Sibanye Stillwater Soars 79% YTD as Bulls Eye ZAR 3,475 Breakout

Sibanye Stillwater Ltd. (JSE: SSW) jumped 4.95% on Monday, closing at ZAR 3,136 per share—a 148 ZAC gain—amid renewed investor confidence.

Quick overview

- Sibanye Stillwater Ltd. saw a 4.95% increase in share price, closing at ZAR 3,136, driven by renewed investor confidence and a rally in precious metals.

- The company's year-to-date share price has risen by 79.25%, with a six-month increase of 53.19% and a one-year return of 27.99%.

- Technical analysis indicates a bullish trend, with the stock targeting ZAR 3,176 after breaking above ZAR 2,938, supported by a rising parallel channel.

- Macro factors, including U.S.-China trade talks and local economic data, are expected to influence Sibanye's performance in the near term.

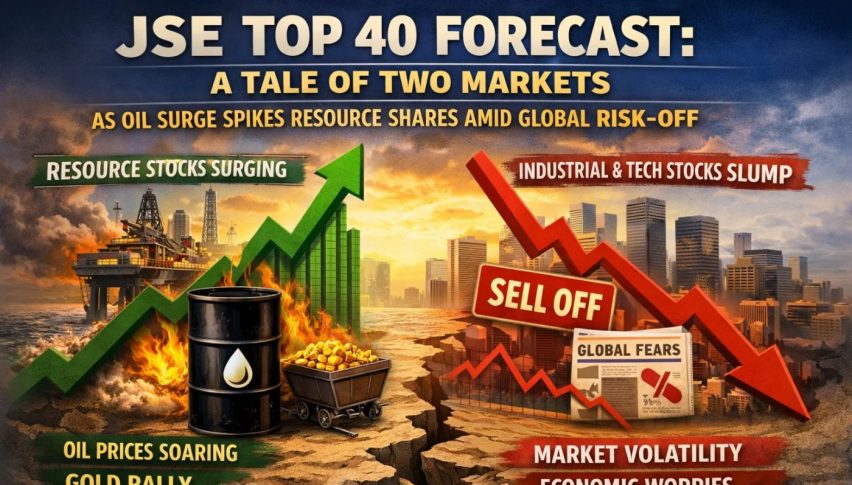

Sibanye Stillwater Ltd. (JSE: SSW) jumped 4.95% on Monday, closing at ZAR 3,136 per share—a 148 ZAC gain—amid renewed investor confidence. This spike follows a robust rally in precious metals and signals possible institutional interest, backed by a strong technical breakout. Year-to-date, Sibanye’s share price has climbed 79.25%, cementing its leadership in South Africa’s mining sector.

The bullish trend is more than short-lived: over the last six months, shares are up 53.19%, while the past 30 days show a 26.98% rise. Even looking at a one-year window, investors have earned a 27.99% return. Though the five-year view reflects a 23.87% decline, the all-time performance stands at an impressive +236.31%, indicating long-term shareholder value creation.

Channel Breakout Points to More Upside

Technical analysis paints a constructive picture. On the 4-hour chart, Sibanye has broken above ZAR 2,938 and now targets ZAR 3,176. The stock continues to trade within a rising parallel channel, supported by higher lows and a bounce from the 50 EMA at ZAR 2,711. A bullish pattern of three white soldiers last week reinforced the breakout.

The RSI is near 70.89—approaching overbought but not yet diverging—implying momentum remains on the bulls’ side. Price action now eyes resistance at ZAR 3,331 and ZAR 3,475.

- Entry: Buy near ZAR 2,938 on a pullback

- Stop-loss: Below ZAR 2,711 (50 EMA support)

- Targets: ZAR 3,331 and ZAR 3,475

Rand, Trade Talks, and Policy in Focus

Beyond technicals, macro factors will influence Sibanye’s path. The South African rand was steady Monday, as traders awaited the outcome of U.S.-China trade negotiations in London. The talks could ease global tensions, which often impact risk-sensitive assets like the rand and, by extension, JSE-listed miners.

Locally, investors are watching for key mining and manufacturing data this week, alongside a revised fiscal budget proposal from Finance Minister Enoch Godongwana. The budget, set for parliamentary debate Wednesday, may shape near-term sentiment toward South African equities.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM