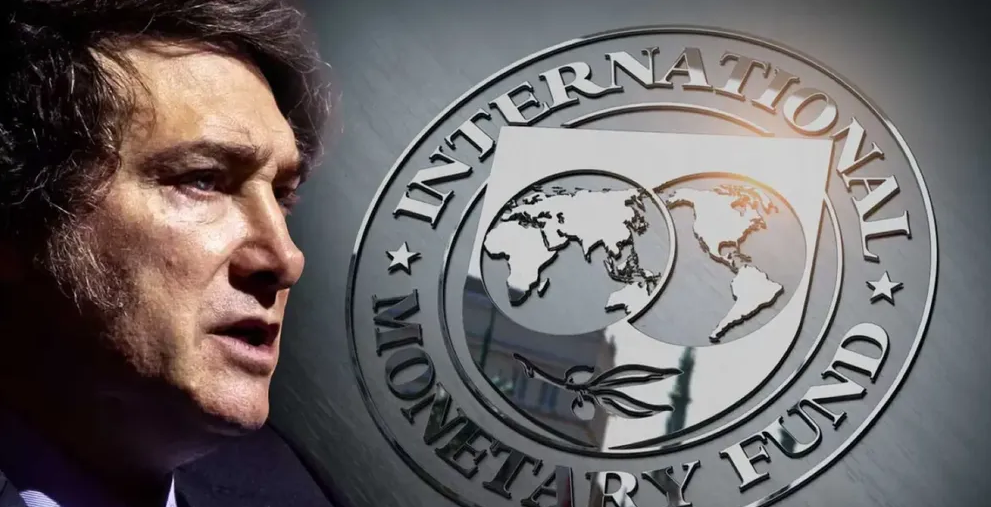

Javier Milei Reaffirms Argentina Will Return to Debt Markets

The libertarian president also acknowledged that inflation remains high but predicted it would significantly decline by mid-2026.

Quick overview

- President Javier Milei confirmed Argentina's intention to return to international financial markets but did not provide a specific timeline.

- He stated that country risk will fall below 700 basis points, which is a prerequisite for re-entering the markets.

- Milei emphasized his administration's economic policies, including a 15-point fiscal adjustment and a claimed 22% drop in poverty.

- Despite high inflation, he predicts a significant decline by mid-2026 due to the effects of monetary policy.

President Javier Milei confirmed once again that Argentina intends to return to international financial markets but stopped short of giving a specific timeline.

Speaking at Expo EFI 2025, he stated: “Since country risk will fall below 700 basis points, we will return to international markets.” This reiterates a stance the government has promoted since securing a $20 billion loan from the IMF, in addition to funding from other international institutions.

Despite this commitment, the administration has yet to clarify when Argentina will re-enter the markets. Analysts speculate it likely won’t happen before the October elections, and some even forecast a mid-2026 return.

During his nearly two-hour speech, Milei reviewed his administration’s economic policies and defended his approach vigorously, emphasizing achievements such as the 15-point fiscal adjustment, the IMF agreement, reforms led by Federico Sturzenegger, and what he claimed was a 22% drop in poverty—lifting 10 million Argentines out of poverty.

Milei’s Words

The libertarian president also acknowledged that inflation remains high but predicted it would significantly decline by mid-2026, citing the delayed effects of monetary policy, which typically lag by 18 to 24 months.

“We fixed the money supply in the middle of last year, which means inflation already has a death date—midway through next year. So now is the time to start thinking about growth.”

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM