Ethereum Tests $2,600 as Foundation Restructures and Exchange Supply Hits Seven-Year Low

Rising almost 4% in the previous 24 hours to reach $2,600, Ethereum (ETH) shows resilience amid major organizational changes at the Ethereum

Quick overview

- Ethereum's price rose nearly 4% to $2,600, reflecting resilience amid organizational changes at the Ethereum Foundation.

- The Ethereum Foundation has restructured its operations, focusing on scaling, roll-ups, and user experience, while also appointing new co-executive directors.

- A significant drop in ETH supply on exchanges suggests bullish accumulation and reduced selling pressure, potentially leading to price swings.

- Technical analysis indicates a bullish cup-and-handle pattern, with a breakout target of $4,000 if Ethereum surpasses $2,750.

Rising almost 4% in the previous 24 hours to reach $2,600, Ethereum ETH/USD shows resilience amid major organizational changes at the Ethereum Foundation and optimistic on-chain indicators implying lower selling pressure across the market.

Ethereum Foundation Streamlines Operations with Strategic Restructuring

Undergoing a significant organizational reorganization, the Ethereum Foundation rebranded its Protocol Research & Development (PR&D) team to just “Protocol” and let go of unidentified employees. Three key areas – scaling Ethereum’s basic layer (L1), extending blobspace for roll-ups, and enhancing user experience, will be the emphasis of the just established Protocol team.

Starting in January when co-founder Vitalik Buterin revealed moves toward technical knowledge, this restructure is the most recent in a string of leadership changes. Appointing Hsiao-Wei Wang and Tomasz Stańczak as co-executive directors, the Foundation formally divided board from executive roles in April.

The reorganization coincides with a turning point since developments in zero-knowledge roll-ups and layer-2 technologies bring Ethereum closer to mass adoption. The Foundation claims that this calculated change puts the protocol for what could be “Ethereum’s best shot at deploying not only our technology, but our values, at planetary scale.”

ETH Exchange Supply Plunges to Seven-Year Low Signals Bullish Accumulation

The sharp drop in ETH supply on controlled exchanges is one of the most interesting technical aspects underpinning Ethereum’s recent pricing behavior. Glassnode’s data shows that Ethereum’s exchange supply has decreased to its lowest level in seven years, suggesting investors are shifting their holdings to self-custody wallets.

Usually, this tendency indicates lowered selling pressure and long-term confidence since less coins are accessible on exchanges usually before significant price swings. Such supply restrictions might cause notable price swings in concert with growing demand.

Vitalik Buterin Targets 10x Scaling Within Next Year

Contributing to the positive attitude, Ethereum co-founder Vitalik Buterin revealed ambitious scaling targets at ETHGlobal Prague, saying that layer-1 should scale by around 10x over the next year. This is a measured approach in comparison to some players in ecosystems who support 1,000x scaling.

“In general, I do think there’s a lot of room to scale safely,” Buterin clarified. “Based on what I know, we should scale L1 roughly 10x over the next year and a bit.”

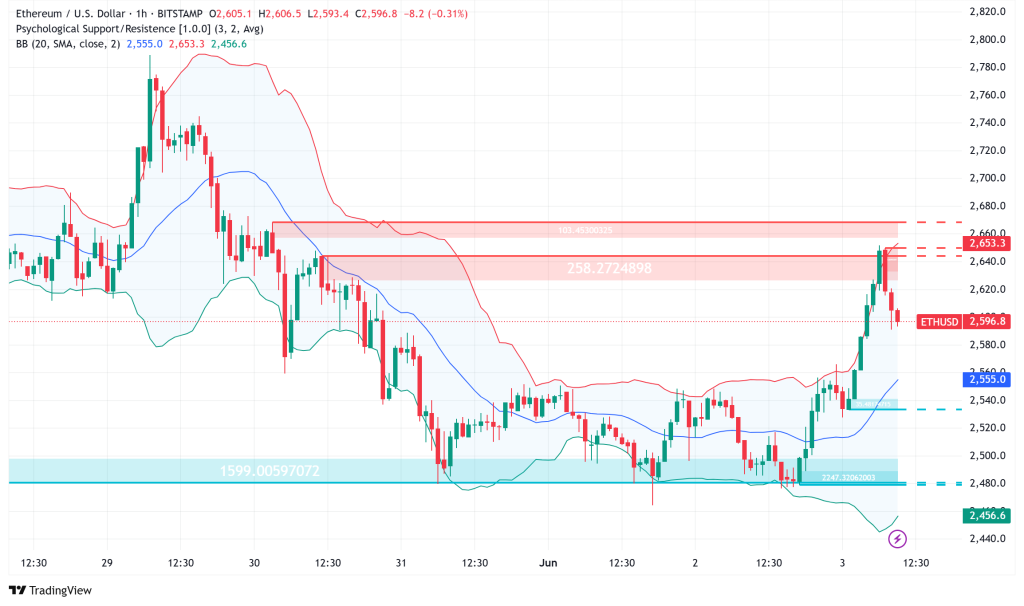

ETH/USD Technical Analysis Points to Potential $4,000 Breakout

Technically, Ethereum is creating what analysts find to be a bullish cup-and-handle pattern on daily charts. Developed since February, this structure points to possible gains of up to 49% should a breakout over $2,750 confirm.

Completing the pattern might propel ETH toward $4,101, a notable climb from present values. Important technological thresholds to monitor include:

- Immediate Resistance: $2,738 and $2,850

- Support Levels: 20-day EMA at $2,502, with stronger support at $2,323

- Breakout Target: $3,000 initially, with potential extension to $4,000+

Though ETH is trading above its 200-day exponential moving average, current momentum indicators offer conflicting signals and resistance at shorter-term levels. Perhaps indicating accumulation periods, volume patterns point to consolidation rather than strong selling pressure.

Market Sentiment Bolstered by Regulatory Clarity

With $321 million in inflows last week and extending their positive trend six straight weeks, Ethereum investment products have shown amazing strength. This performance aligns with the SEC’s clarification of staking practices, therefore opening the path for staking capabilities inside Ethereum ETFs.

The legal clarification has especially helped US spot Ethereum ETFs, which drew $285.8 million in net inflows and ten straight days of positive flows.

Ethereum Price Prediction and Outlook

Technical study indicates Ethereum reaches a turning point about present levels. A good break over $2,750 might cause the cup-and-handle pattern to complete, therefore guiding prices toward $3,000 and finally $4,000.

Failure to keep support above the 20-day EMA at $2,502, however, would cause ETH to drop to the $2,323 level. Reduced exchange supply, institutional inflows, and planned scaling enhancements taken together provide a suitable environment for ongoing increasing momentum.

With the $4,000 level as a reasonable target should current bullish patterns resolve favorably, Ethereum seems well-positioned for possible medium term gains given the confluence of positive technical patterns, strong fundamentals, and lowered selling pressure shown by exchange supply measurements.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM