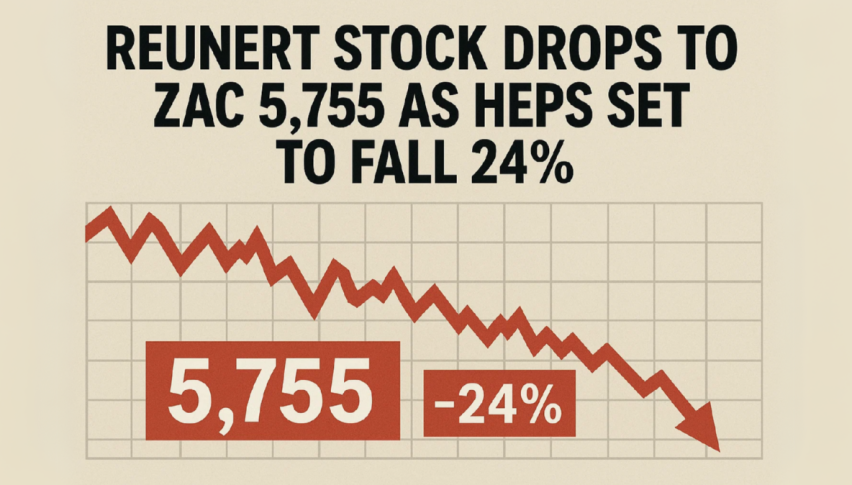

Reunert Stock Drops to ZAC 5,755 as HEPS Set to Fall 24%

Reunert Ltd (JSE: REU) slumped to ZAC 5,755 as it expects headline earnings per share (HEPS) to decline 19%-24% and earnings per share (EPS)

Quick overview

- Reunert Ltd's share price has dropped to ZAC 5,755 as it anticipates a significant decline in headline earnings per share and earnings per share due to delayed revenue and weaker sales.

- The South African rand has strengthened against the USD, providing some relief to Reunert's input costs amid ongoing operational challenges.

- Political stability and fiscal clarity, including a revised national budget, have offered support to South African equities despite Reunert's concentrated earnings weakness.

- Technical analysis indicates a bearish trend for Reunert's stock, with key support and resistance levels identified for potential trading strategies.

Reunert Ltd (JSE: REU) slumped to ZAC 5,755 as it expects headline earnings per share (HEPS) to decline 19%-24% and earnings per share (EPS) to drop 30% for the six months to March 2025. This is due to delayed revenue from a key defence contract and weaker cable sales – linked to postponed South African energy infrastructure investments – and ongoing losses at Reunert’s Blue Nova Energy unit which is to be disposed of.

Excluding Blue Nova, considered a discontinued operation, EPS is expected to fall 16%-21% to R2.35-R2.50 and HEPS 17%-22%. Despite some stability in other divisions, investor concerns over Reunert’s concentrated earnings weakness has led to a sell-off and the share price has been hit.

Rand Gains and Fiscal Clarity Offer Some Relief

Not all is doom and gloom. The South African rand is trading at 17.9 to the USD, its strongest level since December 2024. This is due to rising gold prices and a weaker USD which helps reduce Reunert’s input costs and sentiment.

Political stability and fiscal clarity has also helped:

-

Bilateral talks between President Cyril Ramaphosa and former US President Donald Trump has given hope on critical mineral cooperation.

-

Finance Minister Enoch Godongwana has approved the revised national budget which has eased fiscal uncertainty.

This has given some support to South African equities and Reunert’s share despite its operational challenges.

Technical Signals Point to Bearish Trend

Reunert’s price has broken down below the rising trendline support and is consolidating at ZAC 5,755 with resistance at ZAC 5,869. The 50-period EMA (ZAC 6,037) is dynamic resistance and the MACD is bearish. Key support levels to watch are ZAC 5,633, 5,473 and 5,293.

Key Levels:

-

Support: 5,633, 5,473, 5,293

-

Resistance: 5,869, 6,037 (EMA), 6,190

-

MACD: Bearish crossover below zero

Outlook: Caution advised below ZAC 5,755; wait for a bullish reversal signal or breakdown confirmation before entering trades.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account