Stellar (XLM) Forecast: Bearish Rejection Sets Up Fresh Downside Targets

Quick overview

- Stellar (XLM) has faced strong resistance at $0.2839, confirming a bearish trend as it fails to reclaim this level.

- The price action indicates a potential decline towards the next key levels of $0.2441 and $0.2321, driven by seller dominance.

- Geopolitical tensions, particularly regarding Iran, are contributing to market volatility and may exacerbate the bearish momentum in cryptocurrencies.

- Traders are advised to maintain a bearish stance and look for short entries on minor rallies while targeting $0.2441.

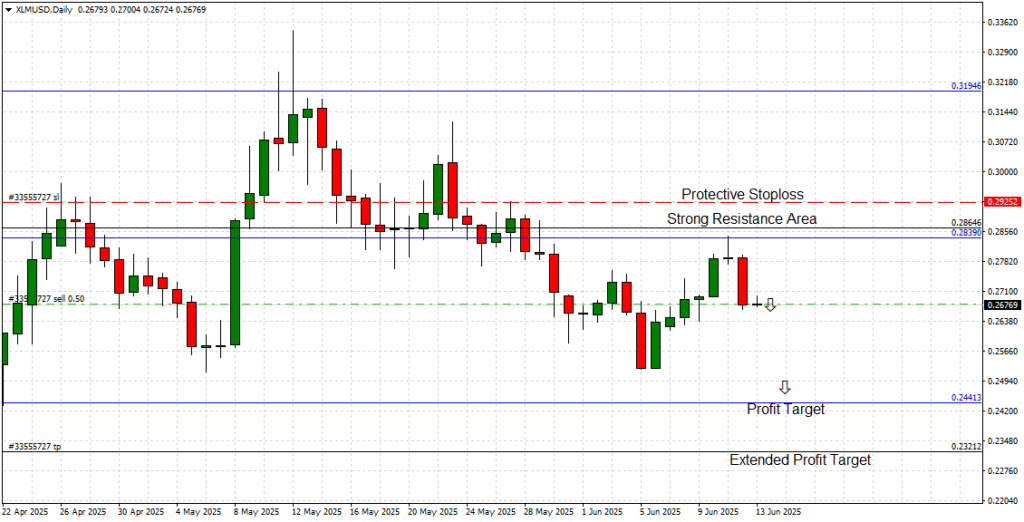

Since our last update on May 23, 2025, Stellar (XLM) has played out a technically precise move against our outlined CPM key levels.

The critical inflection point at $0.2839 was approached from below, and—just as anticipated—it acted as a formidable technical resistance, halting bullish advances and setting the stage for a fresh bearish sequence.

The price action’s rejection at this level is consistent with broader market indecision amidst persistent macroeconomic headwinds. While the overall crypto market attempts to consolidate, Stellar’s repeated failure to reclaim $0.2839 confirms the significance of this resistance and validates our bearish positioning.

Now that price has recoiled from this region, the path lower appears increasingly open, with clean downside room towards the next major CPM key level at $0.2441. This level will serve as the immediate target for the ongoing move, with a further extended bearish objective situated at $0.2321, marking a deeper area of key suppor

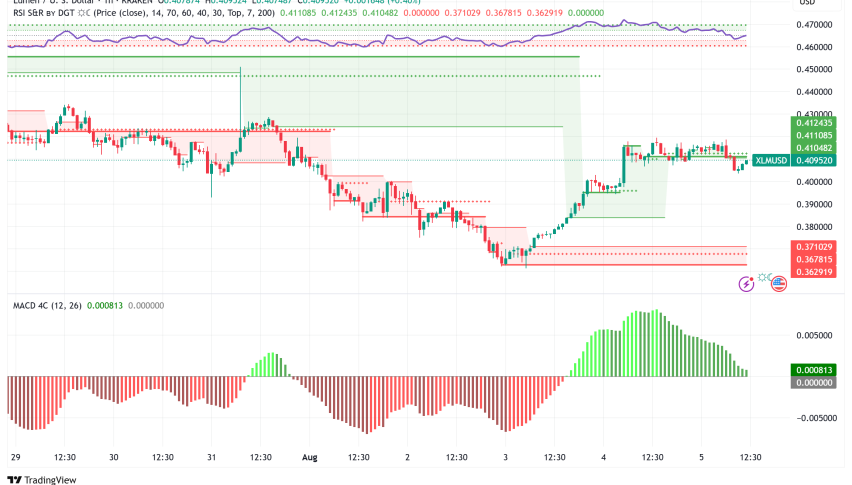

Price Action Momentum

From a price action perspective, Stellar has formed a sequence of lower highs and subdued bullish retracements on the Daily chart since late May. The rejection and failure to hold above $0.2839 underline seller dominance.

Currently trading around $0.2676, the market attempted an upside bounce mid-week but was decisively pushed back below the critical resistance. This confirms bearish momentum is in play and raises the probability of a breakdown toward our highlighted targets.

The price structure remains bearish, with short-term rallies offering fresh opportunities to reload short positions as long as the price holds beneath $0.2839.

Breakout Levels to Watch

-

Strong Resistance Area: $0.2839 / 0.2864

-

Protective Stop-Loss Zone: $0.2925 (above previous high pivot)

-

Primary Profit Target: $0.2441

-

Extended Profit Target: $0.2321

Geopolitical Backdrop: Iran Tensions Fuel Market Volatility

On the geopolitical front, rising tensions over Iran’s nuclear program and renewed threats of military confrontation with Western allies have started to weigh on global risk sentiment. Reports from international agencies and defense departments indicate a growing likelihood of retaliatory strikes in the Persian Gulf, which threatens to destabilize oil markets and risk assets, including cryptocurrencies.

Historically, geopolitical shocks have triggered flight-to-safety trades, favoring hard assets like gold while suppressing speculative assets like altcoins. If tensions escalate further in the coming days, we could see crypto markets experience intensified volatility and an acceleration of technical moves such as the current bearish setup on Stellar.

This geopolitical risk factor strengthens the downside bias for XLM, adding to the technical narrative already favoring a move towards $0.2441 and potentially to $0.2321.

Conclusion

Stellar remains firmly capped beneath the $0.2839 CPM key level, with the technical picture aligned for further downside. Bearish price action structure, confirmed resistance rejections, and a weakening global risk appetite amidst geopolitical instability are collectively fueling the bearish case.

Action Plan:

Maintain a bearish bias while price holds beneath $0.2839. Look for short entries on minor rallies with a target of $0.2441, and consider partial profits there, leaving a runner toward $0.2321 if geopolitical risks continue to escalate. We’ll continue to monitor price action and update our positioning as new developments unfold.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM