Crude Oil dips on Oversupply Situation

Renewed concerns of an oversupply situation emerged after an OPEC+ report suggested there may be plans to increase production levels.

Quick overview

- Oil prices fell again on Friday, indicating a potential decline over the week due to oversupply concerns.

- Brent Oil Futures dropped by 0.5% to $64.11 per barrel, while West Texas Intermediate also fell by 0.5% to $61 per barrel.

- OPEC+ is considering increasing production levels, with a potential hike of 411,000 barrels per day under discussion for July.

- US crude oil inventories unexpectedly rose, adding to the pressure on oil prices amid ongoing concerns about excess supply.

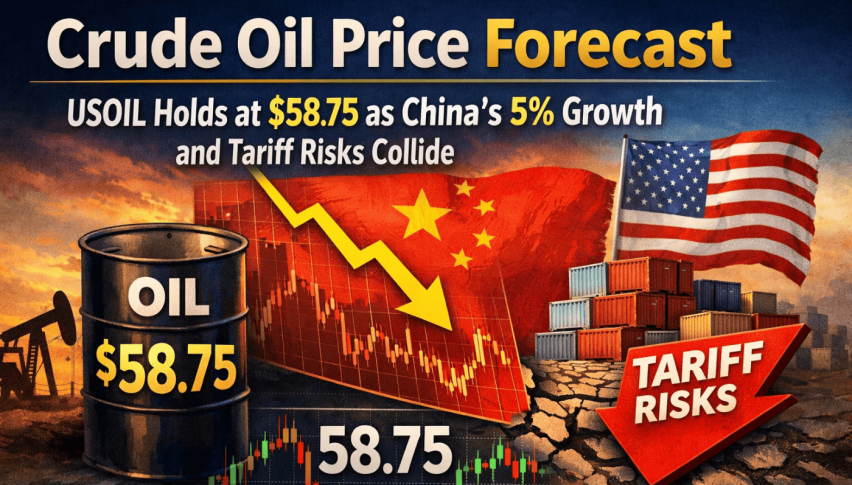

Oil fell again on Friday, indicating a potential decline in value over the week. Renewed concerns of an oversupply situation emerged after an OPEC+ report suggested there may be plans to increase production levels.

Negative predictions for the week continued for Brent Oil Futures, set to expire in July, dropping by 0.5% and trading at $64.11 per barrel. West Texas Intermediate follows the same trend and also dipped by 0.5%, to trade at $61 per barrel.

Both major oil contracts were on track to record a decrease of almost 2% for the week. OPEC+ reportedly weighs a hike in production again

The Organization of Petroleum Exporting Countries and Allies (OPEC+) plans to discuss another increase to the production cap in its next meeting, which is set for June 1.

According to delegates cited in the report, one option under consideration is a supply increase of 411,000 barrels per day in July, but no final decision has been reached yet.

OPEC+ granted more access to supplies in May and June.

The group’s decision on production levels at the next OPEC+ meeting could impact he world’s oil supply and prices, making it a crucial event for the oil market. After the Energy Information Administration (EIA) revealed that US crude oil inventories unexpectedly increased by 11.3 million barrels for the week ending May 16, oil prices were already under pressure, highlighting concerns about an excess supply.

The American Petroleum Institute (API) also revealed earlier this week that US crude inventories unexpectedly increased by 2.5 million barrels. Amid concerns about oversupply, investors cautiously awaited updates on the fifth round of nuclear talks between the United States and Iran, which is set to take place in Rome on Friday, May 23, with Oman continuing to serve as a mediator.

Iran’s uranium enrichment activities continue to be a major source of contention. Iran maintains its right to enrich uranium for peaceful uses, despite the US’s demand that enrichment be completely stopped.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account