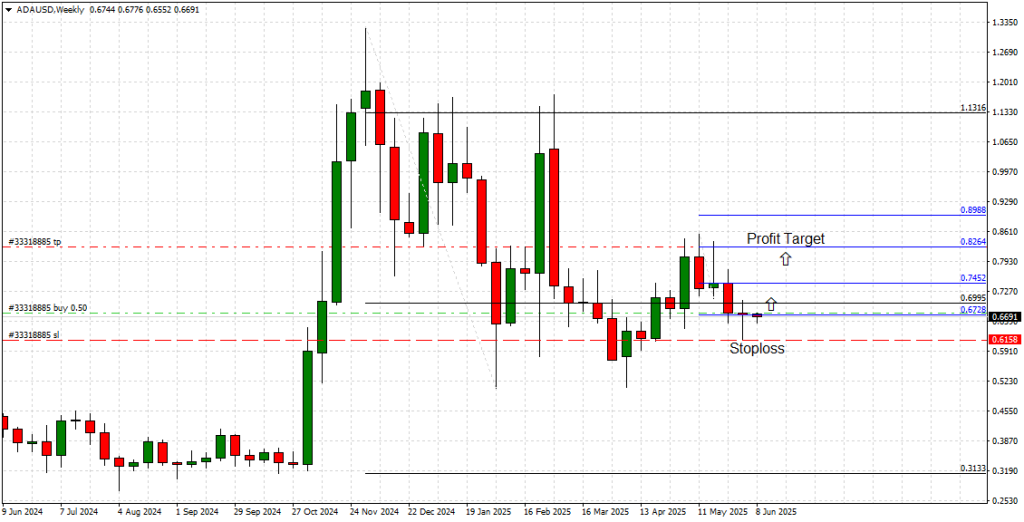

Cardano (ADA) Holds Key Support at $0.6728 — Eyes Set on $0.8264 Rally

Quick overview

- Cardano (ADA) has shown strong price action, closing above the critical support level of $0.6728, indicating potential for a bullish recovery.

- The successful defense of this support sets the stage for a target of $0.8264, contingent on overcoming interim resistance levels at $0.6955 and $0.7452.

- Momentum indicators are turning favorable, suggesting a weakening of selling pressure and a bullish bias in the market structure.

- Fundamental developments within the Cardano ecosystem, including improvements in interoperability and community engagement, support long-term investor confidence.

Cardano (ADA) has displayed a resilient price action performance this past week, reaffirming its strength as a prime contender for a bullish recovery.

After a period of heavy corrective pressure, ADA managed to claw its way back above the critical CPM key support at $0.6728, closing the weekly session firmly above this level — a technical development that sends a strong message to market participants.

This successful defense of $0.6728 now sets the stage for a potential bullish campaign towards the next significant CPM key resistance at $0.8264, which has been earmarked as our primary upside target for this move.

Breakout Levels and Technical Outlook

Referencing the uploaded weekly and daily charts, ADA’s recent market structure illustrates an orderly technical recovery. On the weekly chart, the pair dipped below $0.6728 momentarily but rebounded decisively, closing back above this threshold — an event that confirms the support zone’s relevance and resilience within the current market context.

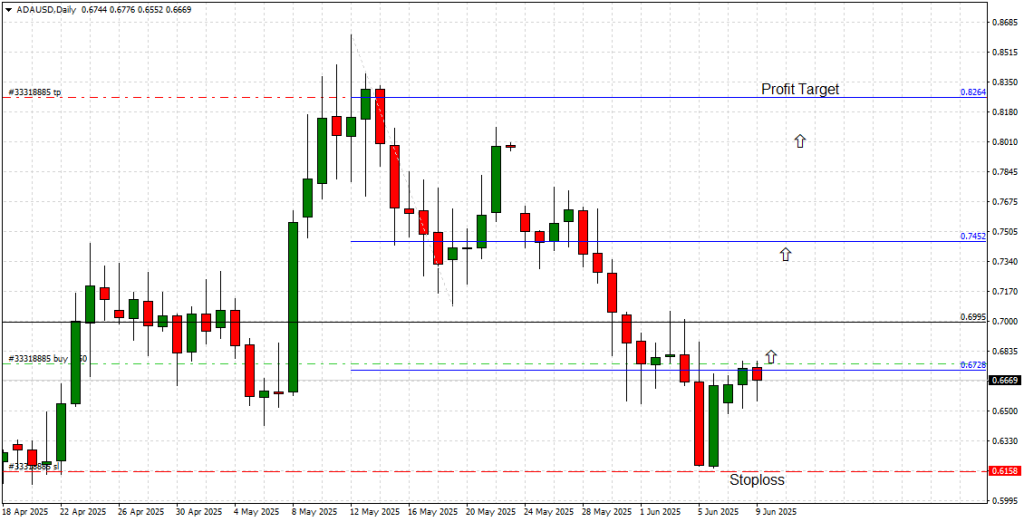

On the daily chart, ADA is currently trading just above the key level of $0.6728, with visible bullish candlestick formations forming a base for upward continuation. Immediate upside hurdles now rest at $0.6955 and $0.7452, with price action expected to test and potentially breach these interim resistances on route to the primary target at $0.8264.

Stop-loss protection remains strategically placed below the recent swing low at $0.6150, ensuring appropriate risk management while allowing the trade ample breathing space for natural market fluctuations.

Price Action Momentum and CPM Dynamics

Momentum indicators on both timeframes are beginning to pivot favorably, with daily bullish engulfing patterns hinting at a return of upward pressure. The weekly close above $0.6728 essentially signals that selling momentum has weakened considerably in this region.

According to the Cross-Price Matrix (CPM) setup, the market’s structure remains bullish-biased as long as ADA continues to hold above the $0.6728 inflection point. The CPM model assigns a higher probability weighting for a move towards $0.8264, provided that interim resistance levels at $0.6955 and $0.7452 are taken out with decisive momentum.

Should ADA push above $0.7452, momentum acceleration is expected, increasing the likelihood of a test at $0.8264. Beyond this level, secondary bullish targets sit at $0.8988, though that would remain conditional on ADA’s performance around the $0.8264 handle.

Technology and Vision: A Steady Pillar

Fundamentally, Cardano continues to make incremental progress within its ecosystem. The network’s recent enhancements in interoperability protocols and layer-2 scaling projects remain important catalysts for long-term investor confidence. While short-term price action hinges on technical dynamics, underlying blockchain developments and staking metrics continue to provide a constructive backdrop for ADA’s valuation model.

The Cardano community has also demonstrated persistent engagement, particularly within the DeFi space, which continues to slowly expand across the platform. As liquidity conditions in crypto markets improve, ADA’s position as a top-tier smart contract blockchain strengthens.

Conclusion

In summary, Cardano’s bullish outlook is underpinned by:

-

A successful weekly close above the key CPM support at $0.6728

-

Bullish daily and weekly price action momentum

-

A clear path beyond interim resistances at $0.6955 and $0.7452

-

A primary bullish target at $0.8264

-

Robust risk management structure with a stop-loss at $0.6150

This CPM-aligned setup offers a favorable risk-reward proposition, and barring unforeseen market-wide disruptions, ADA looks primed for a rally towards $0.8264 in the near term.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM