Avalanche (AVAX) Bearish Forecast Follow-up: Closing distance To Primary Target

Quick overview

- Avalanche (AVAX) is following a bearish trend as predicted in the May 30 forecast, with prices approaching the primary target of $17.17.

- The breakdown below the $21.49 level confirmed a larger corrective phase, with AVAX consistently hitting lower support levels.

- Broader market factors, including geopolitical tensions and high inflation, are contributing to a risk-off sentiment that negatively impacts cryptocurrencies like AVAX.

- Traders are advised to maintain a bearish stance, focusing on short positions below $19.92 while managing risk with a stop-loss at $20.55.

Avalanche (AVAX) continues to follow the bearish script we laid out in our May 30, 2025 forecast to near perfection.

Back then, we flagged a critical breakdown scenario, identifying a decisive move below the $21.49 trigger level as confirmation of a larger corrective phase. The subsequent price action has validated this view comprehensively, with AVAX steadily grinding lower, decisively breaching successive support levels, and now closing in on our primary downside target at $17.17.

Let’s dissect the evolving technical picture and market dynamics driving this move.

Daily Chart Review — Avalanche Respects Every Key Level

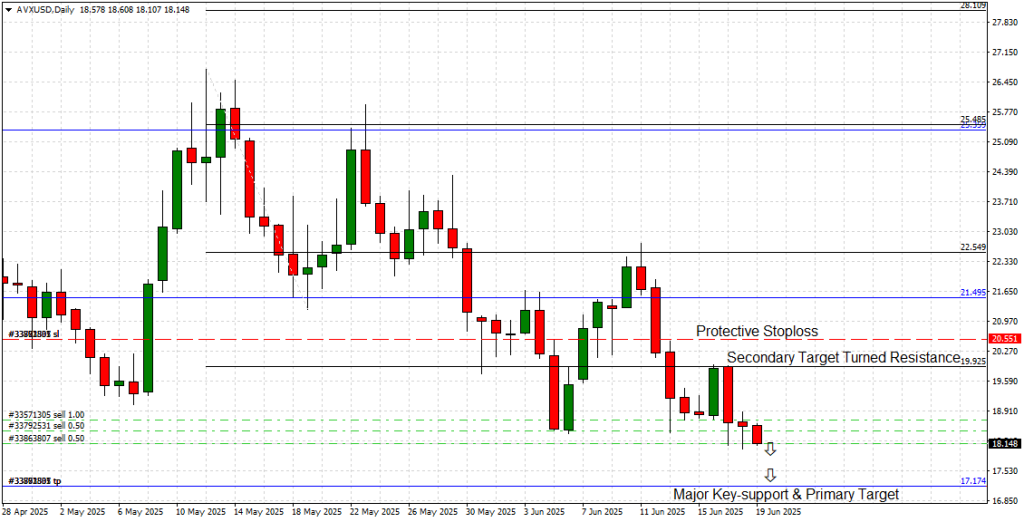

As shown in the uploaded daily chart, Avalanche’s price trajectory has been remarkably disciplined, respecting the key levels we highlighted over the past three weeks.

Following the breakdown below $21.49, the market wasted little time in targeting our secondary objective at $19.92. AVAX sliced through this level on June 13, and interestingly, staged a brief corrective bounce in the sessions that followed, retesting this broken support — now turned resistance — from below. This price behavior perfectly validated the level’s new role as resistance and reaffirmed bearish control.

Since then, the market resumed its downside course, breaking fresh lows and now approaching the next major technical landmark: the $17.17 primary support zone. The daily chart shows consistent lower highs and lower lows, confirming a strong bearish structure. The most recent candle formations — with successive long-bodied red candles and minor bottom-tail wicks — suggest persistent selling pressure, with only minor bid absorption occurring near intraday lows.

Macro Factors Reinforce Bearish Sentiment

Beyond technical drivers, the broader market context continues to favor defensive positioning. The escalating geopolitical crisis in the Middle East, marked by increasing conflict between Israel and Iran, has triggered a global risk-off response. This has seen capital rotate out of speculative assets like altcoins and into traditional safe havens.

Cryptocurrencies with higher volatility profiles, including Avalanche, have been disproportionately impacted by this shift in sentiment. The elevated uncertainty around geopolitical stability — combined with broader macroeconomic concerns like persistently high US inflation data earlier this week — continues to apply pressure on digital assets.

Key Levels to Watch

-

Protective Stop-Loss: $20.55

-

Secondary Target Turned Resistance: $19.92 (retested and confirmed)

-

Major Key-Support & Primary Profit Target: $17.17

If the current bearish momentum persists — and barring any sudden geopolitical de-escalation or crypto sector-specific bullish catalyst — a clean move into the $17.17 zone appears imminent.

Further downside below this level would open up additional targets in the $16.00–$15.50 range, though we’ll reassess this scenario once the $17.17 level is decisively tested.

Ecosystem & Technology Update

Since our May 30 forecast, there have been no substantial updates to Avalanche’s core protocol or roadmap. The network continues to focus on expanding subnet deployment and enterprise partnerships, but no headline upgrades or new ecosystem milestones have surfaced that could materially alter market sentiment or AVAX price action.

While Avalanche remains fundamentally well-positioned within the Layer-1 blockchain landscape — boasting strong scalability, fast transaction finality, and growing DeFi integrations — none of these factors have been sufficient to counteract the current technical breakdown or risk-off macro environment.

Conclusion

Avalanche remains firmly on a bearish trajectory, closely adhering to the downside path we projected in late May. The successive breakdown of key support levels — culminating in the confirmation of $19.92 as new resistance — leaves the market vulnerable to a continued move toward our primary profit target at $17.17.

Unless a significant bullish catalyst emerges or geopolitical tensions ease substantially, traders should maintain a cautious, bearish stance on AVAX, favoring short positions below $19.92, with risk managed above the $20.55 protective stop.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM