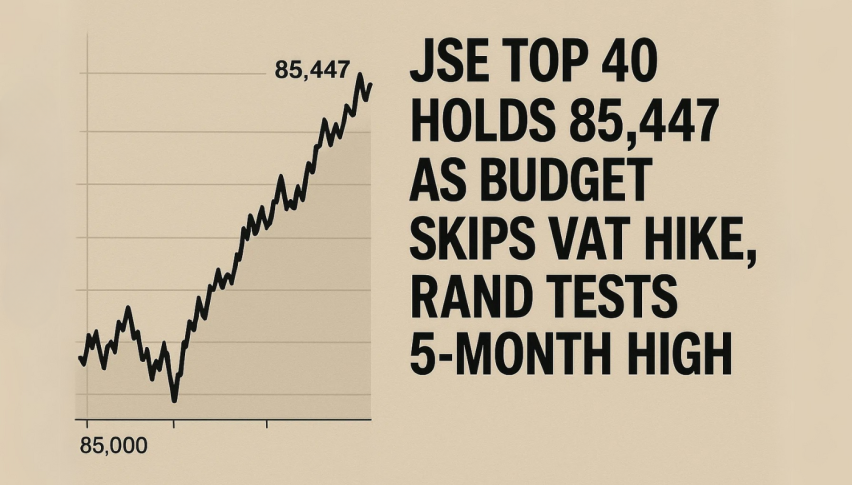

JSE Top 40 Holds 85,447 as Budget Skips VAT Hike, Rand Tests 5-Month High

The South Africa JSE Top 40 Index is holding strong at ZAR 85,447, bouncing off a long term trendline and the 50-EMA at ZAR 85,152.

Quick overview

- The South Africa JSE Top 40 Index is currently at ZAR 85,447, showing bullish momentum with higher lows since April.

- A close above ZAR 86,254 could lead to further tests of resistance at ZAR 86,890 and ZAR 87,517.

- Finance Minister Enoch Godongwana's 2025 Budget avoids VAT increases, opting for other revenue measures amid geopolitical tensions.

- The South African rand is strengthening against the dollar, bolstered by a new US trade proposal focusing on LNG imports and critical minerals.

The South Africa JSE Top 40 Index is holding strong at ZAR 85,447, bouncing off a long term trendline and the 50-EMA at ZAR 85,152. Price has made higher lows since April, so buyers are still in control despite the macro headwinds. On the hourly chart a test of resistance at ZAR 86,254 resulted in a pause, as shown by the small bodied candles – often a sign of indecision at key levels.

Technically it’s still bullish. If price closes above ZAR 86,254 it may test ZAR 86,890 then ZAR 87,517. Watch for bullish engulfing candles or a bounce off the 50-EMA to confirm longs. A close below ZAR 85,150 would shift the bias lower to ZAR 84,302.

South Africa’s Budget and US Tensions

Finance Minister Enoch Godongwana’s 2025 Budget didn’t increase VAT, a relief to households already battling inflation. Instead the Treasury will raise R49.4 billion through bracket creep, increased excise taxes, fuel levies and a freeze on medical tax credits.

The budget comes at a time of geopolitical tensions. President Trump’s Oval Office clash with President Ramaphosa over land reform and South Africa’s ICJ filing against Israel has raised concerns about economic diplomacy. Trump’s previous suspension of US aid has further muddied the waters, overshadowing the budget.

Rand Strengthens as New Trade Proposal Emerges

Despite the political strain the South African rand is holding firm at 17.965 to the dollar, its strongest level in 5 months. Part of this is due to economic diplomacy. Trade Minister Parks Tau confirmed that South Africa has submitted a new US trade proposal which includes:

-

Liquefied Natural Gas (LNG) imports to address power shortages

-

Renewed focus on AGOA renewal by US Congress

-

Expansion of digital trade, customs cooperation and critical minerals

South Africa supplies 9 of the 12 US designated critical minerals, including helium exports through ASP Isotopes. The Equity Equivalence Programme is attracting US firms like Ford and Citibank, while Tesla remains a focus for local EV investment.

Summary: JSE Top 40 still trending higher, technicals vs politics. Above ZAR 86,254 and the noise will be behind us.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account