GBP/USD Price Analysis: Rebound Builds—Will NFP Flip the Trend?

The GBP/USD pair is back up, $1.3310 in early trade after bouncing off the key support at $1.3260 which is the 0% Fib...

Quick overview

- The GBP/USD pair is currently trading at $1.3310 after bouncing off key support at $1.3260.

- It is approaching resistance at $1.3331, which could lead to further gains if broken.

- U.S. jobs data and trade sentiment are expected to influence the dollar's strength in the near term.

- The Bank of England is under pressure to cut rates, which may limit any potential gains for the pound.

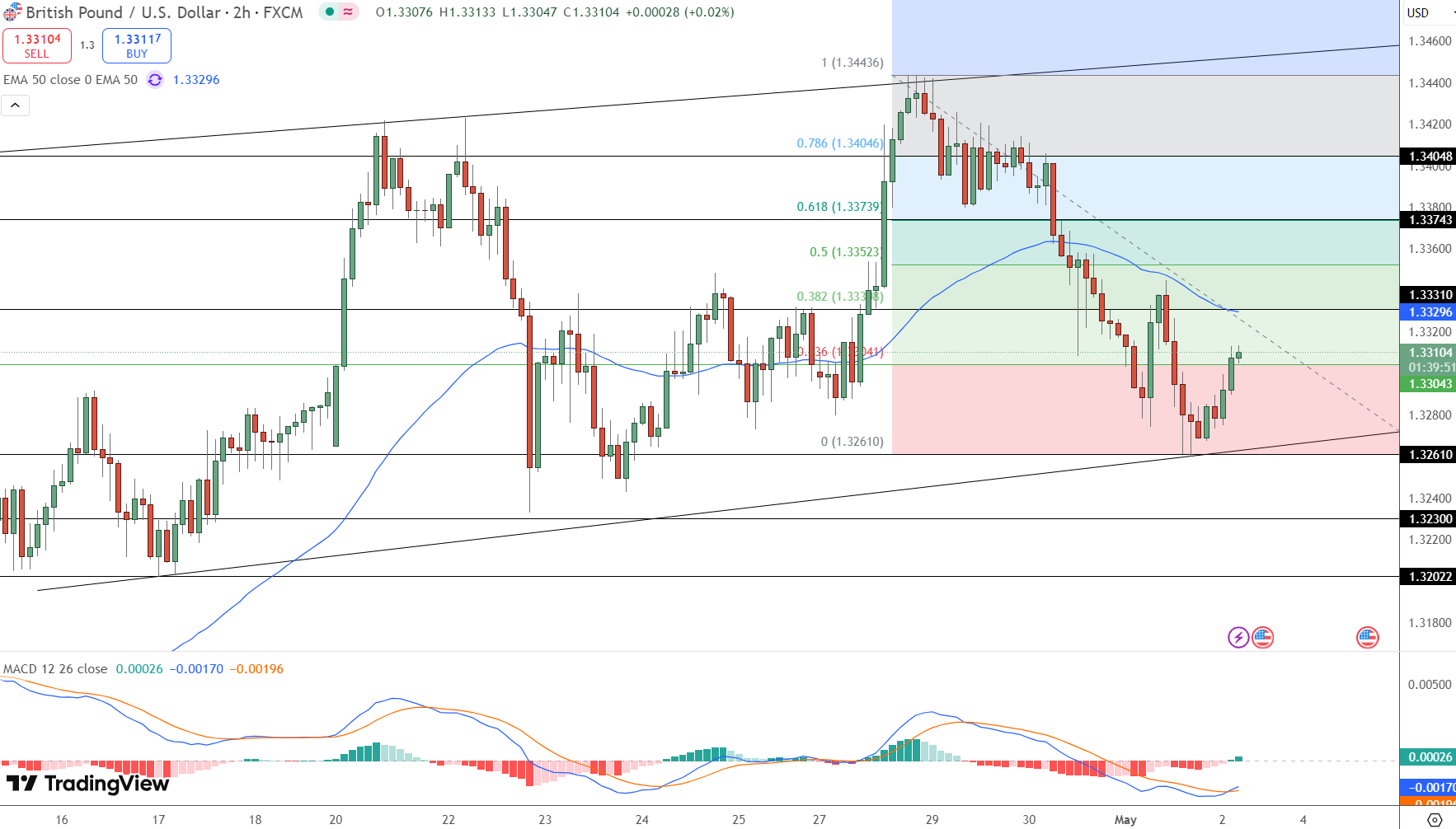

The GBP/USD pair is back up, $1.3310 in early trade after bouncing off the key support at $1.3260 which is the 0% Fib from the recent slide from $1.3443 to $1.3261.

Now GBP/USD is approaching the descending trendline resistance at $1.3331 which is also the 38.2% Fib and the 50 period EMA.

The MACD is turning up, but this is a counter trend bounce – a relief rally within a bigger downtrend. The pivot is at $1.3331. A break above that could see $1.3352 and $1.3374. Failure to clear resistance may see selling resume.

U.S. Jobs and Trade Sentiment to Move Dollar

The dollar has found some support as U.S.-China trade talks show signs of life. After weeks of tariff escalation, Beijing has indicated they are willing to talk again, which has given risk appetite and dollar a bit of a boost.

But all eyes now are on the April U.S. Non-Farm Payrolls (NFP) report. Markets are expecting a slowdown:

-

NFP: 138,000 forecast vs 228,000 prior

-

Unemployment: Expected to remain at 4.2%

-

Wage growth: Seen rising 0.3% month-over-month

A weaker print could see the Fed cut rates and weigh on the dollar – giving GBP/USD room to rally.

BoE Rate Cut Expectations Cap Sterling Gains

The BoE is under pressure to cut. Governor Andrew Bailey said global trade tensions could spill into the UK economy and markets are pricing in a 96% chance of a 25 basis point cut to 4.25% at the May 8 meeting according to a Reuters poll.

This dovish bias may limit sterling gains unless near term data surprises to the upside or global sentiment turns risk-on.

Trade Setup Summary – GBP/USD

-

Entry: Buy on break above $1.3331

-

Targets: $1.3352 and $1.3374

-

Stop-Loss: Below $1.3260

Newbie? Buy on confirmation.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account