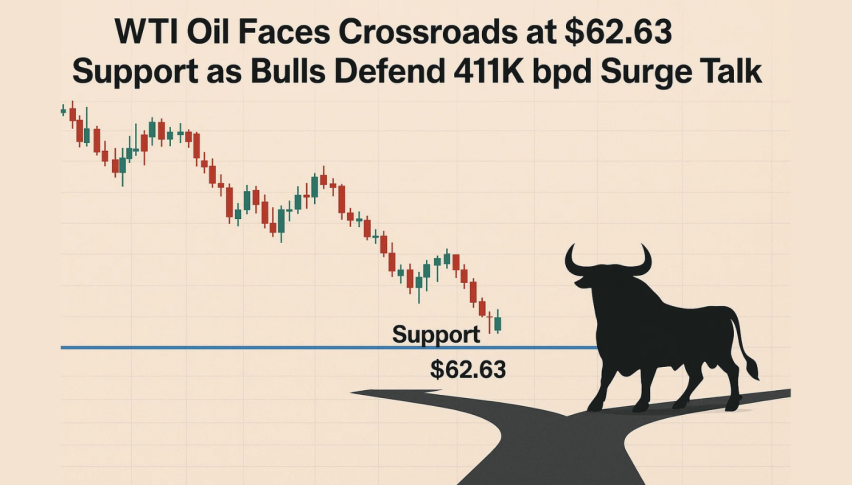

WTI Oil Faces Crossroads at $62.63 Support as Bulls Defend 411K bpd Surge Talk

WTI crude oil fell below $63 on Thursday as oversupply concerns and weak demand weighed on the market. Saudi Arabia may increase OPEC+

Quick overview

- WTI crude oil prices fell below $63 due to oversupply concerns and weak demand.

- Saudi Arabia plans to increase OPEC+ output to capture summer demand, potentially further depressing prices.

- EIA data indicates a crude drawdown but larger-than-expected builds in gasoline and distillates.

- Traders are advised to wait for clearer signals before entering trades, with key support levels identified.

WTI crude oil fell below $63 on Thursday as oversupply concerns and weak demand weighed on the market. Saudi Arabia may increase OPEC+ output by at least 411,000 bbls/d in August and more in September to capture summer demand. But that could further depress prices already struggling with lack of buying interest.

Saudi Arabia cut July crude prices to Asian buyers to the lowest in nearly 4 years – a direct admission of cooling demand. EIA data showed a crude drawdown but bigger-than-expected builds in gasoline and distillates.

Geopolitical noise is a drag on risk sentiment. Markets are waiting for fallout from US trade tensions as Canada prepares to retaliate and the EU makes progress in talks. That has energy traders cautious ahead of the next macro catalyst.

Trendline and EMA Alignment is Support

WTI (USOIL) is sitting above the trendline near $62.63 which has been support multiple times in intraday sessions. This level also coincides with the 50 EMA on the 2-hour chart. Short term traders should look for confluence here.

The MACD is flat and recent candles are consolidating – both signs of indecision. A minor bounce has emerged but conviction is lacking without follow through volume. If price holds above $62.63 and forms a bullish engulfing candle, a retest of $63.67 is likely, then $64.34.

Trade Setup: Wait for Clarity, Manage Risk

Newer traders may want to wait. A clean 2-hour close above $63.10 would confirm the trend. Below $62.44 would invalidate the trendline and expose $61.64 and $60.92. In either case, align trade entries with confirmation candles and pair setups with strict stop-loss management in a choppy macro environment.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account