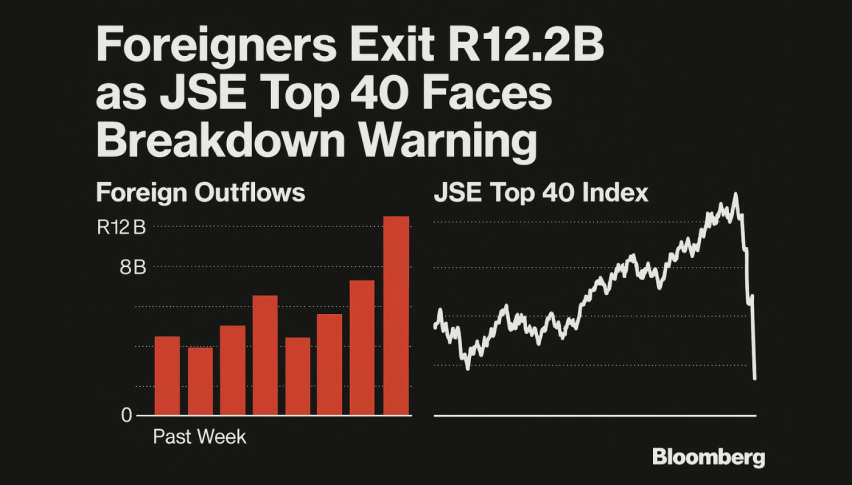

Foreigners Exit R12.2B as JSE Top 40 Faces Breakdown Warning

The JSE Top 40 Index saw intense selling pressure this week as foreign investors sold a net R12.22 billion ($685 million)...

Quick overview

- The JSE Top 40 Index experienced significant selling pressure with foreign investors withdrawing R12.22 billion ($685 million) in local shares.

- Geopolitical tensions and disappointing economic data from China are contributing to a cautious sentiment in South African markets.

- Upcoming consumer inflation and retail sales data are expected to influence the South African Reserve Bank's interest rate decisions.

- Infrastructure investments in the rail sector may improve export supply chains and positively impact JSE-listed stocks.

The JSE Top 40 Index saw intense selling pressure this week as foreign investors sold a net R12.22 billion ($685 million) of local shares. That’s a big outflow and it took the JSE FTSE All Share Index down 0.70% to 94,657.07. The outflow is reflected in the recent weekly trading data and shows a growing reluctance to stay exposed to South African equities in a world of global instability and fragile sentiment.

The sell-off hit multiple sectors but global risk-off sentiment is still weighing on South African markets. Geopolitical concerns in the Middle East and slower than expected China data have added to the caution. Locally investors are also waiting for key macro data releases that will influence the SARB’s July decision.

CPI and Rail Reform Could Change Market Tone

South African consumer inflation and retail sales data out this week will give more clarity on inflation dynamics. Economists are looking for something strong enough to influence the SARB’s interest rate path.

Meanwhile long term sentiment was lifted slightly by infrastructure optimism. The Department of Transport announced they received 162 private sector proposals to fix South Africa’s aging rail network. Improved rail infrastructure will ease export bottlenecks for mining and retail and eventually boost earnings and lift JSE listed stocks.

- Foreign equity outflows R12.22B last week

- CPI and retail data will guide central bank direction

- Rail investments will boost export supply chains

Technical Breakdown in JSE Top 40 Index

The JSE Top 40 Index has broken a key ascending channel on the 4 hour chart and has broken below the 50-EMA at 87,495. A bearish “three black crows” candlestick pattern – three consecutive sessions – confirmed the momentum reversal. The index is now at 86,800 testing former support at 87,166 as new resistance.

The MACD histogram is very negative and the signal lines are diverging, so the bias is down. Until the bulls get back above 87,500 with volume, rallies will invite selling.

Trade Setup:

- Short trigger: Below 86,270

- Targets: 85,671 and 84,960

- Stop-loss: Above 87,500

Technical Highlights:

- Bearish engulfing at 87,495

- Confirmed break of rising channel* MACD is weak

Foreign capital is exiting and domestic triggers are pending, so SA equities will be choppy for now. JSE Top 40 is bearish until we see structural support.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account

- Read our latest reviews on: Avatrade, Exness, HFM and XM