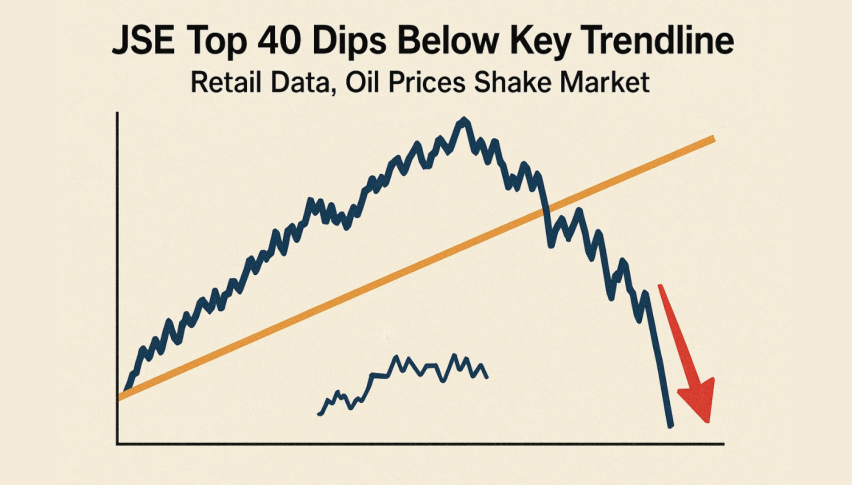

JSE Top 40 Dips Below Key Trendline as Retail Data, Oil Prices Shake Market

The SA equity market got hit as the JSE Top 40 Index broke below a key trendline and closed at 88,028. This is a broader reflection...

Quick overview

- The JSE Top 40 Index has broken below a key trendline, closing at 88,028, reflecting weak domestic data.

- April retail sales are expected to decline by 0.2%, indicating weakening consumer momentum despite slight year-on-year increases.

- Geopolitical tensions, particularly between Israel and Iran, are causing investors to seek safe havens, further impacting the JSE.

- The upcoming G7 summit may influence global sentiment and determine whether the current market correction is temporary or more severe.

The SA equity market got hit as the JSE Top 40 Index broke below a key trendline and closed at 88,028. This is a broader reflection of the weak domestic data. April’s month-on-month retail sales are expected to be down 0.2% after a 0.1% gain in March. Although year-on-year numbers are up slightly, the decline is a sign of weakening consumer momentum.

At the same time SA’s core inflation is stuck at 3% and businesses have no pricing power. They can’t pass on costs to consumers because of low confidence and a fragile post pandemic recovery. This has soured sentiment among investors who were looking for a rebound in demand.

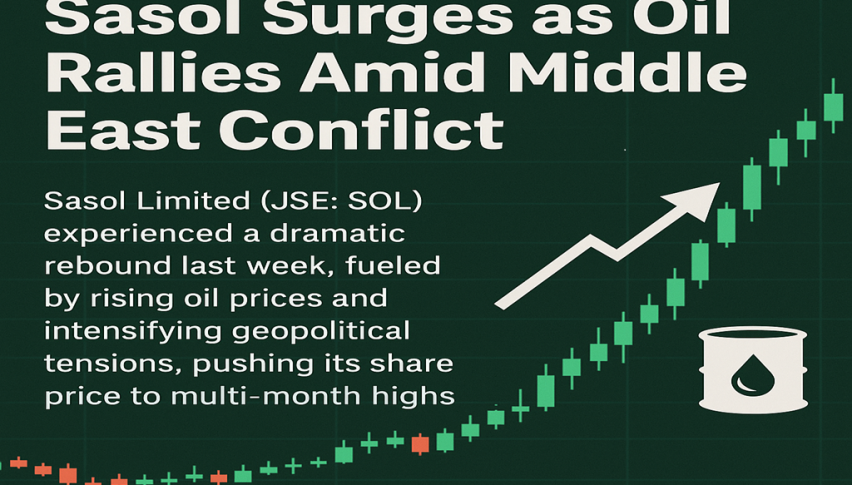

Geopolitical Shockwaves Hit Emerging Markets

Adding to local pressures, geopolitical instability is hitting emerging markets. Tensions flared over the weekend as Israel and Iran exchanged military strikes. This has sent investors running to safe havens and has exacerbated outflows from the JSE.

Oil prices surged:

- Brent crude up 0.4% to $74.53/barrel

- WTI up 0.5% to $71.64/barrel

- Both up more than $4 earlier in the session

Higher oil prices will increase costs for fuel dependent industries in SA from transportation to agriculture and will raise concerns about squeezed margins and weaker corporate earnings.

JSE Technical Breakdown Shows Bearish Momentum

From a technical standpoint the JSE Top 40 has broken. Price action has broken below the trendline at 88,175 and below the 50-EMA at 88,609. This confirms bearish momentum. The rejection from the 88,789-89,276 zone has now turned that zone into a hard ceiling for bulls.

Key signals:

- MACD is bearish with wide histogram and diverging lines

- No bullish reversal signals (hammer, morning star etc) in recent candles

- Two strong red candles show continued selling pressure

Levels to watch:

- 87,617: Immediate support

- 87,294 and 86,923: Deeper support if weakness continues

Novice Trade Setup:

- Short entry: Below 88,000

- Stop loss: Above 88,609

- Targets: 87,617 and 87,294* Bullish alternative: Long on breakout above 88,789 with volume

Until bulls are back in control, the chart is short.

Looking Ahead: G7 Summit to Determine Risk Tone

Now we wait for the G7 summit where leaders will address the Israel-Iran crisis. Any ceasefire signals or changes to sanctions will impact global sentiment and energy markets. For SA equities, clarity from global authorities will tell us if this is a short term or deeper correction.

Quick Summary:

- JSE Top 40 breaks trendline, closes at 88,028

- April retail sales down 0.2%

- Oil surge hits margins, Middle East tensions

- G7 summit to set risk tone

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account