Solana (SOL) Forecast: Key Resistance Failure Confirms Bearish Outlook

Quick overview

- Solana (SOL) is experiencing significant bearish pressure, failing to reclaim the critical $153.36 resistance level.

- The price action indicates a potential further decline towards support levels at $138.11 and $133.21.

- Geopolitical tensions in the Middle East are contributing to a risk-off sentiment in the crypto market, impacting speculative assets like Solana.

- No major technological developments have been announced in the Solana ecosystem, leaving the bearish sentiment unchallenged.

Solana (SOL) continues to trade under heavy bearish pressure, with our previously issued downside forecast from May 28, 2025, remaining firmly intact.

After a clear rejection at the $186.20 resistance mark — a level flagged in our earlier analysis — the market has since failed to reclaim critical technical zones, particularly the pivotal $153.36 support-turned-resistance. This failure now reaffirms bearish control over SOL’s price action, opening up further downside room towards the next significant support levels at $138.11 and $133.21.

Let’s dissect the current state of play.

Weekly & Daily Price Action Analysis

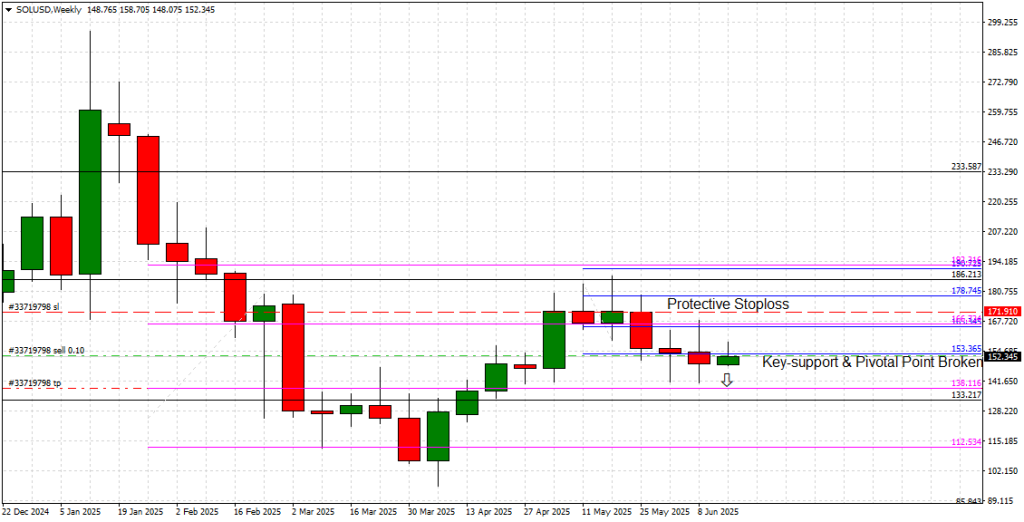

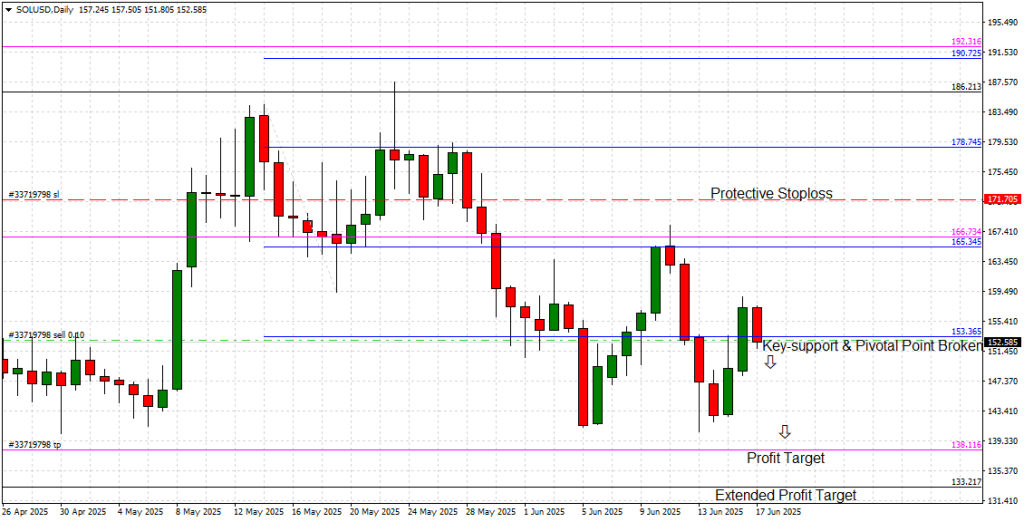

Referencing the uploaded weekly and daily charts, Solana has exhibited a textbook failure to sustain above the $153.36 level after briefly testing it during this week’s trade. As anticipated, sellers swiftly regained control, forcing the price back below this critical threshold.

On the weekly chart, SOL remains trapped beneath a well-defined downward resistance line, with successive lower highs underscoring the bearish market structure. The recent candle pattern, with pronounced upper wicks and an inability to close above $153.36, signals persistent supply pressure.

The daily chart provides an even clearer breakdown. After staging a modest recovery towards mid-June, Solana topped out shy of $153.36 before swiftly retracing. This reinforces the zone as a firm resistance barrier. Furthermore, the sequence of lower highs and lower lows confirms the short-term bearish trend continuation.

With momentum firmly skewed to the downside, immediate focus now turns to the $138.11 support level — historically a pivotal area that previously acted as both support and resistance. Should this level give way, an extended move towards the $133.21 zone becomes highly probable, which coincides with a secondary profit-taking objective identified on our trading models.

Middle East Tensions Fueling Risk-Off Sentiment

Crucially, the broader crypto market sentiment remains heavily influenced by the escalating geopolitical conflict in the Middle East. The already volatile situation between Israel and Iran has deteriorated further over the weekend, with new reports indicating intensified military exchanges and proxy escalations along multiple regional fronts.

This heightening instability continues to stoke investor anxiety, prompting a defensive tilt across global risk assets, including digital currencies. Historically, heightened geopolitical risks tend to fuel a risk-off environment, benefiting safe-haven assets while pressuring speculative plays like altcoins. Solana, with its higher beta nature, remains particularly vulnerable under such circumstances.

Technology & Ecosystem Update

Since our last update, there have been no significant new technological developments or protocol upgrades announced within the Solana ecosystem. The network remains focused on bolstering its validator uptime and addressing minor congestion issues that surfaced earlier in the quarter. The anticipated Firedancer independent validator client upgrade — which promises enhanced network resilience and performance — remains in active development, with beta testing expected in Q3 2025.

Until then, no material ecosystem drivers are currently in play to counteract the prevailing bearish market sentiment.

Key Levels to Watch

-

Immediate Resistance: $153.36

-

Primary Support: $138.11

-

Extended Support/Profit Target: $133.21

-

Protective Stop-Loss for Short Positions: $171.70

Conclusion

Solana remains firmly on the defensive, with technical and macro conditions aligning to sustain bearish momentum. The failure to reclaim $153.36, coupled with intensifying Middle East tensions and a broader crypto market retracement, sets the stage for a further descent towards $138.11 and $133.21.

Traders should maintain a cautious stance, prioritizing tactical short positions below the $153.36 threshold, with well-placed protective stops above $171.70 to manage upside risk in the event of unexpected geopolitical resolution or speculative squeezes.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account