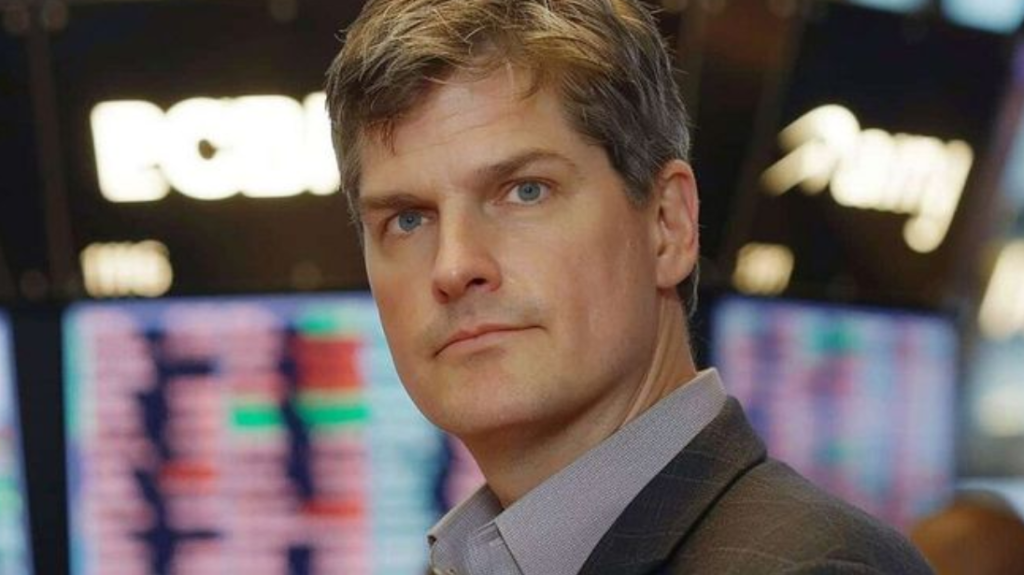

Michael Burry, Who Predicted the 2008 Financial Crisis, Sells Off Entire Portfolio

The only position Burry retained in his entire portfolio is the cosmetics conglomerate Estée Lauder.

Quick overview

- Michael Burry's hedge fund, Scion Asset Management, has divested from stocks heavily impacted by the ongoing trade war.

- The fund sold off Chinese stocks including JD.com, Alibaba, Baidu, and Pinduoduo, and also exited positions in Boeing.

- Burry has taken a bearish stance on the U.S. tech sector, acquiring 900,000 put contracts.

- The only stock retained in his portfolio is Estée Lauder, which he believes will recover despite recent struggles.

The hedge fund owned by Michael Burry has divested from stocks most exposed to the ongoing trade war, according to its latest filing with the U.S. Securities and Exchange Commission (SEC).

Burry — the legendary investor who famously bet against the U.S. housing market and predicted the 2008 financial crisis — sold off numerous positions through his fund, Scion Asset Management. The move was disclosed in the fund’s most recent SEC filing.

Notably, the fund exited Chinese stocks such as JD.com, Alibaba, Baidu, and Pinduoduo, the parent company of Temu.

In addition, Burry placed a massive bet against the U.S. tech sector, acquiring 900,000 put contracts — a clear signal of his bearish outlook. Even Boeing, the American aerospace giant and one of the main beneficiaries of Washington’s global trade negotiations, was sold off in the wave of liquidations.

The Only Stock Left: Estée Lauder

The only position Burry retained in his entire portfolio is the cosmetics conglomerate Estée Lauder. Despite the stock having plummeted nearly 50% over the past year following lackluster earnings reports, Burry appears to believe in the company’s comeback.

The luxury sector as a whole has experienced a slowdown in recent years, and Estée Lauder has struggled to revive consumer demand.

Burry’s recent pessimism may be linked to the escalating trade war launched by the White House.

Meanwhile, companies like Nvidia — much like Boeing — have secured key contracts amid trade negotiations and appear to be aligning politically with the Trump administration, despite significant exposure to China in their supply chains.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM