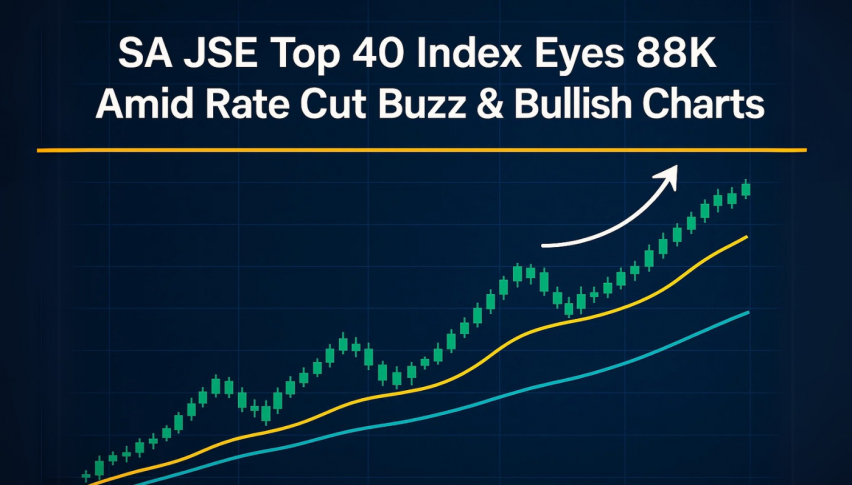

SA JSE Top 40 Index Eyes 88K Amid Rate Cut Buzz & Bullish Charts

South Africa’s JSE Top 40 Index is buzzing with bullish momentum, closing at 87,117 and testing the waters for a potential breakout...

Quick overview

- The JSE Top 40 Index closed at 87,117, showing bullish momentum and testing resistance at 87,332 ahead of the SARB interest rate decision.

- Economists anticipate a 25 basis point rate cut due to April's inflation dropping to 2.8%, below the SARB's target range.

- Despite the positive market sentiment, South Africa's growth forecast for 2025 has been downgraded from 1.5% to 1.2% due to global challenges.

- A breakout above 87,332 could lead to further gains for the index, while failure to maintain this level may result in a pullback.

South Africa’s JSE Top 40 Index is buzzing with bullish momentum, closing at 87,117 and testing the waters for a potential breakout above the 87,332 resistance level. This surge reflects growing optimism ahead of today’s much-anticipated South African Reserve Bank (SARB) interest rate decision.

Most economists expect a 25 basis point rate cut, as April’s inflation cooled to 2.8%, comfortably below the SARB’s 3–6% target range. This dip was largely driven by subdued domestic demand and lower fuel prices, opening the door for a possible easing of borrowing costs. However, global uncertainties—especially ongoing U.S. trade tariffs—are keeping the outlook cautious.

Nedbank economists noted that “upside risks to inflation have diminished since March,” reinforcing the case for a rate cut.

-

Inflation slowed to 2.8% in April, under SARB’s target

-

SARB decision expected today, likely 25bps rate cut

-

U.S. trade tariffs continue to cloud export prospects

Growth Outlook Cut as Global Challenges Persist

Even with the market’s upbeat mood, economists have trimmed South Africa’s 2025 growth forecast from 1.5% to 1.2%, marking the sharpest downgrade since the 2023 power crisis. The 2026 forecast was also lowered to 1.6%, reflecting pressures from disrupted supply chains and tariff-related export slowdowns.

Meanwhile, the yield on South Africa’s 2030 government bond is holding steady at 8.78%, signaling investor caution despite the potential for looser monetary policy. If the SARB delivers the expected rate cut, it could provide a boost to consumer confidence and open up new growth avenues for JSE-listed companies.

JSE Top 40 Index Technical Picture: A Breakout in the Making?

The JSE Top 40 Index has been carving out a bullish path within an upward-sloping channel. The 2-hour chart highlights a steady pattern of higher highs and higher lows, with the 50-EMA at 85,884 offering dynamic support. After closing at 87,117, the index looks poised to challenge 87,332 again. A decisive breakout here could push prices toward 88,173.

-

MACD shows widening signal lines and a deepening histogram, reinforcing the bullish trend.

-

Multiple bullish engulfing candles hint at strong buying interest.

-

A solid close above 87,332 would confirm the breakout, while failure to hold this level could trigger a pullback to 86,614 or even 85,884.

-

Long entry above 87,332, with stops below 86,614; target at 88,173

-

A reversal could set up a short trade targeting 85,884

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM