Stellar Holds $0.2839 Key Level — Can Bulls Drive a Breakout Toward $0.3476?

Quick overview

- Stellar (XLM) has maintained a bullish trajectory since April 2025, with consistent higher highs and higher lows.

- Recent price action faced resistance at $0.3194 but found strong support at $0.2840, indicating a stable bullish structure.

- A confirmed breakout above $0.3000 could lead to a retest of $0.3194, with the next major resistance target at $0.3476.

- Stellar's ecosystem is gaining momentum through new partnerships, enhancing its fundamental outlook alongside the technical bullishness.

Since our last published outlook on April 21, 2025 — “Stellar (XLM) Bullish Outlook: Key Support Holds, Signs of Bottoming Emerge” — Stellar has maintained a textbook bullish trajectory.

The market has delivered a consistent series of higher highs and higher lows, affirming the underlying strength of this current uptrend.

While recent price action encountered resistance at $0.3194, leading to a localized correction, the technical structure remains firmly bullish. With key support levels holding and fresh breakout signals materializing on the daily chart, Stellar appears poised for another upside push in the days ahead.

Breakout Levels and Technical Outlook

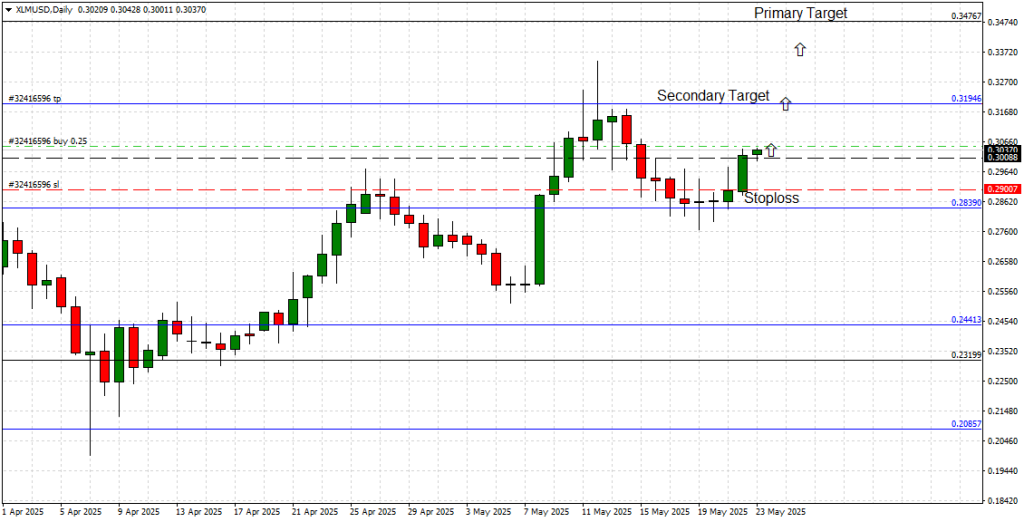

The daily chart (see attached) clearly illustrates Stellar’s upward momentum since mid-April. After initially establishing a local bottom near $0.2441, XLM embarked on a solid rally, eventually confronting significant resistance at $0.3194. This level acted as a natural resistance zone, prompting a corrective pullback.

Importantly, this downside move found strong support at the key CPM support of $0.2840. Price action stabilized in this region before staging a decisive bullish breakout above the localized resistance level at $0.3000. This breakout now reopens the pathway toward a retest of $0.3194, with bullish momentum likely to accelerate should this level be breached.

Beyond $0.3194, the next major upside objective lies at $0.3476 — the primary resistance target for this ongoing bull run. A confirmed breakout above this region would mark a significant technical event, likely attracting renewed buying interest and fueling additional gains.

Key Levels to Watch:

-

Primary Resistance: $0.3476

-

Secondary Resistance: $0.3194

-

Breakout Confirmation: $0.3000

-

Key Support: $0.2840

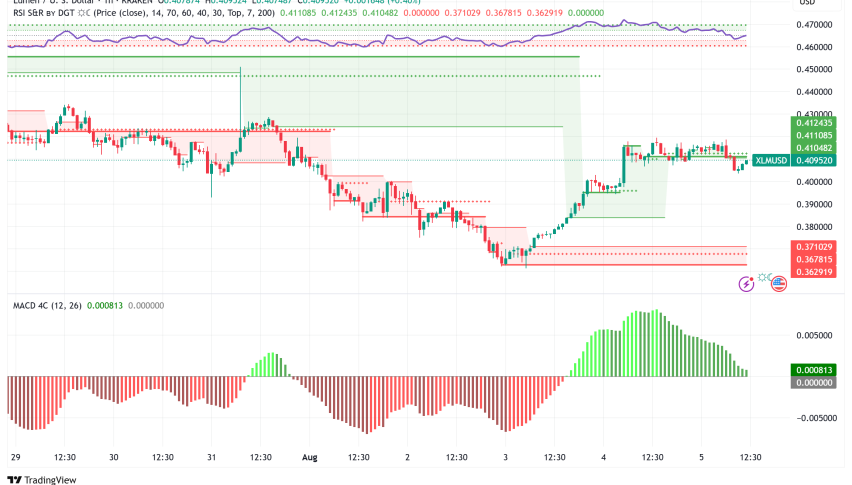

Price Action Momentum

The structure of XLM’s price action continues to favor the bulls. The consistent formation of higher lows reflects strengthening demand, while breakout moves above key resistance levels signal persistent buying interest.

If buyers can maintain pressure above $0.3000, a retest of $0.3194 appears imminent. A clean breakout at that level would likely drive prices toward the $0.3476 mark, where profit-taking might emerge, but with the potential for a bullish extension if overall market sentiment remains supportive.

Stellar’s Technology and Ecosystem Update

On the technology front, Stellar’s blockchain ecosystem continues to quietly build momentum. Over the past month, Stellar Development Foundation (SDF) has expanded its enterprise partnerships in emerging markets, particularly focusing on cross-border remittance corridors in Latin America and Africa.

Additionally, Stellar’s recent partnership with Circle’s USDC stablecoin for enhanced on-chain liquidity and remittance services has driven increased transactional volume on the network — a strong fundamental backdrop reinforcing the bullish technical outlook.

Conclusion: Bullish Outlook Remains in Place

In summary, Stellar (XLM) has followed through on the bullish outlook outlined in our April 21st forecast. With support at $0.2840 holding firm and a breakout above $0.3000 confirmed, the path of least resistance remains to the upside.

A retest of $0.3194 is now within reach, and a breakout at that level would pave the way for a move toward $0.3476 — the primary upside target for this cycle. While short-term corrections are natural, the overall bullish structure remains intact as long as price action holds above $0.2840.

As always, traders should maintain disciplined risk management and monitor key breakout levels closely.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account