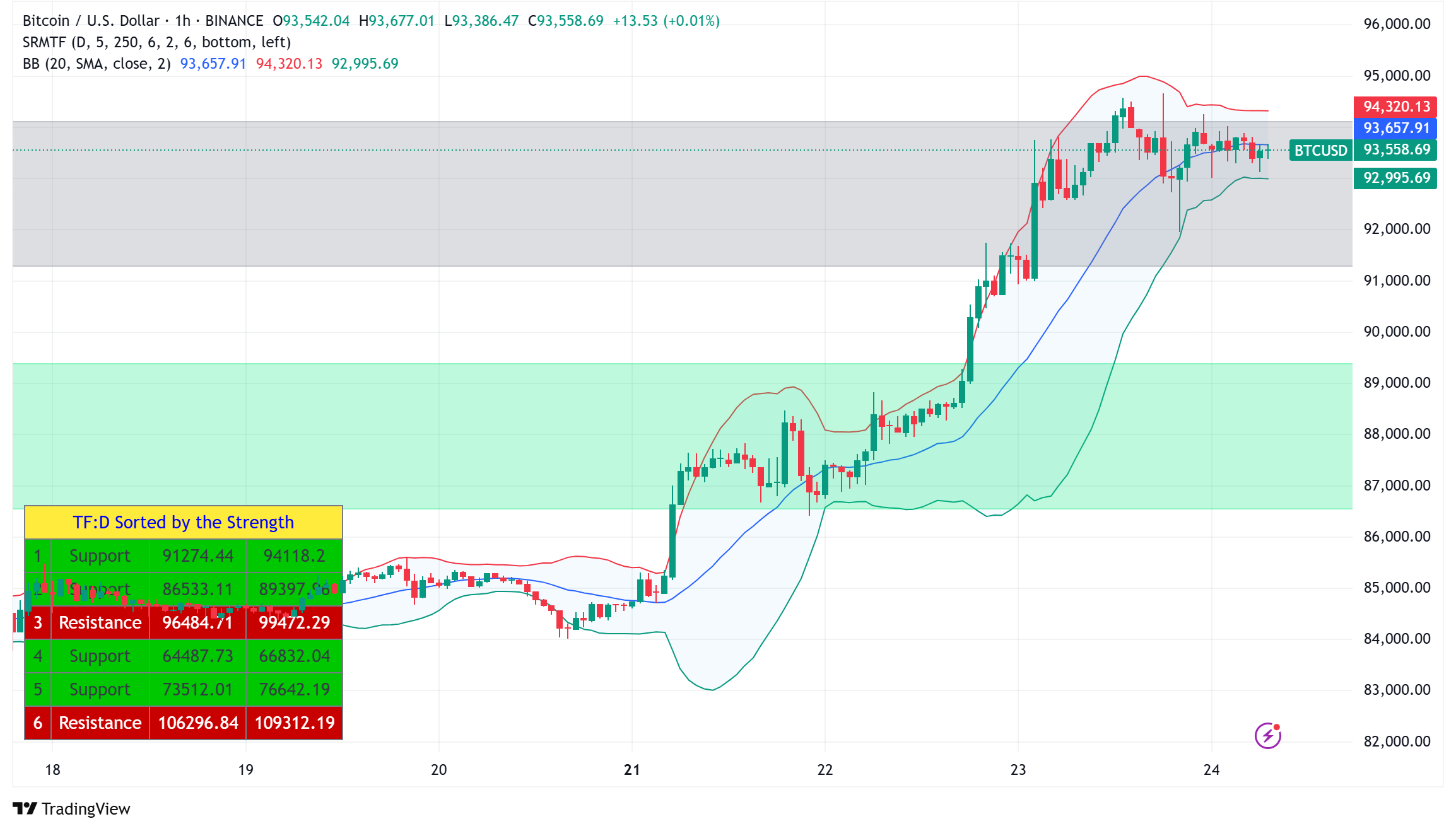

BTC/USD Technical Analysis: Short-Term Holders Return to Profitability

Most short-term holders (STHs) are now in profit as Bitcoin’s BTC/USD climb above $91,700 on April 22 raised its value above the cost basis or short-term realized price. Historically, this is a positive development since STHs in profit usually hold their positions and draw fresh investors, so generating increasing momentum.

First-time buyers in April show “strong activity” according on-chain statistics, suggesting fresh cash joining the market at more price points. While Bitcoin whales and sharks have taken 600% of the annual issuing, long-term holders have raised their allotment by 363,000 BTC since February.

Bitcoin Price Prediction: Potential Resistance Ahead of $100,000

Technical analysis indicates one last resistance level remains at roughly $96,100 despite the positive trend. “At the $96K level, there will be the final resistance from the cohort holding coins for 3-6 months, then the next target of $100K opens up,” claims Bitcoin researcher Axel Adler Jr.

Based on on-chain statistics, investors have over 392,000 BTC at an average cost basis of $97,000, therefore generating a possible resistance zone whereby many could sell at break-even. Before a possible climb toward the psychologically important $100,000 threshold, this emphasis could momentarily slow down Bitcoin’s upward speed.

Identifying three price targets—$131,500, $144,900, and $ 166,700—suggesting ongoing higher movement after overcoming present resistance levels—Anonymous trader Ezy Bitcoin highlighted Bitcoin’s price behavior in the Wyckoff reaccumulation phase for long-term investors.

As sovereign wealth funds and organizations continue collecting Bitcoin as a hedge against currency inflation and macroeconomic uncertainty, the cryptocurrency’s road to new all-time highs appears increasingly likely, with the $100,000 milestone now within striking reach.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account