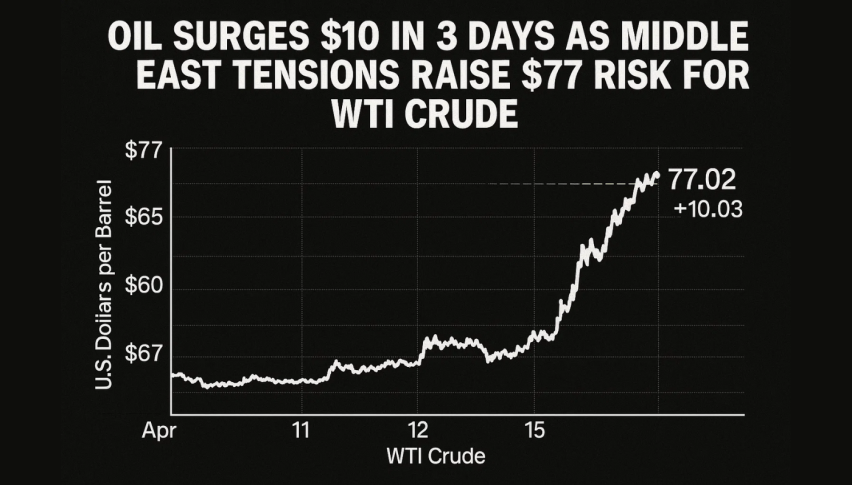

Oil Surges $10 in 3 Days as Middle East Tensions Raise $77 Risk for WTI Crude

Oil prices jumped more than $4 on Friday to its highest in nearly five months. That was a three-day gain of $10 per barrel—the largest...

Quick overview

- Oil prices surged over $4 on Friday, reaching their highest level in nearly five months due to geopolitical tensions following an Israeli strike on Iranian military targets.

- The market is reacting to the potential risk of conflict escalation that could disrupt oil flows through the Strait of Hormuz, a critical chokepoint for global oil supply.

- Despite the price increase, analysts suggest that the fundamentals of the oil market have not changed, with current prices driven more by market anxiety than actual supply disruptions.

- Traders remain cautious, focusing on the potential for volatility as diplomatic responses unfold, while technical indicators show key resistance and support levels for WTI crude.

Oil prices jumped more than $4 on Friday to its highest in nearly five months. That was a three-day gain of $10 per barrel—the largest intraday move since 2022. The big move comes after an Israeli strike on Iranian military targets.

Markets quickly priced in the risk of this conflict spreading and disrupting oil flows in the region. About 20% of the world’s oil—18 to 19 million barrels per day—passes through the Strait of Hormuz, the chokepoint now in focus.

“The risk here is escalation,” said Helima Croft of RBC Capital. “Retaliation beyond Israel could involve oil infrastructure, and that raises the global stakes.”

Despite the jump, analysts like Amarpreet Singh of Barclays say fundamentals haven’t changed yet. But market anxiety is driving safe-haven flows into gold and lifting crude prices as supply disruption risks grow.

Traders Eye Hormuz as Supply Risk Grows

Oil traders are cautious, acknowledging the price move doesn’t yet reflect actual supply cuts but rather fear-based positioning. A Singapore-based oil trader said, “The real concern is to close the Strait of Hormuz. That’s what keeps the market nervous.”

US officials disavowed the strikes but warned Iran not to escalate. The uncertainty leaves room for volatility as the energy market watches diplomatic responses and retaliatory threats.

Meanwhile, political voices are talking contingency. “If oil is caught in the crossfire, spare OPEC barrels may be used to cap price spikes,” Croft said.

WTI Crude Technical Outlook: Fib Levels in Focus

From a technical standpoint, WTI crude hit $77.58 before pulling back to $72.15—the 50% Fib. A short-term bounce is underway, supported by the 50-period EMA at $68.96.

- Key resistance at $73.43 (38.2% Fib) and $75.00

- Critical support: $70.87 (61.8% Fib) and $69.04

- MACD flattening means momentum loss, not full reversal

- Above 50 EMA, the trend is still good. But anything in the Middle East can blow it up. Watch for MACD crossovers and volume spikes.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM