WTI Crude Eyes $61.30 as Demand Recovers – Is a Breakout Near?

WTI crude oil is trading at $59.85, up from recent lows of $57.70 as traders focus on US-China trade talks...

Quick overview

- WTI crude oil is currently trading at $59.85, supported by a bullish trend and supply tightening.

- US-China trade talks resuming this weekend are expected to ease economic uncertainty and bolster oil demand.

- US energy companies are reducing rigs, which will likely tighten supply and support higher prices.

- Traders should watch for resistance at $60.61 and support at the 50-hour EMA of $58.63.

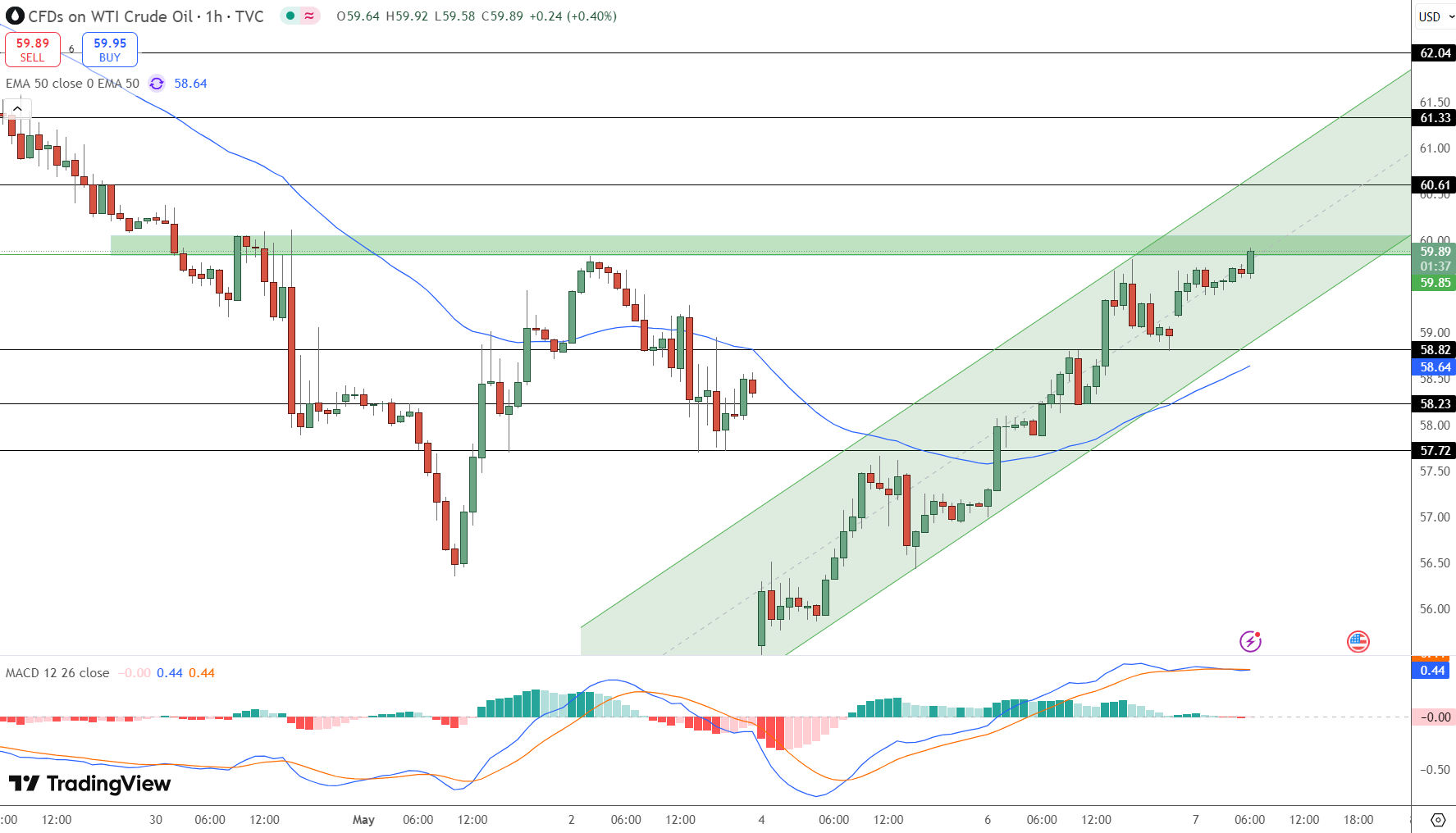

WTI crude oil is trading at $59.85, up from recent lows of $57.70 as traders focus on US-China trade talks and supply tightening. Price is supported by a clear uptrend channel and 50-hour EMA at $58.63 is providing support. The broader structure is bullish.

Trade Dynamics:

-

US-China trade talks resume this weekend and should ease economic uncertainty and support oil demand.

-

US energy companies like Diamondback Energy (FANG) and Coterra Energy (CTRA) have announced rig reductions which should tighten supply over the next few months.

-

US crude inventories dropped 4.5 million barrels in the week ended May 2, according to API data, adding to oil price support.

Technical Levels to Watch

WTI is still bullish and price is within a clear uptrend channel. MACD has turned up and buyers are entering the market.

-

Resistance: Immediate resistance at $60.61, if broken could open up the next target at $61.30.

-

Support: 50-hour EMA at $58.63 and lower channel boundary at $57.70.

Trade Setup

For those looking to get on the trend:

-

Entry: Long above $60.00 targeting $61.30.

-

Stop-Loss: Set stop below 50-hour EMA at $58.60.

-

Take-Profit: Next resistance at $61.30 for a good risk reward.

But if WTI fails to break $60.00, a pullback to $58.20 or even the lower channel boundary at $57.70 is possible.

Final Thoughts

WTI crude oil is up on trade optimism and supply tightening, the next few days should see some volatility as traders react to US-China talks and production cuts. For now, the path of least resistance is up and $61.30 is the next target for bulls.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM