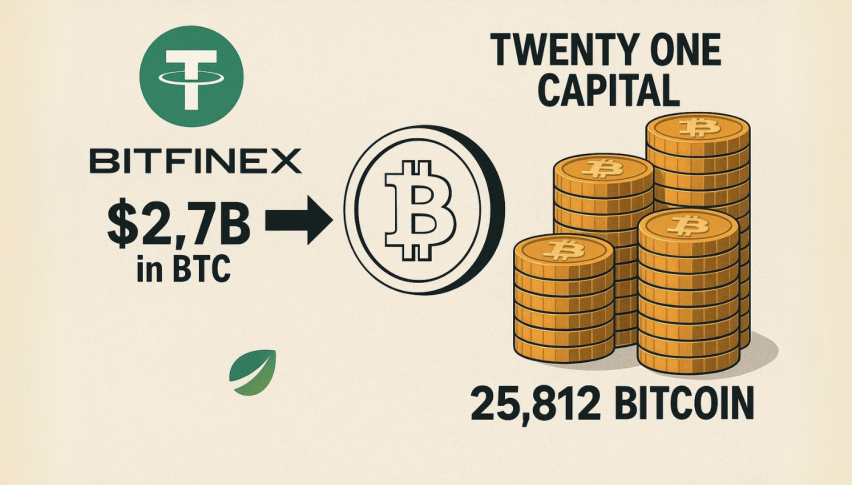

Tether & Bitfinex Transfer $2.7B in BTC to Twenty One Capital’s 25,812 Bitcoin Stockpile

Tether and Bitfinex, two of the biggest names in the crypto space, moved a combined 25,812.22 BTC (worth ~$2.7 billion)

Quick overview

- Tether and Bitfinex transferred a total of 25,812.22 BTC, valued at approximately $2.7 billion, to Twenty One Capital, signaling strong confidence in the new Bitcoin treasury firm.

- Twenty One Capital aims to become the third largest corporate Bitcoin holder by acquiring 420,000 BTC and is going public through a SPAC merger under the ticker 'XX!'.

- The firm plans to raise $685 million through various financing methods to support its Bitcoin acquisition strategy, inspired by MicroStrategy's approach.

- CEO Jack Mallers emphasized Bitcoin's value and transparency, committing to share wallet details as proof of reserve and announcing plans to move an additional 31,500 BTC soon.

Tether and Bitfinex, two of the biggest names in the crypto space, moved a combined 25,812.22 BTC (worth ~$2.7 billion) to Twenty One Capital. This is a big vote of confidence for the newly launched Bitcoin-native treasury firm that’s building a massive Bitcoin reserve.

The BTC was moved in multiple transactions on Monday: Tether sent 18,812.22 BTC in two parts — 14,000 BTC in one transaction and 4,812.22 BTC in another — while Bitfinex sent 7,000 BTC. These are part of the pre-funding for Twenty One Capital’s equity raise and broader Bitcoin stockpile expansion.

Twenty One Capital’s Big Bitcoin Stockpile Plans

Twenty One Capital is positioning itself to be a major player by aiming to hold 420,000 BTC, which would make it the 3rd largest corporate Bitcoin holder in the world. The firm is going public via a SPAC merger and will trade under the ticker “XX!”.

Inspired by MicroStrategy’s well known Bitcoin buys led by Michael Saylor, Twenty One Capital is following a similar corporate strategy. The company just announced plans to raise $685 million via several financing vehicles:

-

$385 million in convertible senior secured notes

-

$200 million in PIPE (Private Investment in Public Equity) financing

-

$100 million in additional convertible notes

This will fuel their big Bitcoin buys.

CEO Jack Mallers on Bitcoin’s Value and Transparency

Jack Mallers, CEO of Twenty One Capital, talked about Bitcoin’s value and transparency in his speech at the Bitcoin 2025 Conference, calling it “money that can’t be printed or debased”. He outlined the company’s mission to be the biggest Bitcoin holding company by safeguarding assets and financial sovereignty.

Mallers also committed to transparency by publicly sharing the company’s Bitcoin wallet address as proof of reserve (PoR), so investors and the public can verify the holdings. One wallet has 4,812 BTC and more wallet details will be shared soon.

He also announced they will be moving 31,500 BTC in the near future which includes contributions from SoftBank, so more institutional support is coming.

This big move of Bitcoin from Tether and Bitfinex cements Twenty One Capital’s aggressive plan to scale their Bitcoin treasury, this is a trend of institutional corporate investment in crypto assets.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM