Morocco’s MASI on Fire—Rate Cuts & Mega Deals in Focus

As of May 2, 2025, the Casablanca Stock Exchange (CSE) is getting close to the record high, with the Moroccan All Shares Index...

Quick overview

- As of May 2, 2025, the Casablanca Stock Exchange is nearing a record high, with the Moroccan All Shares Index closing at 17,422.

- The rally is fueled by strong investor sentiment, accommodative monetary policy, and significant infrastructure projects.

- Key sectors driving growth include Transport Services, Electricity, and Construction, with top performers like Fenie Brossette and TGCC S.A.

- A recent rate cut by Bank Al-Maghrib has improved liquidity and risk appetite, further supporting the market's upward momentum.

As of May 2, 2025, the Casablanca Stock Exchange (CSE) is getting close to the record high, with the Moroccan All Shares Index (MASI) closing at 17,422, just shy of the all time high. The rally is driven by strong investor sentiment thanks to accommodative monetary policy, big infrastructure projects and renewed confidence in Morocco’s growth path.

Momentum Across Sectors

The rally started to accelerate in early 2025 and gained momentum when MASI hit 16,723.8 in February, a major psychological level. Key sectors leading the charge are:

Transport Services: +19.59%

Electricity: +7.84%

Construction: Outperforming on infrastructure stimulus

Top performers are Fenie Brossette, up 31.71%, and TGCC S.A, up 26.2%, on the back of strong earnings and sector tailwinds.

Rate Cuts Unleash Liquidity and Risk Appetite

A major catalyst was Bank Al-Maghrib’s March 2025 rate cut, which brought the benchmark rate to 2.25%, the lowest in years. This move improved liquidity, reduced borrowing costs and encouraged risk taking across local equity markets.

Morocco’s hosting of the Africa Cup of Nations 2025 and FIFA World Cup 2030 is accelerating growth, especially in logistics and public works. This construction wave is feeding into MASI’s core sectors.

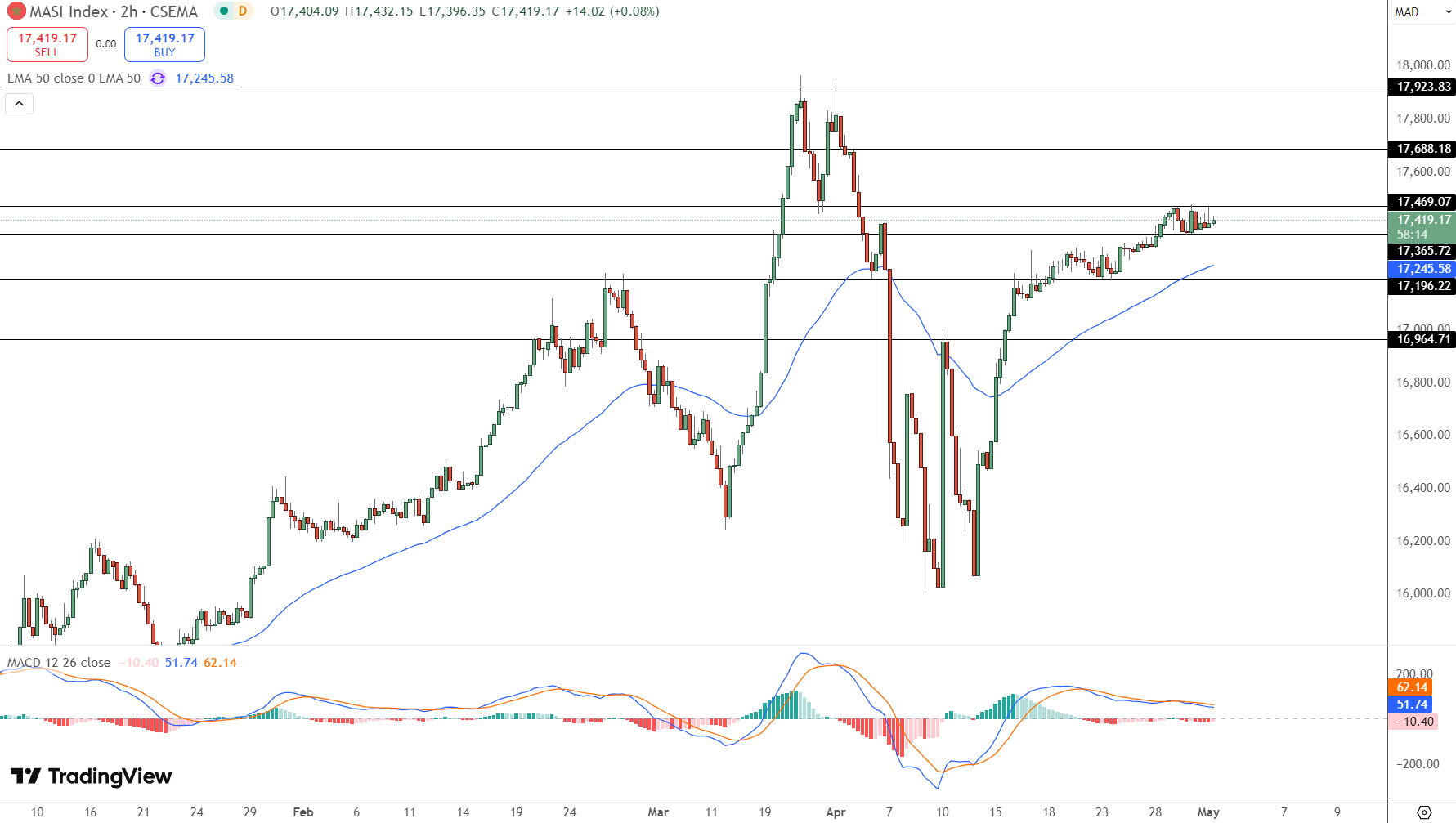

Technical Analysis: MASI to Break Above 17,469

MASI is consolidating just below the critical resistance at 17,469, with strong support from the 50-period EMA at 17,245. Despite the strong rebound from April’s lows, the MACD is flattening, a sign of a potential pause before the next move.

Trade Setup:

Entry: Above 17,470

Target: 17,688

Stop Loss: Below 17,245

Short term, a confirmed break could trigger the next leg up. But don’t enter early, wait for confirmation above resistance.

In January 2025, the Moroccan Minister of Investment met with CSE officials to boost the exchange’s international standing.

Key initiatives are:

Kénitra-Marrakech high-speed rail project (53 billion MAD)

African capital market integration

New incentives for foreign portfolio investors

Bottom Line

CSE’s 2025 is more than short term optimism, it’s the result of targeted fiscal support, strategic infrastructure and technical strength. MASI is getting close to the breakout levels, Morocco’s stock market may soon become one of Africa’s financial centers

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account